The news is full of reports about the expected default of the Chinese construction company Evergrande. We decided to look into this topic and tell you about, what happens to the company and why is it important even for those, who does not have an apartment in China.

When creating the material, sources were used, which can be blocked for users from Russia. We hope, Do you know, what to do.

What is Evergrande

In its free time from financial collapses, the company is the second largest developer in China.

What are the problems

Real estate in China is the main investment for most. It is approximately 75% well-being of a typical household. For comparison: real estate in the USA is about 35% well-being of the average household. All this has led to an indecent increase in real estate prices and speculation in the housing sector.: since 2015, some types of real estate have risen in price by more than 80%.

And there is no end in sight to this rise in prices.: Chinese stocks and bonds are not yet very interested, free money they try to invest in real estate. This makes the Chinese people related to the inhabitants of the Russian Federation.

As part of the fight against rising property prices and speculators, the Chinese Communist Party began to introduce restrictions in this area.: from purchase bans to set resale price ceilings.

The CCP also restricted the development of the real estate market and introduced the following restrictions:

- Banks now have restrictions on issuing loans to developers.

- Highly indebted developers now have limited access to new loans.

- 22 largest municipality party obliged to increase sales of plots of land, while limiting the number of auctions to three.

All this led to a drop in sales and a strong decrease in the growth rate of real estate prices.. Well, certainly, this led to problems for developers, whose financial situation has deteriorated: sales grew worse, than previously expected, and access to loans for operating activities was limited.

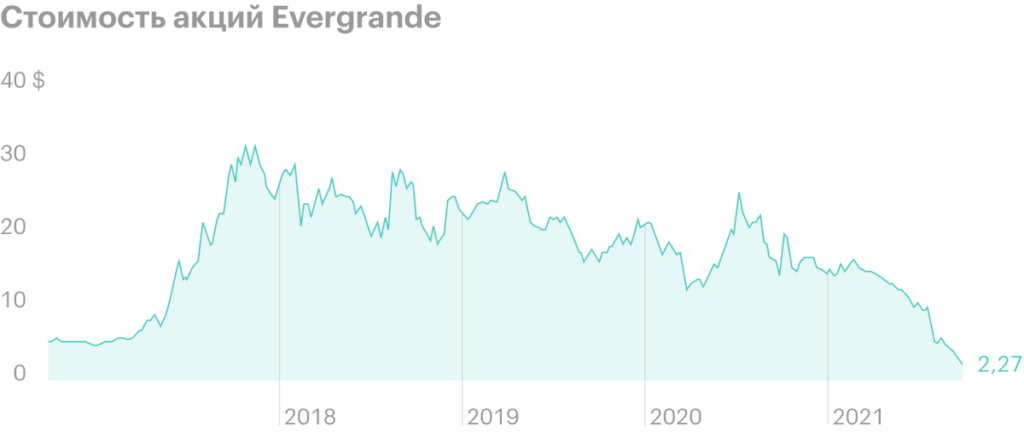

Evergrande was no exception, which for many years expanded due to debt. The company's dollar bonds had a very generous coupon rate - for example, 8,75% per annum. How do you understand, The company has a lot of debt, because she had to take more and more.

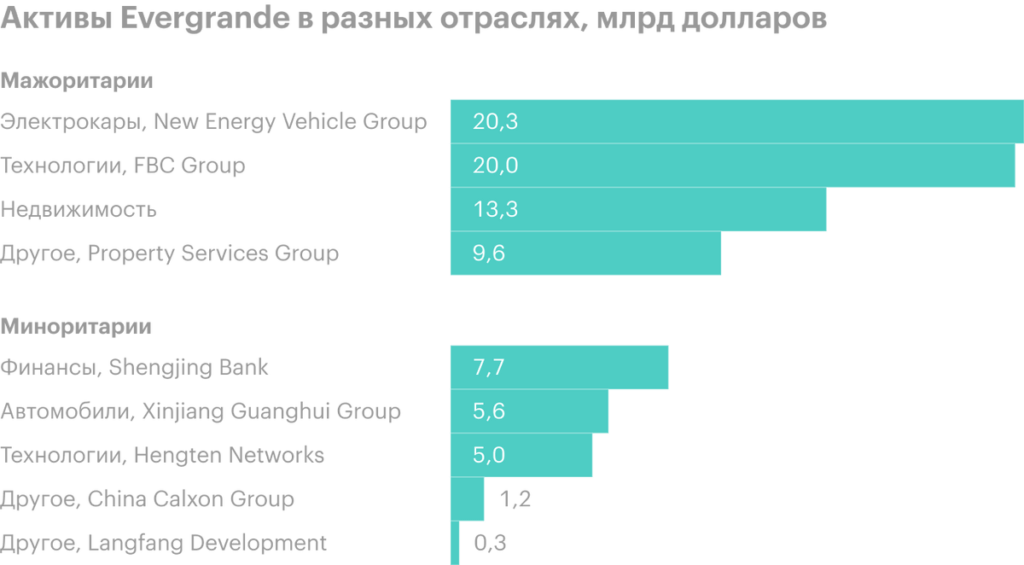

Meanwhile, Evergrande developed in other directions - for example, electric cars.

