J. P. Morgan Chase (NYSE: JPM) - this is one of the largest organizations from the United States according to Forbes Global 2000, providing?? money services all over the world. The company is one of the global leaders in investment banking, cash services for business, commercial banking, cash processing. The bank manages over $ 3.6 trillion.

How the business works

Business J.. P. Morgan Chase can be divided into 4 parts:

- Corporate investment services - forty-one percent.

- Banking service - thirty nine percent.

- Asset management - twelve percent.

- Commercial banking - eight percent.

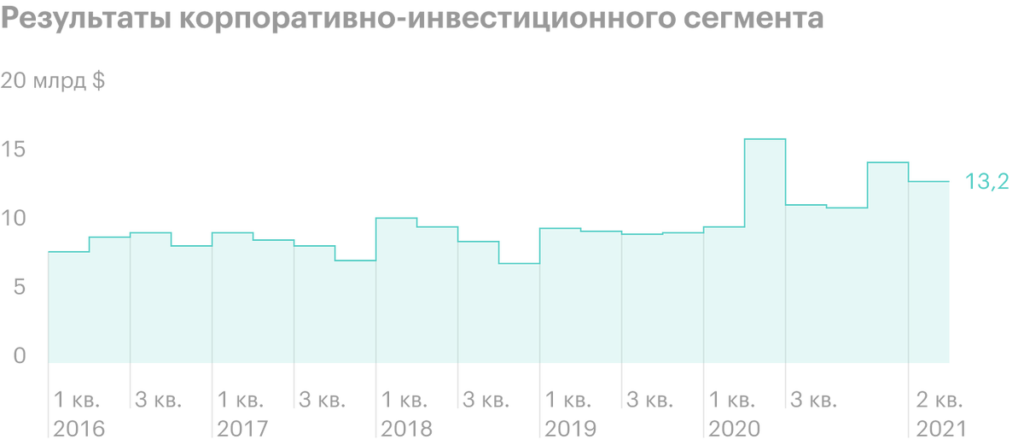

Corporate-investment services. The sector consists of 2 sections: banking and securities market services. Banking provides the full range of investment banking products in all markets, including providing advice on corporate tactics and structure, raising capital and borrowed funds and much more. Securities market services are brokerage and analysis services, global market maker services, also difficult decisions in the field of risk management.

The sector posted the weakest performance compared to other J.P. Morgan Chase destinations in Q2 2021. Revenue fell by nineteen percent in relation to the corresponding time period of the past year. The main reason is the extremely weak characteristics of the bank in investment work, especially in the fixed income market. Direction figures plummeted 44 percent off the bat due to last year's highest base and better criteria. At the same time, the net profit of the entire sector fell by only nine percent.: this is explained by a significant number of positive amendments.

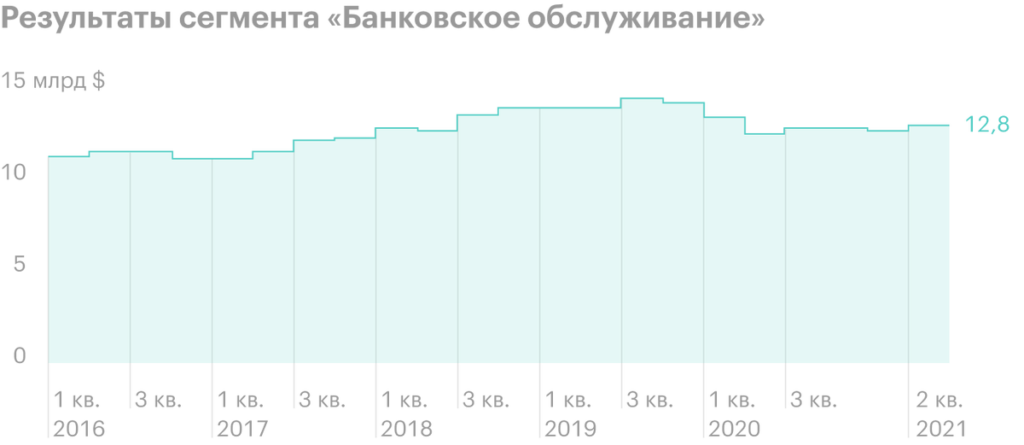

Banking service. J. P. Morgan Chase provides its services to consumers through bank branches, ATMs and digital communication channels. Segment, in its turn, divided into three directions: consumer and business banking, card and car loans, mortgage department. Consumer and Business Banking is the main department, which takes about 50% of the total results.

