Valero Energy (NYSE: FLEA) - American oil company. Her business is on the mend after losses. 2020, and she pays big dividends. What can go wrong?

What do they earn

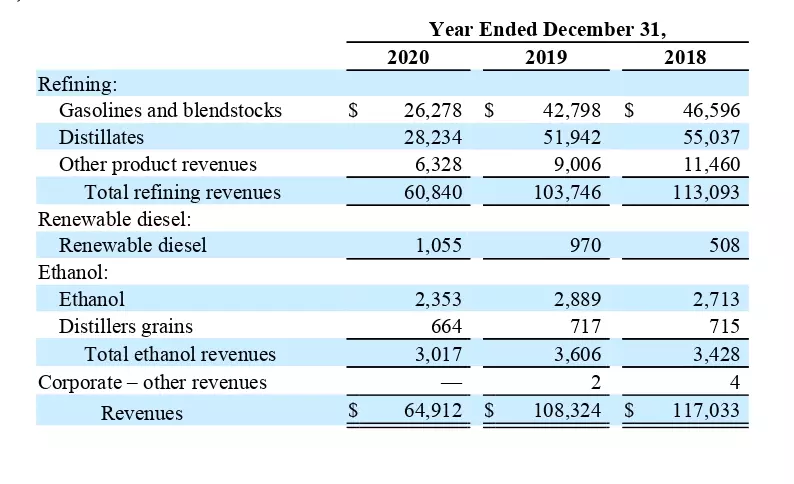

This is a network of refineries, which is also engaged in the sale and delivery of fuel. Something the company sells under its own brand, and something to wholesale buyers, who then sell these petroleum products as their goods. According to company report, her business structure is as follows.

Oil refining — 93,7% of total revenue. In this segment, the company is engaged in the production of gasoline and other fuels from oil.. Margin in this segment is negative: losses here on 2,2% exceed the volume of proceeds.

Ethanol production — 4,7% of total revenue. The company does not only fuel ethanol, but also animal food. The segment is also unprofitable: losses on 2,2% exceed segment revenue.

Clean diesel production — 1,6% proceeds. This is the only profitable segment of the company, its operating profit is 39,53% from segment revenue.

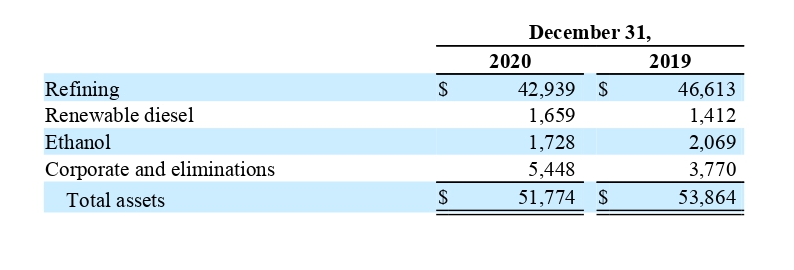

The company operates not only in the USA, but still, her main revenue and assets are in America.

Company ownership map

"Processes are unfolding, unfold!»

