Now we have a speculative thought: take stock of speaker manufacturer Sonos (Nasdaq: I'M), to earn income by increasing the purchasing power of its products.

Growth potential and duration : sixteen percent for 14 Months.

Why stocks can go up: there is a demand for Sonos products.

How do we act: we take shares on 37,86 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

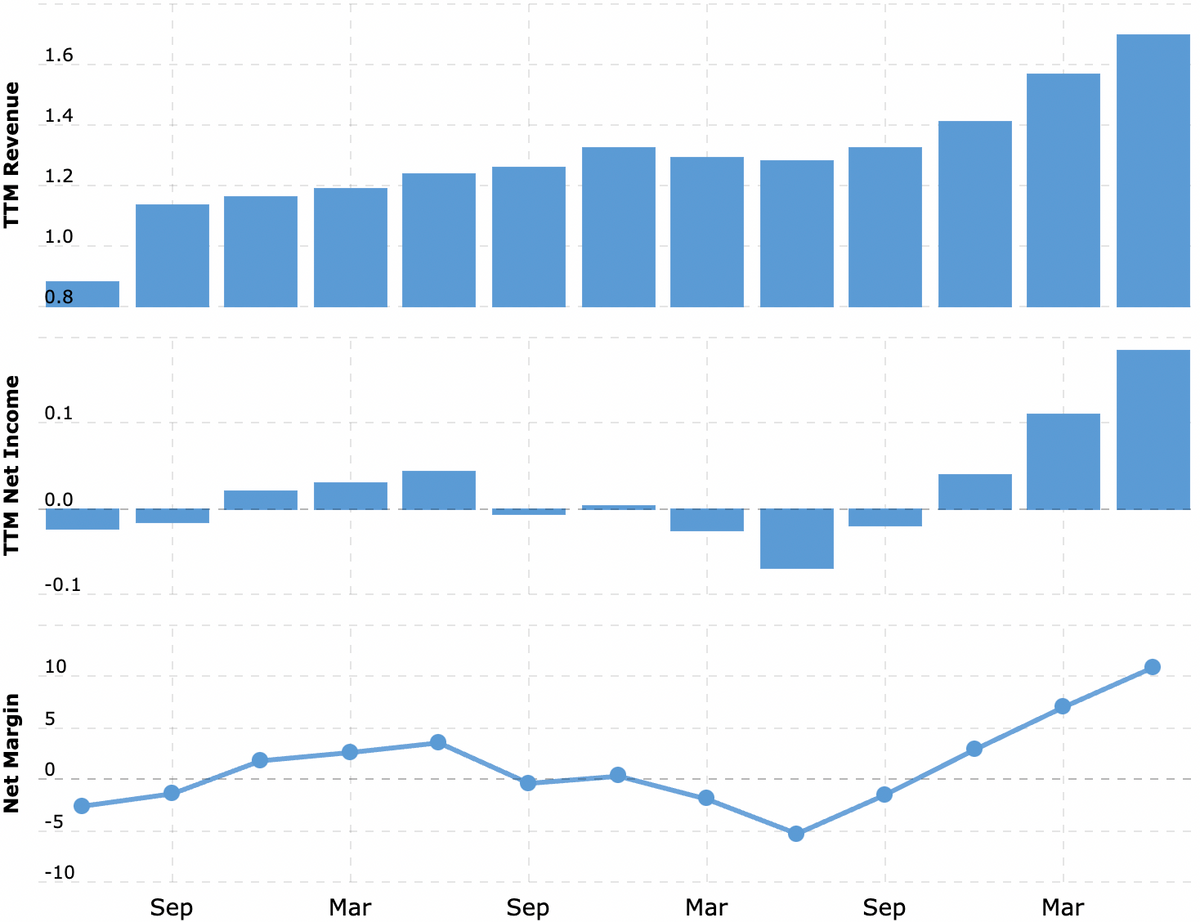

The company manufactures and sells audio equipment. In accordance with the annual report, proceeds are divided in the following way:

- Speakers - seventy-eight percent.