Segment operating results were flat year-on-year due to strong core division performance: consumer and business banking grew by 15%. A small mortgage department showed a decline in results by 20% compared to last year. At the same time, the current dynamics is still worse than the results of 2019, the lag is about 10%. Net profit of the entire segment in the second quarter of 2021 amounted to 5.6 billion against a loss of $ 0.176 billion a year earlier - mainly due to the release of reserves.

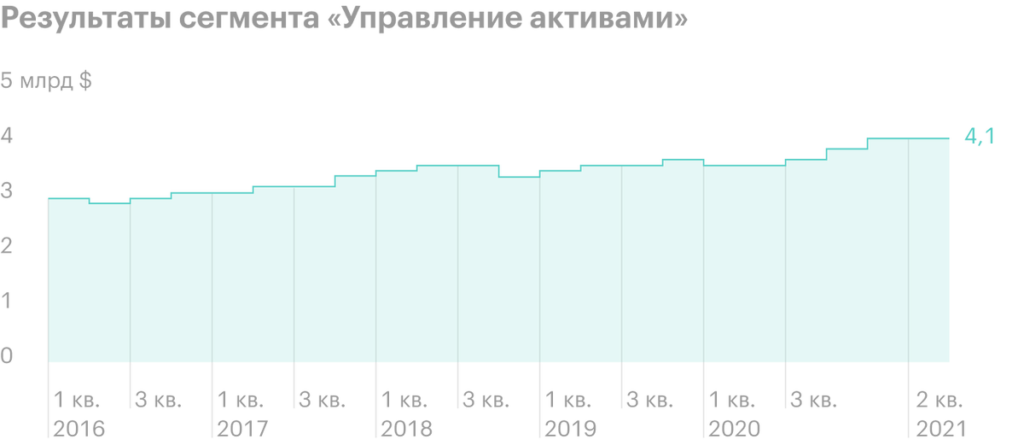

Asset Management. Fast growing segment J. P. Morgan Chase, which does business with 56% of the largest financial institutions. The bank has over 183 funds with ratings over 4 stars from 5.

The segment had a good second quarter of 2021 due to increased demand for banking services. Revenue increased year-on-year by 20% - mainly due to higher management fees. Net profit increased by 74% due to the growth of assets under management at 21%.

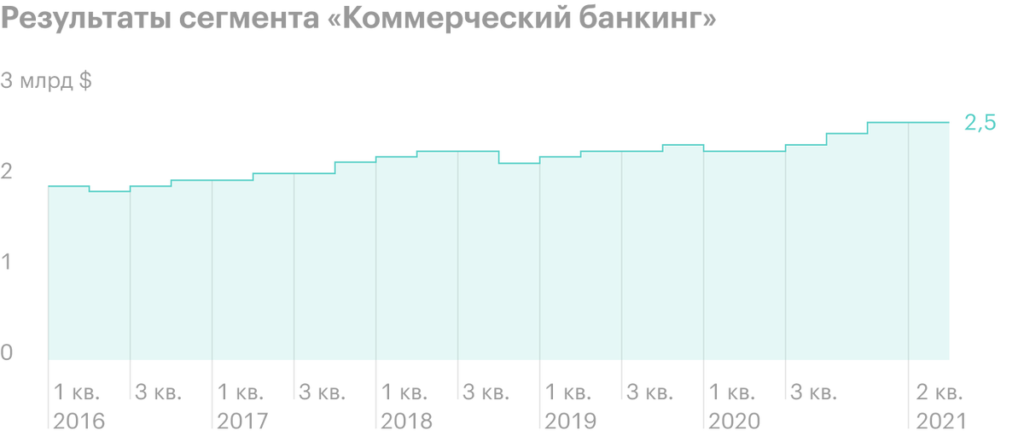

Commercial banking. The segment provides comprehensive financial services to small and large companies, local authorities, as well as commercial property owners. Main directions of activity: various forms of secured financing, work with payments and receipts, investment services, e.g. capital raising or balance sheet and risk management.

