Hubbell (NYSE: HUBB) - American industrial enterprise. The company's shares rose for no reason and now may well fall due to very specific reasons.. Are there any prospects here?

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

What do they earn

The company is engaged in the design and manufacture of various industrial components.

Often, when reporting companies, the numbers are rounded up, therefore, the totals in graphs and tables may not converge.

According to company report, revenue is distributed as follows.

Electrical solutions — 54%. Everything, related to current and power: earthing switches, connectors, various equipment, wiring, lighting solutions. Segment operating margin — 10,37% from its proceeds.

Housing and communal services — 46%. Components for providing power supply in enterprises of the corresponding type. Segment operating margin — 15,5% from its proceeds.

The company has a presentation, where on a graph without specific numbers you can guess the distribution of its revenue by types of customers:

- Non-residential real estate - 23%.

- Residential Properties - 7%.

- Industry - 20%.

- Customers from the housing sector - 50%.

Geographically, the company's revenue is divided as follows: USA - 92,22%, other, unnamed countries - 7,78%.

Arguments in favor of the company

Reliability. The company receives a significant share of its income from housing and communal services enterprises, which makes much of her business pleasantly predictable, - it can attract many investors.

Something about prospects. The company will be one of the beneficiaries of increased spending on infrastructure upgrades in the United States - which will happen even with Biden, even without him, what we talked about in the Emcor idea. Truth, wild income growth should not be expected - but, at least, this will keep the company's earnings at the current level.

Also in the medium term, it will be favored by the growth of industrial production in the United States and the costs of American enterprises to renew fixed assets - plot, which we have already discussed in the ideas for TE Connectivity and Amphenol.

Dividends. The company pays 3,92 $ dividends per share per year - which gives almost 2% per annum. It's not crazy money, but significantly higher than the average dividend yield on S&P 500 c 1,3% per annum. Given the unhealthy interest of American investors in any form of passive income, stocks can attract enough people.

