Cabot Oil & Gas (NYSE: COG) - American oil and gas company. It will soon merge on favorable terms with another company, and the environment for her business looks good. But there are a number of nuances.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

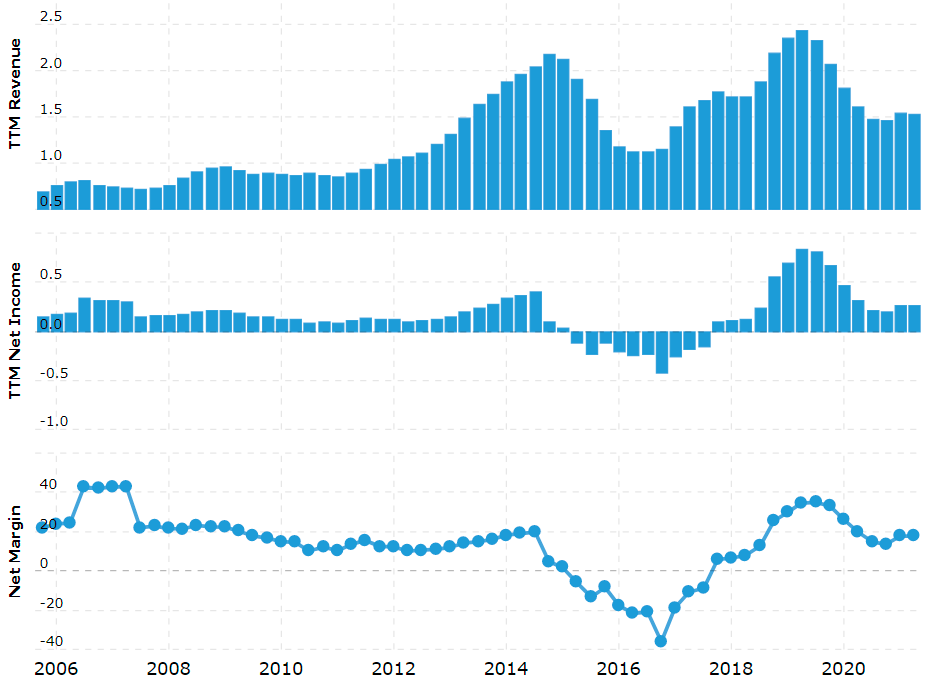

What do they earn

We have already analyzed the business of the company, so we won't repeat ourselves here..