The segment in the 2nd quarter of 2021 presented good results. Net income up $2.1 billion to $1.4 billion as net reserves are released. In the 2nd quarter of 2020, the segment had a loss of $681 million. Revenue remained at the level of the previous year due to a decrease in income from deposits.

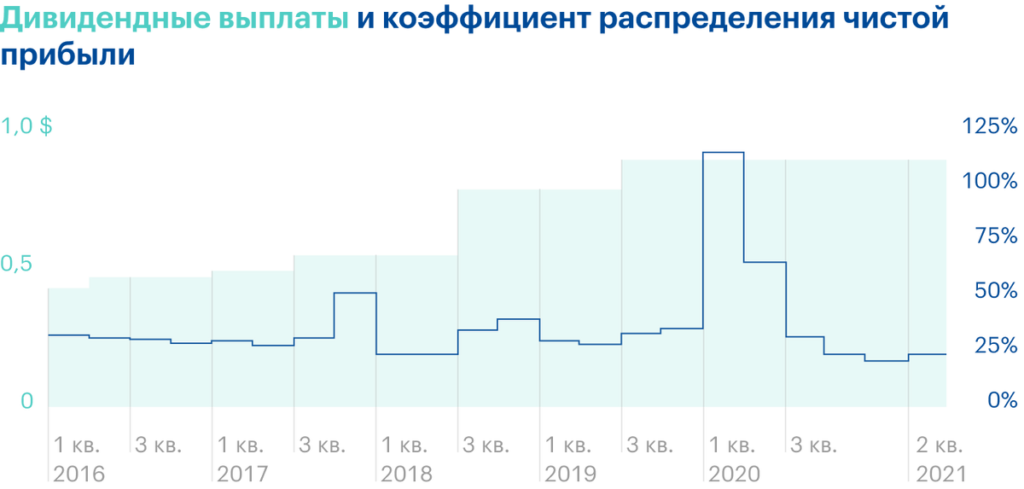

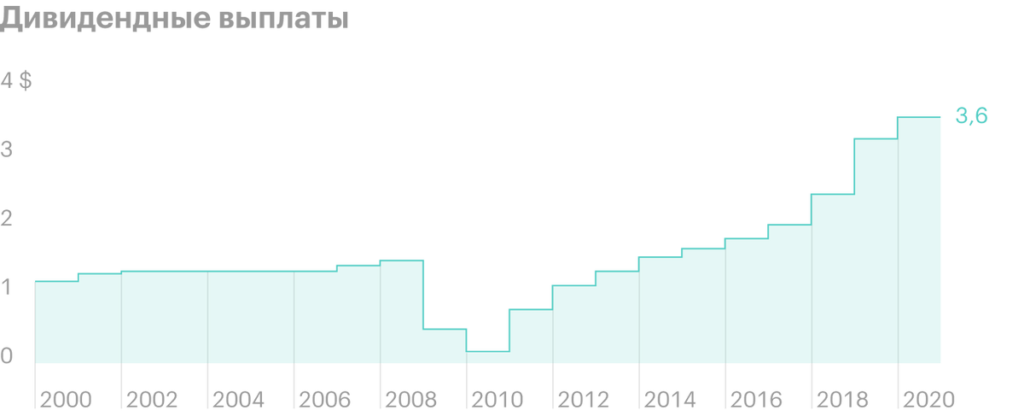

Dividends

The company is interested in stable payments, therefore management warns, that you should not expect a strong increase in dividends. The net profit distribution ratio will remain approximately the same at about 25-30% of net profit, increase to 50% of net profit is not planned. The main reason for this decision is the large CapEx, the bank plans to continue investing heavily in its future growth.

