The IPO of the Russian carsharing service Delimobil is planned for early November (NYSE: DMOB) on the New York Stock Exchange. We decided to look into the business of the company.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

What do they earn

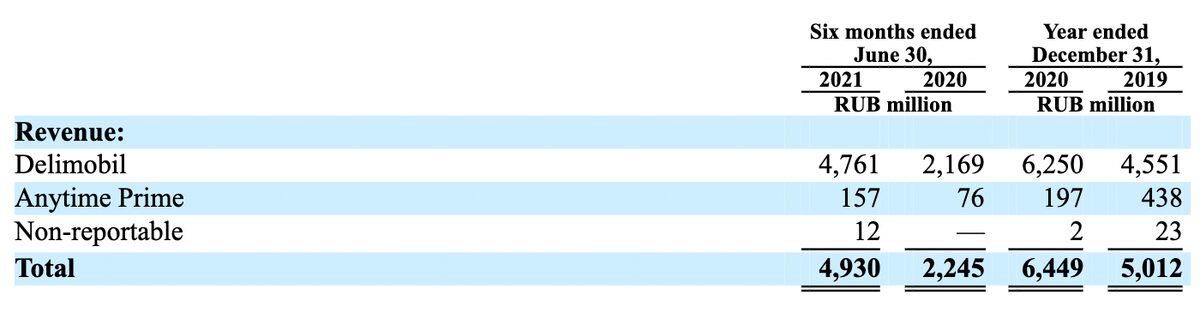

This is a car sharing service: users pay for the opportunity to use the company's vehicles for a short period of time, from a couple of minutes to a day. Business of the company, according to its registration prospectus, divided into the following segments:

- "Delimobile" — 96,57%. Car sharing service.

- Anytime Prime — 3,18%. Long-term car rental service of premium class and above.

- Other - 0,25%. Non-core services of the company: counseling, repair, maintenance, fuel sales, spare parts and accessories. As a matter of fact, this is a segment of corporate settlements between different segments of the company.

You can also look at the business of the company in a different way., since not all revenue consists of car rental:

- car sharing - 79,87%.

- Fines from customers for traffic violations, violation of rental rules and damage to cars - 13,83%.

- Delivery — 3,1%. Revenue from retail companies for the delivery of goods.

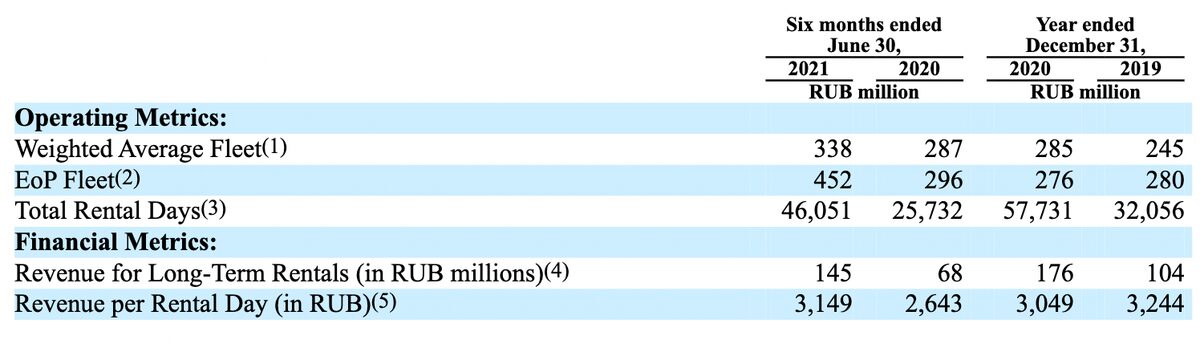

- Revenue from long-term lease — 2,94%. This is less than the revenue of Anytime Prime, Where is, probably, non-core income of the division was also taken into account.

- Non-core income of the company - 0,26%.

