<img class="aligncenter" src="https://daytradergt.com/wp-content/uploads/2021/10/03ef1ce3fe38f6a82f5fd281a5216c89.png" alt="N-able: как устроен бизнес компании, стоит ли инвестировать в акции" />

Today we have a very speculative idea: take shares of cloud business N-able (NYSE: NABL), in order to make money on the rebound of these shares.

Growth potential and validity: 19,5% for 14 months; 11% per annum for 15 years.

Why stocks can go up: they are cheaper, than they could.

How do we act: we take shares now by 12,54 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

NABL has just been listed on the stock exchange - since July 20. It used to be a division of SolarWinds, but then he was allowed to float freely on the stock exchange.

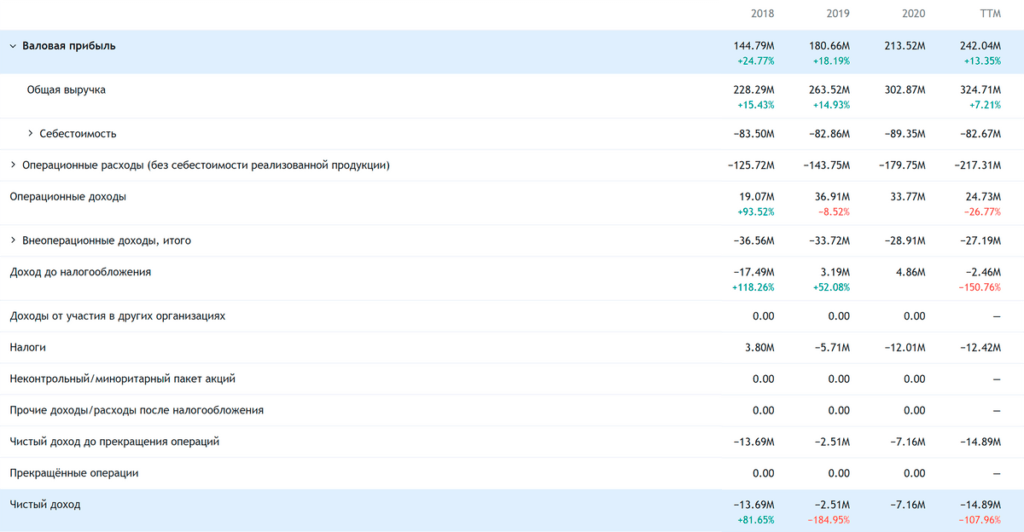

NABL provides access to its cloud-based enterprise IT capacity management software. The main source of information about NABL will be its registration prospectus - however, there is not much information: 97% revenue comes from subscriptions, 3% — technical support for companies, who bought the perpetual right to use NABL software.

Company revenue by country:

- USA - 47,8%.

- United Kingdom — 10,44%.

- Other, unnamed countries - 41,76%.

Arguments in favor of the company

Fell down. Now the company's share price is significantly lower than that, on which they were offered, when they first started trading on the stock exchange, — 15,37 $. So we can take stocks with a rebound in mind.

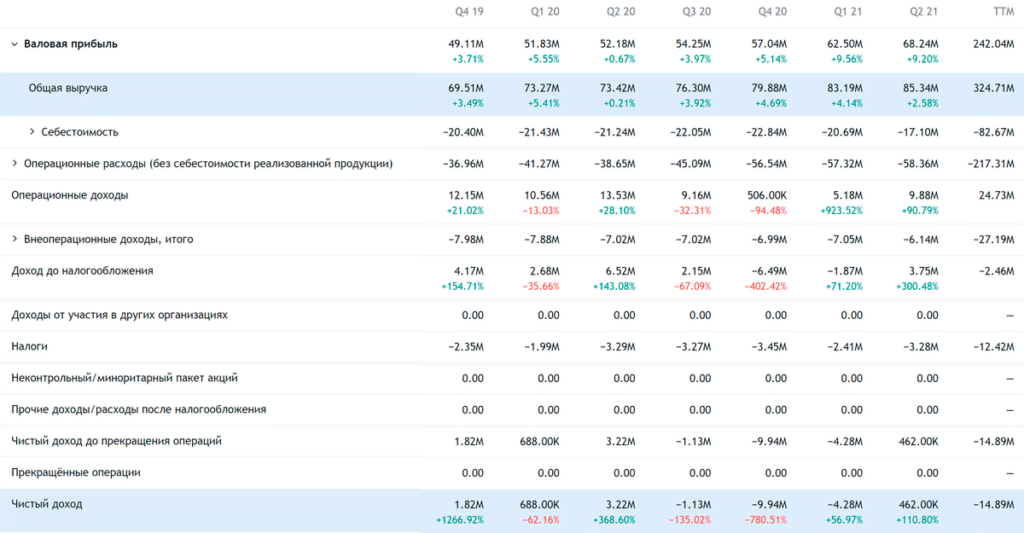

There is room to grow. Like most cloud companies, NABL can look forward to growing demand for its services going forward. What, in general,, noticeable in terms of revenue growth.

Almost well done. Unprofitable IT companies always have the same excuses for their own unprofitability: "We are growing and developing, the whole world is in turmoil, but then!" Usually, there losses are already at the level of operating activity. But NABL's operations are quite profitable. Yes, the company often slides into losses - but at the expense of debt payments. How a NABL business is quite viable.

The company's revenue retention rate is 110%, which is very good: means, the company extracts enough money from the existing subscriber base to, to compensate for the loss of users. All in all, the company looks viable, that already draws attention to her.

Dimensions (edit). Capitalization of NABL — 2.24 billion dollars, which allows us to hope for the simplicity of pumping these shares as retail, and institutional investors. The first will peck at the "promising topic", and the second will be attracted by a combination of prospects with a working business.

What can get in the way

Price. The company itself estimates the size of its market at around $23.3 billion.. I.e, occupying 1,39% market, the company stands as 9,61% from him - which is a little impudent.

However, by 2025 the market will grow to $43.9 billion - and with this in mind, the company's valuation does not look so brazen. У NABL P / S slightly less than 7, which by the standards of IT companies is also not very much.

“... For her small stature, small growth ". Basically, the end users of the company's services come from small and medium-sized businesses.. It's good from a tactical point of view.: small companies are now recovering and therefore we can expect an increase in orders from them. From a strategic point of view, it's not so good: small and medium-sized businesses are vulnerable to new quarantines and it won't take much, to provoke massive bankruptcies. Think, everyone understands, that reduced demand from small and medium-sized businesses will negatively affect NABL's business.

Occasion. SolarWinds had a nasty story last year when its software was hacked.. Maybe, the consequences of this will resurface in the case of NABL and negatively affect its business and quotes.

Loss and debt. The company has a fairly large amount of debt - $405.5 million, of which 57.7 million must be repaid within a year. NABL has enough money to cover urgent debts, but high debt and losses are a bad combination ahead of rate hikes and higher borrowing costs. And this will definitely scare away some investors.. By the way, a significant proportion of NABL's debts are debts to the parent SolarWinds.

What's the bottom line?

Shares can be taken now by 12,54 $. And then there are two options:

- wait, when will they be worth again 15 $, which is below their all-time high. Think, that we will reach this level in the next 14 months;

- hold shares for the next 15 years.

This idea is volatile, so don't take shares, if you are not ready to endure the "storm".