"Pole" (MCX, LSE: PLZL) — a huge gold mining company with assets in the Krasnoyarsk Territory, Irkutsk and Magadan regions and the Republic of Sakha (Yakutia). As of 2020, Polyus has the world's largest gold reserves, which are estimated at 104 million ounces, which is decent more, than most international competitors and almost three times as many, than the nearest Russian competitor , Polymetal.

About company

The company not only owns huge reserves of gold, it is also one of the leaders in terms of its production volume. As of 2020, Polyus entered the top four largest world producers with a result of 2.8 million ounces of gold, which is almost twice as large, than Polymetal. At the same time, the company's production volume has gradually increased in recent years - by 0.6 million ounces compared to 2017. Production indicators for the first half of 2021 are slightly more modest, than in 2020, but slightly.

43% production at the end of 2020 was provided by the company's flagship field - Olimpiada, More on 16% - Natalkinskoe and Blagodatnoe.

An important competitive advantage of Polyus is the world's lowest production costs among major competitors. This can be achieved both due to high-quality deposits with a high content of gold in the rock and that, that they are all open type, and due to mainly ruble costs and constant work to improve efficiency.

The company really does not stand still, and actively expands the business and increases its efficiency: compared to 2014, Polyus increased production by 63%, while reducing overall cash costs (TCC) on 38%. And the company does not rest on its laurels.: capital expenditures for 2021 and the next few years are planned in the amount of 1-1.2 billion dollars per year, despite the fact that in recent years they have been about half the size.

The company plans to spend a significant part of the money on the construction of a new gold recovery plant at the Blagodatnoye deposit., modernization and expansion of production at the Olympics and Kuranakh.

Polyus plans to spend the main capital expenditures of $ 3.3 billion in the coming years on the development of the new Sukhoi Log field. This is a huge field in the Irkutsk region with proven and probable reserves of 40 million ounces., and estimated and identified - 67 million ounces of gold with one of the record low production costs in the future. In 2017, the auction for the right to develop Sukhoi Log was won by a joint venture of Polyus and Rostec State Corporation, after that, Polyus gradually increased its stake in it, fully consolidated in September 2020.

At the moment, a feasibility study of the project is being prepared, and the final investment decision is planned in 2022. Supposed, that the launch of the gold recovery plant at Sukhoi Log will occur in 2027, and the average annual production is planned at 2.3 million ounces, which is not much less than the current production volume of the entire company.

Gold reserves of the world's largest gold miners as of 2020, Moz

| "Pole" | 104 |

| Newmont | 94 |

| Barrick | 68 |

| Newcrest | 49 |

| Gold Fields | 49 |

| Harmony | 35 |

| Kinross | 30 |

| AngloGold | 30 |

| "Polymetal" | 28 |

| Agnico Eagle | 24 |

104

The volume of gold production by the world's largest gold miners in 2020, Moz

| Newmont | 5,9 |

| Barrick | 4,8 |

| AngloGold | 3,0 |

| "Pole" | 2,8 |

| Kinross | 2,4 |

| Gold Fields | 2,2 |

| Newcrest | 2,1 |

| Agnico Eagle | 1,7 |

| "Polymetal" | 1,6 |

| Kirkland Lake | 1,4 |

5,9

Volume of gold production by the company by year, Moz

| 2017 | 2,2 |

| 2018 | 2,4 |

| 2019 | 2,8 |

| 2020 | 2,8 |

| 1п2021 | 1,3 |

2,2

Structure of gold production by the company's deposits in 2020

| Olympics | 43% |

| Наталкинское | 16% |

| Blagodatnoe | 16% |

| Verninskoe | 10% |

| Quran | 9% |

| Placers | 5% |

43%

Cash costs of the world's largest gold miners in dollars per ounce in 2020

| TCC | AISC | |

|---|---|---|

| "Pole" | 362 | 604 |

| "Polymetal" | 638 | 874 |

| Newcrest | 616 | 909 |

| Gold Fields | 748 | 969 |

| Barrick | 719 | 969 |

| Kinross | 700 | 970 |

| Newmont | 710 | 1045 |

| Agnico Eagle | 774 | 1051 |

| AngloGold | 819 | 1059 |

| Harmony | 1146 | 1343 |

Financial indicators

The company's revenue and EBITDA in recent years have grown and doubled compared to 2017-2018. Since Polyus' revenue depends on the price of gold, which is denominated in dollars, can be considered an exporter company.

The company's net profit also tends to grow., but quite volatile. The Company actively uses derivative financial instruments to hedge gold prices and the exchange rate. Their revaluation periodically significantly increases or decreases profits.

The company's net debt has been decreasing in recent years, what is positive, especially against the background of the upcoming increase in capital expenditures.

