2018 the year has become difficult for the cryptocurrency market. Cost records, sharp corrections, temporary market stabilization – it all made both critics, and adherents of cryptocurrencies with interest to watch what is happening. What has happened in the market 2018?

Banks against cryptocurrencies

Already at the beginning 2018 years, traditional financial institutions began to limit the opportunities for market participants. Many banks from different countries began to refuse to service the accounts of cryptocurrency companies. Besides, Visa payment system stopped serving large European cryptocurrency companies. Ordinary customers of many banks have lost the ability to buy digital assets using payment cards. Such a ban was introduced by the largest banks from the USA, Uk, Canada and Australia.

In April, the Reserve Bank of India (RBI) запретил подконтрольным учреждениям предоставлять частным лицам и компаниям услуги, related to digital currencies. In this regard, Indian cryptocurrency exchanges were forced to stop fiat cryptocurrency trading.. And at the end of September, the Indian trading platform Zebpay completely announced the closure of the digital asset exchange service.. The Reserve Bank of Zimbabwe also introduced similar restrictions, but it was later overturned by the Supreme Court.

Such actions by financial giants indicate that, what they began to see in cryptocurrency companies as a potentially dangerous competitor, able to push them globally. So, for example, Bank of America this year for the first time included cryptocurrencies in the list of economic, geopolitical and operational risks, threatening the bank.

Entry of financial conglomerates to the cryptocurrency market

Parallel to this, we observe, how the largest banks are moving into the cryptocurrency market. Goldman Sachs, ING, Barklays and HSBC begin to cooperate with the largest cryptocurrency exchanges and implement their own projects. Below are just a few examples.

So, for example, in February, the startup Circle (the main investor is Goldman Sachs Bank), приобрел одну из ведущих криптовалютных бирж Poloniex. Official representatives of the organizations did not disclose the amount of the transaction, however, Fortune editor Robert Hackett said, what the company paid for the purchase $400 million. Goldman Sachs once invested in Circle $136 million.

In May it was reported, что совет директоров Goldman Sachs одобрил инициативу по созданию сервиса по торговле биткоин-фьючерсами. The company is also developing a platform for trading OTC bitcoin derivatives.. Besides, the bank is considering the possibility of launching custody services, focused on large funds.

The largest financial conglomerate in Japan and the fifth largest bank in the world Mitsubishi UFJ Financial Group (MUFG) in September launched a test of the Mufg coin cryptocurrency among the employees of its division in Tokyo. The bank announced plans to introduce cryptocurrency into its payment system in March this year., and just a month later he announced, what will start in 2019 year large-scale testing of Mufg coin, in which he will involve already 100 thousands of their clients.

SBI Holdings jointly with Ripple has developed a mobile payment application MoneyTap, consumer oriented. The application allows real-time interbank payments using xCurrent technology, in which no XRP token is involved. Several Japanese banks have already started using MoneyTap for domestic payments: SBI Sumishin Net Bank, Suruga Bank и Resona Bank. In July, the company announced the start of the full operation of the VCTRADE cryptocurrency exchange.

Confrontation from Internet corporations

Another limitation, faced by cryptocurrencies in 2018 year - the prohibition of advertising of cryptocurrency projects by such largest Internet giants, like facebook, Google, Twitter, Snapchat, Yandex, Baidu, Weibo, Bing. Chinese messenger WeChat blocked media accounts, related to blockchain and cryptocurrencies. Mobile App Stores Chrome Web Store and App Store Ban Cryptocurrency Mining Apps.

On the one side, blocking can be explained by, that blockchain and cryptocurrencies pose a threat to Internet corporations, because they offer alternative decentralized solutions and new forms of mutually beneficial cooperation with users based on tokens. However, it is quite possible, that the main reason is the restriction of the activities of cryptocurrency companies in countries, where corporations are registered.

Nevertheless, in June, Facebook announced a revision of a complete ban on cryptocurrency advertising. А в конце сентября Google сообщила, which will allow advertising cryptocurrency exchange services in Japan and the USA.

Integration with Internet companies

Meanwhile, other internet companies are looking to integrate new technologies..

В последнюю версию браузера Opera для Android был встроен криптовалютный кошелек. Opera later decided to launch a desktop version of a crypto wallet. Пока приложение поддерживает только Ethereum, ERC20 tokens and collectibles in ERC271 token format, however, in the future, the developers plan to add support for new cryptocurrencies. Remarkably, that according to media reports, in July, the leading manufacturer of Bitcoin mining equipment Bitmain acquired during the IPO 3% Opera Ltd shares for $50 million.

