Expected, what 14 April cryptocurrency exchange platform Coinbase will start trading on the stock exchange Nasdaq UNDER COIN ticker. Although the date may change, we decided to look into the fact, how does this business work, and also to reflect on its prospects.

What do they earn

The main source of data about a company is its prospectus. Coinbase is a cryptocurrency exchange. In total, about 43 million people, 2,8 million of them are active monthly. The platform stores user assets on 90 billion dollars, and the total volume of exchange operations on it for the entire history - 456 billion dollars.

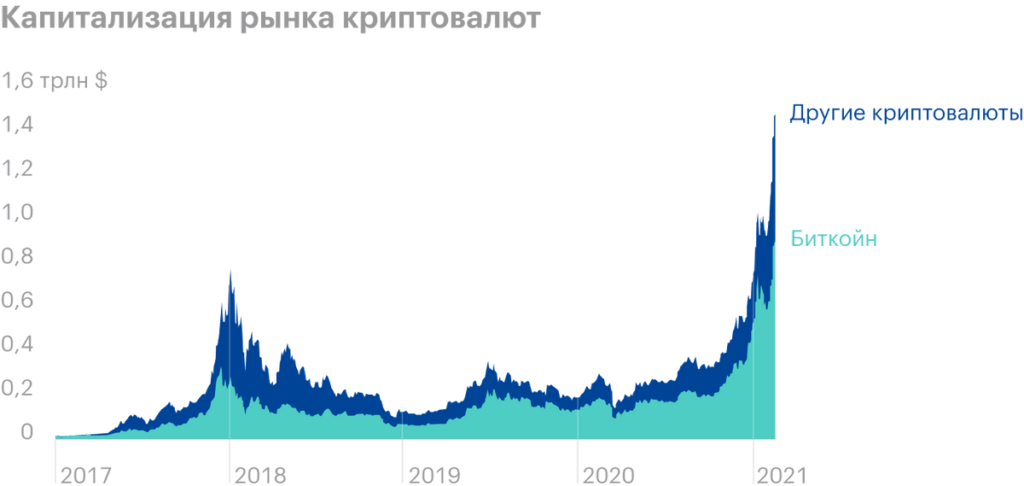

Bitcoin accounts for the majority of trading on the company's platform, which is understandable: in the capitalization structure of the cryptocurrency market, bitcoin occupies a dominant position.

