Norfolk Southern (NYSE: NSC) - a large American transport company, which provides freight rail services. The company has almost two hundred years of development history, and it received its current name in 1982 after the merger of the two companies: Norfolk & Western Railway и Southern Railway.

About company

The main activity of Norfolk Southern Corporation is the rail transportation of raw materials, semi-finished products and finished products mainly in the Southeast, East and Midwest USA. As of 31 December 2020, the Norfolk Southern Corporation's rail network is about 19 300 miles and goes through 22 State and District of Columbia.

The main transportation routes of the company:

- New York-Chicago via Allentown and Pittsburgh.

- Chicago - Macon through Cincinnati, Chattanooga and Atlanta.

- Central Ohio - Norfolk via Columbus and Roanoke.

- Birmingham - Meridian.

- Cleveland - Kansas City.

- Memphis - Chattanooga.

The structure of the company's income, million dollars

| Transportation segment | Revenue | Share in the overall result |

|---|---|---|

| Agriculture, timber and consumer goods | 578 | 21% |

| Chemicals | 494 | 18% |

| Metals | 402 | 14% |

| Automotive products | 206 | 7% |

| Intermodal transportation | 801 | 29% |

| Coal | 318 | 11% |

Current activity

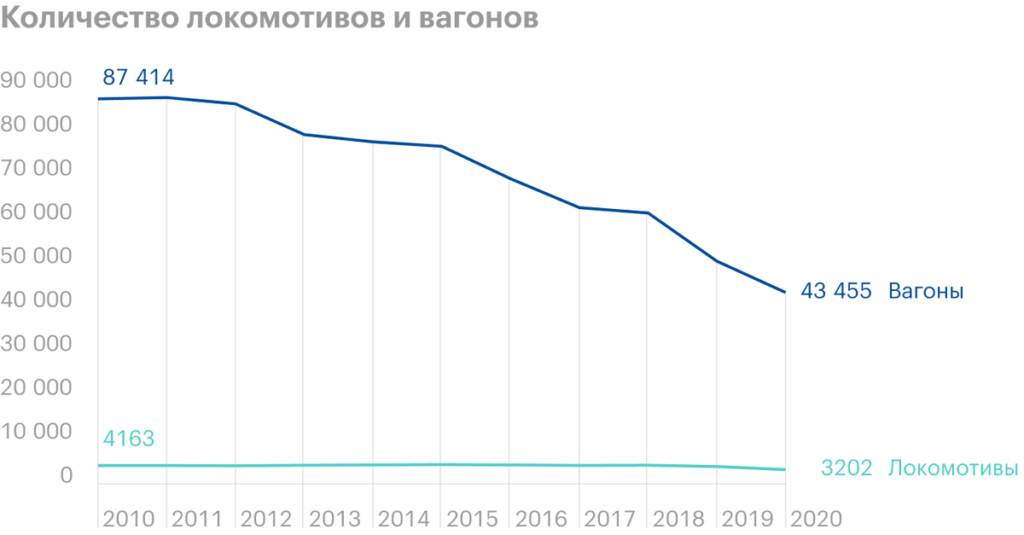

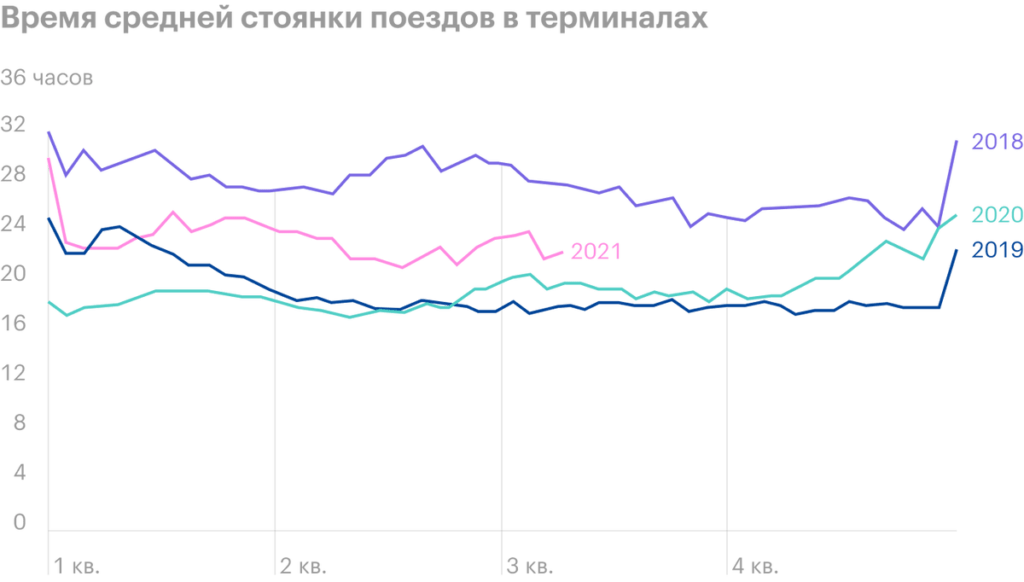

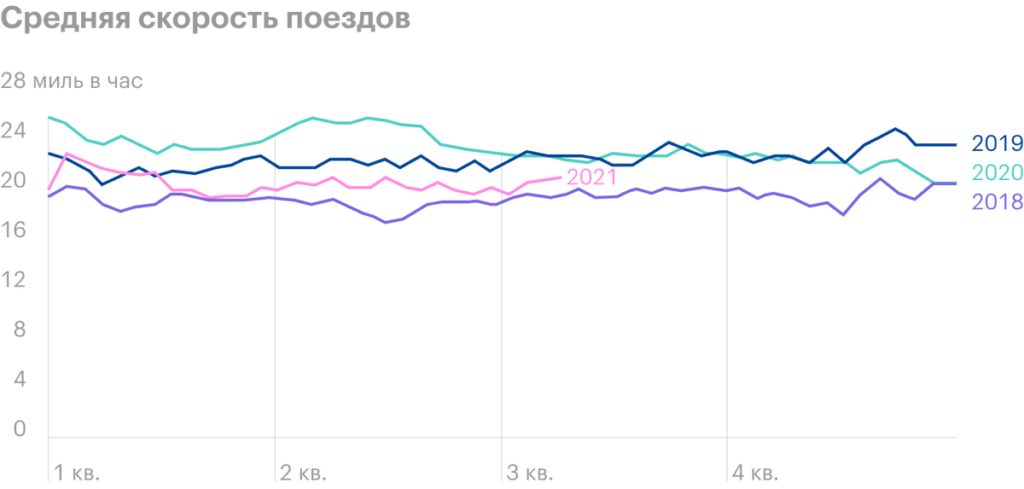

In 2019, Norfolk Southern Corporation introduced a new development plan, with which the board of directors wanted to improve efficiency and productivity, improve financial results, as well as to reduce and modernize their fleet, to ensure an increase in the average speed of trains, train speed, and reduce the average parking time of wagons in terminals, terminal dwell.

