Evergrande defaulted, but no one cares. In the US, judges and FED speculate, taking advantage of office. Merck spent 11.5 billion on who knows what, and Walgreen is considering buying Evolent.

Disclaimer: when we talk about, that something has grown, we mean a comparison with the same quarter a year earlier. Since all issuers are from the USA, then all results in dollars. When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

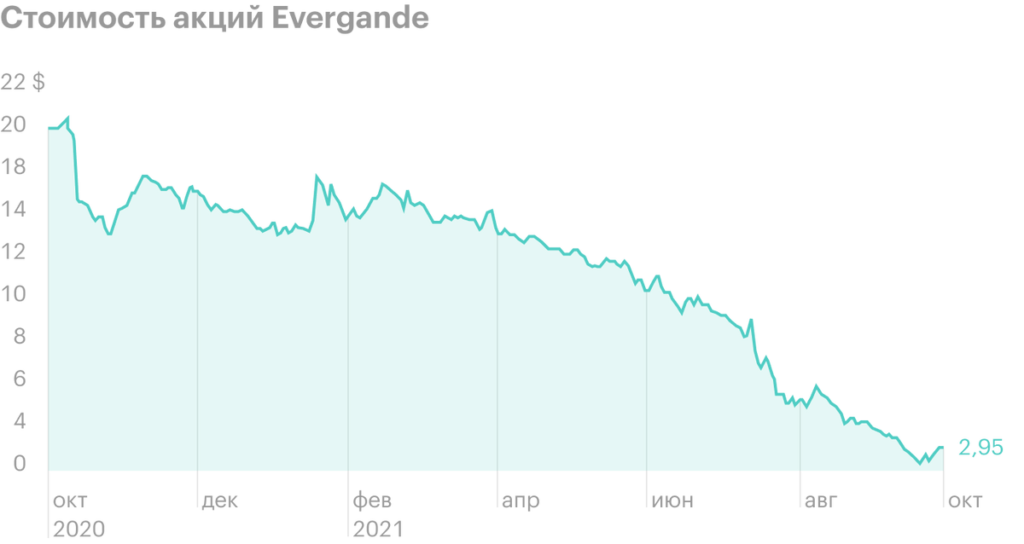

Just default, just how are you

Remember the epic story of Chinese property developer Evergrande? All in all, the default of the company can be considered almost complete: she missed the second payment on her dollar bonds. Here would be the end of the fairy tale, but no: the company even has shares, they, What's on the Hong Kong Stock Exchange, grew a little on the background of the news about, that she sold her stake in a commercial bank to the Chinese state for $1.5 billion. For money, remaining at the disposal of Evergrande, it began to return the investments of Chinese investors in its structured products. Truth, not yet returned.

Seems to be, the Chinese government has chosen the path of minimizing the damage from the collapse of the company inside China itself. This and bad, and good news for investors at the same time.

Good because, what if the slowdown or recession in the Chinese economy is not stopped, then at least they will significantly soften it - which will be positive for those Western companies, which have a significant share of sales in China.

The bad news is that, what, obviously, the Chinese government does not care about the company's foreign bondholders, so what would I expect, that foreign investors will be more cautious about all borrowers from China, which will greatly complicate the access of Chinese companies to foreign financing and, Consequently, will negatively impact their growth prospects.

Where is your ethics, brother?

Presidents of regional branches of the US Federal Reserve, specifically from Boston and Dallas, left their positions. They were both accused of, that they owned shares of companies, whose position was highly dependent on the policy of the Fed and the situation with the key rate. In other words, both presidents could be economic beneficiaries of the Fed's decisions, which they influenced.

In the Fed, certainly, the news caused a stir and a revision of the rules, regulating the process of stock trading for Fed employees. But that's just the tip of the iceberg.