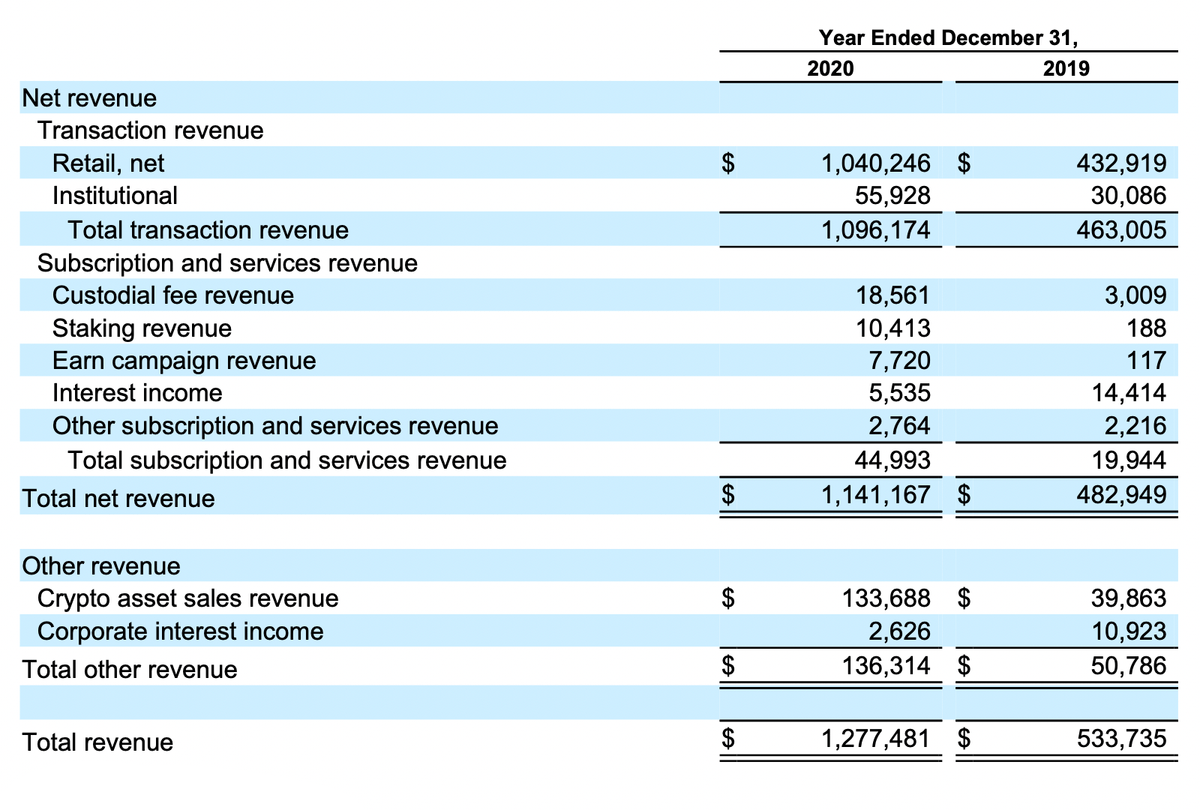

Coinbase decided to leave the samsara of typical IT startups and therefore enters the exchange as a profitable company, which in itself can be considered valor in our leaden age of unprofitability: the company has a very steep final margin - 28,24% from proceeds. The company's revenue is divided into three segments.

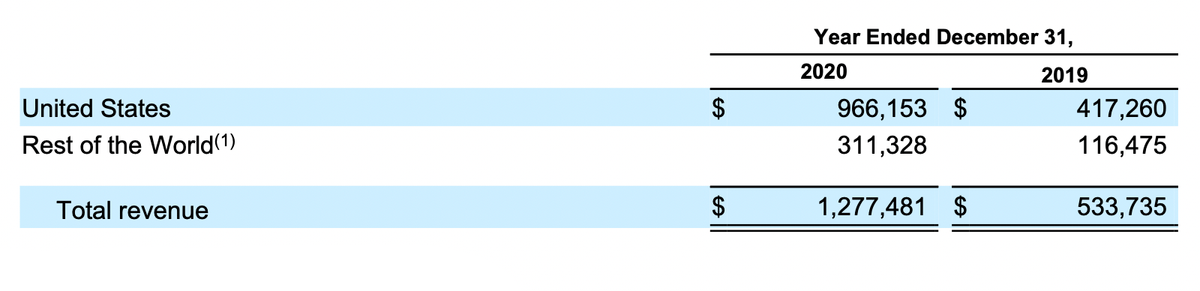

Transaction — 85,8% proceeds. These are commissions, that Coinbase collects from users per purchase, sale and withdrawal of money from the platform. Retail Investors Dominate Coinbase Client Structure, the share of institutional clients is still small, although the last few quarters, institutional clients are satisfied with the highest trading volume.

Subscription and Services — 10,67% proceeds. In this segment, the company charges users for the storage of their assets., Cryptocurrency staking - holding cryptocurrencies to receive rewards, – use of the Coinbase social platform and analytical service. On the platform, users can post tutorials video and tasks for other participants, the company takes a commission from, who sells their content on its platform.

Other — 3,53% proceeds. This is mainly the proceeds from cryptocurrency trading., which Coinbase itself does, and income from clients margin trading. It also includes the receipt by the company of interest on its deposits..

The main part of the proceeds 75,6% - the company makes in the USA, the rest goes to other countries, none of which gives more 10% from the entire revenue of the company. Would like to note, that the company's revenue outside the US is growing faster, than at home: with 2019 on 2020 sales in other countries almost tripled.

