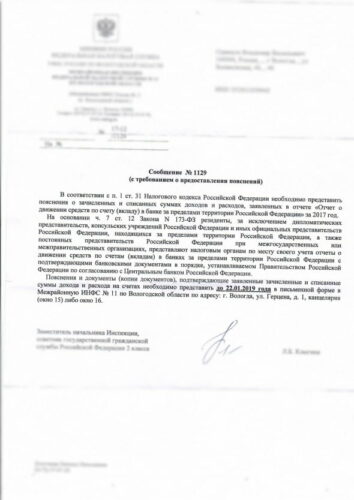

Recently I received a letter from the IFTS with a request to provide explanations and supporting documents to the statement of cash flows on foreign accounts. В письме приводится фрагмент ч.7 , which states, that residents are required to provide reports with supporting bank documents.

but, в оригинале закона этот фрагмент имеет противоположный смысл, namely, that all residents, кроме физических лиц… обязаны предоставлять отчеты и подтверждающие документы. For individuals it is separately spelled out, что они обязаны просто предоставить отчет о движении денежных средств в порядке, устанавливаемом правительством РФ. Порядок предоставления отчета содержит пункт 8, about that, that the tax authority may request supporting documents, но обязанности физическим лицам закон не устанавливает, unlike legal.

If you received a similar letter, then it is better to provide explanations to the statement of cash flows, and primary documents (Bank statements) - at your discretion. You can refer to that, what because. Law 173-FZ does not explicitly oblige an individual to provide supporting documents, in 2017 G. these documents were not generated, and at the moment it is no longer possible to form them.

Порядок действия закона «О валютном регулировании и валютном контроле»

From the end 2018 G. automatic exchange of financial information between tax authorities of different countries began to operate. More than 100 countries. () Российские власти уже начала получать информацию от своих зарубежных коллег. Об этом пишут . How this might affect traders and investors, opened accounts with foreign brokers?

We have previously written, that trading on the exchange through foreign brokers can lead to huge fines!

Law № 173-FZ of 10.12.2003 (ed. From 03.07.2016) "On Currency Regulation and Currency Control" prohibits Russians from making transactions on foreign accounts.

The article 12 (Bank accounts of residents, located outside the territory of the Russian Federation) there is a list of allowed operations. Операций с ценными бумагами на иностранных биржах в перечне нет. Полностью текст закона можно скачать здесь:

At an official request, the Federal Tax Service responds, that since brokerage accounts imply settlements on them with the use of funds, then such accounts are subject to the requirements of article 12 Law № 173-FZ (). Это же подтверждает руководитель ФНС в своем интервью изданию : “…the exchange began not only in banking, but also for any financial accounts, treaties, which involve raising money or other financial assets, storage, management and investment in the interests of the client.”

Now about the fines. Согласно Кодексу Российской Федерации об административных правонарушениях от 30.12.2001 № 195-FZ (ed. from 01.05.2016) (with rev. and extra., introduction. in force from 13.05.2016), article 15.25, the implementation of illegal foreign exchange transactions entails the imposition of an administrative fine on citizens, officials and legal entities in the amount of from three quarters to one size of the amount of an illegal currency transaction. In this way, the amount of the fine can significantly exceed your deposit and be comparable to your trading volume for a year.

Предлагаем экспертное мнение Александра Захарова, партнера Paragon Advice Group, candidate of legal sciences

This topic was also covered in the program "Levchenko. Rakurs "on RBK channel 9 January 2017 G.

The invited experts suggested one of the ways to solve the problem - registration of a legal entity abroad and opening a bank / brokerage account for this legal entity.

There is also another way to legally trade on foreign accounts. – trust management. The law states, that profit is allowed, received from trust, if the manager is a non-resident of the Russian Federation (article 12 Law 173-FZ, p.5.1.) Для этого подходит схема с ПАММ — счетом. A PAMM account can be opened for any foreign citizen, including, and for a citizen of the republics of the near abroad.

Ну и самый простой способ “get around” foreign exchange law – open a brokerage account in the country, which has not joined the automatic exchange system: Thailand, Montenegro, Грузия и США. but, многие американские Brokers отказывают россиянам в работе, and if, yet, you have agreed to open an account, be ready, that you may be required to verify the legitimacy of the origin of your funds. Please note that, что ваш счет должен быть открыт именно в американской юрисдикции (US entity), not in the European branch! By coincidence, we have just registered our brokerage company in one of these countries – in Georgia (more details).

The limitation period for these tax violations is 2 of the year. At first 2019 G. налоговые органы уже начинают требовать предоставлять пояснения к отчетам о движении денежных средств на зарубежных счетах.

To 28 February 2019 a capital amnesty is in effect and you can submit a notification to the tax office about opening an account without a penalty, which constitutes 2-3 thousand roubles. . but, this amnesty does not exempt from the fine (of the same) за непредоставление отчета о движении денежных средств и самое важное, for illegal currency transactions.

Original post: smart-lab.ru/blog/517756.php