Corporation "VSMPO-Avisma" (MOEX: VSMO) — the world's largest titanium producer with a full technological cycle: from processing of raw materials to the release of finished products. The company was formed as a result of the merger of two enterprises in 2005: OJSC VSMPO and OJSC Avisma.

About company

VSMPO-Avisma Corporation manufactures its products from the following metals.

Titanium. Main export item, its share in the overall results is more than 90%. This metal is particularly valued for its low density combined with high strength and excellent corrosion resistance.. The main consumer is the aerospace industry, since titanium alloys can function at temperatures from 0 up to +600 ° C, therefore they are used in aircraft engines for disks, blades, shafts and housings.

Ferrotitanium. It is an alloying alloy of iron and titanium with a minimum weight (20%) and maximum (75%) titanium content, obtained by reduction or remelting.

Aluminum. One of the most common and cheapest metals, its share in the overall results is about 2,5%.

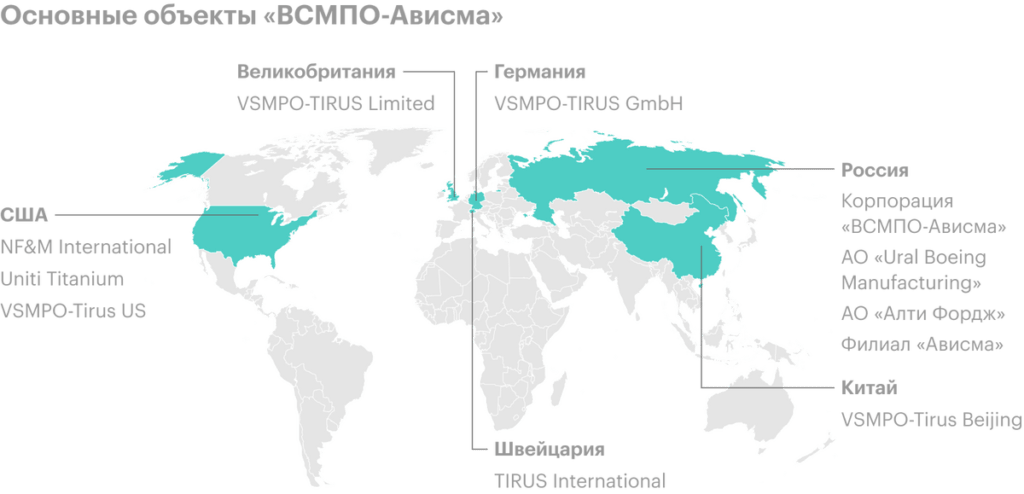

The main production facilities of the corporation are located in Russia and the USA, and distributors in Europe and Asia. In addition to these companies, there are two enterprises in Ukraine: VSMPO Titan Ukraine and Demurinsky GOK, – as well as representative offices in Cyprus and the British Virgin Islands.

Main objects of "VSMPO-Avisma"

| Country, city | Activity | |

|---|---|---|

| Corporation "VSMPO-Avisma" | Russia, Verkhnyaya Salda | Titanium production |

| Branch "Avisma" | Russia, Berezniki | Titanium sponge production |

| АО «Ural Boeing Manufacturing» | Russia, Verkhnyaya Salda | Mechanical processing of titanium stampings |

| JSC "Alti Forge" | Russia, Samara | Manufacture of products from titanium and aluminum alloys |

| VSMPO-TIRUS GmbH | Germany, Frankfurt am Main | Local distributor |

| TIRUS International | Switzerland, Lausanne | Global distributor |

| VSMPO-TYRE Limited | United Kingdom, Redditch | Local distributor |

| NF&M International | USA, Monaka | Treatment, billets and blanks |

| Uniti Titanium | USA, Pittsburgh | Deliveries of products from commercially pure titanium |