Number of verified users on the company's platform by quarter, million people

| 1 neighborhood 2018 | 23 |

| 2 neighborhood 2018 | 24 |

| 3 neighborhood 2018 | 25 |

| 4 neighborhood 2018 | 26 |

| 1 neighborhood 2019 | 27 |

| 2 neighborhood 2019 | 29 |

| 3 neighborhood 2019 | 31 |

| 4 neighborhood 2019 | 32 |

| 1 neighborhood 2020 | 34 |

| 2 neighborhood 2020 | 37 |

| 3 neighborhood 2020 | 39 |

| 4 neighborhood 2020 | 43 |

Average monthly number of trading users on the platform, million people

| 1 neighborhood 2018 | 2,7 |

| 2 neighborhood 2018 | 1,2 |

| 3 neighborhood 2018 | 0,9 |

| 4 neighborhood 2018 | 0,9 |

| 1 neighborhood 2019 | 0,8 |

| 2 neighborhood 2019 | 1,3 |

| 3 neighborhood 2019 | 1,2 |

| 4 neighborhood 2019 | 1,0 |

| 1 neighborhood 2020 | 1,3 |

| 2 neighborhood 2020 | 1,5 |

| 3 neighborhood 2020 | 2,1 |

| 4 neighborhood 2020 | 2,8 |

The value of assets on the company's platform and the capitalization of the cryptocurrency market, billion dollars

| Assets | Capitalization | |

|---|---|---|

| 1 neighborhood 2018 | 13 | 271 |

| 2 neighborhood 2018 | 13 | 258 |

| 3 neighborhood 2018 | 11 | 224 |

| 4 neighborhood 2018 | 7 | 123 |

| 1 neighborhood 2019 | 8 | 143 |

| 2 neighborhood 2019 | 21 | 331 |

| 3 neighborhood 2019 | 18 | 217 |

| 4 neighborhood 2019 | 17 | 192 |

| 1 neighborhood 2020 | 17 | 182 |

| 2 neighborhood 2020 | 26 | 266 |

| 3 neighborhood 2020 | 36 | 352 |

| 4 neighborhood 2020 | 90 | 782 |

The percentage of different cryptocurrencies in the structure of assets on the company's platform

| 2019 | 2020 | |

|---|---|---|

| The money | 6% | 4% |

| Etherium | 9% | 13% |

| Bitcoin | 70% | 70% |

| Other | 15% | 13% |

How much? Such much? For whom how

According to the latest data, The company plans to list its shares on the stock exchange at a price 343,58 $, which will give it capitalization in the area 70 billion dollars. With current earnings P / E the company at the specified price will have about 245. On the one side, that's quite a lot, but on the other hand, the company is profitable and its profit is growing. So from that perspective, Coinbase is a good investment..

You can look at a huge number of unprofitable technology companies with quotes, storming all new highs, to make sure, that Coinbase as a whole does not look very expensive in general.

My experience shows, that investors for the most part are ready to endure any bullying, if there is even a hint, that the issuer operates in a promising sector. And here Coinbase has something to hope for.

Master of COIN

On the Coinbase platform, it trades approximately 11% from the cost of all cryptocurrencies, which is approximately 1,5 trillion dollars at the time of writing. This fact alone will stimulate interest in the company's shares from a crowd of retail investors..