What can get in the way

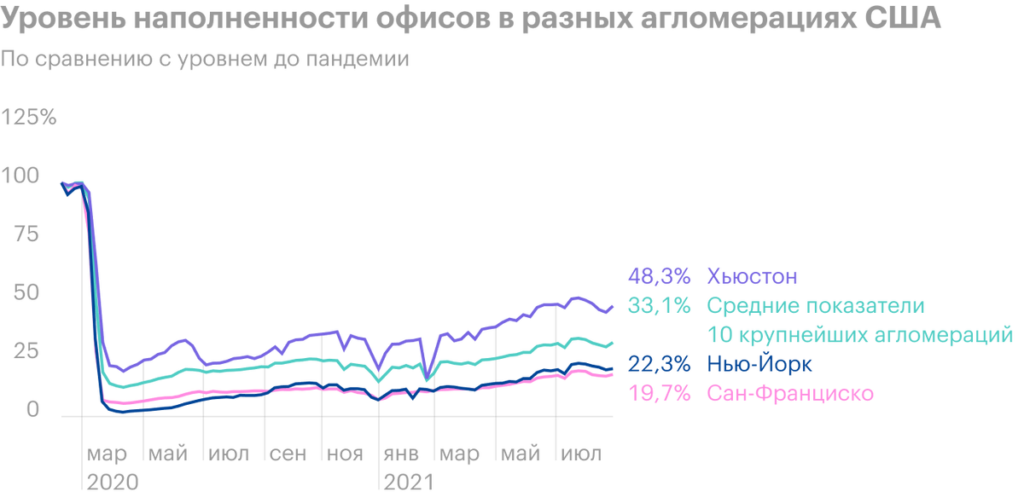

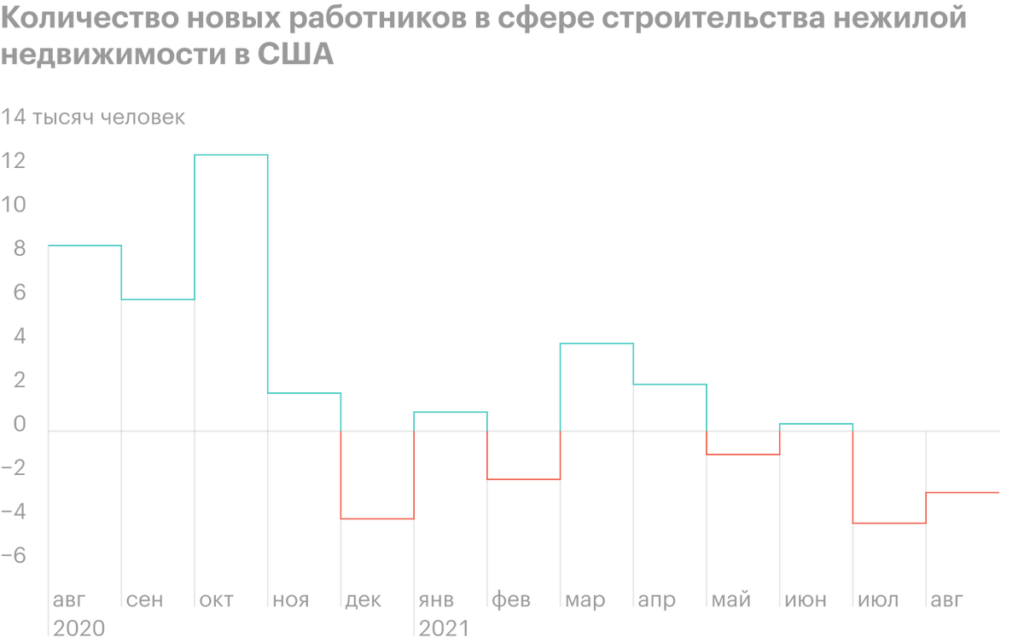

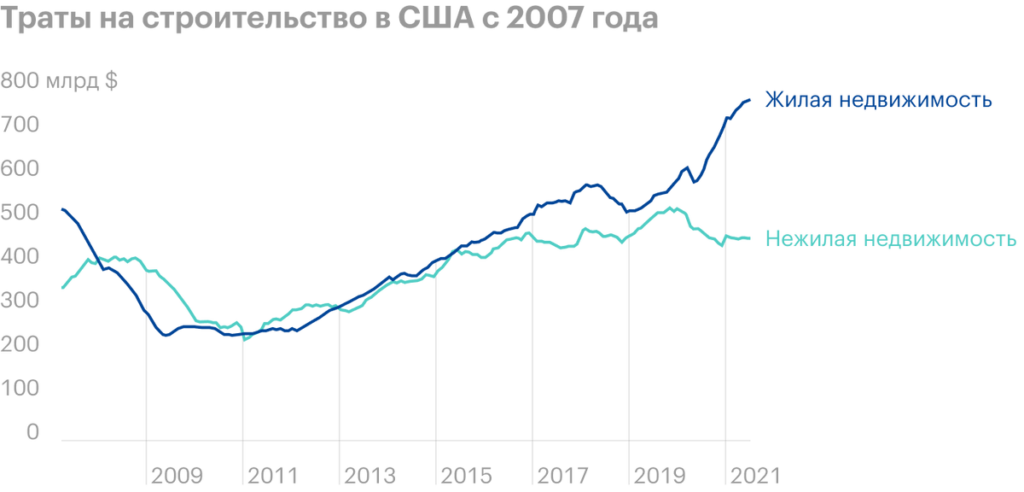

Not there. Almost a quarter of the company's income comes from commercial residential real estate. Given the exodus of workers from offices, this is very bad. Actually, the latest economic statistics already show a weakening of activity in this area, what poses problems for the respective Hubbell division.

The company itself is moderately pessimistic in this regard.: commercial real estate segment for this year, she predicts growth in the region of 1-3%, and this is the weakest growth of all segments of the company. But, it seems to me, given the negative developments in the commercial real estate sector, even this weak forecast risks not coming true.

This is unlikely to be a disaster for Hubbell., but the results of this segment will slow down the overall growth.

"A boy walks wide, I need to calm down ". Since October 2019, the company's shares have risen by 41% in the complete absence of its progress in terms of revenue and profits - and for me this is just a nail in the coffin of any investment in Hubbell stock with their current price.

In his presentations, Hubbell skillfully juggles facts in the spirit of fraudulent mathematics.: "Look, How did our operating profit grow?, on 15%! And what is our organic sales growth excluding acquisitions!" Yes, impressive growth - but only because, what compares the situation with the economic failure of 2020. Against this backdrop, anything will look good..

Maybe, investors bought shares of all near-infrastructure issuers for the future in anticipation of the adoption of the Biden infrastructure plan - including Hubbell. But it must be understood, that even if the plan is accepted, then these infrastructure spending will be spread out over a very long period of time.

And in the case of Hubbell specifically, these expenses of the American government will not greatly increase the company's revenues., because the main money there will receive engineering, design and construction companies. In addition, against the backdrop of the story of the skillfully spent $ 2 trillion in Afghanistan, if I were investors, I would still think about, how exactly the money from the Biden package will be spent inside the United States. All in all, I think, that the "infrastructure" factor in the case of Hubbell is greatly overestimated.