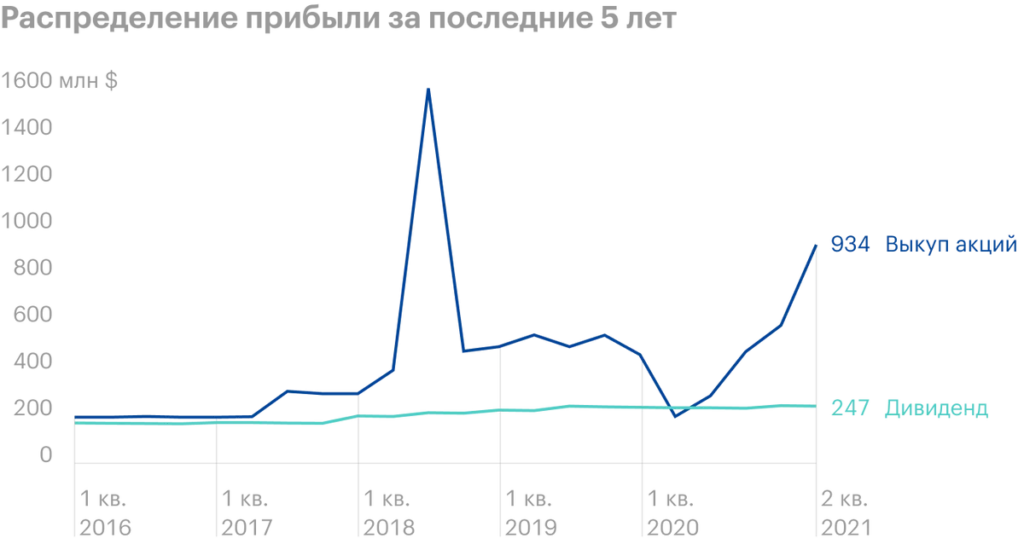

Profit distribution

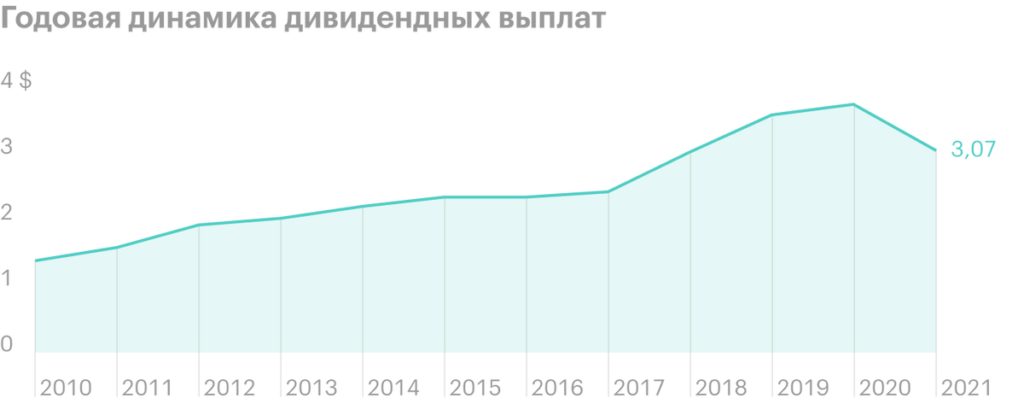

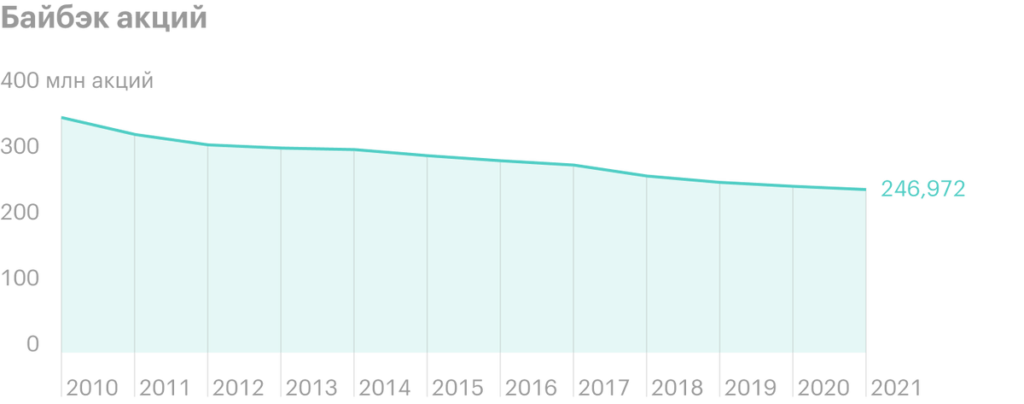

Norfolk Southern Corporation is a company with a stable dividend history and always strives to return the maximum possible profit to shareholders. So, for example, in 2017, the company received an additional profit of $ 3.482 billion due to Trump's tax reform, after which it immediately increased dividends and buyback.

Financial results and outlook for 2021

Norfolk Southern Corporation has demonstrated strong financial performance over the past five years: annual EBITDA result is $4-5 billion. Taking into account the first half of the year, the company in 2021 can show data, which will be similar from 2018 or 2019.

Norfolk Southern Corporation management forecast for 2021:

- Revenue will increase by 12% against the backdrop of growth in traffic in all segments: forest products, Chemicals, metals, automotive goods, intermodal transportation, coal.

- Capital expenditures will be at the level of $1.6 billion.

- Dividend payments will amount to 35-40% of net profit.

- The buyback of shares will be carried out at the expense of excess cash.

Financial results for the last 5 years, billion dollars

| Revenue | EBITDA | Net profit | net debt | |

|---|---|---|---|---|

| 2016 | 9,888 | 4,104 | 1,668 | 9,256 |

| 2017 | 10,551 | 4,645 | 5,404 | 9,146 |

| 2018 | 11,458 | 5,063 | 2,666 | 10,787 |

| 2019 | 11,296 | 5,127 | 2,722 | 11,616 |

| 2020 | 9,789 | 4,160 | 2,013 | 11,566 |

| 1п2021 | 5,438 | 2,768 | 1,492 | 12,047 |

Comparison with competitors

| EV / EBITDA | P / E | net debt / EBITDA | |

|---|---|---|---|

| Norfolk Southern Corporation | 14,27 | 22,62 | 2,33 |