Evergrande's problems were obvious to everyone for a long time.: Western observers called the company a pyramid scheme back in 2017. So, almost a year ago, she had to pay $ 13 billion in penalties to investors, but they refused to exercise their right. Maybe, helped the communication of the company's management in high echelons.

But that didn't help the company much.: limited access to loans led to delays in payments to counterparties, and over the year the situation reached its current state. In the process, By the way, company management forced employees to invest in Evergrande projects.

Not so long ago, bills totaling $34 million from paint supplier Evergrande paid with unfinished properties - and it became clear, that default is very likely.

Why it matters

To understand the magnitude of the problem, Let's take an example from everyday life..

Imagine, what do you lend at a high interest rate to a person, playing cards. The player borrows from you for more than a year and pays interest. In parallel, he borrows money from other people in the area, also at a high interest rate - and all this continues for many years..

Then things start to get worse for the player., it becomes harder for him to give money, and it starts to take even more. And then, if the player is unable to give back the money and becomes bankrupt, you and other creditors will not receive the money, who were counting on. In this case, you will start to cut costs: reduce your trips to restaurants, start buying products cheaper and less frequently, cancel a sea trip, put off buying a new car, etc.. So much for the economic crisis within the same region. If you and other lenders have borrowed money yourself, counting on it, that the debtor-player will return what is owed to you, then the situation will become even worse for a larger circle of people: your financial difficulties will become several orders of magnitude worse, and they, who lent you money, become more careful in lending and give less money to other people, and this will negatively affect the consumption level of these failed borrowers. well, did you understand.

Many investors and large funds rely on coupon payments from Evergrande and eventually redemption of their bonds.. If they don't get them, this may affect their investment activity: she will become more conservative.

The company owes approximately $110 billion in bonds and loans., which is already a very large amount. But that's not all.

Considering Evergrande's debts to employees and contractors, then the total amount of debt is approximately $ 300 billion. For comparison: Greece's troubled debt, around which there was so much talk in 2012, was $ 200 billion. However, Evergrande's debt will be less than $ 600 billion in debt from Lehman Brothers, the collapse of which began the global financial crisis.

Are they so alone or not?

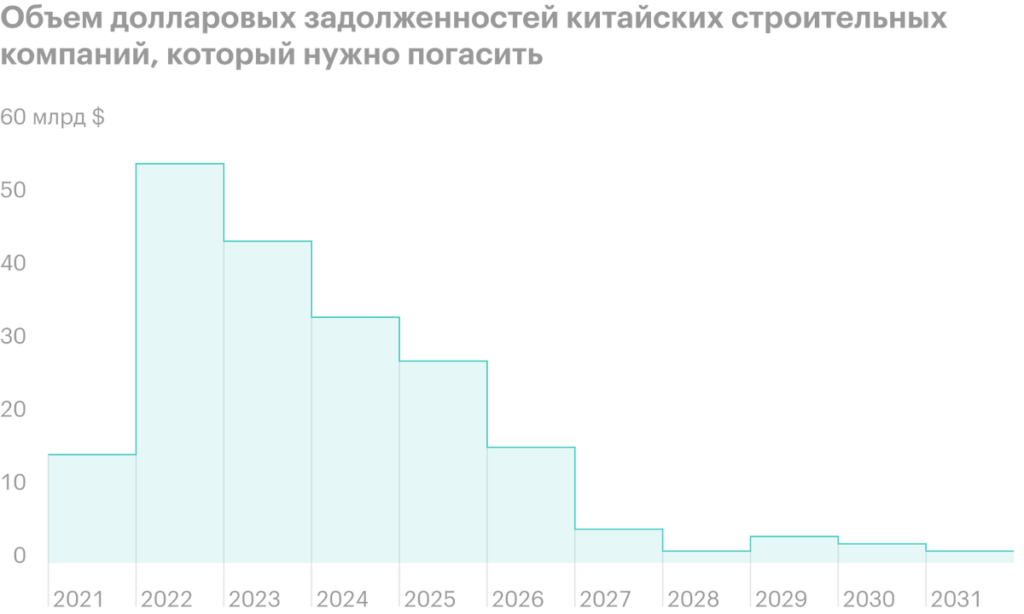

Not, there are other companies from the Chinese construction sector with a lot of debt at high interest rates. Their situation will depend on, how things will develop with Evergrande. There are risks of major bankruptcies of a series of companies in the sector.