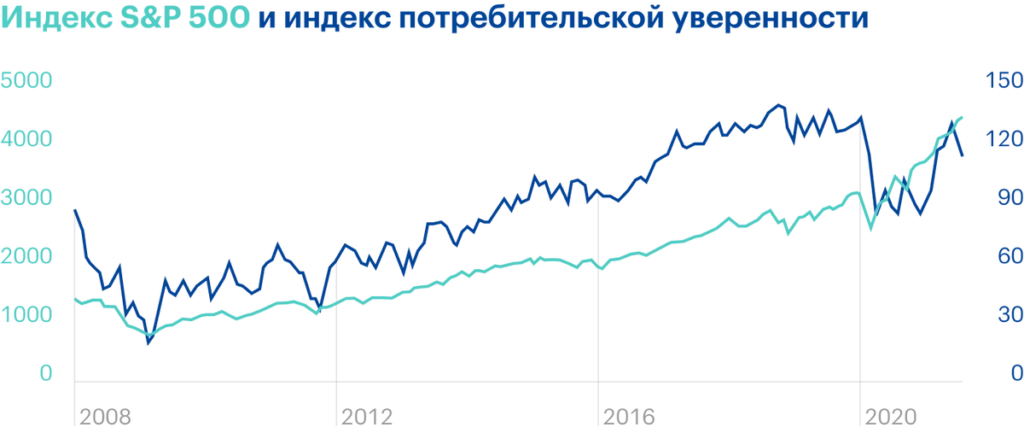

Considering, what stock market in the USA too clearly out of touch with reality: for example, US consumer confidence index fell sharply, - I would be afraid of a market correction, during which those who suffer, who deserves it the most, - in particular, issuers, which did not support the growth of their quotations at all with an improvement in financial indicators.

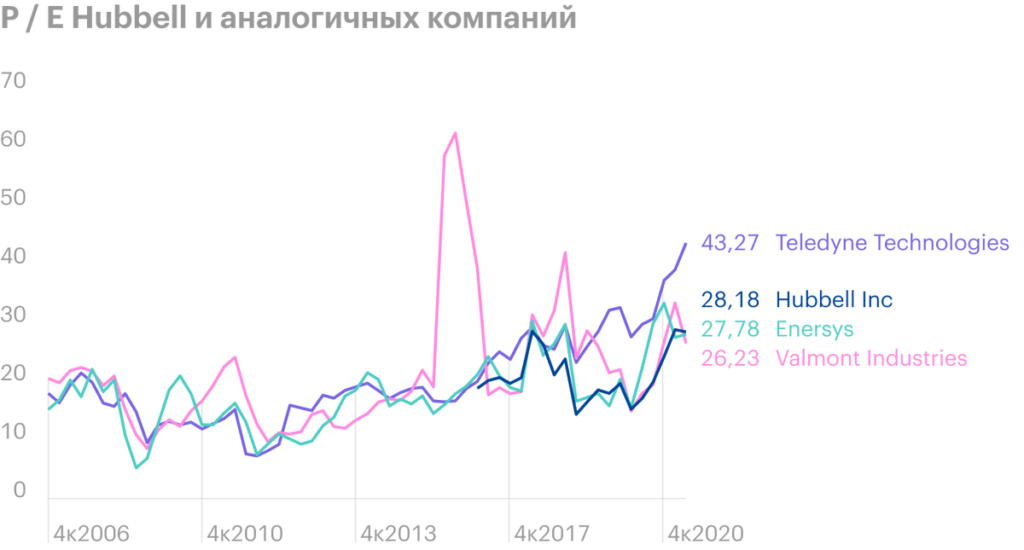

Nothing special. Hubbell doesn't have a very high P / E - closer to 30, - but in comparison with similar companies, it does not look underestimated. Taking into account the modest achievements in terms of increasing business indicators, it turns out that, that there is no particular reason for further growth.

