The book "Turtle Traders" is a story about, as casual students, many of whom had no experience on Wall Street., taught to be traders - millionaires.

These newcomers were thrown into the fire and tasked with producing money almost instantly., and millions were at stake. They didn't try to sell ice cream on the streets.. They traded stocks., bonds, currencies and assets of other markets, to earn millions.

Potential students, who did accept, were like stunned by a blow to the head. The phrase “this can't be, because it can never be "repeated continuously. An invitation to learn from the greatest trader of modern Chicago, and then use his money for trading and get some of the profits, looked absolutely incredible. One of the greatest opportunities of the century has attracted thousands of job seekers, from suggestions, written on coconut, to the banal “I think, that I can make money for you ". Honestly, speculation about, what can make a rich man, an inaccessible and eccentric trader to pay attention to you and invite you to the next stage - a personal conversation - were absolutely outrageous.

The experiment has become a cult, information about him was often spread in the form of rumors.

Only two weeks taught students, knowing nothing about the exchange and trading everything necessary, to trade bonds, currencies, grain, oil, securities and other assets. Turtle traders learned to trade not on noisy stock exchanges with their active gestures, but in quiet offices without a TV or computer, equipped with only a couple of phones.

Each of the students, after passing the instructions, received 1 million dollars for trading operations. They were supposed to 15 % arrived. As a result of this experiment, 3 billion dollars.

This story destroys the usual picture of success on the stock exchange., which was painted so carefully by pop culture: prestige, connections and no chance of winning for a simple guy (and it is not easy to beat the market). Legendary investor Benjamin Graham always said, that analysts and asset managers are unable to beat the market even together, because to a large extent they are the market. To top it all off, academics have been talking about efficient markets for decades., repeating over and over, that it is impossible to surpass the average values of the markets. Some critics try to explain the "turtles" phenomenon by skilful selection of especially smart students..

However, making big money, conquering the market, - really, if you don't follow the crowd and think outside the box. Everyone has a chance to win in the market game, but you need the right rules and approach. And these rules and approaches are contrary to the very nature of man..

Much has changed since the 80s, and many might ask, has this story lost its relevance. Turtle traders and their history are more relevant now, than ever.

But still the biggest problem is, what most people don't really want to understand, how real pros make big money. They want, so that the road to wealth is easy.

Instead of calling on statistical thinking to help make stock decisions, the public continues to invest, based on impulsive feelings, allowing a set of emotional inclinations to rule their lives. Finally, to your own detriment, people are hostile to risk on the way to profit, but tend to take risks on the way to losses. They are arrogant.

The method for achieving success for the average novice investor looks questionable. He enters the market, because his friends do it. Then the media floats stories about ordinary guys., performing well in a bullish market. They all start investing, buying cheap assets. While the markets are buzzing to support them, they never have thoughts of collapse (“So much money invested - the price cannot go down!»). They never notice, when their doom comes, even if their bubble is no different from the previous ones.

The media tell us, that the average investor today supposedly understands the concept of risk, although worrying about probabilities and ignoring opportunities at the same time reaches painful proportions. People are losing fortunes, following losing intuition, or halve the position, when logic dictates to increase it. In the end, they never come close, to learn how to do things right.

But outside the crowd there are those few, who have a supernatural skill to foresee, when to buy or sell, coupled with supernatural skill in accurately calculating risks. Markets are like a game of monopoly, and the strategy, regulations, transactions and numbers are objective and amenable to study.

Trading teaches you not to perceive traditional knowledge, for granted. The money earned is the clearest confirmation of the fact, that most people make mistakes very often. The vast majority make mistakes even more often. Markets are very often just a bunch of crazy people., and they are often irrational. And in a state of general heightened excitement, people almost always make mistakes.. With a standard outlook on money, you can never succeed in this business..

What role does luck play in trading? In the long term, no. Absolutely none. I do not think, that anyone is able to rise high in this business, thanks to, that he was lucky.

Overcome the psychological barrier, like in trading, so in business, means to reach such a point, when you are challenged intellectually and psychologically, and you answer this: "Yes, I can do it".

Some Outstanding Traders Are Quite Wise People, but some - not at all. Many of the amazingly smart people are terrible traders.. It's enough to be just a person of average intelligence. Besides, psychological stability is more important. This is not the science of launching rockets. Anyway, much easier to learn, what to do in trading, than really do it.

As in other areas of life, most people know, how to act, but at the same time they do not act like that. And trading in this is no different from other types of human activity..