Will there be general consequences

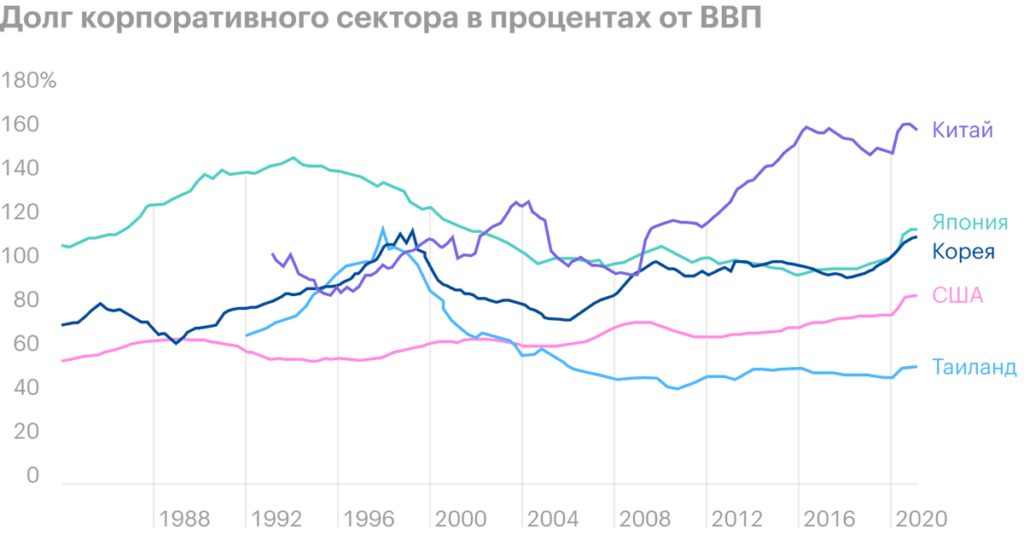

We can say for sure, that inside the PRC, after the whole story with Evergrande, the standards for issuing loans will begin to tighten. And that's the problem, as the Chinese corporate sector is heavily indebted, even when compared to the US. So,, the pace of development of the Chinese economy depends on the ease of obtaining loans within the PRC.

Actually, lending rates began to fall even before, how everyone started talking about Evergrande, which led to the slowdown of the Chinese economy recorded back in August. Inside the PRC, in the event of further tightening of lending standards, money will become harder to borrow. The same applies to loans outside China.: investors will demand higher returns from all Chinese borrowers due to increased risks. All this may negatively affect the plans of the Chinese corporate sector for investment and business development..

The default of Evergrande with its 1.3 thousand properties will surely lead to a serious drop in property prices, there is no lack of supply in the market. If Evergrande goes bankrupt, then a huge volume of unfinished housing will splash out on the market, And that will drive home prices even further.. Considering, that many Chinese households invested in real estate and tied their financial aspirations to speculating in it, at least a strong decrease in consumption can be expected, and as a maximum - a series of bankruptcies of individuals: I suspect, that the residents of the PRC, known for their gambling, probably took out loans secured by real estate with an eye to its sale at a high price.

By the way,, sales of land for construction are 30% revenues of local municipalities in the PRC - so that the deterioration of the situation in the construction industry will affect them and affect the level of investment in the regions.

Many competitors of Evergrande - like China Resources Land, Country Garden Holdings, China Overseas Land & Investment and Longfor Group Holdings - things are going better. But tightening credit standards within the PRC and falling property prices could lead to the bankruptcy of developers weaker, which will further lower housing prices and again affect the economy as a whole. Considering, that next year, Chinese developers will need to repay approximately $55 billion in dollar obligations, in a year, we may see the collapse of dozens of "little Evergrande".

Basically, considering all of the above, an economic crisis within China is quite possible with a drop in activity in almost all sectors. In addition, Evergrande has 200,000 employees – and every year it hires 3.8 million people as subcontractors.. The instantaneous disappearance of such a large enterprise will negatively affect the situation for everyone, who worked with Evergrande and simply depended on demand from those, who worked for Evergrande.