A recent Wall Street Journal analysis showed, that approximately 130 federal judges in the United States violated the ethics of their profession, making decisions on corporate disputes of companies, whose shares were owned by the judges themselves or members of their families. Strictly speaking, in such cases, the judge, instead of conducting the case, must recuse himself, that there is no conflict of interest. For example, judge Timothy Batten, being a shareholder of bank J. P. Morgan Chase, led 11 cases with his participation - and in most cases delivered verdicts in favor of the bank.

Extremely interesting, that in most cases the volume of investments was in the region of 15-50 thousand dollars. These are significant amounts, certainly, but not that big by American standards. So what can we say, that you don't need a lot of money to, to "solve the issue" in the US. You could even say, that the judicial position in the United States is bought "for a small price".

This news serves as a good demonstration of that, how things are done in the USA. As Ivan the Terrible said in this case, "…it is seen, at your place, except you, other people own, and not only people, and the trading men, and do not care about our sovereign heads, and about honor, and benefits for the country, but are looking for their trading profits".

By the way, high-profile US company insiders are quite successful in beating the market, despite all the restrictions on their trade, - after all, nothing can replace primary access to information, Fed staff and judges would agree. It has always been this way. For example, Joseph Kennedy, father of the future president and attorney general of the United States, made millions of dollars in insider trading and market manipulation in the 1920s—and in the 1930s chaired Roosevelt's Securities and Exchange Commission (SEC) and severely pursued those, who did the same, what did he do in the 1920s.

Let this story serve as a reminder to us, that it is not the gods who burn the pots.

The market is controlled or heavily influenced by people's behavior, often weak and greedy, with specific vested interests. AND, what is especially important, poor people: all those boring judges and officials, frankly,, not multimillionaires. What, actually, and makes them extremely vulnerable to manipulation - including blackmail. The main problem here is, that it is from such cases that the non-public circuit of market management consists, and, in a broader sense, society, which greatly complicates the analysis of the general situation. But still, it is not necessary to deeply analyze the news turnover of the level “Fed chairmen hinted at the expectation of rising inflation”. because, probably, these chairmen, at the moment they are presenting the mentioned hints, are thinking about completely different things. Anything on the level: in a year on such news I will make 50 thousand, and then I'll buy a house by the lake, next to it I will build a tire shop with a barbecue and I will get high until the very end of my lucky life.

The doctor prescribed merger for you

Let's also talk about the latest transactions of companies, reviews or investment ideas on which we once did. This time in the medical field.

American pharmaceutical giant Merck (NYSE: MRK) buys Acceleron Pharma (NASDAQ: XLRN). The cost of the transaction is 11.5 billion dollars, 180 $ per share. Acceleron develops drugs for respiratory and blood problems. For biotech start-ups, loss-making is the most important place in the rules of good manners, and Acceleron will not disappoint anyone here: the total margin of the company is -218.63%.

For Merck, this deal, certainly, monstrous dear: Acceleron shares are bought at a premium in the area 30%. But just as expected: the company has many patents expiring in the future, so she needs new developments. Merck has enough money to buy, but the main question here is, Will this deal pay off in the future?: if Sotatercept, currently tested drug Acceleron, will receive the blessing of the regulators, then the first sales will still begin only in 2024.

Merck management expects, that by 2027 Sotatercept sales will be approximately $1.4 billion per year. It's a lot, but Merck has an annual revenue of about 50 billion a year. So it's not about that, so that Merck can increase its existing, but rather about hedging its risks, associated with the expiration of existing patents. The more new drugs she develops, the more diversified the company's business. But the trials of Sotatercept are not over yet., and if the drug is not allowed on the market, then it will be a big problem for Merck.

However, deal news is a boon for all loss-making biotech startups. It shows, that Big Pharma is ready to spend unrealistic money on drugs that have not yet been released.

Walgreens Boots Alliance pharmacy chain (NASDAQ: WBA) wants to buy medical software maker Evolent Health (NYSE: EVH). There are no details about the deal yet., but Evolent shares have risen seriously on this news. Basically, I assumed such an option in my investment idea: small capitalization and the halo of "prospects" Evolent played a positive role.