Competitors

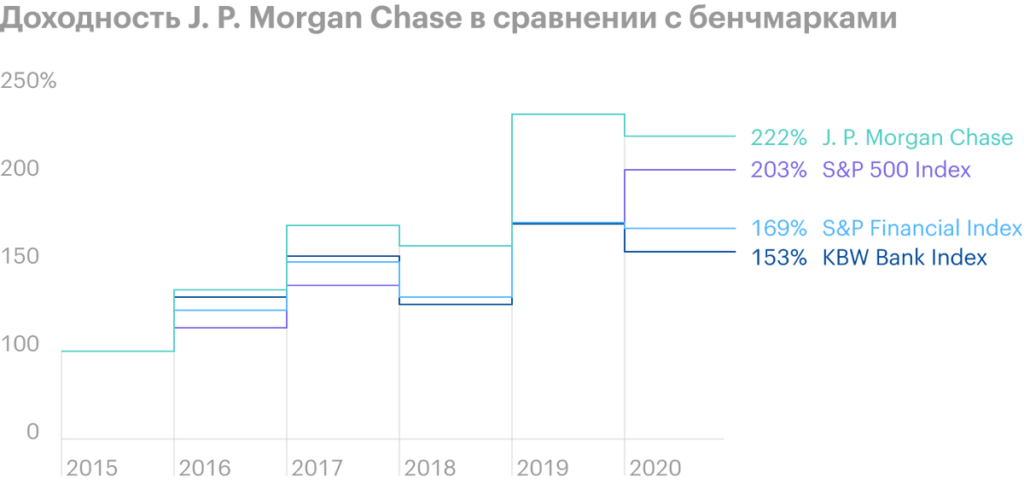

Currently, J. P. Morgan Chase is one of the most efficient banks in America in terms of ROTCE. The indicator is calculated by dividing the net profit, relating to shareholders, on average monthly capital.

Comparison with competitors

| P / E | P / BV | ROTCE | |

|---|---|---|---|

| J. P. Morgan Chase | 9,87 | 1,6 | 23% |

| Bank of America | 12,54 | 1,18 | 19,9% |

| Morgan Stanley | 13,48 | 1,67 | 18,6% |

| Wells Fargo & Company | 13,28 | 1 | 16,3% |

| Citigroup | 6,62 | 0,7 | 15,2% |

Forecasts and management's view

The bank presented the following targets for 2021:

- The company plans to earn 52.5 billion dollars in net interest income. This value was negatively received by the market..

- J. P. Morgan Chase expects, that the net charge-off rate on cards will not exceed 2.5%. The net write-off rate is the ratio of net annual write-offs to the average outstanding loans.

- Annual adjusted spending will be at the level of $71 billion.

«J. P. Morgan Chase has shown strong results, while continuing to actively invest. In Q2, we again benefited from the release of reserves, as we grow more confident in the economy in light of the continued improvement in the COVID-19 situation in the US. Of particular note, that this quarter saw accelerating growth in spending on cards, and therefore, although the number of issued cards remains lower, than before the pandemic, This quarter's trends give us optimism. Total card spending increased by 45% on an annualized basis and, what is more important, on 22% compared to Q2 2019.

Strategy J. P. Morgan Chase remains the same: Firstly, invest and develop our market-leading businesses, Secondly, pay stable dividends and, third, return any remaining surplus capital to shareholders through share repurchases, which we plan to continue in accordance with our existing permit", Jamie Dimon said, CEO J. P. Morgan Chase.

Arguments for

Strong financial results. J. P. Morgan Chase has the best profitability compared to other large banks.

Buyback. Bank approves $30bn share buyback for 2021.

Growth of quarterly dividend. The company's management plans to increase the quarterly payment from the 3rd quarter of 2021 from 0,9 to 1 $.

High rates of vaccination. As of early August 2021, about 50% population. The development of herd immunity will lead to the lifting of all quarantine restrictions, what, in its turn, could boost bank profits further amid pent-up demand.

Arguments against

Low dividend yield. The bank's current annual dividend yield is 2,3%.

High multipliers. J.P. Morgan Chase has an expensive valuation compared to other banks.

What's the bottom line?

J. P. Morgan Chase is an interesting company to invest in for the long term due to its strong business strategy., high profitability and leading position in the industry.

Looking at the short-medium term, then the bank's quotes do not have much growth potential. The ideal would be to buy shares of the company at a valuation of equity or lower, the current value of the share capital per share - 95,84 $. The bank's shares last traded below its equity in Q1 2020.