Who can get hurt

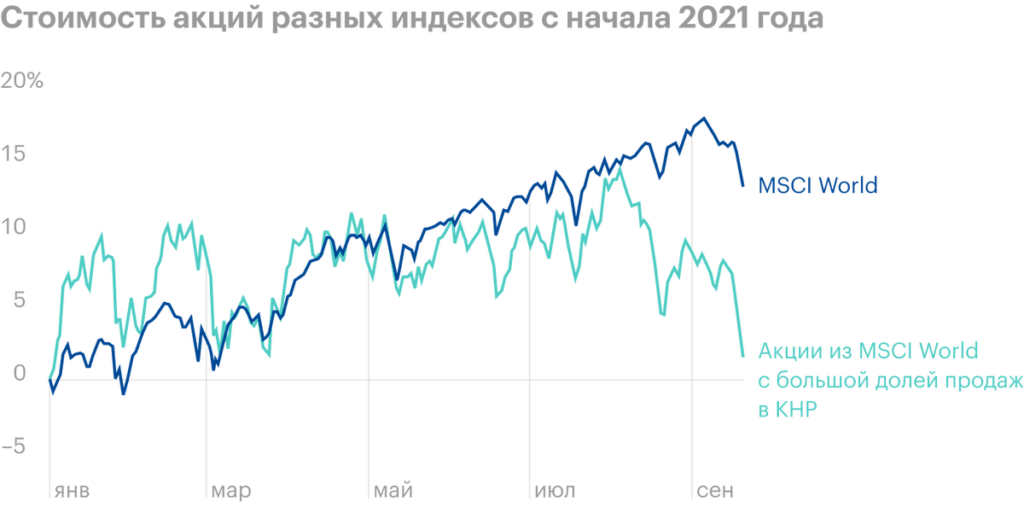

Firstly, quotes of all Chinese companies may fall dramatically. Secondly, American companies with a significant share of sales in China could be seriously affected, how their quotes have already suffered, if it comes to a full-blown recession in China.

Thirdly, a significant drop in commodity prices is likely, in particular for iron ore, from investors' expectations regarding the decline in demand in China. This will hurt companies., engaged in the extraction of raw materials. However, here everything will depend on the duration and severity of the recession in the PRC - provided, that such a recession will still happen.

Fourth, investors may take the news in China as a reason to arrange a massive sell-off in the US in anticipation of a new economic crisis.

Fifth, the cost of loans for the corporate sector will increase, not only in China, but also other developing countries. The fall of Evergrande has already led to a decrease in investor interest in bonds from China. Evergrande accounts for 16% Chinese corporate sector junk dollar bond debt.

If the company goes bankrupt, the default rates among Chinese junk bonds will rise from 3 to 14%. Such a surge would affect the reputation of all Chinese borrowers and make it harder for all Chinese companies to access Western capital markets.: the yield on Chinese junk bonds is now 14% per annum - much more 7,4% this February. Surely this will indirectly affect the bonds of all developing countries, including RF: in such situations, Western investors usually get rid of all non-Western assets.

All in all, nothing good will come of it - therefore you should be mentally prepared for everything.

Or maybe, everything will be ok?

It all depends on the position of the Chinese government. I doubt it, that it will buy back the company's debts: it will set a bad example for all other loaned borrowers. However, The CCP doesn't want a full-blown recession either. So anything is possible.

Evergrande has assets, and with skillful management of the bankruptcy process, the consequences of a default will be leveled. But serious damage cannot be avoided..

conclusions

The most terrible story of Evergrande is, that the situation with the company was not a secret to anyone. Everyone knew about her problems, but continued to credit her. How many more of these Evergrande is fraught with the Chinese economy - a mystery. 99% those, who's talking about Evergrande now, found out about her just the other day. So in the future we may learn other amazing stories., like Evergrande.

It seems to me, that such things happen in China because, that there are still many wild archaisms left. In the case of real estate, for example, technically there is no sale of land as such in China: the investor buys the right to use it - and for a certain period. That is, ownership can be extended. Might not extend. This significantly limits the planning horizon and stimulates thinking at the level of “grabbing more now.”, and after us at least a flood ". Which, in general, demonstrates the example of Evergrande, who borrowed a lot of money for development and, obviously, not going to give them away.

By the way,, loans sponsored the company's dividends, which she has generously paid since her listing: By June 2021, Evergrande has paid 69 billion yuan in dividends to its shareholders.

Who got the most? The head of the company and his relatives, which in total belonged at that time 76,7% Evergrande shares, - they received a total of 53 billion yuan, approximately $ 8.197 billion.

So be aware of such risks when investing in China and other ever-evolving countries..