Competitor Opera, Brave Cryptocurrency Web Browser, back in May was loaded more 5 million times from the Google Play mobile app store, just through 6 months after crossing the threshold in 1 million downloads. Brave was created by Mozilla Firefox co-founder Brendan Eich.

Компания Yahoo в августе добавила возможность торговли биткоином, Ethereum and Litecoin on Yahoo Finance, popular among traders and other representatives of the financial world.

В июне американский технологический гигант Microsoft приобрел известный веб-сервис для хостинга IT-проектов и их совместной разработки GitHub. The transaction amount was $7,5 billion.

And in July, the TRON blockchain platform acquired BitTorrent. It is planned to integrate the TRON protocol into the BitTorrent service, as well as the use of TRX tokens to sell special services and additional options, including increased download speed.

Cryptocurrency ETFs

One of the most notable topics since the summer was the question, will the US Securities and Exchange Commission allow (SEC) cryptocurrency exchange-traded funds (ETF). The wait for US ETFs is comparable to waiting for CBOE and CME futures to launch in 2017 year.

In January, the SEC expressed serious doubts about the liquidity and price volatility of cryptocurrencies and related products and asked the companies, ETF applicants, withdraw them. However, due to the fact, that the market has stabilized since the beginning of the year, since April there have been messages about new applications. Since then, applications have been submitted: ProShares, Winklevoss Bitcoin Trust, VanEck и SolidX, Chicago Options Exchange (CBOE), GraniteShares, Biwise, Direxion. A number of SEC companies managed to refuse, but later she promised to reconsider her decision, excluding the application from the Winklevoss brothers, rejected again after 2017 of the year.

While the regulator is postponing decisions on applications and calls for participation in the discussion of this issue. Opinion was expressed in the crypto community, that decisions will be postponed as long as possible - until the start 2019 of the year. Besides, many express an opinion, that ETFs will negatively affect the cryptocurrency market.

Meanwhile, in August as an alternative to the exchange Nasdaq Stockholm launched another similar financial instrument – exchange notes (ETN) of bitcoin, developed by the Swedish company XBT Provider AB.

Formation of legislation

Expected, what 2018 year will become year, when countries will decide on the regulation of the cryptocurrency industry and create appropriate legislation. Really, many countries on all continents are actively discussing this issue, draft laws are being prepared. Some countries seek to limit the development of their industry, due to the difficulties in countering the use of cryptocurrencies in money laundering and control over digital assets in general against the background of the active growth of the cryptocurrency market. Other countries, on the other hand, seek to attract representatives of the industry and stimulate its development., seeing this as an opportunity for their economic growth.

Malta is a prime example of the latter.. 4 июля парламент страны принял три законопроекта, regulating the cryptocurrency and blockchain industry, namely: "Digital Innovation Law", "Act on innovative technologies, agreements and services "and" Act on virtual financial assets ". Thus Malta became the first jurisdiction in the world, providing a legal basis for the application of distributed ledger technology.

Previously, 27 February, Federal Ministry of Finance of Germany (BMF) signed a decree recognizing bitcoin as legal tender, equating it to traditional fiat currencies and freeing it from taxation. Converting fiat currencies to bitcoins is tax-free. Also, BMF does not intend to regulate the mining industry.. Thus, Germany became one of the first European countries, determined to regulate.

Regulatory discussions throughout the year are also held at the interstate level and the level of international organizations., in particular at the G20 level (G20). High expectations were placed on the G20 summit in Buenos Aires in July. It was supposed, that specific recommendations will be offered on the regulation of cryptocurrencies. But the presentation of standards for the application of anti-money laundering rules (AML) regarding cryptocurrencies have been postponed until October. If they are presented, they will play an important role in the formation of legislation and regulation of the cryptocurrency industry in individual countries.

Attracting institutional investors

IN 2018 year they started talking about entering the market of institutional players. Согласно результатам опросафранцузской консалтинговой компании Capgemini, almost half of the owners of large private capital (from $1 million) interested in cryptocurrency investments: 29% millionaires showed a high degree of interest, and further 27% - moderate interest. А опрос консалтинговой фирмы DeVere Group показал, that more than a third of capital owners want to have cryptocurrencies in their portfolio.