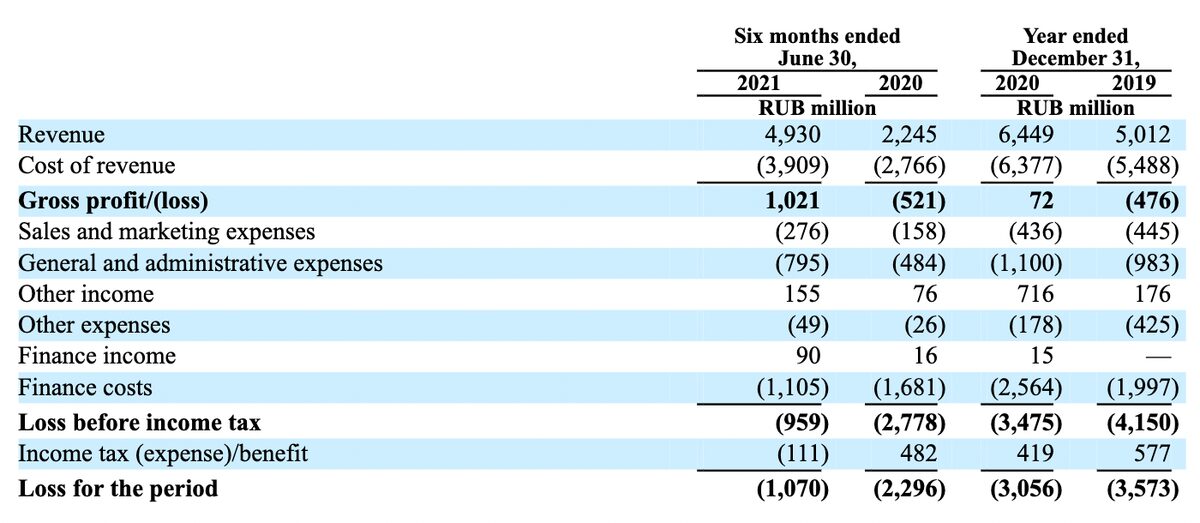

Delimobil operates in Russia, but plans to expand towards the Czech Republic, Kazakhstan and Belarus. The company is unprofitable: in the first half of 2021, the final margin was −21.7% of revenue. At the end of 2020, the final margin was −47.38%.

Arguments in favor of the company

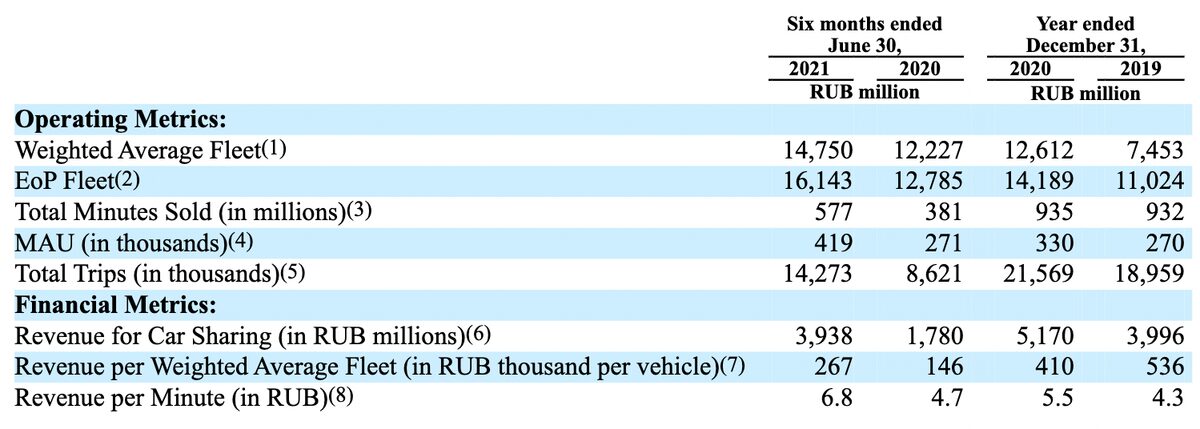

Growth, height, height! Various beautiful metrics of the company demonstrate quite start-up growth rates. This can attract a category of investors into the company's shares, who hopes, that someday this growth will come to fruition and the company will become profitable.