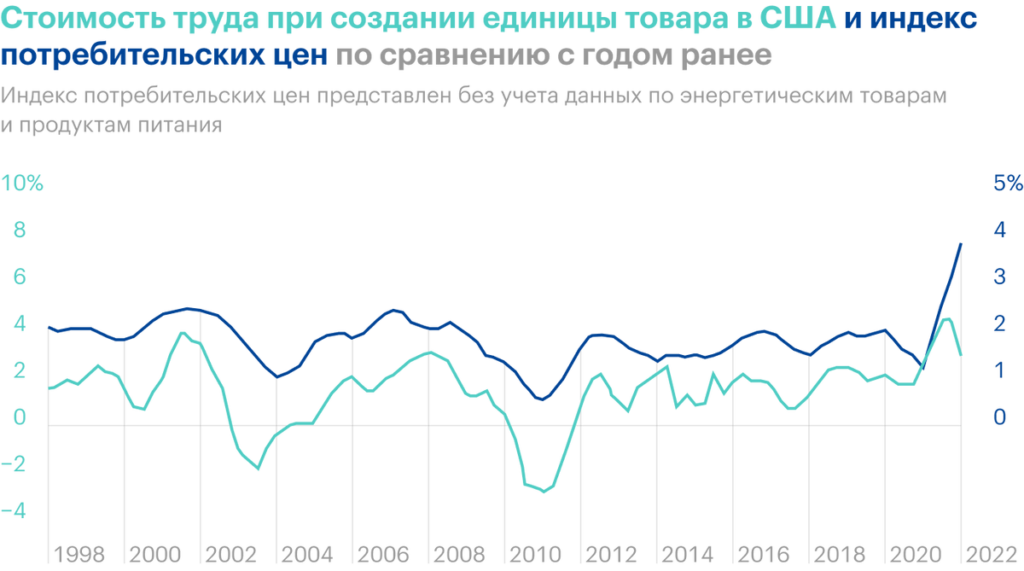

Flesh salary. Like all manufacturing companies, Hubbell risks rising labor and raw material costs. The possible repetition of a large-scale quarantine can also add to the company's problems.: Hubbell's previous big quarantine was not without loss.

We count other people's money. The company spends $ 215.6 million a year on dividends - almost 59,7% from her profits for the past 12 Months. The company has enough money, to close all urgent debts, but she has 2 billion more long-term debts.

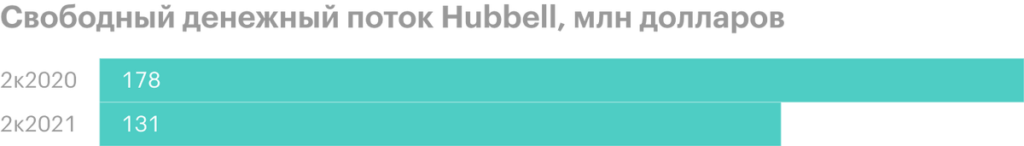

Considering all of the above about the growth of the company's expenses and the fall in income from commercial real estate, I would prepare for that, that the free cash flow of the company will soon fall even more. This may lead management to think, that dividends can be cut or canceled altogether for the greater good. Considering, that the dividends here are not the smallest, you need to be mentally prepared for a fall in stocks from such news. However, this threat is more theoretical.

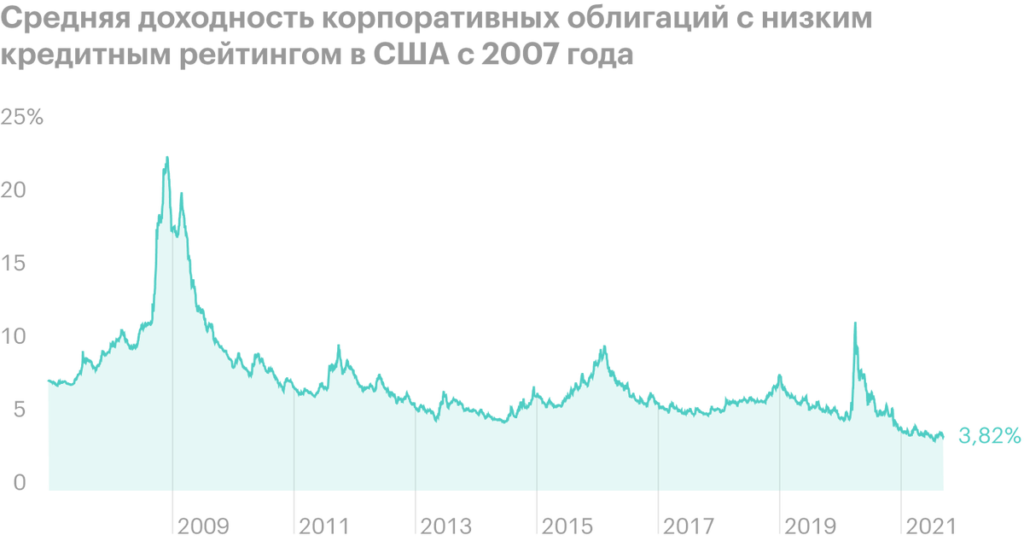

At the same time, high levels of debt, in theory, should scare away investors: rate hike and higher loan prices are just around the corner.

Resume

Hubbell is an interesting issuer. But the unreasonable growth of the shares of this company is based only on the speculative expectations of investors, - in my opinion, makes buying Hubbell at the current price a very risky investment. What, however, does not change the fact, that the company's business looks quite stable. So someone can decide, that it is quite possible to take risks here with the hope of further growth. But I would wait for the entry point below the current level - closer to 160 $ per share.