Revenue, EBITDA, net profit and net debt by year, billion rubles

| Revenue | EBITDA | Net profit | net debt | |

|---|---|---|---|---|

| 2017 | 156,5 | 99,2 | 72,2 | 177,2 |

| 2018 | 184,7 | 118,4 | 28,2 | 214,4 |

| 2019 | 257,8 | 172,2 | 124,2 | 203,4 |

| 2020 | 364,0 | 269,5 | 119,2 | 155,8 |

| 1п2021 | 168,6 | 121,1 | 81,1 | 150,0 |

Share capital

The history of Polyus stretches back to Soviet times with the eponymous artel of prospectors. In the 1990s, the artel was corporatized., after which the shares were consolidated by its head Hazret Sovmen. In 2002, he was elected President of the Republic of Adygea, after which he sold his shares to Norilsk Nickel. In 2006, its gold mining assets were spun off into a separate company., Polyus went public, and in 2009, the main shareholder of Norilsk Nickel, Vladimir Potanin, sold a large stake in Suleiman Kerimov's structures.. Gradually, the Kerimov family increased its stake in the company., and to date, Said Kerimov is the controlling shareholder of Polyus with a stake 76,34%.

In December 2020, the company conducted buyback of shares: about 1.43 million securities were purchased for the employee incentive program, deals M&A and for the consolidation of assets of PJSC "Lenzoloto", through which Polyus owns placer deposits.

Share capital structure of the company

| Polyus Gold International Limited, beneficiary — Said Kerimov | 76,34% |

| Management of the company | 1,03% |

| Treasury shares | 0,78% |

| Free float | 21,85% |

76,34%

Dividends and dividend policy

At the "Polyus" with 2018 the dividend policy is in effect, according to which the company plans to pay dividends on a semi-annual basis in the amount of 30% of EBITDA, if the value of the multiplier Net Debt / adjusted EBITDA does not exceed 2.5. Dividend yield in recent years has been around 5%.

Dividends and dividend yield of the company

| Dividend | Dividend yield | |

|---|---|---|

| 2016 | 152,41 R | 3,4% |

| 2017 | 251,42 R | 5,5% |

| 2018 | 274,73 R | 5,1% |

| 2019 | 407,73 R | 5,7% |

| 2020 | 627,33 R | 4,7% |

Why stocks can go up

A growing industry leader with good multipliers. Polyus is not just the leader of the gold mining industry in Russia – the company is constantly increasing its production and financial performance, increases business efficiency. And polyus still has the development of the giant Sukhoi Log field ahead.. Quite possibly, that in the next few years the company's business will become much larger. And in anticipation of this growth, investors can also receive quite good dividends..

Besides, Polyus has good multipliers in absolute terms, and in comparison with competitors. The company is less leveraged, than competitors. "Polyus" is somewhat more expensive, but it makes sense: it is larger and more efficient.

Return on equity has dropped from prohibitive 222,3 to 62,1%, but that's because of the fact that, that the company had a fairly small net worth, and then it started to grow.. Especially pleased with the multiplier Net Debt / EBITDA, the value of which was constantly decreasing and reached a very comfortable value of 0.52.

Defense sector. In times of stock market turmoil, investors massively buy up defensive assets, and one of the main defensive assets is gold. One of the options for investing in gold is the purchase of shares of gold mining companies. So they often have the opposite correlation with the whole market. Gold mining companies are exporters, since gold prices are set in dollars, which means, they also protect against the devaluation of the ruble.

ESG. The company is actively working towards compliance with ESG standards: in recent years the agency S&P Global, MSCI, Sustainalytics and CDP upgrade Polyus' ratings by several notches, reflecting the company's achievements. These include reducing carbon dioxide emissions., reduction in water consumption, and in 2021, the company dramatically increased the percentage of energy used from renewable energy sources from 36 to 100%.

To be more precise,, then Polyus decommissioned some of its own thermal power plants and increased the share of energy consumed, produced at hydroelectric power plants, to 90%, and to compensate the remaining 10% bought green I-REC certificates. Given the popularity of ESG, these actions should help the company attract investments in its securities and in the future not pay gradually introduced taxes on carbon emissions.

Why stocks might fall

Dependence on market conditions. In the reviews of commodity companies, we often pay attention to the fact that, that their business is often highly dependent on market conditions. And if the prices, for example, oil and steel are more or less dependent on the balance of supply and demand, from the level of business activity in the world, then with gold everything is much more complicated. Total 8% of gold demand for 2020 was provided by the industry, yet 38% - jewelry industry, and all the rest of the demand was related to investment.. That is, a significant proportion of gold buyers are private and institutional investors., Confident, that it is a good investment asset, or those who want to make money on that, that many others are sure of this. And faith is a shaky question..