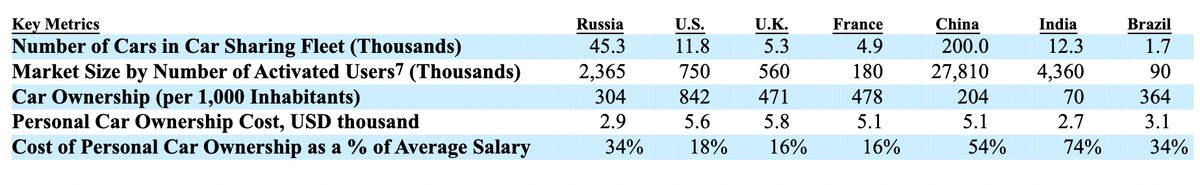

It seems promising. The main arguments in favor of Delimobil are presented in the Т—Ж test about the well-being of citizens of the Russian Federation. Here is the basic information from there:

- The average resident of the Russian Federation cannot afford a car.

- More 88% of the population of the Russian Federation live on a salary of less than 60 thousand rubles a month - about 32 612 R.

Most people cannot afford their own car in the Russian Federation, therefore, such a scheme for renting a car in the Russian Federation looks promising. Given these facts, betting on carsharing does not look meaningless.

ESG. Although from an economic point of view, profitability in this direction, probably, will not, but Delimobil can be seen as an analogue of Uber: such an economic experiment under conditions of pauperization.

The movement “responsibly

consumption” – with Delimobil in the Russian Federation it will be possible to hone the concept of the general use of such a status object, like a car.

This does not mean, that Delimobil will make a profit: maybe, he will never make a profit, but there is a high probability, that the company will be subsidized by various funds. So, investors pumped up the quotes of Uber and Lyft, moreover, that both companies are hopelessly unprofitable, - but their stock market success has created an image of a “promising direction” for the entire industry, money went into it, which kept her afloat..

Certainly, this is a speculative factor, but sometimes the calculation is justified, and Delimobil may become the new Uber.

What can get in the way

The company is too expensive. The prospectus contains the following estimates of the company's market: the car sharing market in the Russian Federation in 2020 amounted to about 22.6 billion rubles a year, cumulative growth rates up to 2025 are expected to be around 10% in year.

Certainly, if we expand the concept of "target market of the company" to the maximum and include a taxi there as well, then the target market of Delimobil will grow tenfold. To do so, of course, no need: the company still specializes in carsharing and its expansion to taxis will require significant investments. We have already decided in a paired review of Uber and Lyft: there is no profit in the market of taxi aggregators.

Approximately 20 operators, and the total size of the fleet in this area is about 45.3 thousand vehicles. With its 18.4 thousand cars and about 44% market in terms of revenue, Delimobil looks like a major player. But, given the range of expected capitalization of the company, the share placement price will be in the region from 10 to 12 $, this is 0.7-1.1 billion dollars of capitalization. With such a capitalization, the company is unrealistically expensive.

If we focus on the lower capitalization limit of Delimobil at $ 0.7 billion, then in terms of rubles it will amount to 48.686 billion rubles - in 2 more than times its target market, where Delimobil is not the only player.

There are other companies in this market - and they are all unprofitable. In Moscow, for example, Delimobil is forced to compete with Yandex, which has very deep pockets. And there's no reason to count, that this will change soon: the meaning of carsharing is to save. Any price increase will make car sharing much less profitable for the consumer., what will affect the growth of the service.

Registration. Company, in fact, Russian, despite, that the parent company is registered in Luxembourg, - and it creates problems.