Lots of people will risk little money day in and day out., not afraid to lose them. But as soon as the volumes of resources increase, say, on 100 %, the decisions they make become more important and less obvious. They start thinking about, how much can they gain or lose, and it becomes harder for them to keep trading in mind. Emotions burst out, and they find it increasingly difficult to maintain objectivity. Learning not to perceive the value of dollars was an important part of, what was inoculated in the "turtles".

There are people, able to trade one at a time, two or even five positions, without taking money.

Even minimally winning trader must receive money at the expense of other market participants.

When good deals, not necessarily profitable, are committed for the long term, the chances of their profitability increase significantly. Bad month, a bad quarter and even a bad year ultimately don't matter much. The most important thing is to have a sustainable trading approach, proven in the real world.

The method of exchange speculation has no external restrictions. Everything happens in a limitless environment. You can invest any amount in any possible market trends at any suitable time. But by entering this limitless market and not protecting your capital, sooner or later the probability of error will certainly catch up with the trader.

A trader must make money through trends. These traders always wait for market shifts and then follow those shifts.. Their goal is to exploit the trend, make a profit.

Trend catchers don't try to predict the magnitude of price changes. The trend catcher “cultivates in his mind a set of conditions for entering and leaving the market and acts in accordance with these conditions., regardless of other market factors. And one can hope, that such behavior will save the decisions made from the influence of emotional judgments ".

Trending traders do not claim to be completely correct. They admit their mistakes in individual transactions., suffer losses and move on. However, in the long run, they expect to make a profit..

If the reaction to the news, stock reports or economic reports, were the key to trading success, everyone would be rich.

The key axioms of the "turtles" were practiced by the greatest speculators a hundred years before.:

- "Don't let your emotions change as your capital grows and falls.".

- "Be consistent and unperturbed".

- “Judge yourself not by your results, but according to its development ".

- "Know, what will you do, when the market knows, what will he do ".

- "The impossible can and must happen at any moment".

- “Remember your plans for the day ahead and surprises, who lie in wait for you ".

- “What can I win, what to lose? What is the likelihood of both events?»

Anyway, there was infallibility behind the familiar euphemisms.

Traders, receiving equal opportunities, must trade the same. You can't connect personal feelings.

Many of those, who makes a big profit, do not want to lose her. They try to withdraw profits from circulation, to feel safe.

If a trader loses money, he should just move on. Taking and managing losses is part of the game.

Trader, not ready for losses, is not doing his business. The "secret" is, how does he deal with the wrong positions, not with successful. Losing trade management allows traders to approach winning trades (great profits). This is why the entry price is not that important., as when leaving.

When markets go up, this is good. When markets fall, it's also good. The trader must profit from any of these situations..

Measuring volatility is especially important for a trader. Most people ignore it in their work.. You should always know the answer to the question.: how big should you invest, based on this volatility?

Keywords.

"Long" - the one, who purchased the futures contract or owns the underlying asset.

"Short" is the one, who sold a futures contract or borrowed an asset and sold it on the market in order to buy it back cheaper.

Short - sell a futures contract or sell borrowed assets. Selling short or "shorts" is a way to make money on falling prices of stocks or bonds.

Volatility is a measure of price change over a certain period, calculated as the range of price fluctuations relative to the average.

Futures contract - a standard contract to sell or buy a specific underlying commodity on a specific date in the future. This date is called the delivery date.. The price of the underlying asset at the date of delivery is called the settlement price.. Estimated price, usually, tends to the futures price at the delivery date. Upon delivery, the seller delivers the raw material to the buyer and receives the money. On non-deliverable futures, settlement is made in non-cash money. To withdraw from the obligation before the delivery date, the holder of the futures must close the position either by selling a long position or buying back a short position. Futures contracts, or just futures, traded on exchanges.

Market order - an order to sell or buy, immediately executed by the broker, at the current price. As long as there are willing to buy or sell, market orders will be executed.

Stop order (sometimes also referred to as a stop loss order) Is an order to buy (or sell) asset at the moment, when the price went higher (sank lower) a certain mark, denoted, as a stop price. When a certain price is reached, stop order is perceived as a market order.

Moving average - one of the key indicators in finance and technical analysis, used for data analysis in time. A moving average series can be calculated for any time series, but most often used to calculate stock prices, profit or trade volumes. Moving averages are used to smooth out short-term changes, while highlighting long-term trends or cycles. The moving average formula is identical to the average formula. This average is called "sliding" because, what, being superimposed on the exchange schedule, she kind of slides behind the price.

There is a fairly accurate definition of systematic traders.. They are, usually, follow a certain set of rules, computer generated, who tell you when and how much to buy and sell, and also when should you go out.