Many companies began to offer a wide range of products, focused on institutional investors. Various companies began to offer custody services for cryptocurrencies. Among them Nomura, Coinbase, BitGo, VersaBank. Also, various services for big business for working in the cryptocurrency market are offered by Coinbase, Intercontinental Exchange (ICE), Caspian, Huobi, Nasdaq, Ernst & Young, Bitfinex, Crypto Fund AG (subsidiary of Swiss Crypto Finance Group), LMAX Exchange Group, and many others.

OTC market development

Since many institutions are often interested in buying / selling a large volume of cryptocurrency, which is difficult to accomplish on ordinary trading and exchange platforms, during the year, it was announced the opening of many cryptocurrency OTC platforms as cryptocurrency companies, and companies from the traditional financial market. In particular, BCB Group, OTCQX, Gemini, Jump Trading, Kraken, Blockchain, eToro.

But the OTC market also attracts other players.. Many miners prefer to sell the mined cryptocurrency outside the exchanges.. For startups, completed ICO, it is also a convenient way to sell the collected cryptocurrency for fiat to implement your project.

According to the report of the international research company TABB Group, over-the-counter (OTS) bitcoin market at least in 2-3 times more in volume, than the exchange. Considering, that the bitcoin exchange market processes about $4 billion a day, then over-the-counter, according to TABB calculations, processes more $12 billion per day on an ongoing basis. Wherein, analysts believe, that these transactions are invisible in the blockchain, since it is not the bitcoins themselves that move, and private keys from wallets.