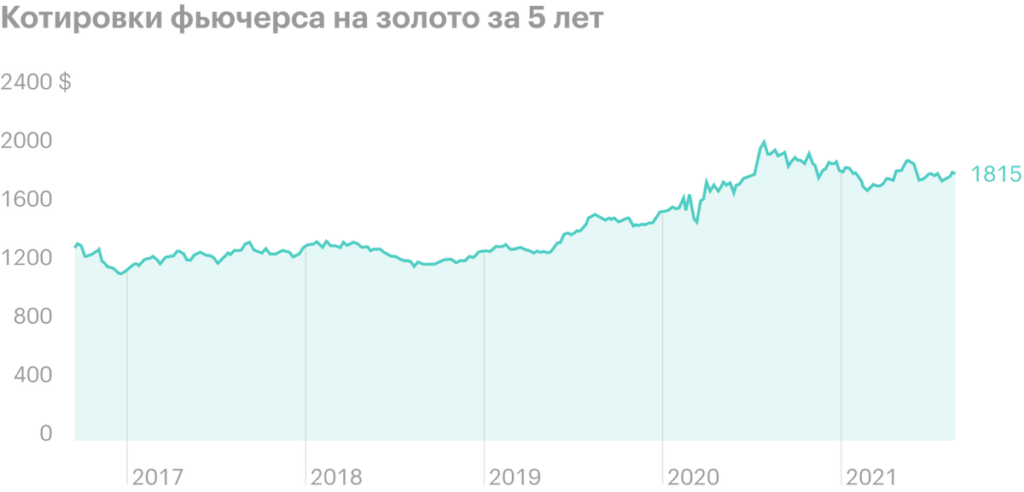

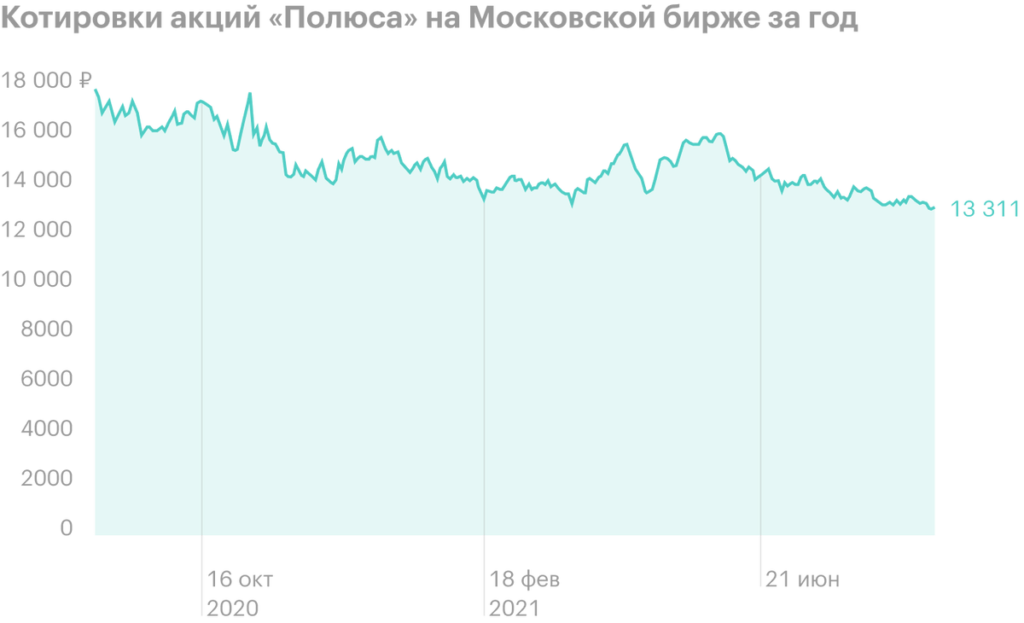

Polyus' business is generally fine: production and financial indicators are growing, but gold prices have fallen from historic highs a year ago, and this immediately affected the company's quotes: over the past year, shares have fallen in price by about a quarter.

In addition to the volatility of the prices of gold itself, Polyus' financial performance is significantly affected by exchange rate differences, and revaluation of derivative financial instruments.

Possible introduction of additional fees. In the summer of 2021, the authorities introduced temporary duties on the export of ferrous and non-ferrous metals.. These duties did not affect gold miners., but a precedent has been set: maybe, in the not-too-distant future, we'll see something similar for them., which will reduce the company's revenues and cause a drop in quotations on this information occasion.

Structure of global gold demand in 2020

| Jewelry sector | 38% |

| Bars and coins | 24% |

| Exchange-Traded Funds | 23% |

| Industry | 8% |

| Central Banks | 7% |

38%

Polyus multipliers by year

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| 2017 | 8,50 | 222,3% | 1,79 |

| 2018 | 25,6 | 112,6% | 1,81 |

| 2019 | 7,64 | 110,8% | 1,18 |

| 2020 | 14,9 | 68,5% | 0,58 |

| 1п2021 | 13,9 | 62,1% | 0,52 |

Multipliers of the largest Russian public gold miners for the first half of 2021

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| "Pole" | 13,9 | 62,1% | 0,52 |

| "Polymetal" | 8,21 | 56,7% | 1,05 |

| "Petropavlovsk" | Lesion | Lesion | 1,9 |

| "Seligdar" | 5,02 | 34,7% | 2,31 |

Eventually

Polyus is the leader of the Russian gold mining industry and one of the largest and most efficient players in the world in this market. In recent years, the company has shown good production and financial results and is not going to stop there.. Something "Polyus" reminds "Rosneft": despite the huge scale of the business, ahead of the company is the development of a giant field, which will help to significantly improve production performance.

But do not forget, that the gold mining industry is very specific: it doesn't just depend on raw material prices, but largely depends on the mood and people's belief in gold as an investment tool.