| VSMPO-Tirus US | USA, Leitsdale | Local distributor |

| VSMPO-Tire Beijing | China, Beijing | Local distributor |

Operating activities

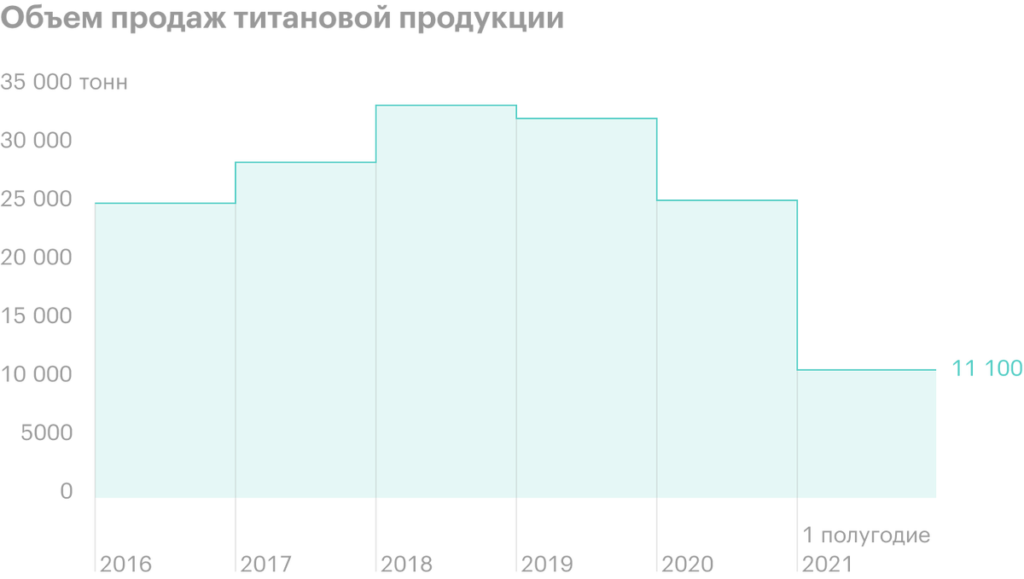

COVID-19 has an extremely negative impact on the results of the corporation due to a drop in demand from the main buyers - aircraft manufacturers. Airline passenger traffic declined sharply in the second quarter of 2020, because of which they had to reconsider their plans for the purchase of new aircraft, what, in its turn, led to a drop in sales of titanium products.

UNITI is a joint venture with the American company Allegheny Technologies, which now takes about 30% of the world market, supplying industrial titanium equipment worldwide.

Geography of deliveries of titanium products

| Russia and CIS | 35% |

| Europe | 26% |

| USA | 26% |

| UNITI products: USA, Europe, Asia | 7% |

| Other countries | 6% |

35%

Export structure of titanium products

| Aerospace | 50% |

| Engine building | 23% |

| Industrial application | 22% |

| Medicine | 5% |

50%

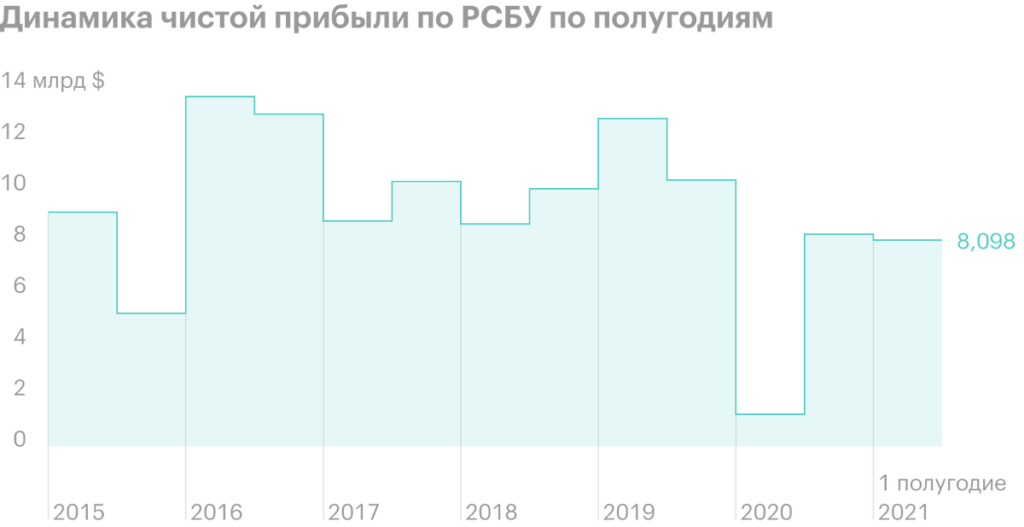

Dividends

The corporation does not have a pegged net income distribution ratio. At the same time, before the COVID-19 pandemic and the crisis in the industry, the company tried to distribute almost all net profit under RAS among shareholders, doing this twice a year - for the first half of the year and for the second.