Largest ICOs. The growth of alternative ways to raise capital

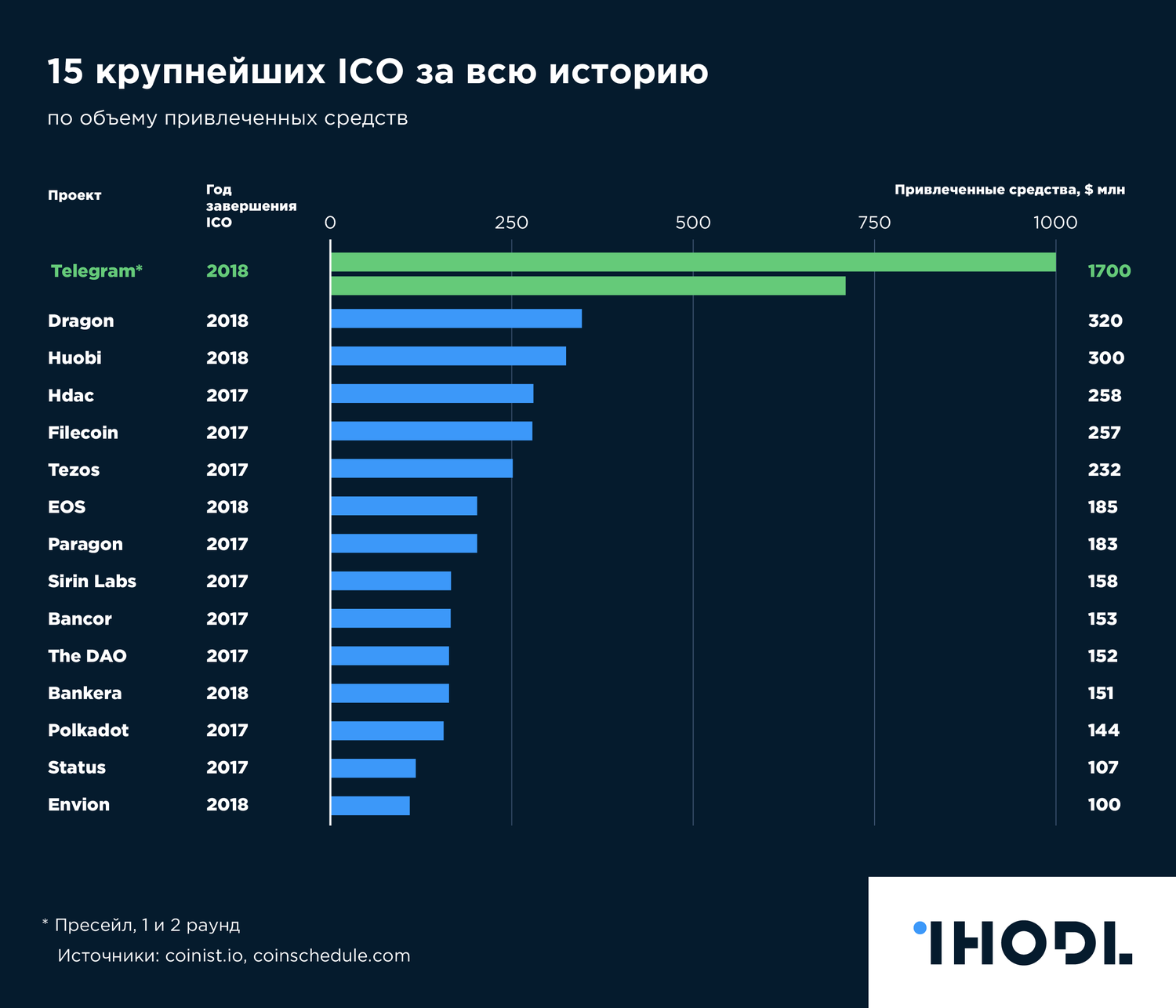

Despite the fall in cryptocurrency prices and the reduction in market capitalization, in 2018 more ICOs have already been held in a year, than in the previous: 741 against 514, according to ICOBox researchers as of early October. And funds were collected almost in 3 times more: $18,16 billion against $6,89 billion.

The most sensational was the ICO of the Telegram messenger, closed round $1,7 billion and abandoned the public stage. The founder of the messenger Pavel Durov considered, that the funds raised are sufficient and there is no need for a campaign open to the public. Although previously reported by the media, what the project was going to collect $3-5 billion.

ICO Telegram можно считать крупнейшим в этом году, если не учитывать ICO EOS, which started back in June 2017 years and lasted exactly one year. During this time, EOS collected $4,2 billion. These are not only the most successful camps in 2018 year, but also in the entire history of the initial issue of coins.

Nevertheless, certainly, ICOs are losing popularity. According to the research group Diar, 70% ICO tokens cost less today, than during sales. Furthermore, most tokens fell in price by more than 90% from their peak values. Diar believes, that it contributed to the growth of attraction to the blockchain- and crypto venture capital startups. Only for the first three quarters 2018 years of venture capital investments amounted to $3,9 billion, What's on 280% most indicators of all 2017 of the year. Moreover, the number of investment transactions for an incomplete 2018 almost doubled in a year.

Besides, some companies began to offer alternative forms of attracting investment in light of the, that many ICO organizers showed bad faith or turned out to be scammers at all. So, started talking about the initial offer of security tokens (Security Token Offering — STO) as a safer way to raise funds. Although potentially STO could bring the entire blockchain industry to the level of the global stock market, until it became widespread, and only a few cases are known. Among them: Good Money, Spin, Overstock tZERO.

IPO of cryptocurrency companies

Considering the above and despite the fact, what ICO – an easier and faster way to attract investment for startups, many cryptocurrency companies in 2018 year decided to turn to traditional methods and started talking, on the IPO. Probably, another reason is, that IPO guarantees higher investment security, which means, attracts big capital more. But for now 2018 a year, only one participant in the cryptocurrency market managed to hold an IPO, the rest have just applied for or reported such plans. First of all, the companies distinguished themselves, related to cryptocurrency mining.

In early August, the IPO of the British mining company Argo Mining PLC took place, which offers its users the ability to remotely mine cryptocurrencies. The company managed to raise £ 25 million (about $32,5 million).

At the end of September, the largest mining company Bitmain submitted to the Hong Kong Stock Exchange (HKEX) listing application for an initial public offering (IPO). Listing will take place either in the last quarter of this year, or already in the first quarter 2019.

Other companies announced plans for an IPO. So, in September, the developers of the mobile crypto trading application Robinhood announced this. This is despite the fact, that in May the company's capitalization reached $5,6 billion after funding round D.

Canadian public company GoverMedia Plus Canada Corp. подписала меморандум о намерениях с криптовалютной биржей EXMO, which grants her exclusive rights to negotiate the purchase of the latter for a period of 180 days. If the deal goes through, The combined company will continue to do business under the EXMO brand and will be listed on the Canadian Stock Exchange (CSE).

January

The year did not start very well for the crypto market. Immediately after the December rally, a decline began - so in January we recalled the largest Bitcoin crashes.