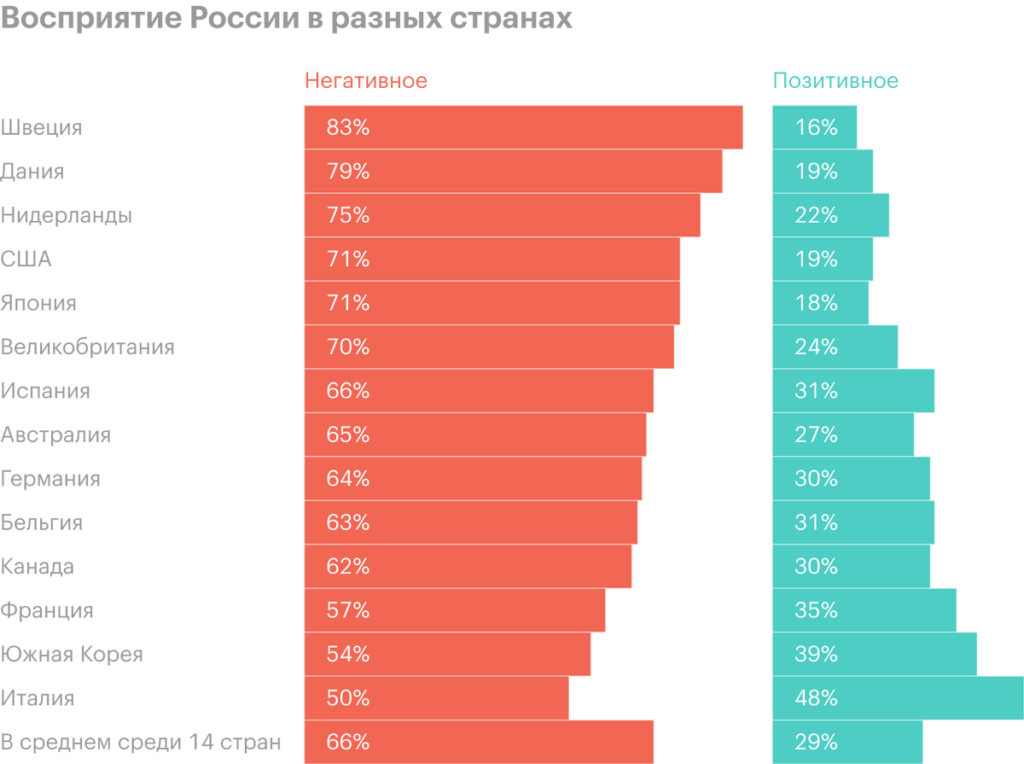

There may not be enough demand for a company's shares in America simply because, that she is Russian. Russia is not liked in the USA, and quite possibly, that stocks would discriminate. For example, shares of companies from the PRC, even before the summer wave of regulation of the technological sector in China, were significantly cheaper on the American stock exchange than their American counterparts - and after all, the Russian Federation does not even have an image of an intensively developing large economy.

“A loss-making car-sharing service from a gloomy Eastern European country with high political risks and a generally bad image in America” - well, such a description. According to opinion polls, for example, USA doesn't like Russia.

All revenue of the company in rubles. Bearing in mind that, how unreliable the ruble is, you can already now worry about quarterly reporting in case of a depreciation of the ruble. In general, the company's revenue in rubles may grow, but if the ruble falls - and it often falls, - then Western investors will sell these shares.