Before the pandemic, the company earned an average of 10 billion rubles, and now earns 8 billion rubles. If management decides to return to the payment of all net income under RAS, then the current dividend will be at the level 700 R for half a year with a net profit of 8 billion rubles, and the target dividend is 900 Р with a net profit of 10 billion rubles.

Despite zero dividends, the company did not refuse to distribute net profit among shareholders, VSMPO-Avisma announced a share buyback in November 2020 (buyback) in the amount of 5 billion rubles by the end of 2021.

Dynamics of dividend payments

| 2013 | 533,91 R |

| 2014 | 831,07 R |

| 1п2015 | 788 R |

| 2п2015 | 458,22 R |

| 1п2016 | 816 R |

| 2п2016 | 1300 R |

| 1п2017 | 762,68 R |

| 2п2017 | 890,45 R |

| 1п2018 | 756 R |

| 2п2018 | 873,42 R |

| 1п2019 | 884,6 R |

| 2п2019 | 0 R |

| 2020 | 0 R |

533,91 R

results

The company is still in crisis, from which management hopes to exit no earlier than 2022. Financial indicators of VSMPO-Avisma lag behind pre-pandemic values by an average of 15-20%.

Financial results for the last 5 years, billion rubles

| Revenue | EBITDA | Net profit under RAS | Net income under IFRS | net debt | |

|---|---|---|---|---|---|

| 2016 | 89,408 | 39,841 | 26,632 | 25,483 | 23,788 |

| 2017 | 87,979 | 34,214 | 19,138 | 12,826 | 34,227 |

| 2018 | 101,402 | 40,770 | 18,788 | 15,335 | 49,484 |

| 2019 | 105,431 | 36,430 | 23,262 | 20,781 | 61,799 |

| 2020 | 89,050 | 32,869 | 9,529 | 6,525 | 33,969 |

| 1п2021 | 41,067 | 17,022 | 8,098 | 7,154 | 43,026 |

Multipliers of VSMPO-Avisma for the last 5 years

| EV / EBITDA | P / E, RSBU | P / E, IFRS | P / BV | Net Debt / EBITDA | |

|---|---|---|---|---|---|

| 2016 | 4,36 | 5,62 | 5,88 | 1 | 0,6 |

| 2017 | 6,56 | 9,9 | 14,83 | 1,1 | 1 |

| 2018 | 6,02 | 10,4 | 12,78 | 1,09 | 1,21 |

| 2019 | 7,46 | 9,02 | 10,10 | 1,15 | 1,7 |

| 2020 | 8,05 | 24,2 | 35,34 | 1,14 | 1,03 |

| 1п2021 | 12,21 | 21,61 | 25,92 | 1,69 | 1,32 |

Arguments for

Baibek. The buyback will continue, the company spent less than half of the assigned amount - only 5 billion rubles. On the accounts of a subsidiary, which is carrying out the buyback, located 70 890 VSMPO-Avisma shares are about 2 billion rubles.

Dividends. Before the COVID-19 pandemic, the company tried to distribute all earned profit under RAS among shareholders.

Protection from sanctions. VSMPO-Avisma provided up to 35% all Boeing titanium needs, 65% Airbus demand and 100% — Embraer.

Arguments against

Short-term decline in demand. According to VSMPO-Avisma, decrease in global passenger turnover by 40% in 2020 with subsequent growth by 19% in 2021, on 10% in 2022 and at 5% starting in 2023 will lead to a decrease in demand for new aircraft in the short term by about 25% compared to pre-coronavirus outbreak estimates.

Evaluation. VSMPO-Avisma's current multiples are much higher than the average values of the previous periods.

Non-core investments. In April 2018, the corporation bought almost a 6% stake in RusHydro, and in the 1st half of 2021, VSMPO-Avisma announced the purchase of 8709 kg of gold.

What's the bottom line?

VSMPO-Avisma has a unique business, which will quickly recover after the exit of the economies of developed countries from the crisis. It's going to happen., probably, in 2023, it is logical to return to the payment of dividends during this period.

But if management decides to do it now, then the dividend for half a year will be 700 R: For the last two half-years, the corporation has been steadily earning, on average, about 8 billion rubles according to RAS. With these data, the dividend yield of VSMPO-Avisma for 6 months will be 2,3%, and in 12 months 4,6%. This is below, than our colleagues in the steel sector at NLMK, MMK and Severstal and in the mining industry - from Norilsk Nickel, "Alrosy", "Raspadskaya".