February

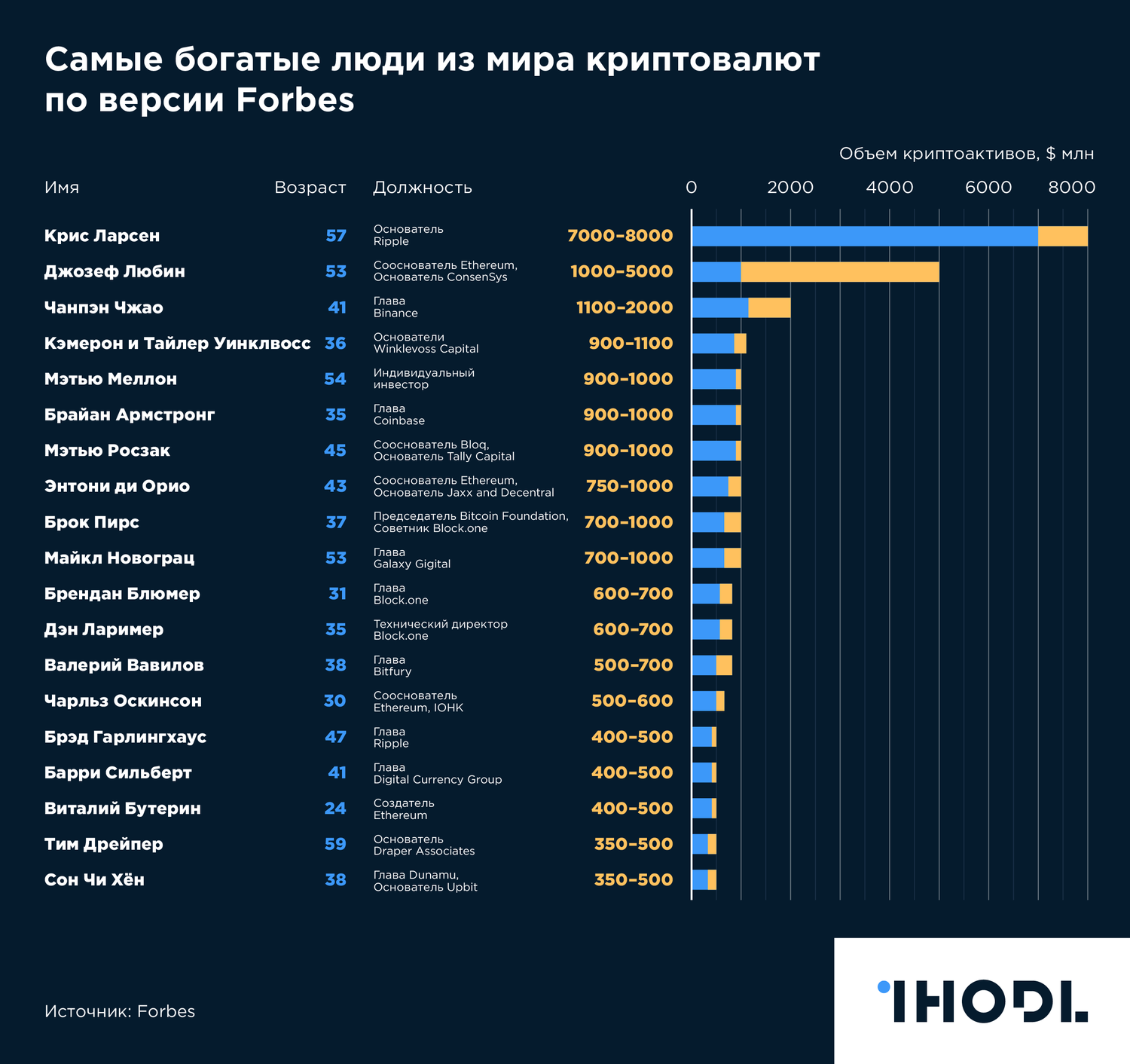

Forbes first published a ranking of the cryptocurrency rich. First place went to fintech entrepreneur and head of Ripple Chris Larsen with a fortune of $ 7-8 billion (he still leads this ranking, despite a significant decrease in capital due to the market crash).

March

Bitcoin price dropped to $11 000, and this figure still inspired respect. But there were other cryptocurrencies., which cost more. Much more.

April

While everyone was watching the fall of bitcoin, the ruble also fell - to a minimum in a year and a half (due to the imposition of US sanctions). "Volatility Happens", - the press secretary of the President of Russia Dmitry Peskov commented on the situation.

May

ICO Telegram became the largest in history in terms of the amount of funds raised - Pavel Durov's company collected 1,7 billion dollars. Truth, EOS will become the leader in a couple of months, which will attract 4 billion dollars.