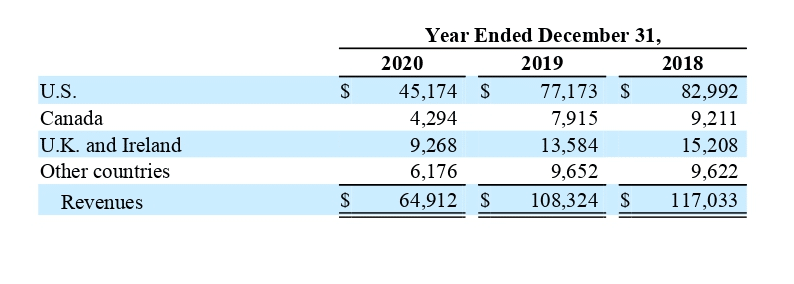

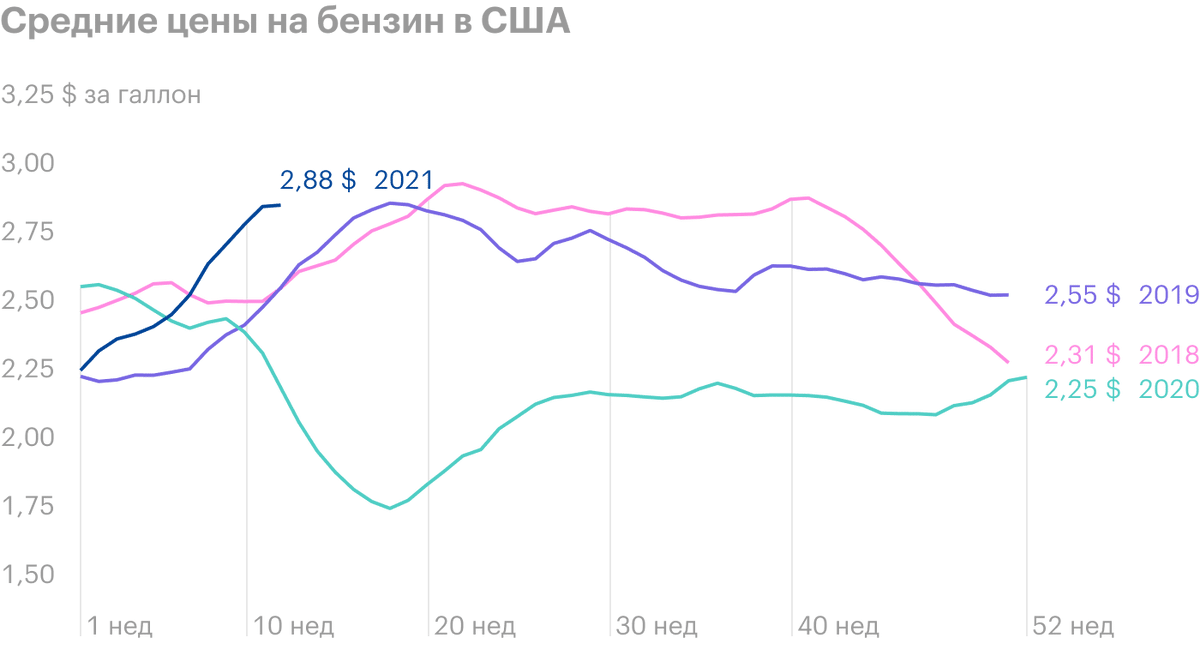

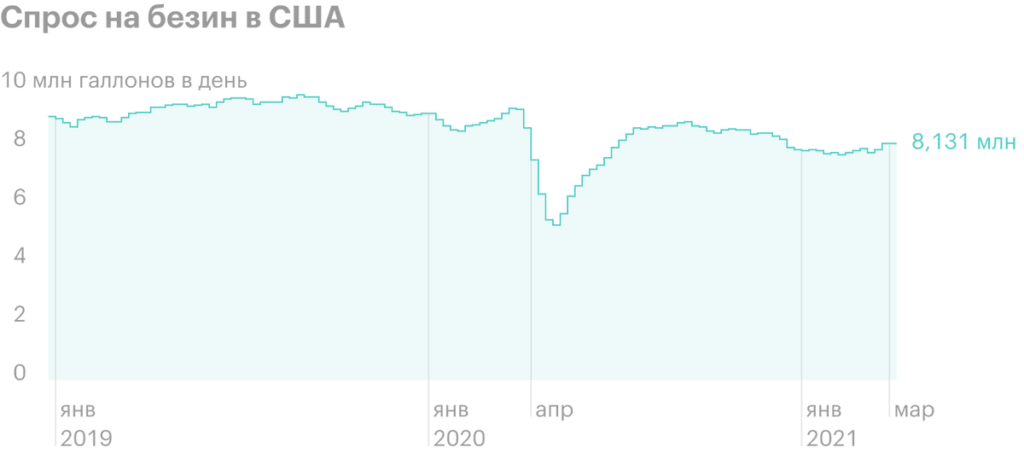

