Against the background of setting new exchange rate records for BTC and ETH, the demand for digital assets from investors is growing and fund managers are making every possible effort., what to satisfy him

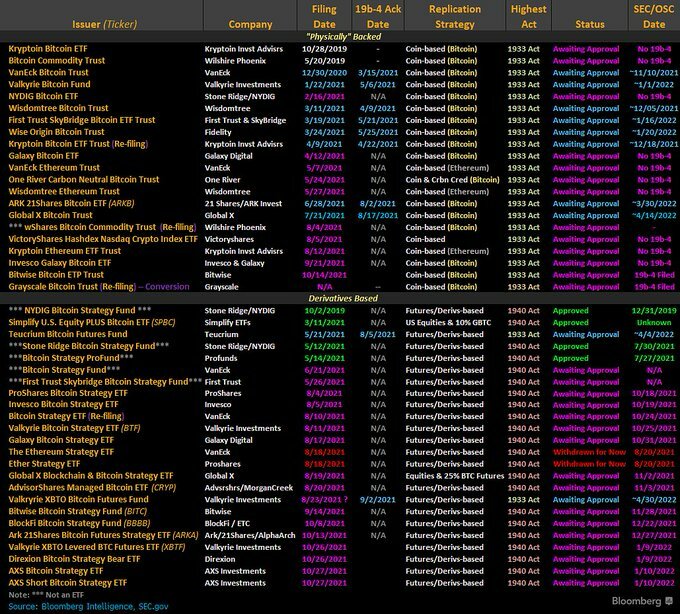

According to Bloomberg Intelligence analyst James Seifart, currently over 40 crypto-currency funds or ETF pending US listing. He even cited a screenshot from Bloomberg Terminal.

4 of these have already been approved by the Securities and Exchange Commission (SEC).

Recent applications for the launch of funds received 27 October by AXS Investments: AXS Bitcoin Strategy ETF and AXS Short Bitcoin Strategy ETF. The vast majority of pending funds intend to work with BTC or futures and derivatives. Some funds have chosen a mixed strategy, planning to place only a share of assets in BTC, and the rest to direct to the purchase of shares of blockchain companies.

but, there is 3 applications for ETH funds working with: VanEck Ethereum Trust, Wisdomtree Ethereum Trust and Kryptcoin Ethereum Trust. All of them were filed this year and are currently awaiting approval..

The SEC needed 8 years, to allow the work in the United States of such financial products and they have already become quite popular among investors. Proshares Bitcoin Strategy ETF became the first cryptocurrency ETF, listed in the United States. Its assets have already exceeded $2 billion.