June

The most anticipated event in the world of football, the 2018 World Cup, took place in the summer.. In honor of this, we decided to find places in Moscow, where you can spend bitcoins. The result is a curious map

July

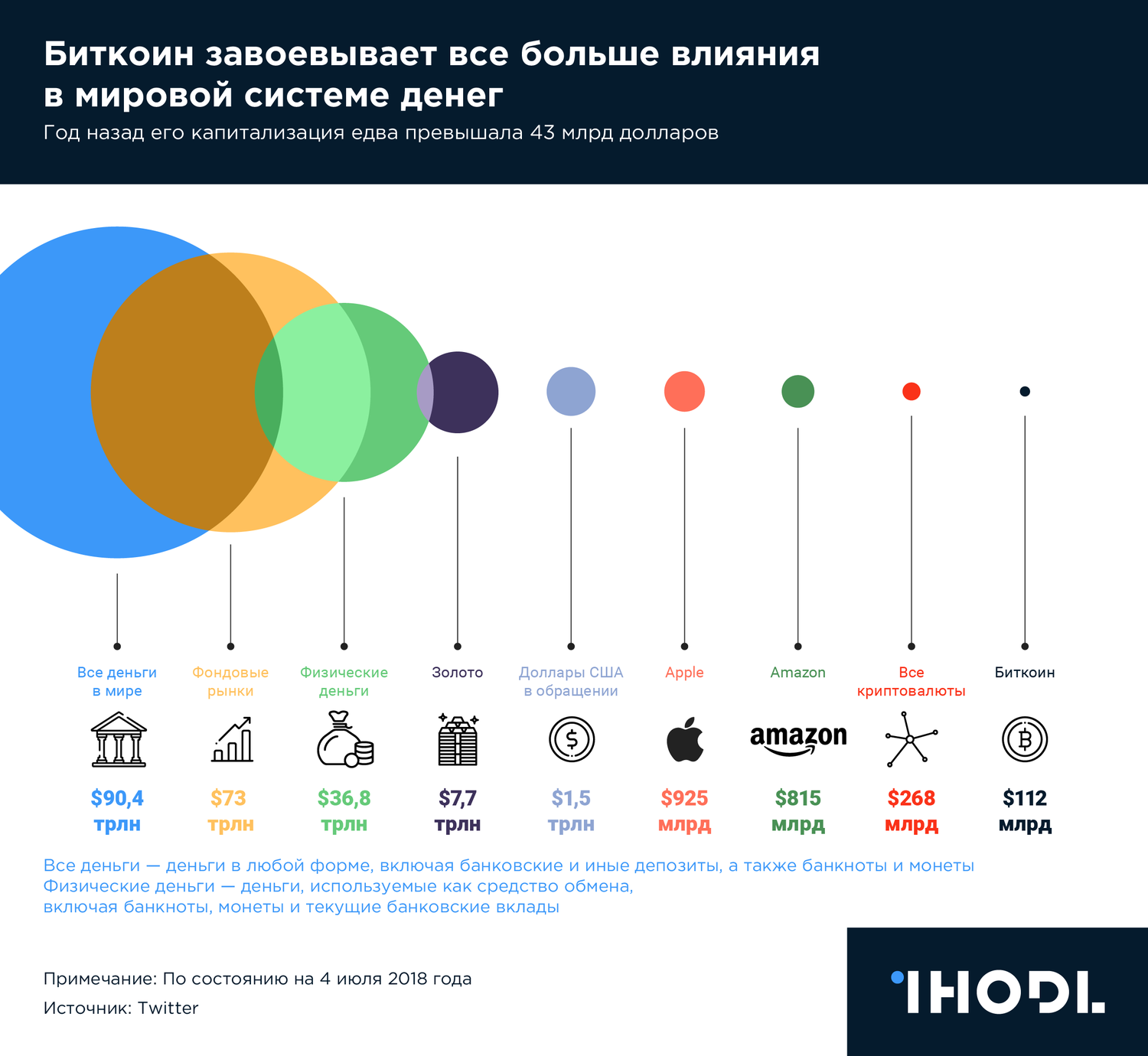

Bitcoin has firmly won its place in the world money system. In the summer, only one person in the world had enough funds, to buy up all the BTC to the last, - this is Jeff Bezos.