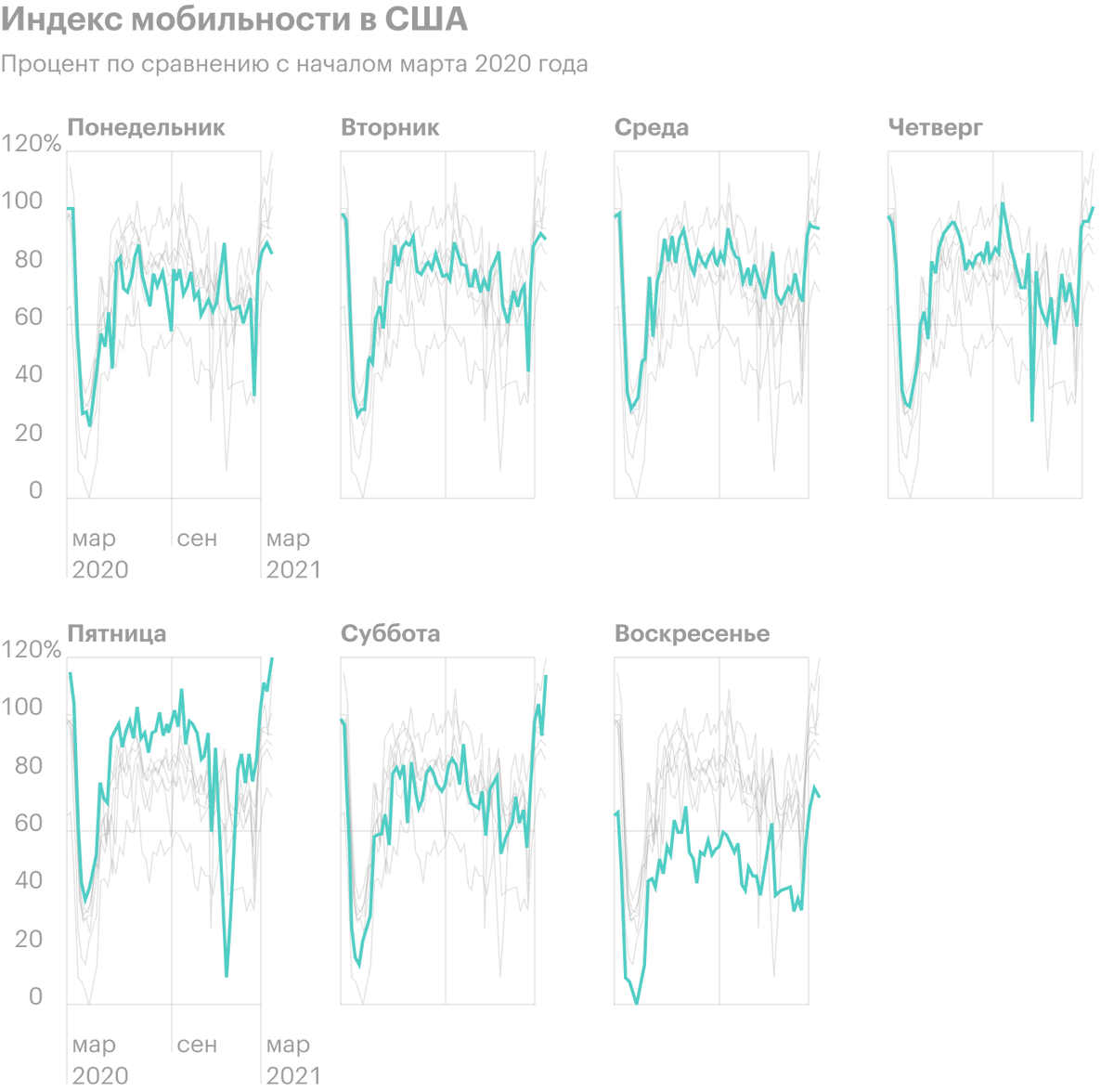

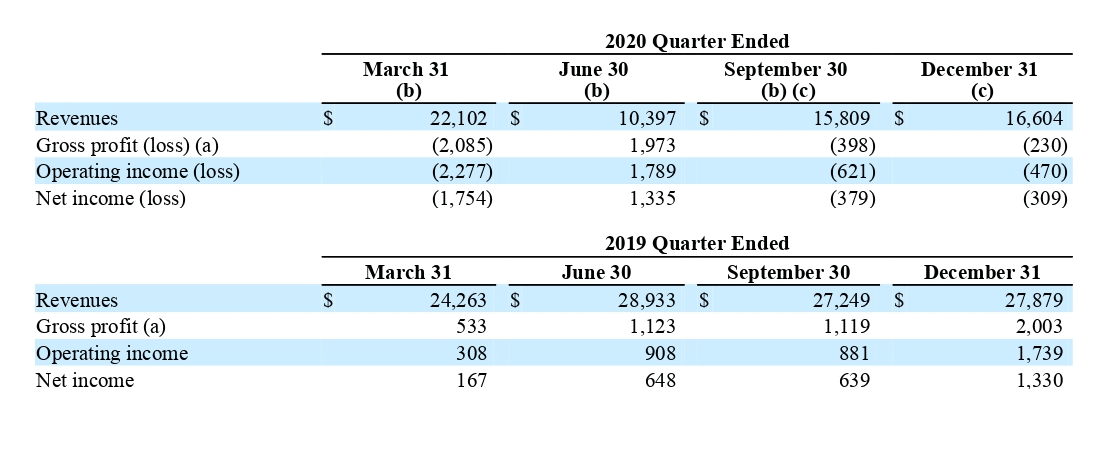

The terrible coronavirus year hit Valero's business hard and led to heavy losses. But things are getting better now: U.S. gasoline prices and demand rise, which is caused by the relative increase in population mobility.

