Walgreens Boots Alliance (NASDAQ: WBA) is the world's largest network of pharmacies, which was formed by the merger at the end of 2014 of two companies: Walgreens и Alliance Boots. The company has 100 years of experience in healthcare.

Business structure

The company's activities are divided into three divisions.

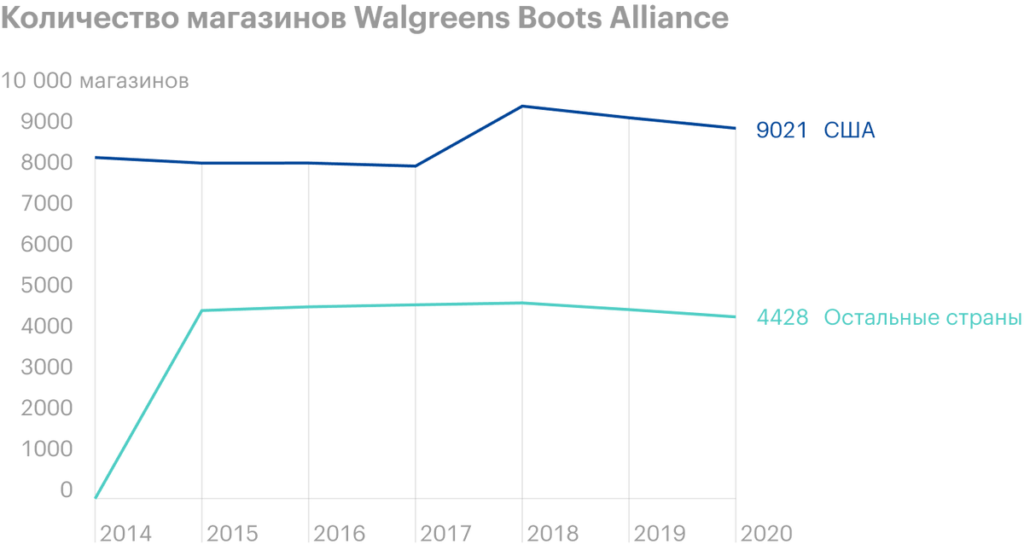

Pharmacy chain in the USA. The most profitable direction, consisting of more than 9 thousand pharmacies, which are present in 50 States, D.c., Puerto Rico and the US Virgin Islands. Major brands: Walgreens и Duane Reade.

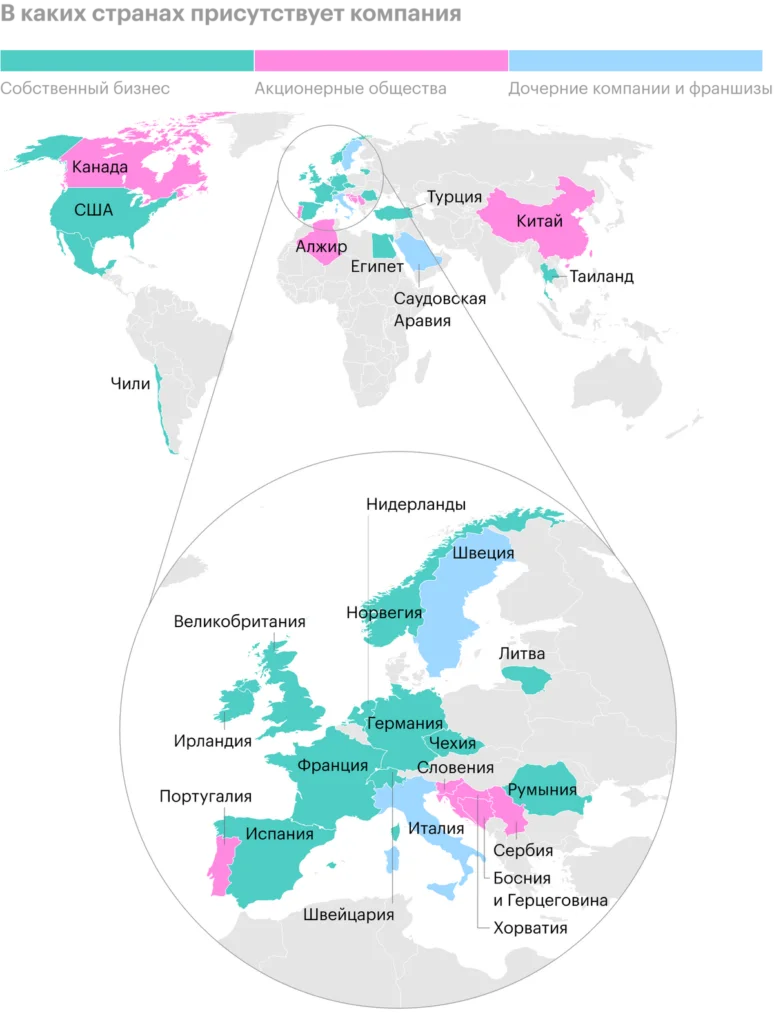

International pharmacy chain. In addition to North America, Walgreens Boots Alliance operates on all continents of the Earth, except Australia and Antarctica. The company owns over 4,400 pharmacies in these regions. Major brands: Boots, Benavides and Smoked.