August

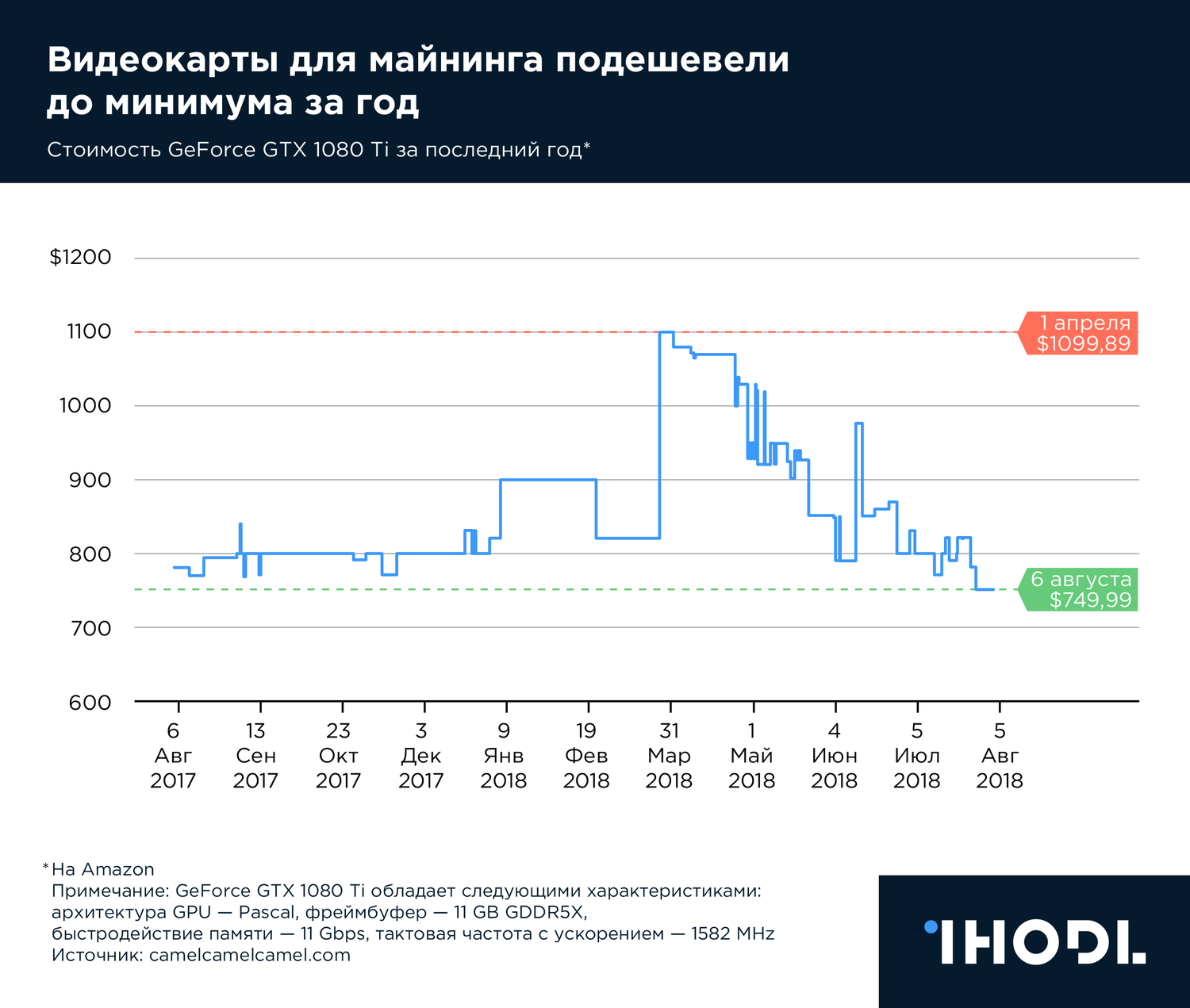

Another decline in cryptocurrency prices led to the fact, that video cards have fallen in price to a minimum in a year.

September

The ICO market was also not in the best shape: 70% tokens, emerging in 2018 year, fell in price after the initial offering. The losses of some companies were in the tens of millions of dollars..