| CSX Corporation | 12,94 | 21,10 | 2,04 |

| Kansas City Southern | 20,60 | 37,58 | 2,40 |

| Union Pacific Corporation | 15,59 | 23,68 | 2,59 |

Arguments for

Growth of indicators in 2021. The company records an increased demand for its services. Noticing this fact, management has increased its annual forecast of financial results.

High level of profit sharing. Norfolk Southern Corporation for the first 6 months of 2021 returned $ 2.021 billion to shareholders through dividends and buybacks with a total capitalization of $ 61.79 billion. The profitability for the first half of the year was 3,3% against 2,2% у CSX Corporation.

Moderate debt burden. The company currently has a net debt of $12.047 billion., and the multiplier "Net debt / EBITDA »equal 2,33.

Green Agenda. Norfolk Southern Corporation plans to reduce greenhouse gas emissions by 2034 42%.

Arguments against

Older fleet of locomotives and wagons. Whose average age is 26 years against 21 year at CSX Corporation.

Biden's legislative initiatives. White House Promotes Influence Scheme, to force large carriers to subsidize smaller companies.

What's the bottom line?

Norfolk Southern Corporation is a financially sound company, which aims to maximize the return of profits to its shareholders. Even the global financial crisis in 2020 did not prevent the railway carrier from maintaining buyback - the buyback decreased, but did not reset to zero — and ensure a stable level of dividend payments.

Rapid recovery of US economy and business of Norfolk Southern Corporation, which has almost reached its dock-like values, indicate, that the company will continue to adhere to the current development strategy in the future - at least until the adoption of a new business plan.