Pharmaceutical wholesale. Only works in 10 European countries and Egypt under the Alliance Healthcare brand. The main activity is the sale of medicines and other medical products to pharmacies, doctors and hospitals from 306 distribution centers. In the third quarter of 2021, this division was taken over by a subsidiary of AmerisourceBergen.

Walgreens Boots Alliance operates in 25 countries, and its network of pharmacies has grown by 62% - to 13 449 stores.

Revenue structure by segments, billion dollars

| Revenue | Share in overall results | |

|---|---|---|

| Pharmacy chain in the USA | 107,701 | 77,1% |

| International pharmacy chain | 10,004 | 7,2% |

| Pharmaceutical wholesale | 23,958 | 17,2% |

| Magazines | −2,126 | −1,5% |

Revenue structure by regions, billion dollars

| Revenue | Share in overall results | |

|---|---|---|

| USA | 107,701 | 77,1% |

| United Kingdom | 12,099 | 8,7% |

| Europe without UK | 17,270 | 12,4% |

| Other countries | 2,467 | 1,8% |

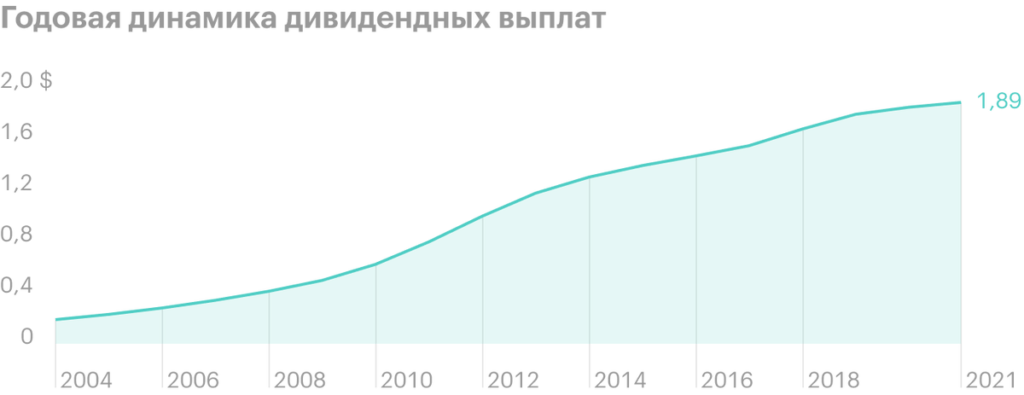

Dividends and buyback

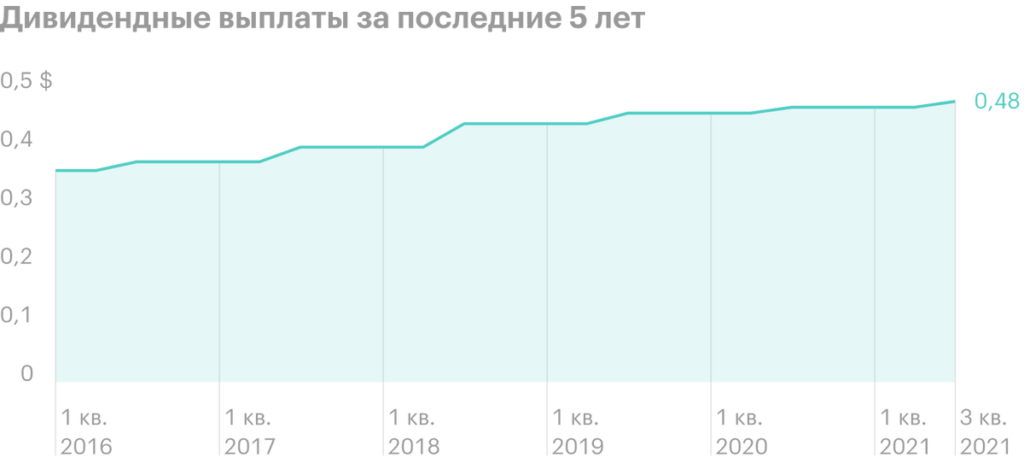

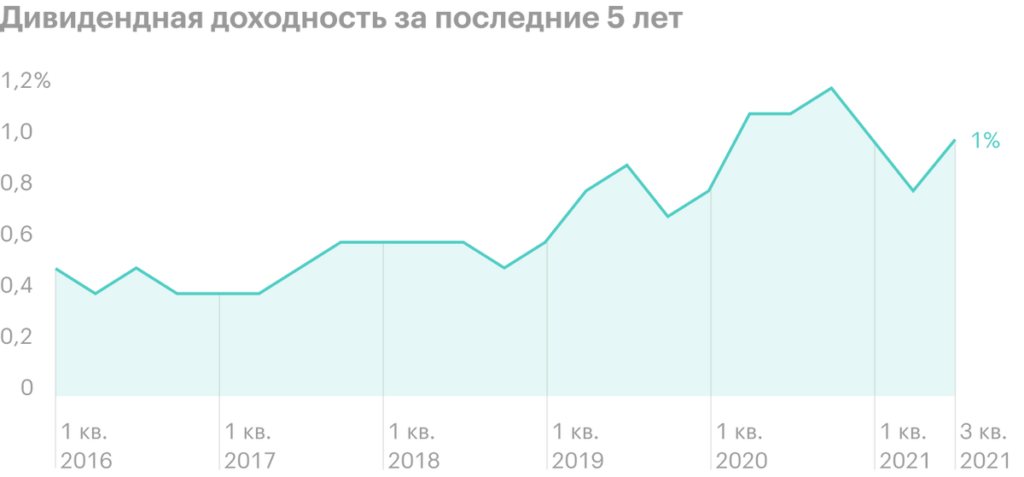

Walgreens Boots Alliance - US Dividend Aristocrat, company for over 45 years in a row increased its dividend payments.

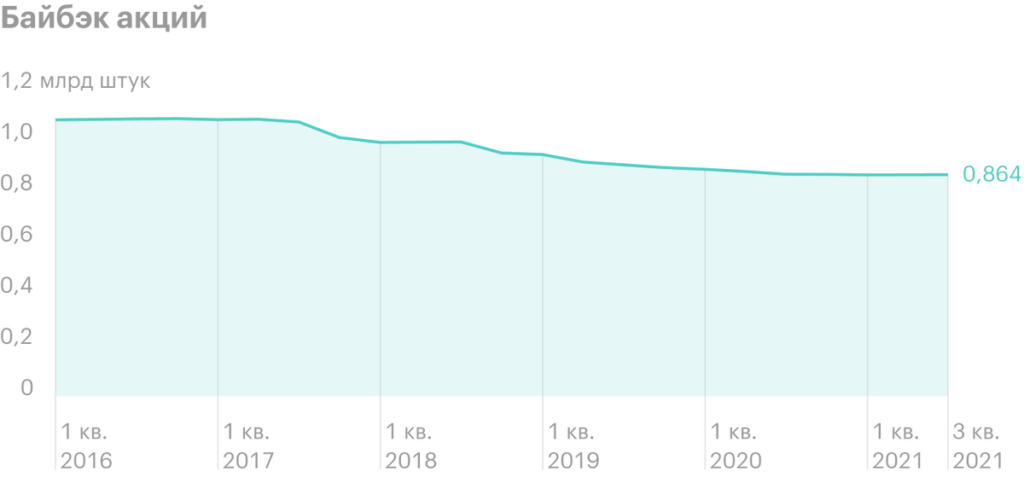

Walgreens Boots Alliance Board of Directors, watching quotes fall, started a fairly aggressive buyback program: for the latest 5 years the company bought out about 20% their shares. At the same time, in the short term, management decided to refuse to buy back securities from the market in order to increase financial stability and reduce the debt burden.

results

Walgreens Boots Alliance shows no growth, financial results of the company are stable, except for 2020, when the retailer had to make a series of write-offs. Because of this, net profit decreased to 0.456 billion dollars - against an average annual value of 4-5 billion dollars.

