Now we have a very speculative thought: take shares in self-driving truck software maker TuSimple (Nasdaq: TSP), to earn income on the hype in this area.

Growth potential and duration : twenty seven percent for 15 Months; 131% for eight years.

Why stocks can go up: this sector seems promising to almost everyone.

How do we act: we take at the moment 30,67 $.

What the company makes money on

The company makes software for self-driving heavy trucks. TSP went public not so long ago, so the main source of information will be its registration prospectus.

TuSimple gives potential clients two formats of work:

- Carrier subscribes to TSP software and pays TSP to implement this software on carrier-owned vehicles - the price is determined by the number of miles, which the truck will have to pass.

- The cargo carrier orders the delivery of cargo on an automatic guided truck, owned by TuSimple.

The company's revenue is currently extremely low., since it is mainly engaged in testing its own technology on US highways, China and several other countries.

The company receives almost all of its revenue from the format of work with automatic guided trucks.. This is hard to count as real operational work.. In fact, the company is currently working in trial mode.,80 % of its employees is the R&D department.

The company currently has 5.7 thousand pre-orders, 4 thousands of them came from financial partners in companies like Navistar. A similar number of orders is in the region of $ 420 million in potential revenue per year for 5 years, but any of these pre-orders can be canceled.

Arguments in favor of the company

Fell down. TSP shares have dropped dramatically since June this year - by 56,95%. Now they are even cheaper., than the price, for which the shares were placed during the IPO, - then they were sold by 40 $. So I think, that we can take these stocks now in anticipation of a rebound, especially since there are many reasons for this.

Robots are everywhere. In the UiPath idea, we analyzed, why people will be replaced by machines everywhere, wherever possible. The same prerequisites apply to TSPs..

According to company data, the cost of drivers' labor is almost 43% operating expenses in cargo transportation and the final operating profit for many carriers is 8% from proceeds. The turnover among drivers is huge, and during periods of economic growth, it exceeds 100% - the cost of a simple driver replacement is in the range of 2.2-21 thousand dollars. At the same time, trucks account for 80% transporting goods to the United States - so companies from a wide variety of sectors will feel the reduction in driver costs. And I believe, that the demand for TSP services will grow in the near future due to economic reasons.

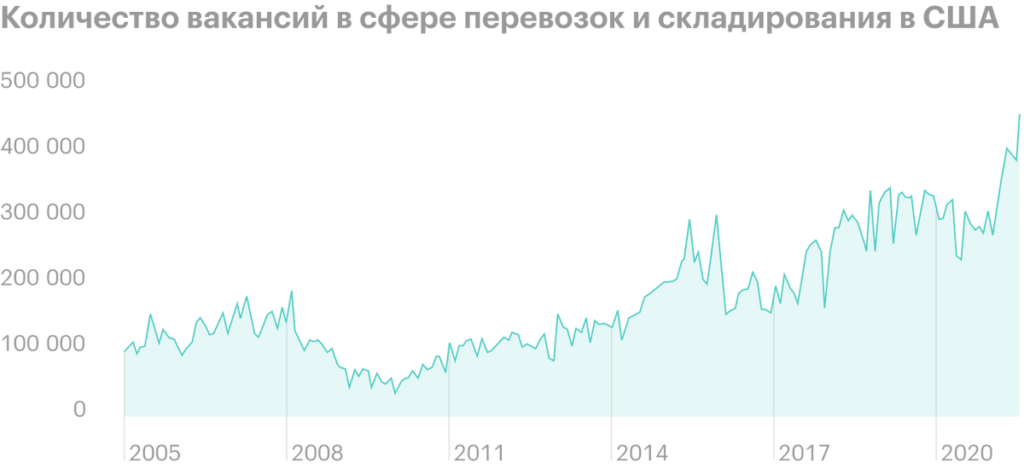

Now the American labor market is experiencing a huge need for workers in the field of logistics - in particular, in drivers. Actually, our recent ideas with Knight-Swift logistics companies, Schneider National, Skirt, J. B. Hunt Transport Services и C. H. Robinson is spinning just around that, that now companies are forced to spend a lot of money on logistics due to a lack of drivers. America is missing 60,000 drivers — and by the end of the decade will be missing 160,000. So the need to invest in transportation automation is already here and now.