Arguments in favor of the company

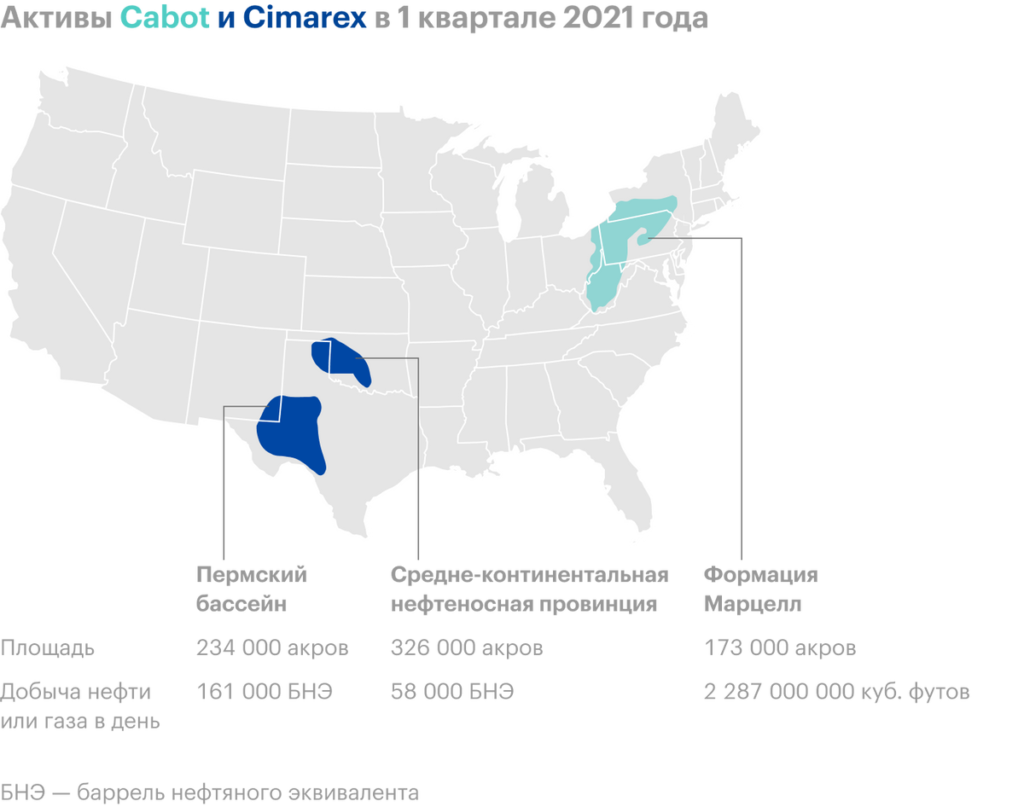

Doubling. In May of this year, we wrote about the merger of Cabot with the oil company Cimarex. Main introductory:

- Cabot shareholders will receive 49,5% shares of the new company, and Cimarex shareholders will get 50,5% Shares;

- Cimarex produces mainly oil and operates in Texas, New Mexico and Oklahoma. Cabot produces mainly gas in the Appalachians;

- the combination of companies will allow them together to save up to $ 100 million a year.

Overall, this association is a boon for Cabot., what can be seen from the conditions of the merger.

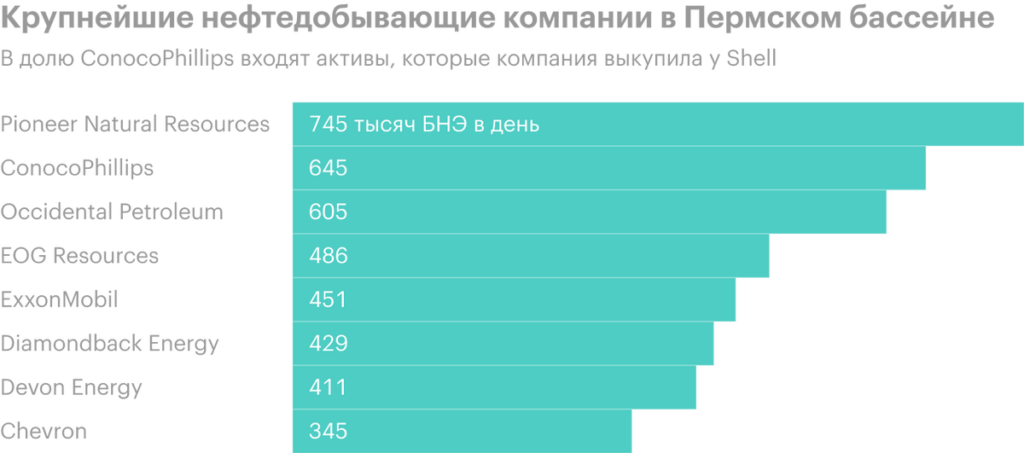

Can buy. Given the consolidation trend in the US oil and gas sector, there is a very high probability, that the new combined company will be bought by one of the major players. The presence of large assets in the Permian Basin will add special attractiveness to the merged Cabot.