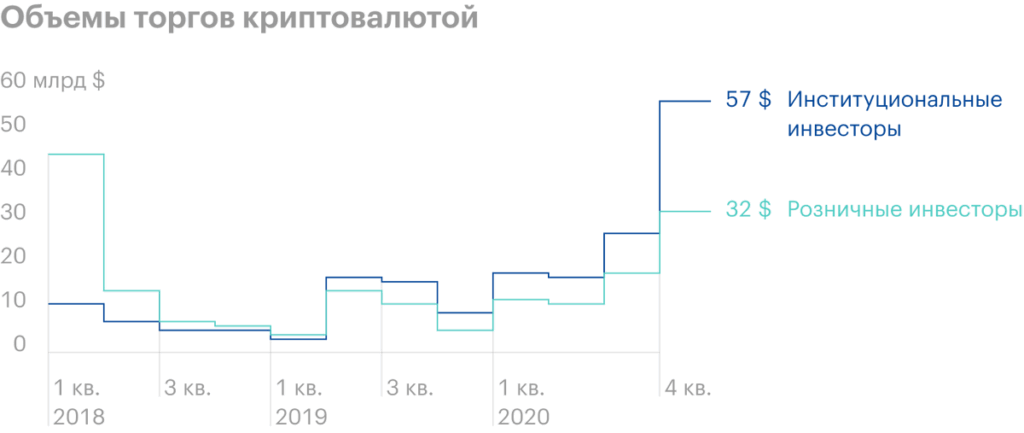

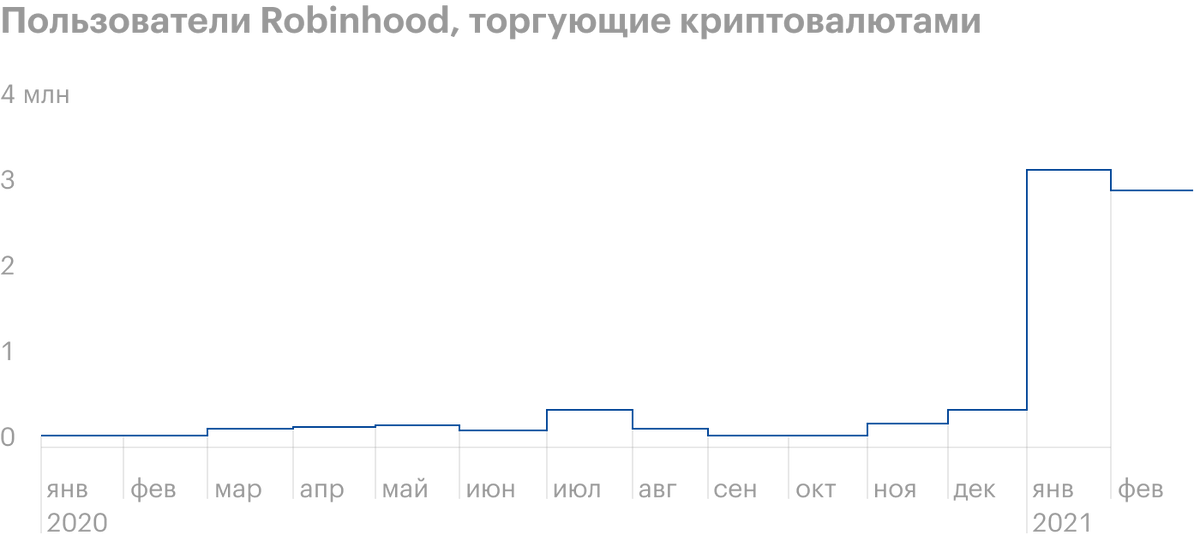

For example, on the Robinhood platform, whose users distinguished themselves in battles under GameStop and AMC, for the first 2 months 2021 the number of users trading cryptocurrencies has increased tenfold. Now they make up a little less than a quarter of the total number of Robinhood users - this indicates a great interest of the general public in the topic of cryptoinvesting.. So,, Coinbase has every reason to expect an influx of new users and an increase in trading volume, from which she can receive commissions.

