Disclaimer: when we talk about that, that something has grown up, we mean a comparison with the same quarter a year ago. Since all issuers from the United States of America, then all indicators in dollars.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

Watching reports

Morgan Stanley Investment Bank (NYSE: MS) told the financiers about the revenue growth from 13,66 to 14,579 billion, and profits have grown since 3,196 to 3,511 billion. Investment Banking Division posted an increase of 16 percent thanks to a wave of mergers and acquisitions, and here at the department, who dealt with instruments with passive efficiency, revenue fell by forty-five percent: low rates made this sector of the market the least attractive. In addition, revenue from stock trading fell by eight percent.. The Wealth Management Division showed a thirty percent increase, as retail financiers were very active, and partly through the acquisition of E-Trade. Investment Management increased revenue by 82 percent, driven primarily by the prior acquisition of big industry player Eaton Vance.

The company's performance was generally better than expected, but stocks fell, as financiers are concerned about the fact that the proceeds from trading in stocks and fixed income instruments are falling.

Earnings per share

| Current | Forecast | |

|---|---|---|

| 3 kV. 2020 | 1,59 $ | 1,28 $ |

| 4 kV. 2020 | 1,92 $ | 1,30 $ |

| 1 kV. 2021 | 2,22 $ | 1,72 $ |

| 2 kV. 2021 | 1,89 $ | 1,66 $ |

| 3 kV. 2021 | — | 1,58 $ |

3 q. 2020

Current

1,59 $

Forecast

1,28 $

4 q. 2020

Current

1,92 $

Forecast

1,30 $

1 Q. 2021

Current

2,22 $

Forecast

1,72 $

2 Q. 2021

Current

1,89 $

Forecast

1,66 $

3 Q. 2021

Forecast

1,58 $

U Goldman Sachs (NYSE: GS) revenue increased by 16%, and profits increased from 373 million to 5,486 billion. Different segments had different results: investment banking increased revenue by 36% because of the same, why and a similar business Morgan Stanley, Wealth management and consumer loans segment grew by 28%, but the division of world markets showed a decrease by 32%. The asset management division showed itself the coolest - growth was as much as 144%, mainly due to the activity of GS themselves on the stock market. The result was much better than analysts' expectations.

У Wells Fargo (NYSE: WFC) best results since the start of the pandemic - revenue increased by 11%. The growth of the company was largely due to income, non-loan, like different fees. One-off incomes also played a significant role in this - an increase in the cost of venture investments and bank investments in private companies.. Loss in 2,38 billion was replaced by a profit of 6,04 billion. In general, such a good result became possible due to the improvement of the business environment in the United States: a year ago the bank limited its activity, preparing for a wave of defaults, which never came. Now Wells Fargo may act a little more actively against the backdrop of economic growth in the US, although low rates and low demand for lending weights hang on the company's core business.

The bank is also conducting a campaign to combat unnecessary expenses.: number of employees in 2 quarter 2021 decreased by 5 thousands of people. Last quarter spending, not related to the payment of interest on deposits, Amounted 13,34 billion - less 14,55 billion a year earlier. Bank results were better than expected.

Food manufacturer Conagra (NYSE: CAG) quite expectedly showed a decrease in revenue by 16,7%. Do not forget, What do we have to compare with last year's results?, when the company became the beneficiary of Americans' panicky purchases, preparing for the apocalypse. Now sales are back to normal - compared to the same period 2019 revenue increased by 2,4%. That's not a lot, but this is generally a standard result for all food manufacturers in the US: about the same growth rate they had before the pandemic.

But the profit has grown by as much as 54% - mainly due to the receipt of a large tax deduction. Operating profit fell by 15,5%. The results of the company spoil the growth of logistics costs and the rise in prices of agricultural raw materials, which she uses. Expected, that these factors will continue to play their negative role in the near future.