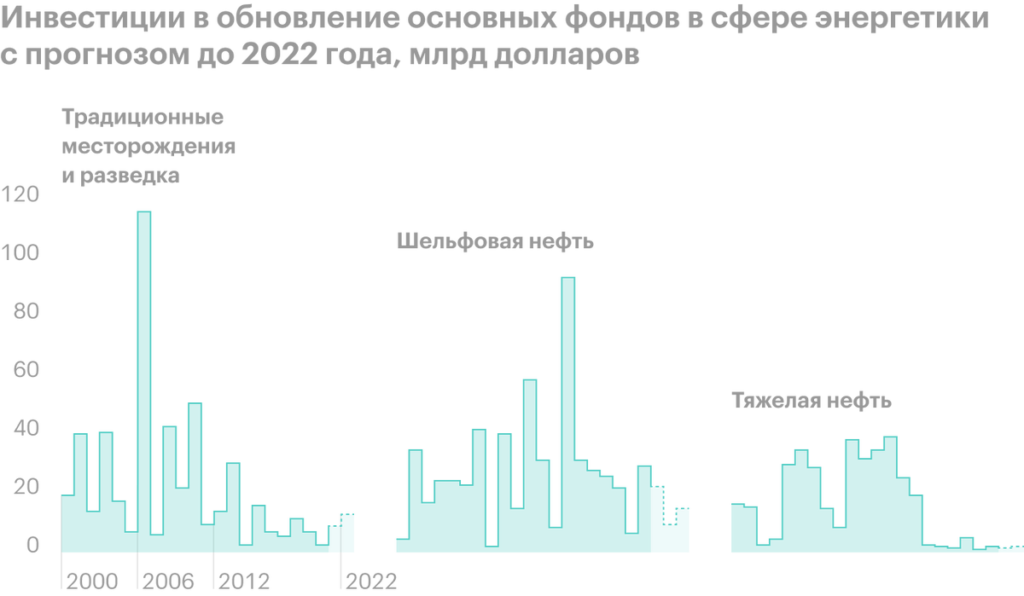

You need. And oil, and gas is now much more expensive, than six months ago, and even more expensive than "pre-war" December 2019. So this is a tangible plus for the accounting department of the company.. This is largely facilitated by high demand, while, that reserves are like oil, so the gas is reduced.

At the same time, the lack of investment in oil exploration and production over the next few years could lead to a more serious shortage of oil and gas.. Prices from this, may be, and will not grow, but at least remain at the optimal level for Cabot. It's not accurate, and there are nuances, but from a purely economic point of view, the medium-term environment for the company looks good.

What can get in the way

ESG. Every day comes news about the next big wins of the ESG lobby, and by and large one can say, that ESG is now mainstream in the investment world. In this context, Cabot quotes can endlessly stagnate even in the event of a strong improvement in business performance, simply because, that large investors will ignore stocks for environmental reasons.

Also, inconsistency with the commandments of ESG-teachings can and, probably, will be manifested in the difficulties of obtaining loans by the company. Not to tell, that Cabot has a particularly terrible bookkeeping - there is enough money there to close the most urgent debts, but difficulties in obtaining loans to any company do not add attractiveness.

Can repeat. The greatest paradox and tragedy of oil and gas companies is that, what, being suppliers of a resource of great civilizational importance, they have practically no control - and they are constantly interfered with dirt. Negative oil prices in the first half of 2020 are exactly what the ritual humiliation of commodity companies and demonstrative mockery of the economy. This moment, that this story passed without consequences at all, shows, that it can be repeated many more times. But even without negative prices, it is quite possible that prices will fall due to, for example, a sudden jump in energy production and an oversupply in the market. Although, in view of what has been said before, this is unlikely. But the new large-scale quarantine of the company definitely does not bode well.

Count other people's payments. Cabot pays 44 a cent of dividends per share per year is about 2% per annum. If it were a manufacturing company, i would say, that enough fans of passive income can flock to these small dividends. But the risks of the oil and gas industry are obvious to everyone, so this return is absolutely insufficient for investors in the case of Cabot. At the same time, about 61,5% company profits, so considering the difficulties, described above, payments can cut.

Resume

Cabot is not the worst option, to invest in the American commodity sector. Especially considering, that the company will arrange a merger with Cimarex on more favorable terms. But the risks listed here are still quite large.. Therefore, you can invest in these stocks, only being aware of all the risks.