October

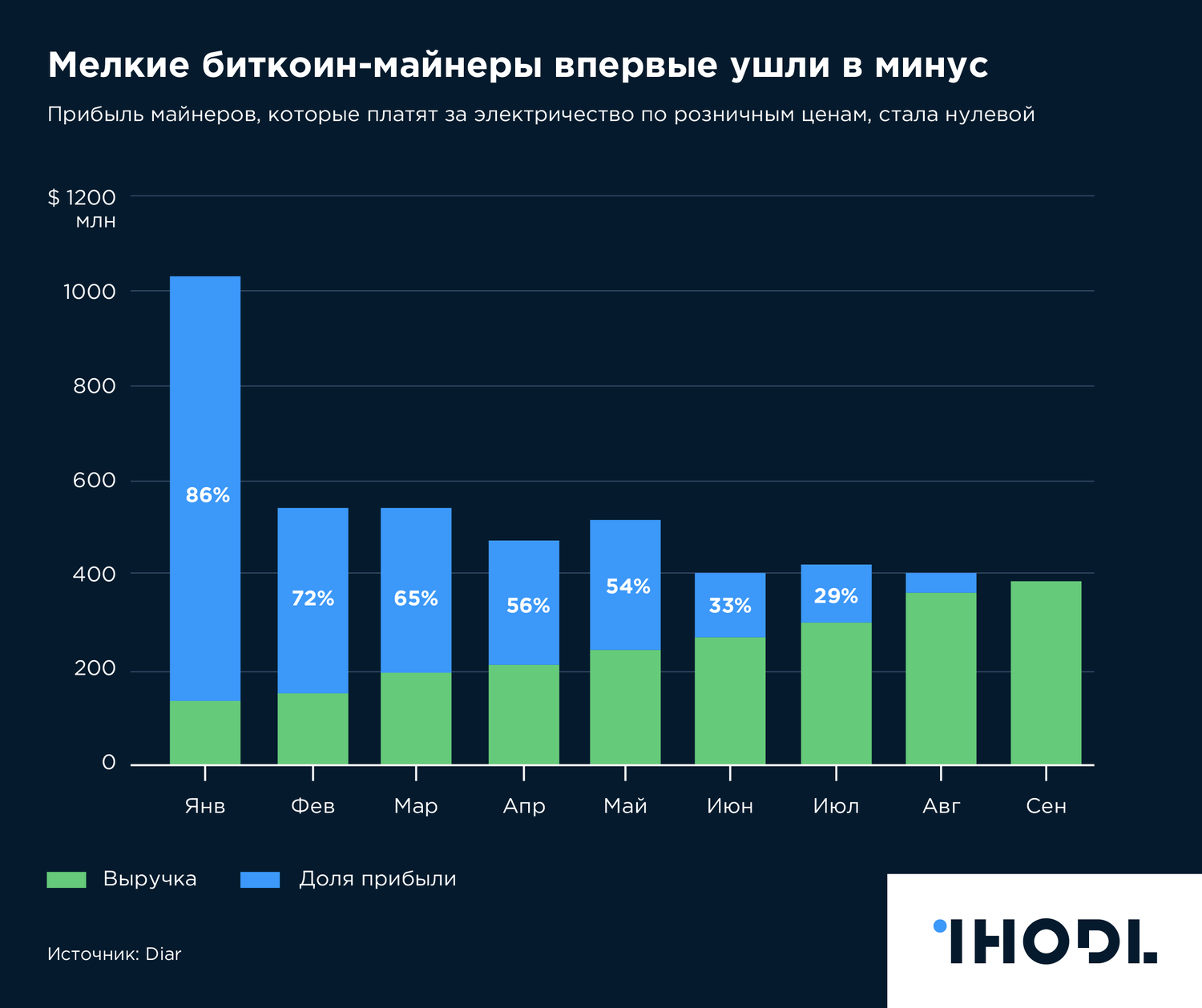

Due to the market fall, bitcoin mining became unprofitable and passed into the hands of large players. So, profit of small miners, who pay for electricity at retail prices, became zero. This happened for the first time in history.

November

Another market crash (one of which was the Bitcoin Cash hard fork). 1453 cryptocurrencies from 1880, tracked by CoinMarketCap, - that is, almost 80% - collapsed on 90% and below their record levels.

December

What will happen to bitcoin? Today this question is asked by all crypto investors.. We tried to find the answer, but the forecasts of the best experts differ dramatically. Someone is predicting, that bitcoin will rise to 1 million dollars, someone - that he will fall to $100. Who will be right? Will show 2019.

A source:

- bitcryptonews.ru/blogs/ryinok-kriptovalyut-samyie-vazhnyie-sobyitiya-2018-goda/

- ru.ihodl.com/infographics/2018-12-25/kriptorynok-v-grafikah-itogi-2018-goda/