Bank "Saint-Petersburg" (MOEX: BSPB) is a major Russian regional bank, which has more than 30 years of development history. The head office is located in St. Petersburg.

Business structure

The bank's core business is divided into four business segments.

Corporate banking — bank account services for organizations, attracting deposits, providing loans and credit lines.

Retail banking - banking services to individuals, e.g. opening and maintaining bank accounts, Consumer, mortgage and other types of lending, attraction of deposits and much more.

Operations in financial markets — trading operations with financial instruments, granting loans and attracting deposits in the interbank market, transactions with foreign exchange and derivative financial instruments.

Unallocated articles - the result of internal funding, which is formed by the reallocation of resources within the bank in the normal course of business between business segments.

Bank Saint Petersburg income structure, billion rubles

| Net operating income | Share in overall results | |

|---|---|---|

| Corporate banking | 9,092 | 47% |

| Retail banking | 5,247 | 27% |

| Operations in financial markets | 1,154 | 6% |

| Unallocated articles | 3,883 | 20% |

Bank assets

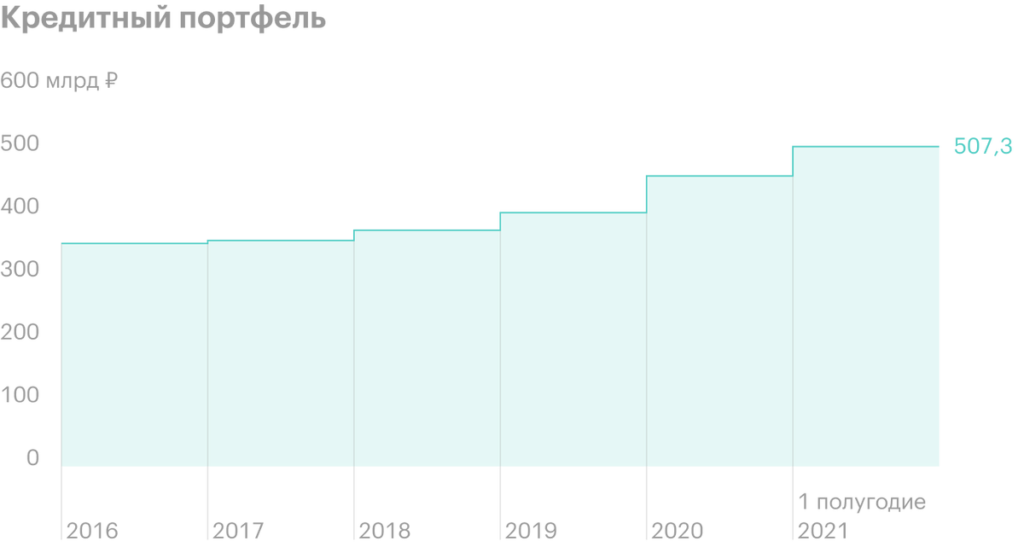

The main financial asset of the bank is its loan portfolio, which for the last 5 years grew by 43% and as of 30 June 2021 amounted to 507.3 billion rubles.

Bank assets

| Customer loans and advances | 63% |

| Securities and REPO | 24% |

| Fixed assets and other assets | 5% |

| The money | 4% |

| Bank loans | 4% |

63%

The structure of the loan portfolio of Bank Saint Petersburg

| Individuals | 24,6% |

| Trade | 14,6% |

| Leasing and financial services | 11,6% |

| The property | 10,6% |

| Heavy engineering and shipbuilding | 7,5% |

| Oil & Gas | 6,2% |

| Manufacturing and food industry | 5,6% |

| Construction | 5,4% |

| State institutions | 5,1% |

| Transport | 4,2% |

| sports and health | 1,5% |

| Other | 3,1% |

25%

Share capital and distribution of profits

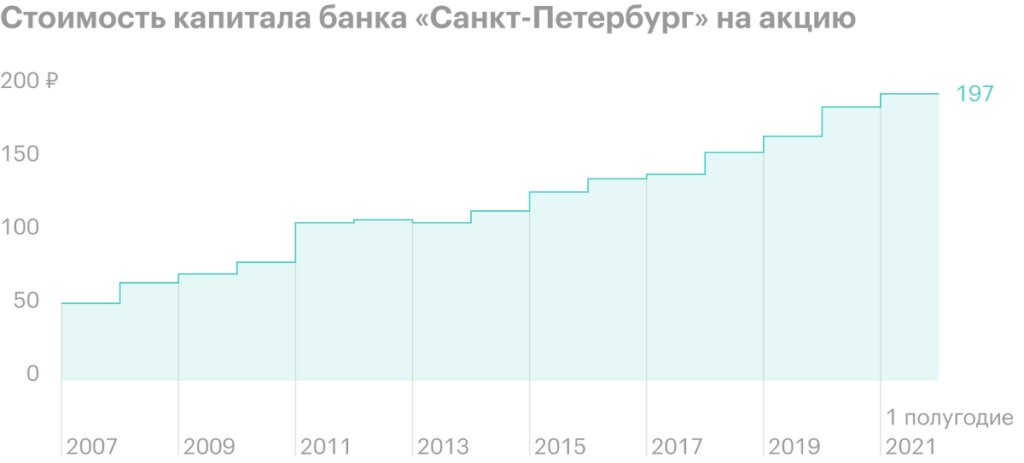

The main feature of the company is a low valuation in relation to its capital, which is largely due to the dividend policy of Bank Saint Petersburg.