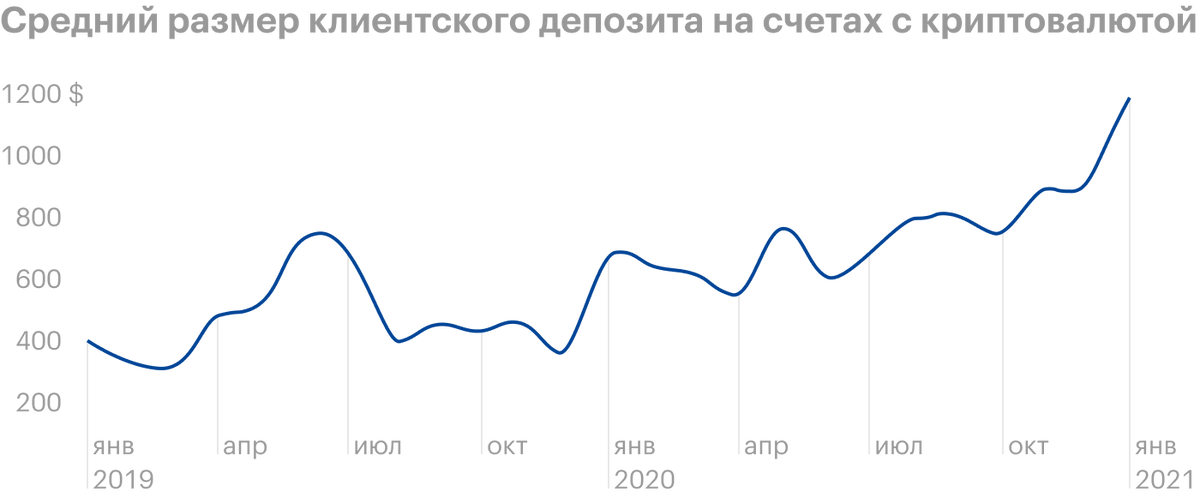

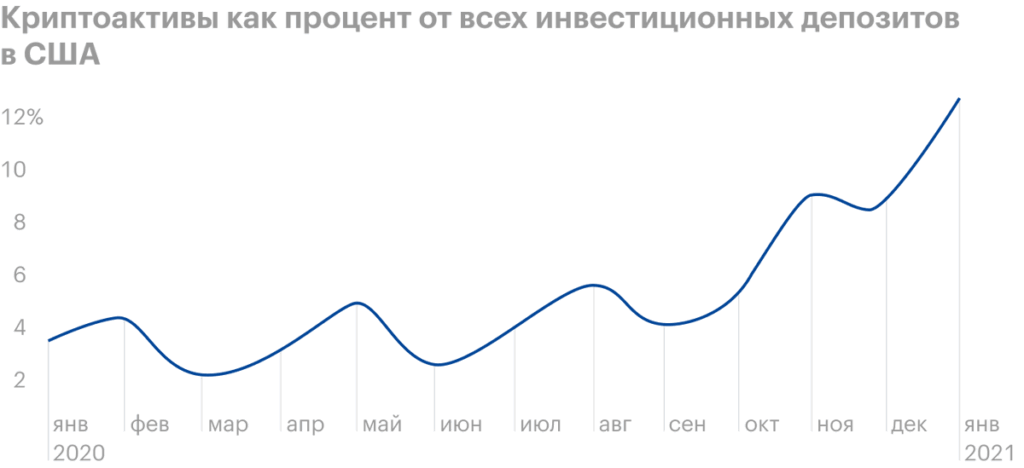

In addition to the number of cryptocurrency investors, the average size of their deposits in this area is also growing.. Most of the new cryptocurrency investments come from new users, and the majority do not have serious knowledge in this matter, which is understandable: they are newbies. Therefore I would expect, that they will be hyperactive on the exchange and will contribute to the growth of Coinbase revenue.

In view of the foregoing, I believe, that market conditions favor Coinbase's business. By the way,, The recent rise in cryptocurrency trading volumes has led to, what in 1 quarter 2021 the company's revenue exceeded all of Coinbase's revenue for 2020 year. A separate plus for Coinbase is the possibility of increasing the company's trading volume outside the United States, where most of the cryptocurrency trading takes place.

Coinbase also decided to host a Q&A session on Reddit in preparation for going public., to show it to users, how advanced and youthful she is. And it makes a lot of sense: Raid traders from among the users of the aforementioned Robinhood and the like have nested on Reddit and coordinate their stock pumping activities from there.. As the example of Elon Musk shows, to please the inhabitants of the network can be very useful for quotes.

