22 September chairman FED Jerome Powell held a press conference after the regular meeting of the commission. Here is the main thing, what did he say.

Results of the meeting

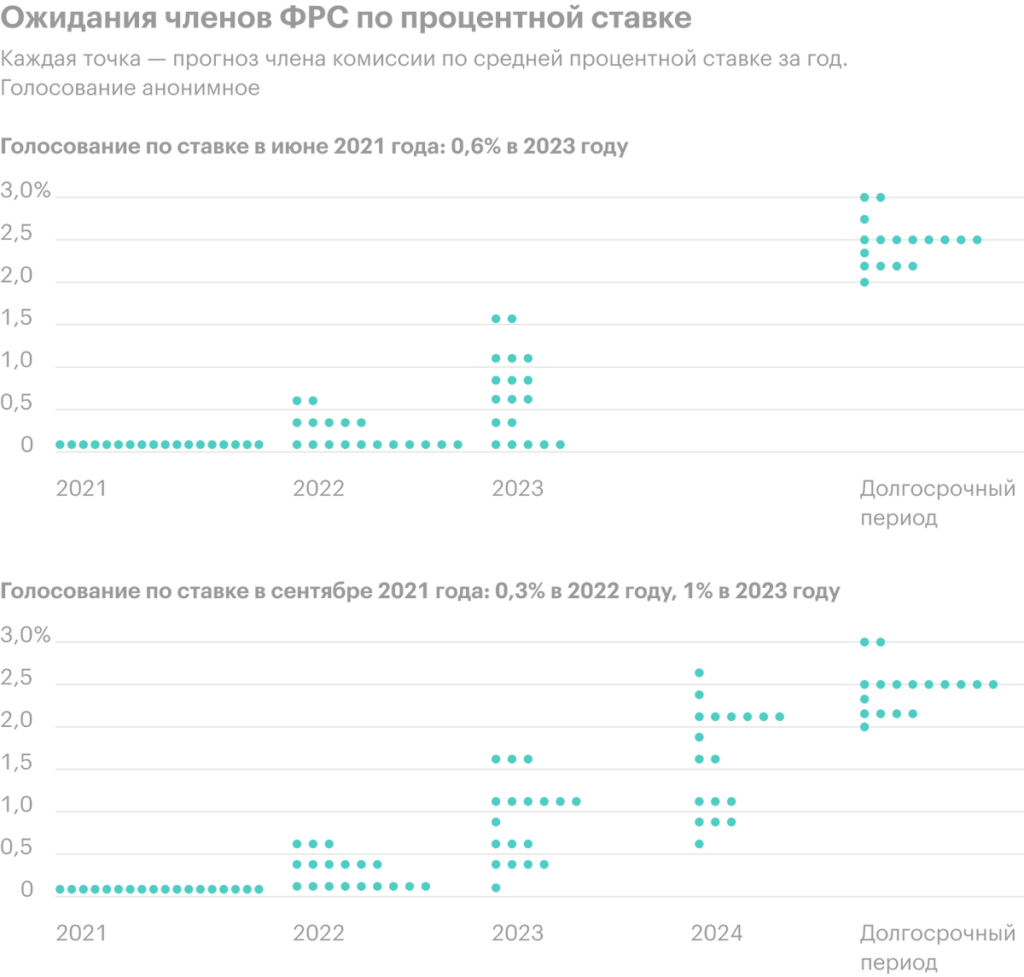

Interest rate. All members of the commission unanimously voted to keep the interest rate at a near-zero level.. Compared to the June meeting, more and more committee members consider, that it is worth starting to raise rates as early as 2022. Median forecast - 0,3% in 2022 and 1% in 2023. Last time the committee voted for a rate hike in 2023 to 0,6%.

Quantitative Easing Program. The Federal Reserve will continue to buy treasury and mortgage bonds at 80 and $ 40 billion a month. The regulator noted the economic recovery, but did not name the start date for the reduction of stimulus measures.

GDP and unemployment. Commission revised GDP forecast for 2021 from 7 to 5,9%, but increased expectations for next year with 3,3 to 3,8%. The expected unemployment rate in 2021 rose from 4,5 to 4,8%.

Inflation. Inflation rate, according to the Fed, by the end of the year will be 4,2% and will remain at 2.1-2.2% in the next three years. Due to disruptions in supply and the difficult situation on the labor market, raw materials, goods and services have risen in price compared to last year. According to Powell, the situation will return to normal, but more recently, the regulator expected much lower inflation: in March - 2,4%, in June - 3,4%.

Market reaction

Over the past few days, in anticipation of the meeting, the main stock indexes sank by more than 2%, but after Powell's press conference began to grow. Per day S&P 500 added 0,9%, Dow Jones и Nasdaq — 1%.

The Fed's loose monetary policy is one of the main drivers of stock market growth. March last year, when S&P 500 fell by 30%, The Fed cut interest rates to 0-0.25% and announced a quantitative easing program. The stock market began to grow and by August 2021 had doubled and added 100%.

Bond prices and yields move in the opposite direction. Bond yields remain low due to low rate and quantitative easing program. If the regulator changes policy, bond yields will start to rise, what can affect the stock market.

Borrowed companies may suffer more than others. It will become more difficult for them to service and refinance debts. But the financial sector can win. Banks will be able to lend at a higher interest rate, which will increase their profits.