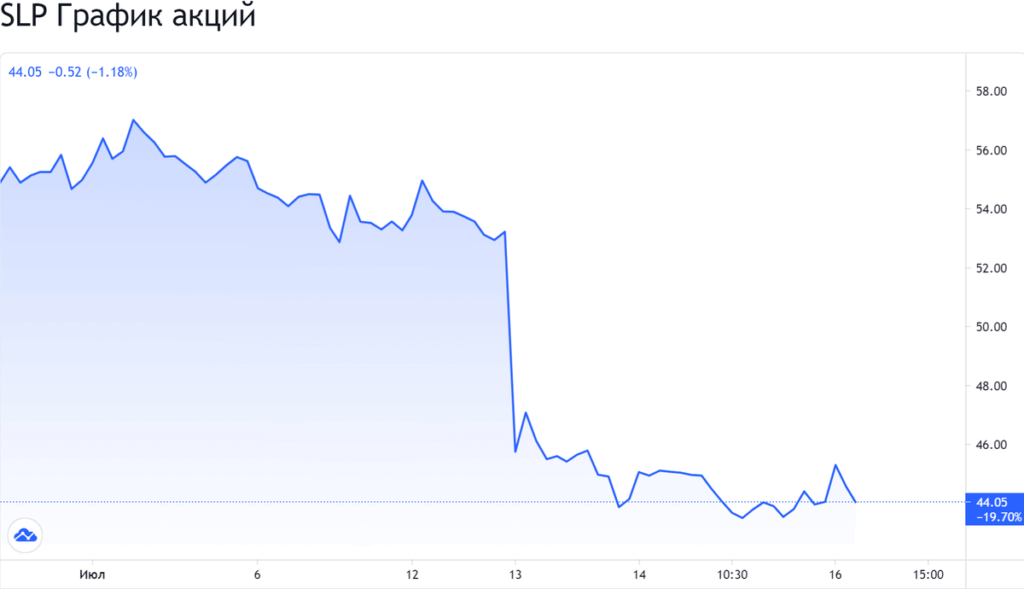

Software maker Simulations Plus (NASDAQ: SLP) showed an increase in revenue by 4% - software revenue increased by 21%, but a decrease in demand for services for 18% messed up the overall result. The profit increased by 29%. The results were worse than analysts' expectations - therefore, after the publication of the report, the shares fell sharply.

Aluminum manufacturer Alcoa (NYSE: AA) increased revenue from 2,148 to 2,833 billion, and a loss of 197 million was replaced by a profit of 309 million. Considering the economic recovery and the growth of industrial indicators as in the United States, as well as in other countries, one might say, that the situation favors the company.

Taiwan Semiconductor Manufacturing (NYSE: TSM) revenue increased by 19,8%, and profit - by 11,2%, what, in general,, unsurprisingly, given the shortage of semiconductors. I would expect, that the company will continue to skim cream in the face of a powerful increase in demand for its products.

M&A News

We will also say a few words about recent acquisitions of companies, for which we had reviews and investment ideas.

Military shipbuilders from Huntington Ingalls (NYSE: HII) buy for 1,65 billion dollars Alion, engaged in research and development and design in the field of intelligence, surveillance, cybersecurity and military training. Some analysts took this information critically., pointing out, that similar "non-core" acquisitions in 2016 And 2019 did not bring much benefit to Huntington's naval operations. But you should keep in mind, what the same analysts say, that instead of buying Alion, the company should have used the money to buy back shares, - so I would not unequivocally negatively assess the Huntington initiative. In any case, the effect of this acquisition can only be seen in the future..

Knight-Swift Carriers (NYSE: KNX) buy groupage carrier AAA Cooper Transportation for 1,35 billion dollars. AAA is the 17th largest company in the US in its niche, and her purchase for Knight-Swift makes sense in the long run.

The transportation of groupage cargo is considered to be a more marginal business compared to the transportation of conventional cargo, because groupage cargo transportation is practiced by online commerce companies, where is the most powerful growth today. Expected, that already this year AAA will add an additional $780 million in revenue to its new owner.

Cybersecurity software maker NortonLifeLock (NASDAQ: NLOK) is negotiating with the creators of Avast antivirus, to buy them for the amount in the area 8 billion dollars. Capitalization of Avast on the London Stock Exchange - 5,2 billion British pounds, that is approximately 7,2 billion US dollars. The deal could still fall apart, but if it does happen, then NLOK will have to find many, many billions of dollars somewhere, insofar as, according to the latest report, there is no excess free money at the disposal of the company. But, at least, Avast is profitable - and this is a great achievement by the standards of the cybersecurity sector. So in the long run, such a purchase can benefit NLOK.