Expected Result (or difference, expected value) calculated using a simple formula:

E = (PW х AW) – (PL x AL),

where E is the expected result or difference; PW - percentage of successful transactions; AW - average profit; PL - percentage of losing trades; AL - average loss.

Feel free to experiment with breakout lengths. Don't Stop at Specific Values The key to success is, to establish the breakthrough value and work it out carefully. Verification and practice are essential to confidence. Trust, but check.

Two-thirds of success is, what drives our profits. Our small filters for early entry and quick exit, volatility filters - if that's all, thanks to which we get profit, then nothing shines for us. The key point is a simple moving average or breakout system. Think, it is important to make our parameters more long-term, but if it takes too long to think, analysis and other fun work, then you should expect ... a very bad situation.

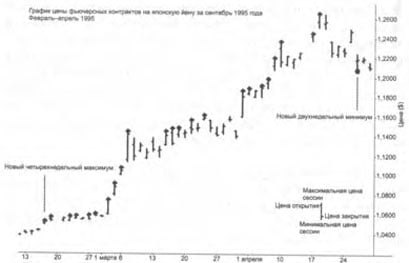

An example of the entry "turtles" (Japanese yen)

September Japanese Yen Futures 1995 years reached a new four-week high 16 February 1995 of the year. Turtle rules prescribed entry on the next day of trading. The position was held throughout all subsequent highs and was closed after another two-week low 26 April 1995 of the year.

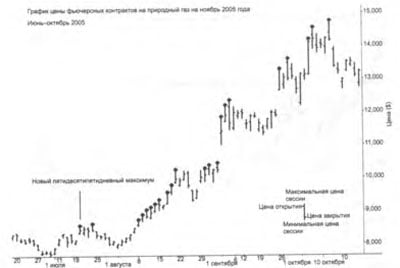

An example of a long entry "turtles" (natural gas trade)

New Fifty-Five Day High for November Natural Gas Contracts 2005 year was reached 12 July 2005 of the year. The market continued to rise to 5 October 2005 of the year. The first breakthrough occurred in mid-July. When entering through this breakout, it was not known, will this upward trend, but she continued, and the "turtles" just followed her, making a lot of money., that breakout could easily have been unprofitable. In fact, it was possible to get a whole series of losses in a row with numerous false breakouts..

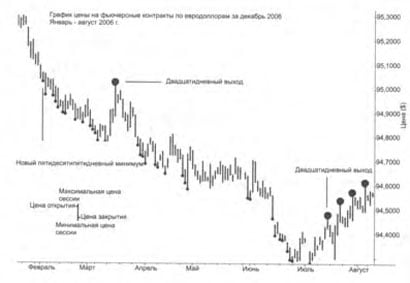

An example of a short entry and exit of the "turtles" when trading Eurodollar futures

December Eurodollar Futures 2006 of the year hit a 55-day low, signaling the entry. 20 February 2006 the market went down a bit, until it reached another 20-day high 16 Martha. Short positions in the market were closed with losses, 29 Martha 2006 the market entered a new low, and positions were opened again. The market continues to fall until a new exit signal, 20-daily high, happened 14 July 2006 of the year.

The chart demonstrates the possibility of making a profit in a falling market. It was an opportunity to "shorten". Each point reflects a minimum of fifty-five days. The first "short" breakout happened in February 2006 of the year, and the market continued to fall, until it hit its low in June.

Hiding a twenty-day breakout breakout on the Eurodollar price chart, you can see the full context of the deal. Initial "short" breakout occurred in February, and a twenty-day breakout in mid-March. This was the impetus for the exit. The first breakout ended with small losses.

However, the market continued to fall at the end of March., and the next breakout signal sounded. The Turtles are back short again. The final exit took place in July, when the twenty-day high was reached. This place is marked with a larger dot on the graph.. Arrived, received from the second transaction, more than compensated for the losses from the first. The Turtles had no right to ignore the second break just because, that the first breakout brought losses. They had to jump on that horse again. The second breakthrough turned out to be like this, how they wanted to see him, although no one could have predicted it. This game is all about waiting.

When the breakout occurs, short or long, impossible to know, what will happen next. Maybe, the market will go up for a short time, and then it goes down again, causing losses. May be, the market will go higher, giving a good profit.

Many of the systematic traders devote a significant portion of their time to looking for "good" moments to enter the market.. It is necessary to refrain from such actions.: seems, that focusing on the most hopeful aspect of the trading cycle is part of human nature. but, studies show, that exit from the market is much more important, than entry. If you enter the market relatively randomly, then, good closing position, you can get an extremely successful result.

Stop thinking only about, how to enter the market. The secret of success is, to always know, when will you go out.