The authorized capital of the bank is divided into 475 554 232 ordinary shares, which are traded on the Moscow Exchange under the ticker BSPB, And 20 100 000 preferred shares, which are also traded on the Moscow Exchange under the ticker BSPBP.

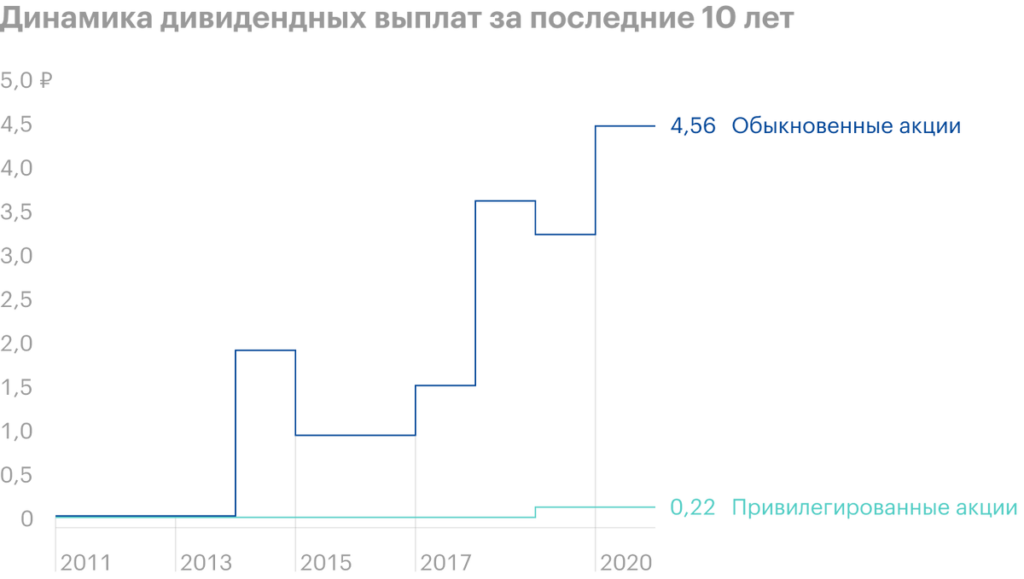

Bank Saint Petersburg has one of the lowest IFRS net profit distribution ratios for ordinary shares on the Russian stock market — 20%. For preferred securities, the company pays fixed 0,11 P annually.

The company tries to compensate for the low profit distribution ratio with a buyback. Last buyback announced 6 August 2021, during it, the bank plans to proportionally purchase from shareholders 14 million ordinary shares at a price 75 R.

Bank strategy for 2021-2023 and financial performance

Bank Saint Petersburg has been demonstrating strong financial results over the past five years, showing a double-digit return on equity and growth in net income.

At the end of 2020, the company updated its development plan for the next three years. In the previous version of the strategy for 2018-2020, the bank expected to reach the following indicators:

- Ensure the growth of assets up to 700 billion rubles. Goal accomplished, result of 2020 — 730 billion rubles.

- Achieve sustainable return on equity, Exceeding 15%. Goal not met, result of 2020 — 12,9%.

- Increase the market value of the bank in 3 times - up to 75 billion rubles. Goal not met, result of 2020 — 24.6 billion rubles.

New goals for 2023, billion rubles

| Results for 2020 | Goal for 2023 | |

|---|---|---|

| Loan portfolio | 460 | 600 |

| Legal entity loans | 350 | 440 |

| Loans to individuals | 110 | 160 |

| Revenue | 37 | 50 |

| Net profit | 10 | 17 |

| CIR | 36% | 34% |

| Index H1.2 | 9,9% | > 9,5% |

| Return on equity | 12,9% | 15% |

Financial performance of the company, billion rubles

| Net interest income | Net profit | Return on equity (ROAE) | Return on assets (ROA) | |

|---|---|---|---|---|

| 2016 | 21,358 | 4,278 | 7,3% | 0,7% |

| 2017 | 19,658 | 7,491 | 11,4% | 1,3% |

| 2018 | 21,895 | 9,047 | 12,3% | 1,4% |

| 2019 | 23,281 | 7,906 | 10,2% | 1,2% |

| 2020 | 25,523 | 10,827 | 12,9% | 1,5% |

| 1п2021 | 13,096 | 7,269 | 16,1% | 2% |

Comparison with competitors

| P / E | P / BV | ROE | |

|---|---|---|---|

| Bank "Saint-Petersburg" | 2,45 | 0,38 | 16,1% |

| Sberbank | 6,74 | 1,45 | 25,3% |

| VTB | 5,93 | 0,61 | 18,5% |

| TCS Group | 24,18 | 9,12 | 38% |

Arguments for

Evaluation. Multipliers of the bank "Saint-Petersburg" are far behind all competitors.

High profitability. As of 1 half year 2021 the bank's return on equity - 16,1%.

Reduction of the authorized capital. After the buyback, the company redeems the repurchased shares.

Russia's GDP growth. According to analyst consensus, growth of the Russian economy this year will be 3,9%.

Arguments against

Profit distribution rate. Bank allocates 20% net profit under IFRS on dividends - against 50% in Sberbank and VTB.

Low valuation of shares upon repurchase. The company announced the price of the last buyback - 75 R per ordinary share, this corresponds to the estimate P / BV c 0,38.

What's the bottom line?

Bank Saint-Petersburg is ideal for long-term investments, counting on a good dividend yield of 6-8% and a strong undervaluation compared to competitors. The bank is able to grow several times, if the company's management decides to improve its dividend policy to the rate of distribution of payments of the leaders of the banking sector - 50% net profit.