IN 1 In the quarter of 2021, the company recorded an operating loss of $ 1.4 billion due to investments in its subsidiary AmerisourceBergen.

Walgreens Boots Alliance Key Goals for 2021:

- Complete the sale of Alliance Healthcare.

- Achieve approximately $ 2 billion in annual savings.

- Show Adjusted EPS Growth About 10%.

Financial results for the last 5 years, billion dollars

| Revenue | EBITDA | Net profit | net debt | |

|---|---|---|---|---|

| 2016 | 117,351 | 7,719 | 4,173 | 9,221 |

| 2017 | 118,214 | 7,211 | 4,078 | 9,634 |

| 2018 | 131,537 | 8,184 | 5,024 | 13,612 |

| 2019 | 136,866 | 7,036 | 3,982 | 15,813 |

| 2020 | 139,537 | 3,239 | 0,456 | 15,225 |

| 9м2021 | 103,116 | 2,981 | 1,915 | 14,35 |

Arguments for

Dividend aristocrat. Walgreens Boots Alliance более 45 years increases dividends.

High safety margin. The company needs $400 million per quarter to maintain its dividend payout, and she earns about a billion dollars, excluding one-time write-offs. Because probably, that dividend growth and buyback will continue.

Arguments against

Amazon. The largest IT retailer plans to enter the market for the sale of prescription drugs.

Debt load and credit rating. The multiplier "net debt / EBITDA »equal 3,49. Due to the high level of net debt, the company has low ratings:

- Fitch: BBB−, negative outlook;

- Moody’s: Baa2, negative outlook;

- Standard & Poor’s: BBB, negative outlook.

What's the bottom line?

Walgreens Boots Alliance May Like Investors, who collect their portfolio of shares based on the following principles:

- Decent dividend yield, about 4% with an average for the American market of about 2%.

- Further growth of dividend payments.

- Solid financial results.

- Buyback availability.