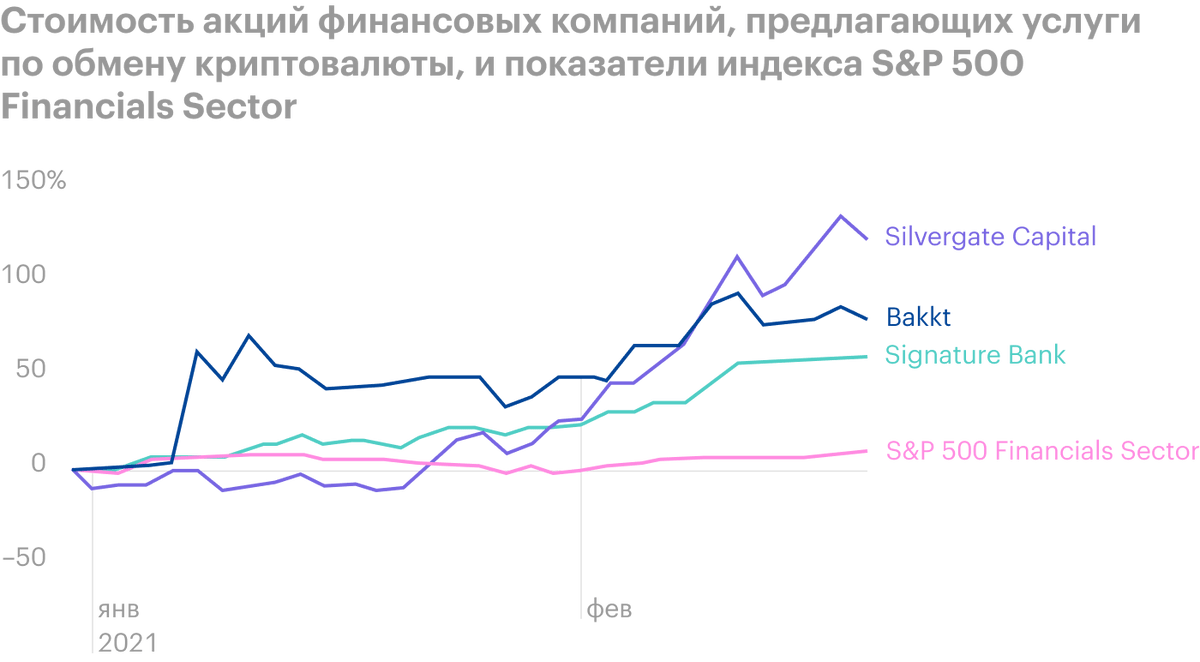

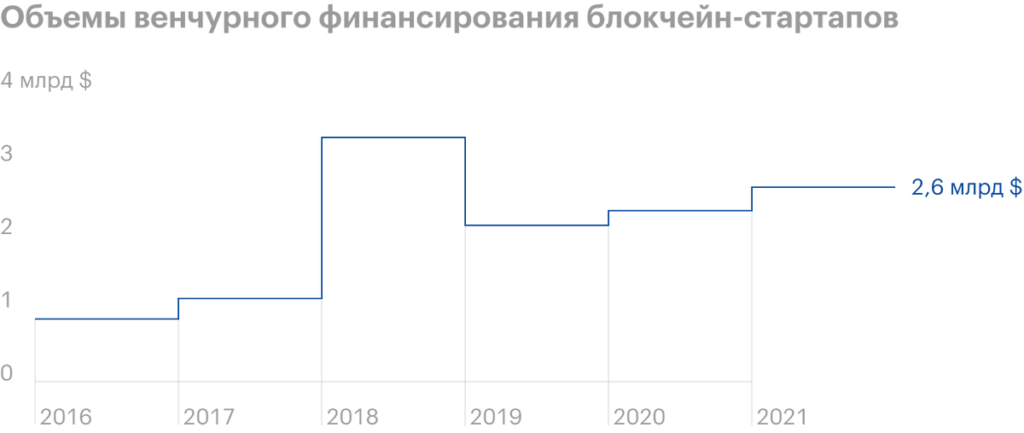

In favor of that, that Coinbase shares will be in demand on the exchange, works and the fact, that the shares of ordinary financial institutions, providing clients with access to cryptocurrency trading, showed growth well above the market. And Coinbase is all about cryptocurrencies. Considering the large volume of venture funds investing in blockchain startups, I would expect increased investor attention to Coinbase going public.