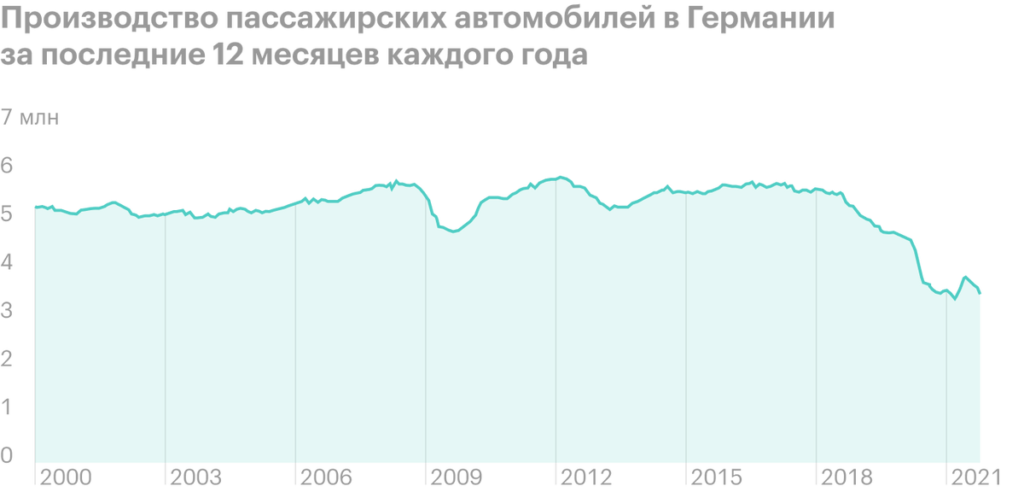

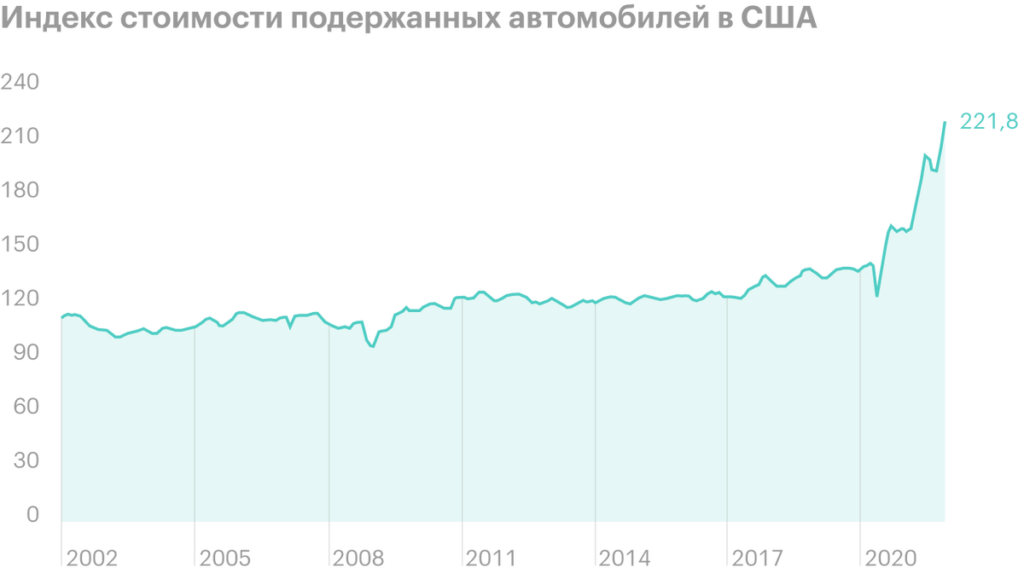

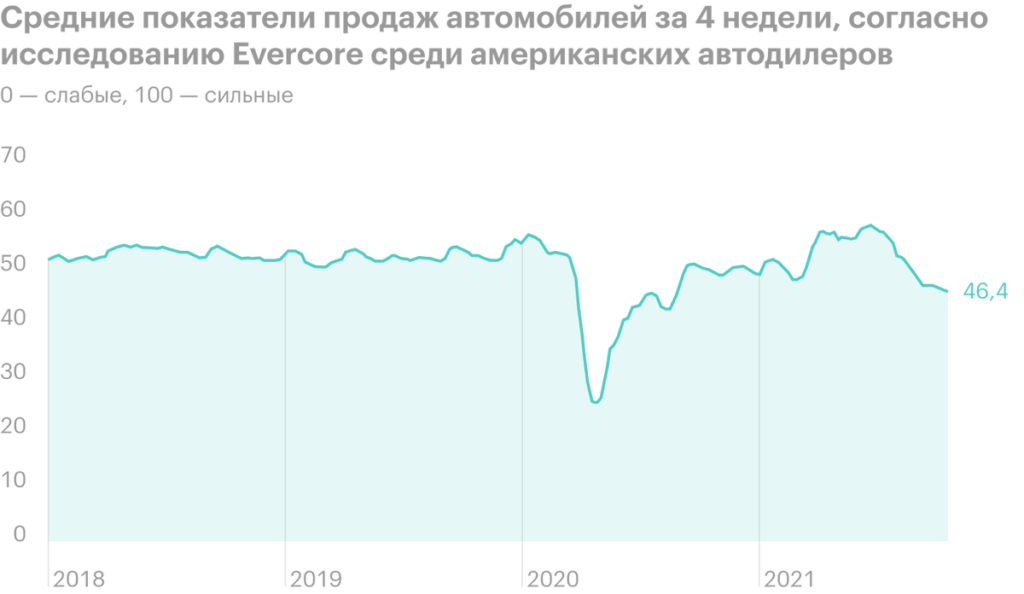

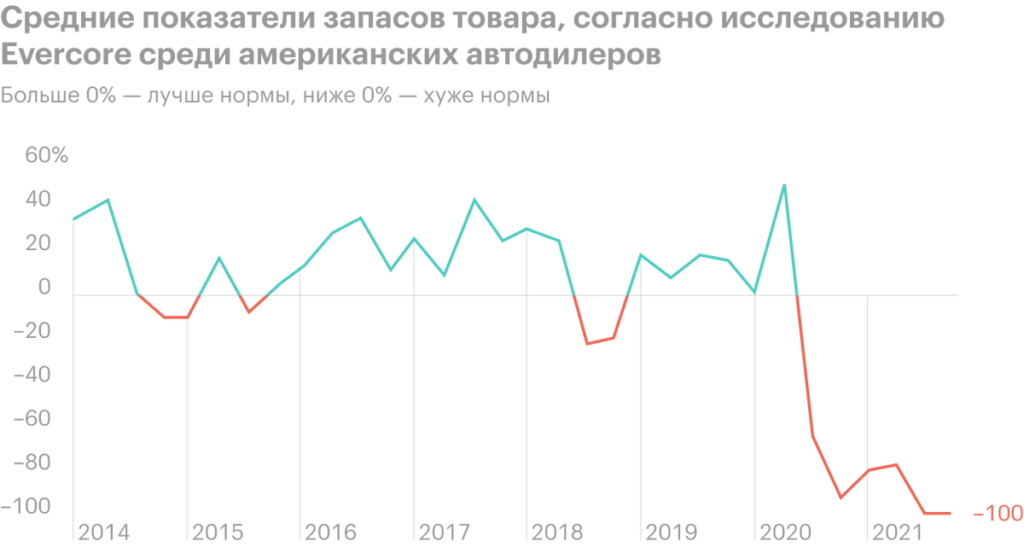

We didn't come there. Prices for new cars are rising in Russia, and on the old ones - and all because, that there are big problems in the world with car production. And there's no reason to count, that this will change soon.

US car shortage, yes in the world, will spur the rise in prices for cars in the Russian Federation: importing cars from the US to Russia has become more expensive, because in the USA demand has grown in the secondary market.

The only bright spot here is, that most of the Delimobil fleet is VW Polo and Hyundai Solaris, which are not found in the US. But even these machines will become more expensive inside the Russian Federation, both due to the increase in the cost of important components., and because of the growth in demand for these cars within the Russian Federation.

Therefore, the problem with the availability of cars in the world means problems with their availability within the Russian Federation.. For Delimobil, this will mean an increase in the cost of cars and components., But for a loss-making company, this is a disaster..

Accounting. The company has 22.058 billion rubles of liabilities, of which 11.694 billion need to be closed during the year. The company plans to raise about 240 million dollars during the IPO - approximately 16.8 billion rubles. It's not that much, And, essentially, most of this money will go to close the company's obligations - there will be little money left to expand the business. In addition, the company is loss-making., and her money will run out quickly. Shares of unprofitable companies are a priori volatile - and the threat of bankruptcy is always nearby.

Resume

Delimobil looks like a very speculative idea, invest in which you can only at your own peril and risk. The company's business looks too risky.