Now we have a uniformly speculative and even slightly conservative thought: take stock of home products manufacturer Spectrum Brands (NYSE: SPB), to earn income by increasing the purchasing power of its products.

Growth potential and duration : eleven percent for 12 Months; twenty percent for 21 month; nine percent per annum for fifteen years.

Why stocks can go up: business is reliable and the situation is good.

How do we act: take shares at the moment 79,22 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

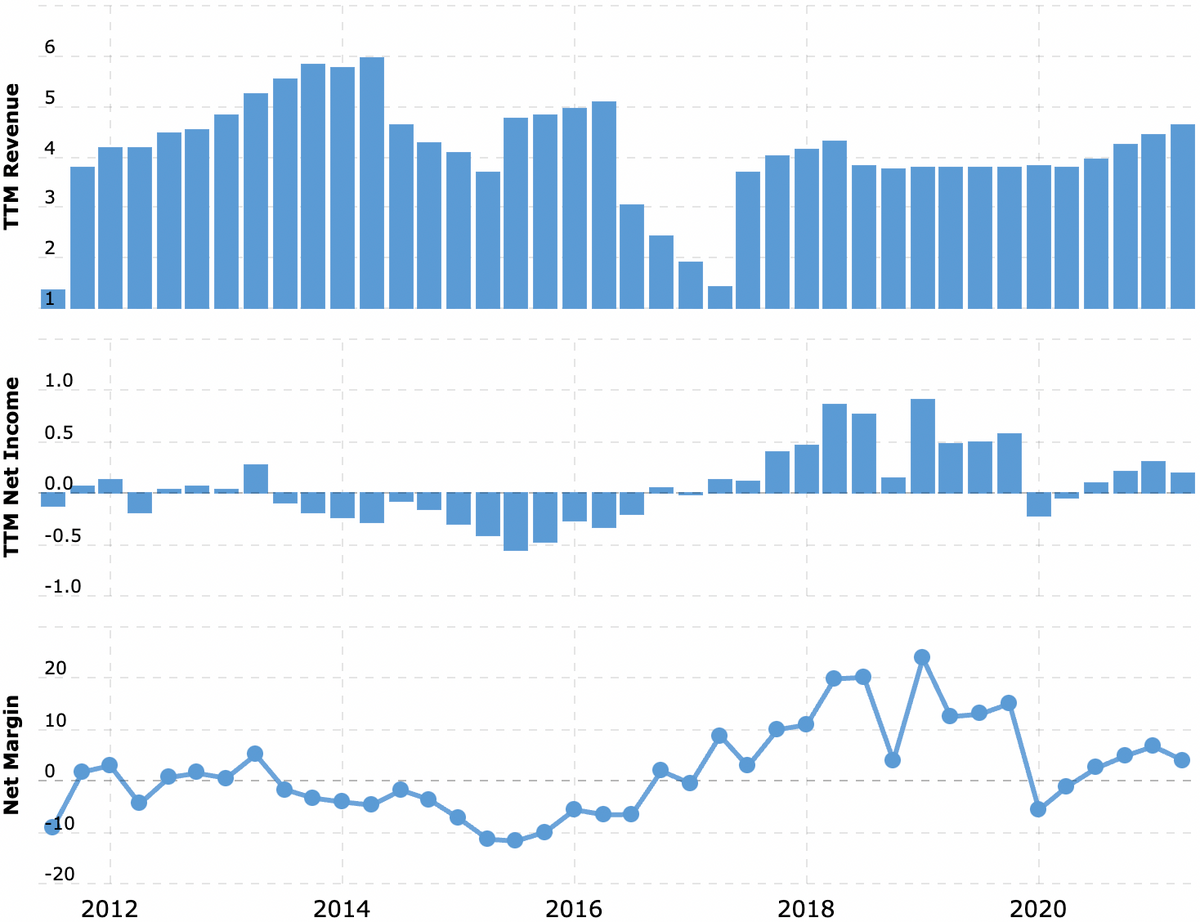

Spectrum is engaged in the creation of household appliances and other products for the home under its own brands. In accordance with the annual report, the company's revenue looks like a follow-up.

