The largest Chinese developer Evergrande has recently attracted increased attention of stock market participants. Investors sell stocks in anticipation of default on the debts of a heavily leveraged developer, the amount of debts which exceeds 300 billion dollars.

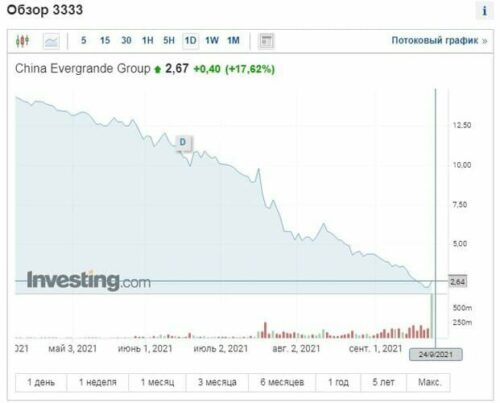

Evergrande's shares on the Hong Kong Stock Exchange have been declining for most of the year, accelerated the fall in the summer and eventually fell in price with 14,9 to 2,64 Hong Kong Dollar, having lost about half of the cost in the last month.

At the same time, the company reported, that it becomes increasingly difficult for them to repay debts, as in the summer sales decreased by 88%.

Rice. 1. Schedule changes in the value of Evergrande Group shares. A source: investing.com Ris. 1. Evergrande Group Share Price Change Chart. A source: investing.com

29 September, Evergrande is due to transfer more 47,5 mln USD. on bonds maturing in 2024 G. If interest is not paid within 30 days after the scheduled date, the issue may be in default.

According to Bloomberg sources, some banks are waiting for Evergrande's offers on payment extension plans. Total to the end 2021 G. the company must repay 669 mln USD. debts, and most of them are in dollar bonds.

At the same time, the Western media note, that Evergrande is one of the largest real estate developers in China. Consequently, the collapse of the company may spread to global markets.

How the situation with Evergrande will affect other market participants?

With the impending collapse of Evergrande, four other Chinese developers - Fantasia, China South City Holdings, Guangzhou R&F and Xinyuan Real Estate Co are also in trouble. Their bonds similarly collapsed due to fears of foreign investors..

"These concerns have further limited the ability of these companies to issue new bonds., to refinance maturing bonds and pay current investors", - notes WolfStreet.

Since the beginning of the year, developers have already defaulted on the debt on 6 billion dollars, which is about five times more, than the previous twelve months. Among them is China Fortune Land Development Co with its almost 10 billion dollars. outstanding debt, including 4,6 billion dollars. on dollar bonds. In March, the company defaulted on bonds on 550 mln USD.

Last month Ping An Insurance Co.. reported the write-off of its investments from the developer on 5,5 billion dollars.

Developers VS GDP

Previously, developers were an important factor in Chinese economic growth.. They account for 28% Gdp. And much of it was funded by debt., including dollar debt, most of which is now crumbling.

“Foreign investors have been actively investing in the real estate sector for many years, buying hundreds of billions of dollars worth of bonds, including dollar bonds, produced by Chinese developers. They liked the yield of these securities, which in some cases was more than 10%, and they thought, that the Chinese authorities will not allow these companies to default, will save bondholders, as it used to be, after all, the real estate sector is very important for the Chinese economy.", WolfStreet analysts said.

Now, however, things have gone wrong for foreign investors.. Chinese authorities take action against overburdened developers, aggressively attacking liquidity inflows into the housing sector.

If the PRC government refuses to help bondholders and allows investors to, especially foreign, suffer serious losses in order to reduce the debt in the economy, it will be a fundamental change for all, who invests in Chinese real estate.