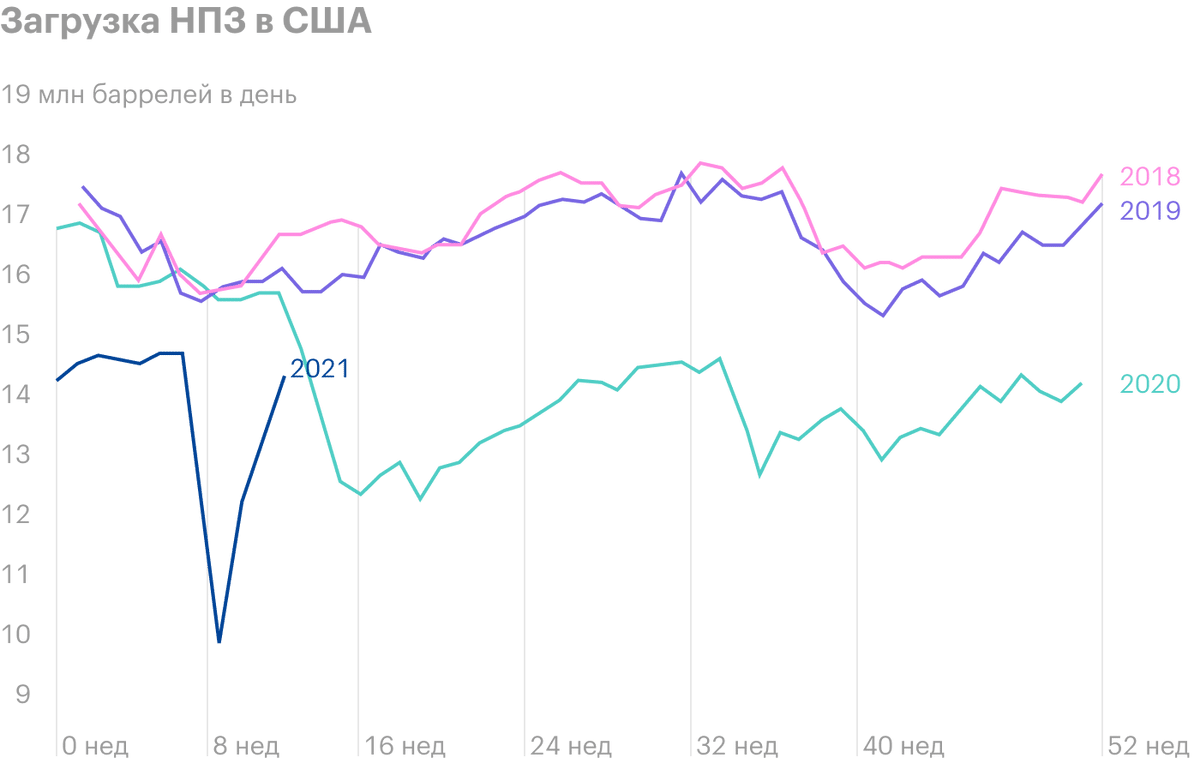

U.S. refinery utilization is at a fairly high level. Therefore it is possible, that Valero Energy shareholders should expect the company's financial situation to improve this quarter. But there is one caveat.

Cold welcome. A significant proportion of the company's operations are located in Texas, therefore, the February frosts could not but affect them: U.S. refinery activity dropped sharply during that period. Known, that during the frosty period the company suspended the operation of the plant with processing capacities at the level 335 thousand barrels of oil per day, that's not much: the company processes about 2,6 million barrels of oil per day. However, you should be prepared for, that the Texas frosts will not have the best effect on the company's reporting.

And it's important, because Valero Energy pays big dividends: 3,92 $ per share per year, nearly 5,41% per annum, - it costs the company 1,6 billion dollars a year. According to the latest report, the company has about 3,313 billion dollars, but she has debts 32,132 billion dollars, out of which 9,283 billion needs to be repaid within a year. If the company cuts payouts, then the stock will go down. Given their high dividend yield, there should be a lot of passive payments lovers among Valero Energy shareholders, therefore, in the event of their reduction, the fall in shares can be quite strong.

Komsomol badge. On the other hand, there is a good chance, that Valero Energy will be able to refinance at an acceptable interest and it will have enough money to pay. And it's all about the company's environmental merits - it invested 3,1 billion dollars in the development of eco-production. Valero Energy is the world's second largest producer of biodiesel and is actively investing in the expansion of the corresponding capacities. Expected, what in 2021 the volume of production of biodiesel by the company will increase from 275 million gallons per year to 675 million gallons. The company is quite vocal about its ESG metrics: how she helps the environment and how many women and minorities she employs.

In general, this is a very important point - the thesis about encouraging socially concerned investors and banks of the "right" companies and punishing the "wrong" ones.. Investors are actively buying shares of such companies, and banks give them financing on acceptable terms. Valero Energy in this context is more of a "right" company: this is a large and extremely unenvironmental business, which actively invests in the production of clean fuels and takes steps, to look as progressive as possible.

The Hongweibing investment community is very fond of such stories in the spirit of “the prisoner embarked on the path of correction and, maybe, cooperation with the administration "- after all, such examples are intended to inspire other companies to carry out similar reforms. This, By the way, explains, why Valero Energy shares over the past year have grown by as much 50% with complete absence of revenue and profit growth. So that, may be, quotes and accounting of the company will be supported by a powerful clique of ethical investing enthusiasts.

Average US gasoline prices

US gasoline demand

US Mobility Index

Refinery load in the USA

Capacities of the company's refineries in different regions

| Capacities, thousand barrels per day | Percentage of the company's refinery capacity | |

|---|---|---|

| US Gulf Coast | 1484 | 57% |

| Mid-continental oil province | 461 | 17% |

| North Atlantic | 440 | 17% |

| US West Coast | 230 | 9% |

Gulf Coast share of oil refining by different companies

| Capacities, thousand barrels per day | Percentage of the company's refinery capacity | |

|---|---|---|

| Valero Energy | 1484 | 57% |

| Marathon Petroleum | 1171 | 41% |

| Phillips 66 | 784 | 35% |

| PBF Energy | 185 | 19% |

Resume

22 April, the company has a report for 1 neighborhood 2021. I think, that given the increase in refinery utilization rates in the US and the obvious growth in demand for gasoline, investors can expect good results. But still, you should be prepared for the unpleasant consequences of the terrible Texas frosts and a possible cut in dividends..