Home improvement products - thirty four percent. The sector's operating margin is 16,7 % from its proceeds. Sector revenue distribution:

- Security - sixty-seven percent. Like electronic, as well as ordinary castles, door handles and accessories.

- Plumbing - twenty one percent. Cranes and accessories.

- Accessories for closing devices and doors - twelve percent. In practice, this is a continuation of the "Security" sub-segment., since we are talking about gate leaves and other things.

eighty-seven percent of the sector's revenue comes from North America and only three percent from Latin America.

Household and personal care products — 28%. Segment operating margin — 3,9% from its proceeds. Segment revenue distribution:

- Home Appliances - 58%. Small kitchen appliances: toasters, coffee machines, blenders, juicers, irons, teapots.

- Personal care products - 42%. Hair dryers, hair straighteners and hair removal products.

Geographically, the segment's revenue is distributed as follows: 42% - North America, 41% - Europe, Middle East and Africa, 11% — Latin America and 6% - Asian-Pacific area. An important point: almost all equipment in this segment is not produced by the company itself, and third parties in Asia.

Goods for pets — 24%. Segment operating margin — 4,9% from its proceeds. Segment revenue distribution:

- Products for pets - 69%. Treats, toys, products for washing and caring for animals, feed.

- Aquarium - 31%. Aquariums for private users, as well as for the corporate sector, Pump, filtration systems, feed.

Geographically, the segment's revenue is distributed as follows: 71% - North America, 24% - Europe, Middle East and Africa, 4% — Asia-Pacific and 1% - Latin America. A significant part of the goods, sold in this segment, produced by third party companies.

Home & Gardening Products — 14%. Segment operating margin — 16,5% from its proceeds. Segment revenue distribution:

- CONTROL - 41%. Household chemicals for weed control, repel insects and animals.

- Household insecticides - 34%. Poison for insects of all kinds: from spiders and scorpions to ants and wasps.

- Repellents - 25%. Sprays and other insect repellents.

99% segment revenue is generated in North America, and 1% - in Latin America.

By country and region, the company's revenue as a whole is divided as follows::

- USA - 71,19%.

- Other North American countries — 3,81%.

- Europe, Middle East and Africa - 17%.

- Latin America — 5%.

- Asian-Pacific area - 3%.

Arguments in favor of the company

Little growth. According to the latest US Retail Report, sales of electronics and home appliances grew by 1,26%. Comparing July 2020 with July 2021, then the growth was 23,4%. Such progress, certainly, attributed to the coronavirus crisis 2020. But there is growth.: even if we compare July 2021 with "pre-war" July 2019, he makes up 4,68%. Therefore, the situation for the company is moderately positive..

Sum of typology. Essentially, the company's business offers a bit of everything in quite different sectors. For the "animal" part of Spectrum Brands' business, the situation is always good, with or without a pandemic, - we talked about this in the idea for PetMed. The business of a company with locks and gates will grow due to the worsening crime situation in the United States - we have already analyzed this story in the Allegion idea. Well, the "anti-insect" part of the Spectrum business is favored by the exodus of Americans from big cities to private homes in the suburbs., we already had a bunch of ideas and reviews about this - for example, about Lennar.

Overall the Spectrum looks like a good one., stable business - this can already attract investors into the company's shares, seeking stability in these unstable times. The company does not have a very large P / E — 18,46, - and it costs very little in absolute terms: capitalization - 3.37 billion dollars. So the influx of investors into these stocks can become very noticeable., and this will help the good cause of pumping quotes.

Dividends. The company pays 1,68 $ dividends per share per year - almost 2,12% per annum. It's not crazy money, but still Spectrum's return is well above the average for S&P 500 c 1,3% per annum. I think, that connoisseurs of stability will also look for more or less tolerable passive returns in stocks, what Spectrum can offer them.