You need to enter the market randomly, and manage transactions after entry. If the risks are properly managed, the worst situations can be dealt with, what can be in trading.

Risk management has many names. It can be found under the names "asset management", measuring risks or even "measuring positions".

Risk management starts with measuring the daily volatility of the markets. It can be assigned a conditional name N(ee is also called mean true range).

It is necessary to take the maximum values of the following parameters of any market to output N:

- Distance from Today's High to Today's Low.

- Distance from yesterday's close to today's high.

- Distance from yesterday's close to today's low.

If the result is negative, then it must be reduced to an absolute value. In mathematics, the absolute value of a real number is equal to the distance between that number and zero on the line of numbers. So, for example, 3 is the absolute value for 3 And -3.

The maximum value of these three quantities is called the true range or, in a technical sense, absolute distance (how up, so and down), which passed the market for certain 24 o'clock. Then you need to take a moving average of the true ranges for twenty days. The result is an approximate volatility over the past few weeks for each market traded..

You can determine the average true range for any stock or futures contract. Just take fifteen of the last true ranges, add them up and divide the result by 15. Repeat this procedure every day., discarding the value of the oldest range. Many computer programs do this automatically..

Volatility is something, what can be described, as a moving average process. Introducing the element of volatility into trading is a way to learn, how big should our positions be. The further the stop is from the entry point, the less the volume of the opened position should be, and vice versa. The number of contracts to be opened is thus determined by the distance from the buy or sell price to the stop order activation price. It not only saves you problems in difficult times, but also allows you to collect large profits, when things go well.

You need to recalculate volatility every day. You need to invest fixed 2 percentage of your capital at the time of each transaction. Every day you need to know, how many contracts can be concluded, depending on, how much money is on the account at this moment.

To calculate the risk, you need to take the amount on the account (never mind, how big is it), and multiply it by 2 %. For example, account risk 100000 dollars will be 2 %. or 2000 dollars for each trade. It is always best to invest a small amount of money in each trade first, just in case, if the calculations are wrong (it happens more often, than in 50 % cases).

Imagine, what do you trade stocks Google when N is equal to 20. So 2N for the output will be 40. If you are losing 40 points on google, you should go out, without asking unnecessary questions.

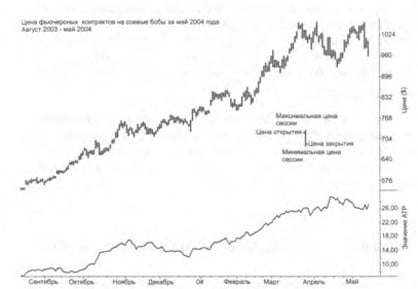

Soybean Price and Daily N Value Chart.

Soybean futures daily price change chart for May 2004 year shows a lower N value at the beginning of the trend. According to the "turtle" rules of asset management, a smaller value of N allows you to trade more contracts. By the end of the trend, N rises significantly, decreasing the position size, which you can own.

All the best trends often start with very low volatility during the initial breakout entry. If recently the volatility is very low, not 5 dollars in gold, and 2,5 dollar, then you can enter with a large enough position. Low input N is a good sign, when you can open a really big position. And when volatility is low, this usually means, that the market has been stagnant for a certain time. Everybody hates, when the market, where many have lost money, grows a lot.

If you want to make money, like "turtles" - you need to use lending. The main thing is to use lending like this, so that it does not go beyond your limits.

Aggressive pyramid building from an increasing number of lots has its drawbacks. If a strong trend doesn't start, then small losses from wrong breakouts absorb limited capital even faster. It is necessary to cut position sizes as much as possible. When markets turn the other way, this prudent behavior increases the chances of a quick recovery, to return to big profits again. The weakest exponential rise from a strong trend will always exceed the steepest linear fall.

You need to react to the first exit signal dropped.

As long as there is liquidity and the ability to choose a market and there is volatility in this market, you can work anywhere.

There is no one specific portfolio, which can be traded. Today traders work by the "turtles" rules, using all kinds of portfolio options (stock, currency, bonds, raw materials, etc.. d.). This is why traders are successful to varying degrees.. There is also no single start-up capital., which can predetermine the success of any trader. Some start small and earn a lot.. Some have a lot of money from the start, but they don't earn much.

It is very important to avoid having at least one pair of interconnected markets.. Simply put, interconnected markets, usually, move in sync. Too many interconnected markets increase risks.

The combination of long and short positions within a portfolio provides greater diversification.

Not trading in the absence of market movement is one of the most important rules. If there is no trending market, no profit. Without the markets moving, there is no need to open a position.