- Audio Products - 16,49 %. Amplifiers, wifi extenders, etc..

- Partner products and other revenue — 5,51 %. The company sells IKEA furniture, cables, charging, racks and more.

Revenue by state and region:

- USA - 52,58 %.

- Germany - 8,22 %.

- England — 8,47 %.

- Other states and regions 30,73 %.

Arguments in favor of the company

Unexpected, but the fact. A lot of good things can be said about the company's products., as well as about the mood of American consumers, but a good driver of the company's sales growth seems to be the exodus of Americans to the suburbs. In your home, a good home theater is more appropriate, than in an apartment.: lived there, and there, understand, that the apartment will always have problems with neighbors complaining about the sound volume.

But even without the relocation of Americans, consumers in the US and around the world are now actively spending on the purchase of new technology., compensating for the lack of large purchases in the corona crisis 2020. So that, maybe, the company will continue to outperform analysts' forecasts and break sales records.

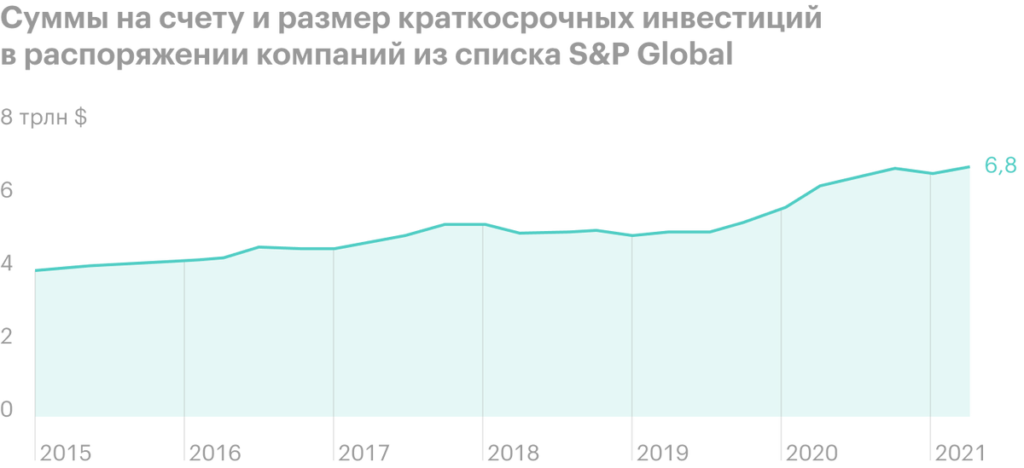

Probability of purchase. The company is inexpensive: capitalization - 4.76 billion dollars, P / E - in the area 27. It may well be bought by some large conglomerate, household appliance manufacturer, - for example, Sony. Companies around the world have accumulated huge sums, and can be expected, that soon they will start spending them, including expansion of existing business. Moreover, Sonos has some pretty cool patents., which may come in handy for the same Sony.

What can get in the way

Concentration. According to the company's annual report, 12% some unnamed client gives her proceeds. Changing the relationship with him can have a bad effect on reporting.

Consumer sentiment. In the US, many consumers consider, that now is not the best time for large purchases due to their high cost. Basically, this opinion is expressed by them in the context of discussing the rise in price of houses, machines and large household appliances. Sonos Products, in general,, not that expensive, but in the current situation they can also fall under the distribution.

Coronavirus - fight! И girl. Corona crisis restrictions have an extremely negative impact on the company's business, because it greatly increases its costs. So the repetition of a full-scale quarantine in the spring of 2020 will definitely hit the reporting.

But even without quarantine, the company will have to put up with rising cost of components and logistics., and also with supply disruptions.

What's the bottom line?

Shares can be taken now by 37,86 $. Think, that during the next 14 months, they will exceed historical highs and reach prices in 46 $.