A separate bonus for the company is the gradual entry of large institutional investors into cryptocurrency trading: many market participants consider, that the value of cryptocurrencies will start to grow even more from this, because the trading volume will increase. And this will surely spur activity on the Coinbase site..

The share of assets on the platform from the capitalization of the entire cryptocurrency market

| 2018 | 4,5% |

| 2019 | 8,3% |

| 2020 | 11,1% |

Share of cryptocurrency deposits

| New deposit holders | Old depositors | |

|---|---|---|

| November 2020 | 14,8% | 82,5% |

| December 2020 | 30,1% | 69,9% |

| January 2021 | 39,0% | 61,0% |

| February 2021 | 41,5% | 58,5% |

The level of knowledge about the subject among new investors in cryptocurrencies

| Tall, fully understand their value and potential | 16,9% |

| Middle, I study their value and potential | 49,5% |

| Developing in this area, basically familiar with it according to others | 31,0% |

| No knowledge or interest | 2,5% |

Mr. Sivka and his steep slides

Activity and, respectively, Coinbase's profitability correlates well with bitcoin, the main subject of operations on the company's site.

The cryptocurrency market has grown somehow unrealistically fast and may well fall for several years, as has happened so many times, – then the financial performance of Coinbase will worsen. Finally, how to make a fortune in the cryptocurrency market, and lose it - so Coinbase's current profit can easily be replaced by losses, if the cryptocurrency market crashes.

And such a collapse may well take place in a very short time.: often people come to cryptocurrencies in the hope of easy money. All in all, Coinbase shares, due to the specifics of its activities, will be very volatile.

Also, do not forget about the numerous competitors of the company., the largest of which, Binance, controls as much 60% cryptocurrency exchange market - much more than the share of Coinbase. Don't Forget the CME Group's Traditional Listed Companies, Nasdaq and Deutsche Boerse, who are also interested in the cryptocurrency market. Maybe, Coinbase will have to spend a lot of money to acquire smaller exchanges and even cut their fees, to compete with the specified enterprises.

Although just these large institutional players from among the large exchanges can enter into an agreement with Coinbase to conduct trading through its platform instead of developing their own capacities, and this will give Coinbase a big advantage: it will be possible to catch up with a crowd of ordinary retail investors from large sites on its exchange.

The reasons, according to which investment managers add cryptocurrencies to the client portfolio

| 2020 | 2021 | |

|---|---|---|

| Low return on other assets | 54% | 54% |

| High potential profitability | 30% | 38% |

| The ability to offer customers something new | 23% | 28% |

| Customers are asking to do this | 26% | 27% |

| Hedging inflation | 9% | 25% |

| Other | 9% | 7% |

You know the drill

There are a few subtle points, related to the company's listing on the stock exchange, worth keeping in mind, before investing in these stocks.

This is not an IPO, and the DPO. Coinbase plans to conduct a direct public offering, so technically it's not an IPO (English. initial public offering - initial public offering), and the DPO (English. direct public offering - direct public offering). Promotions, placed on the exchange during the DPO, can be much more volatile, rather than stocks, which appeared on the stock exchange during the IPO. We talked more about it in the Roblox review., who also preferred DPO.

You are nobody, and no way to call you. The company will have 2 class of shares - A and B. Class B shares have much more voting power in company decisions, And, how did you guess, most of the class B shares are held by the company's management - they have a total of 60,5% of votes. This may become a problem in the future, when the interests of management and minority shareholders diverge: management can make a decision, which will be against our interests.

This is not for you. Last fall, Coinbase announced, that the company should be apolitical, as a result of which she left 5% employees. This fact may negatively affect Coinbase quotes in the future.. For example, "socially responsible" funds and banks will refuse to invest in these stocks, and then they just start shorting them. The possibility of such pressure on Coinbase is more theoretical, but still it should be taken into account.

Resume

I have a very bad attitude towards cryptocurrencies, but as a speculative idea, Coinbase is a very interesting option: the excitement around this area is, which means, you can earn on it, even if you consider cryptocurrencies to be a tool to drive fools into a financial pyramid. But, certainly, investing in these stocks, need to be aware of, that they can be stuck indefinitely, same as in bitcoin.