Today's hyperactive crowd, checking stock quotes every minute, such long periods of doing nothing would be perceived as useless. Today, people in large quantities absorb information and daily advice from any famous experts., what to buy and sell. Crowds wanting to get rich quick have spawned a whole culture of traders, afraid to miss something. They are absorbed in the analysis of that, what has happened or will happen in the markets, even if it does not in any way affect the decisions they make.

All great traders work like crazy today, to come up with a trading philosophy. They transform this philosophy into rules. Then they bide their time and check, do their rules work like that, as they expected. But if you created a system, giving you points of entry and exit, besides telling you, how much to invest, and determining your capital and market volatility at any given time, no more analysis required.

Professional traders consider, which is difficult to define, where does the truth end. The difference between, what do you read on the headlines, and topics, what is really going on, - as between white and black.

Main idea, which allows you to make a big profit, is, to take calculated large risks. Reducing the level of risk instantly leads to a decrease in potential profit. In the trading business, big profits are critical. The basics of capital building are also key. Even if the trader diminishes his willingness to take risks, he turns out to be practically unprotected from the possibility of bad earnings in the next year.

Some investors are foreign to the idea, that a mechanical trading system is capable of generating high profits.

Volatility is that, which gives high profits, which investors expect from the markets in the first place. AND, taking the risk, investors should expect appropriate rewards, and big profits do not come without strong high volatility

Good plan, clearly put into action today, better, than next week's perfect plan.

A high IQ is hardly the key to success in life.. In the long run, the mind provides nothing; it takes more to be successful.

Character traits, owned by successful entrepreneurs:

- Non-conformism - lower need to adjust, which indicates autonomy and independence.

- Emotional withdrawal - not necessarily cold to others, but they may not pay attention to them.

- "Parachutists" - less sensitive to physical impact, but that changes with age.

- Riskiness - more relaxed about risk.

- Social "resourcefulness" - more convincing in contacts and disputes with people.

- Autonomy - great need for independence.

- Change Seekers - A Kind of Innovation. Differ from 99 % other people.

- Energy - a great need and the ability to work for a long time.

- Self-sufficiency - does not need understanding or encouragement, but still need connections, therefore, self-sufficiency should not be taken too extreme.

Competence is not easy to acquire. Learn from other people. Do it right every day, focus on, what are you doing, and let the cards fall there, where will they fall.

Trend following is a strategy. Trending traders trade financial instruments around the world, from foreign exchange markets to energy, wheat, gold, bonds, raw materials.

Technical traders don't need specific knowledge of the markets, which they trade. They should not obey meteorological phenomena, geopolitical incidents or the economic impact of world events on a specific market. It is sometimes difficult for people to perceive such logic.. Investors want big profits, seasoned with clever history, which has fundamental confirmation.

In the long term, market prices tend to "return to true value". If stock prices are overvalued (or underestimated), they, in the end, go back to the mean. However, exchange prices do not return to a given location in one day.. They can remain overvalued or underestimated for a fairly long period of time.. Such a long period of time is stranded, which sinks ships. People, who invest in markets, behaving calmly, wash out gold for fools. Human nature has a belief in a return to origins. It's just a fatal market strategy.

"Fatal" is the word, which seems to grab you by the throat. "Most of the time" the bet is not good enough. The highlight is, that these centennial floods, shocking return traders, actually happen every two or three years - and they can swallow our profits, and they do it.

Understanding, why selfishness and excessive hopes squeeze all the juice out of some traders, at the time, how others confidently go towards their success, shows, that it is necessary to strive for long-term success.

Actually, thanks to the natural mind, implementing a well-planned trading system does not require intelligence as a key factor: “Good traders put every ounce of their brains into building their systems., but then they turn into boobies, following them. You Must Have a Schizophrenic Approach. Work, like a horse, to make the system good, and then ignore her, as if you are a brick wall. "

There are many ways to analyze successful entrepreneur traders, but "profitability" is the starting point. Beyond all the talk about teamwork and balance, people still rate trading success by individual ability to make big money. Real traders have excellent immunity to losses. It just isn't a factor, able to take them out of the game, even if losses do happen. They have a sincere and persistent indifference to their surroundings.. They are tireless optimists. Winners chase prizes, because they are sure, that they are able to win them. They are less afraid of being kicked out of the game., than not to use every possible chance on your way.

The system is a good thing, to guide you, but sometimes it is helpful to leave the system aside. Here are the probabilities: it's all a math game.

Uniqueness is not in the idea, which is the key to success. The uniqueness lies in your ability to implement this idea..

Original : findfxway.com/konspekt-knigi-cherepahi-treyderyi/