What can get in the way

Concentration. According to the report, a number of customers account for a very significant portion of the company's sales:

- in the segment "Products for home improvement" 42% revenue comes from Home Depot and Lowe's;

- in the segment "Products for housework and personal care" 34% sales give Walmart and Amazon;

- in the segment "Products for animals" 46% revenue comes from Walmart, Amazon и PetSmart;

- in the segment "Products for the home and gardening" 64% proceeds give Walmart, Home Depot и Lowe’s.

A change in relationship with any of these retailers could negatively impact Spectrum's reporting.

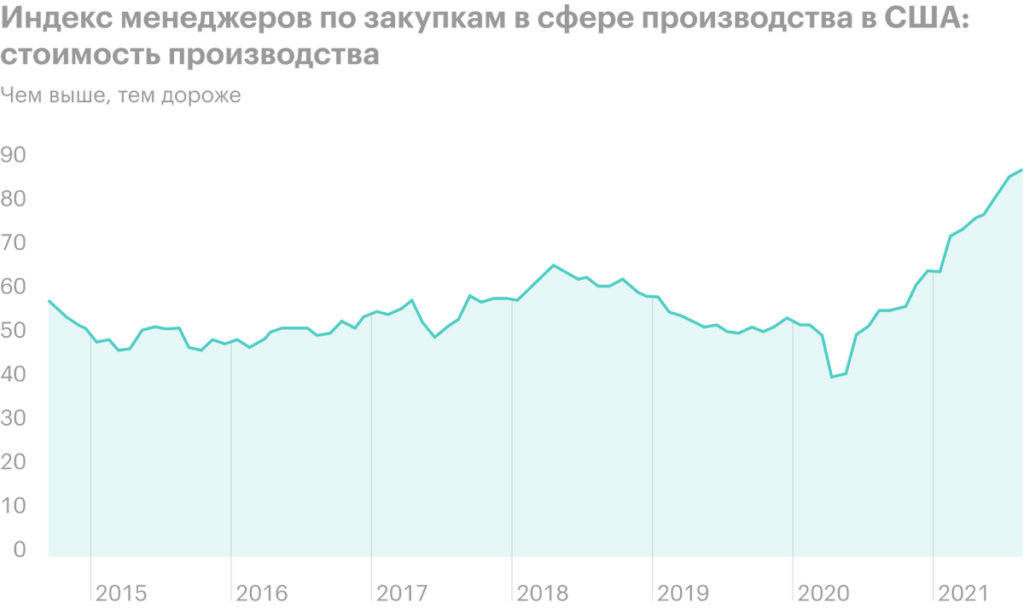

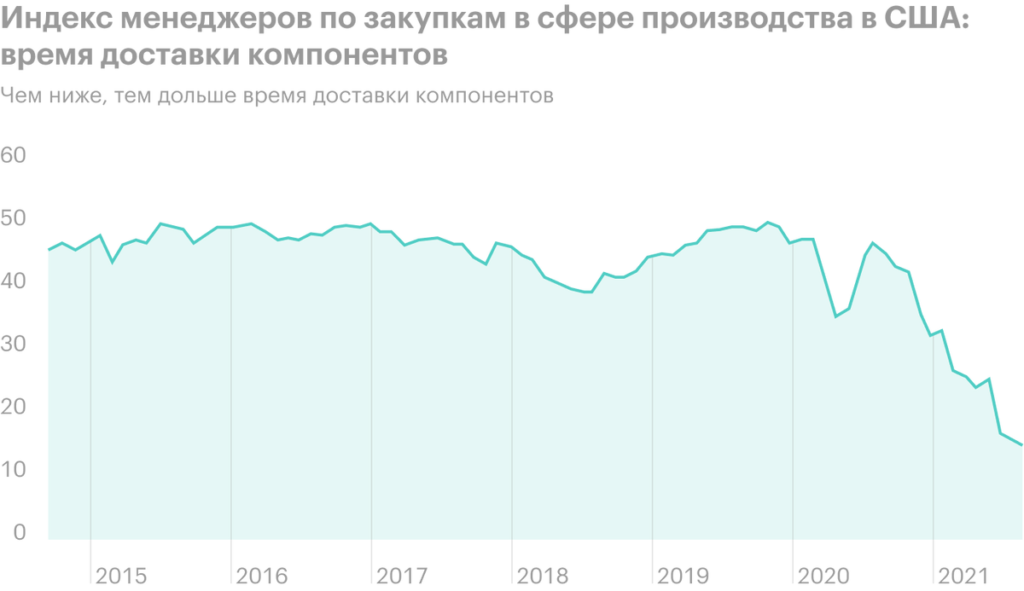

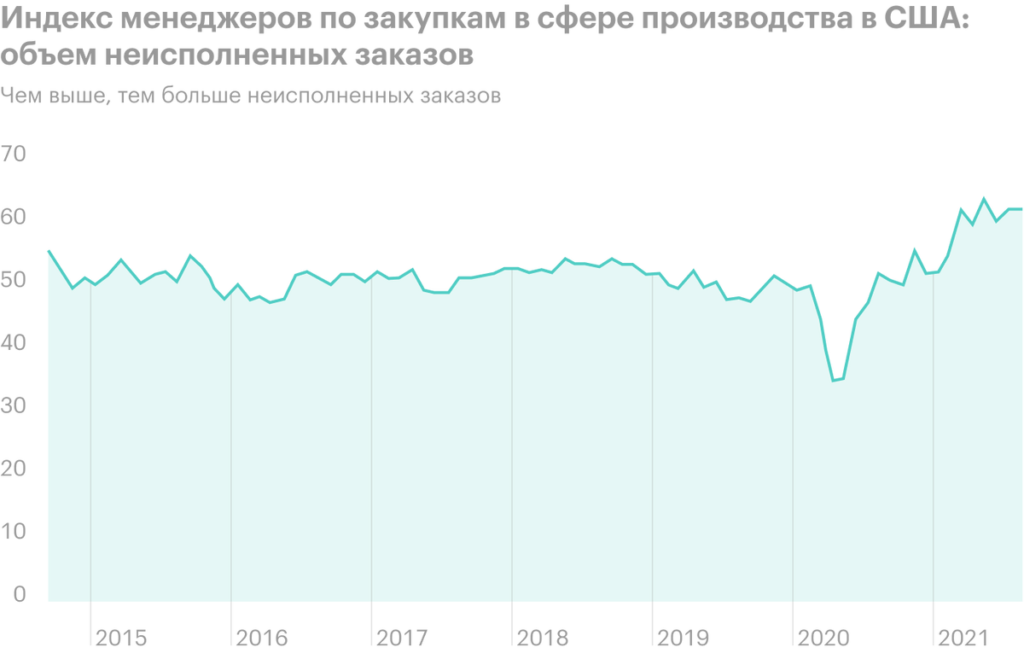

Mmm-hmm, must be the season of the witch. In the US, factories are busy and suffer from late delivery of components and their high cost - this problem has certainly not passed Spectrum. See also, that a large proportion of Spectrum products are made in Asia, which will also add problems with logistics. All in all, you have to be mentally prepared, that the company's reporting may be affected.

Accounting. The company spends $72.24 million a year on dividends, roughly 38% from its profits over the past 12 Months. She also has a large amount of debt.: 3,916 billion dollars, of which 932.9 million must be repaid during the year. Not much money at the disposal of the company: 130,2 million on accounts and 554.5 million debts of counterparties, so, maybe, the company will cut payments.

But maybe, and won't cut, and instead will borrow money, using low rates. But still, this amount of debt is not very good.. Investors can mark this moment too., which will negatively affect the attractiveness of these shares in their eyes. Moreover, in 2009 the company went bankrupt - this will be taken into account as investors, as well as lenders.

What's the bottom line?

Shares can be taken now by 79,22 $. And then there are two options:

- wait 88 $. Think, that this level of action is reached within a year: How much did they cost back in May? 2021, and the circumstances for the company are mostly positive;

- wait, when will the stock be worth again 94,94 $, like this May. Here, I think, will have to wait longer - 21 month;

- keep shares next 15 years.

But you should still keep an eye on the news section on the Spectrum Brands website.: suddenly the dividends were cut, and you still don't know.