In this regard, TSP can expect an increase in orders. Besides, I think, that stocks will also rise due to interest from retail investors. The company is now not very large capitalization - 6.41 billion dollars, - so, given the growing interest in technology, its shares can grow well only on the influx of those, who read online, that "self-driving trucks are the future".

What can get in the way

TuDimple. The company is active only in the states of the South and Southwest of the USA. Expansion of testing to other states will occur sometime in 2022-2024. When the company will be able to earn its full potential in America, not yet clear, since only 26 states allow commercial carriage of goods by self-driving trucks, though 44 states allow testing this technology. In other countries, legislation in the field of autonomous vehicles is at different levels of development.: somewhere it is more progressive, like in the Netherlands, somewhere not so progressive, like in mexico. TSP revenue growth will depend on the speed of implementation of this technology.

By the way,, in 2016 the company expected, that in 2020 its revenue in the US alone will be $284 million. But, as you can see, it's already 2021, and the company's annual revenue as a whole is less than $2 million.

Genesis problems. Chinese investors were at the origins of the founding of TSP, And, although the registered company is American, this may become a problem in the future. For example, if the American government is concerned with the question, how TSP works with data collected in the US. Or if the Chinese government decides to make it harder for a company to operate in China just to spite the Americans, on the pretext that, that TSP software may send information about Chinese users to US regulators. All in all, there is a whole fan of possibilities - not at all good, worth noticing.

You should also consider that, what the company has 2 class of shares: BUT, where one vote per share, and B - 10 votes per share. All in all, the founders of the company have 62,5% of votes. This may become a problem in the future, if they make decisions not in the interests of minority shareholders.

Way of the Samurai. The company may not live to see the active introduction of self-driving trucks on the roads of the United States and the rest of the world.. TuSimple is a startup in the full sense of the word. Everything can go wrong here. For example, trucks of the company or its competitors can get into a serious accident - and then the shares of all, who works on truck automation, can seriously fall, as airlines promotions after 11 September. Or worse: lawmakers will slow down the process of creating a legislative framework for the widespread use of auto-driving trucks.

Grizzly sight. Research company Grizzly Research, engaged in the study of the negative about various issuers in order to short the shares of these same issuers, recently released a critique of TSP. There, the company is even compared with the infamous Nikola, including on the basis of, what Nikola and TSP have - oh horror! - there is a common investor. But, in my opinion, most important criticism of TSP technology, as very simple and copyable competitors. If it is true, then, certainly, TSP's chances of success are rapidly declining. But you shouldn't take Grizzly's word for it either.: it is in their interest to short stocks of companies, about which they write negative research.

Here you need an analysis of a professional - and not a fact, that such analysis will ever appear, because here you need full access of the reviewer to the technology itself. Extremely doubtful, that TSP will give someone such access: after that, its technology can really be copied. But even without industrial espionage, there is a threat of growth of competitors due to the development of their software.

From a training point of view, TSP software is not the most complex algorithm in the world.: 80% goods in America are carried by 10% its road routes, teaching the program to drive along the desired trajectory will not be so difficult. Other companies understand this too., working in the field of truck automation: Aurora Innovation, More at Embark. So they may well develop similar software technology., and then TSP will not be easy to compete with them.

What's the bottom line?

We take shares now by 30,67 $, and then there are several options:

- wait for the price in 39 $ - just below the IPO price. Think, that we will reach this level in the next 15 Months;

- wait, When will stocks return to all-time highs?, achieved in June this year. Think, that here the waiting period can reach 8 years.

But this idea is extremely risky., so you should invest in it only that money, who are not at all sorry.