Now we have a uniformly speculative thought: take stock of Shutterstock content storage (NYSE: SSTK), to generate Shutterstock income by growing this business.

Growth potential and duration : thirteen percent for 14 Months,9 % per annum for fifteen years. All excluding dividends.

Why stocks can go up: business companies stable and attractive.

How do we act: we take at the moment 91,06 $.

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

Analysis, for example this and this, testify to, that the accuracy of the prophecies of motivated prices is not great. And it's acceptable: there are always a lot of surprises on the stock exchange and clear forecasts are rarely realized. If the state of affairs were reversed, then funds based on computer algorithms would perform better than humans, but no matter how annoying it may sound, they work worse.

Because we do not try to build difficult models. The performance forecast in the article is the author's expectations. We indicate this forecast for guidance.: as with investing in general, readers decide for themselves, it is worth trusting the creator and focusing on the forecast or not.

The overview has a screenshot of a table from the report. To make it easier to use, we transferred it to a google spreadsheet and translated it into Russian.

Download the table from the report

What the company makes money on

This, in fact, photobank: users acquire access to a certain type of information. The company provides its customers with access to the following types of information:

- Imagery. Photos and illustrations.

- Video.

- Music.

- 3D-models. Models for use in games, architecture and interactive learning.

The company's customers are divided into three types:

- Corporate masters and organizations. How commercial, and non-profit organizations.

- Media- and broadcasters. Mass media, filmmakers.

- Small and medium-sized businesses, also personal customers.

The company's revenue is divided into two sectors.

Online-commerce. Revenue from resources, owned by the organization: shutterstock.com, bigstock.com and premiumbeat.com. This sector provides 61,86 % proceeds.

Companies. Special solutions for large corporate customers, which include access to content, which is not available on the company's sites. This sector provides 38,14 % proceeds.

Geographically, the company's revenue is distributed as follows:

- North America - 35,48 %. The USA gives thirty-three percent of the revenue here;

- Europe - thirty-three percent. England brings eight percent;

- other states and regions 31,52 %.

Arguments in favor of the company

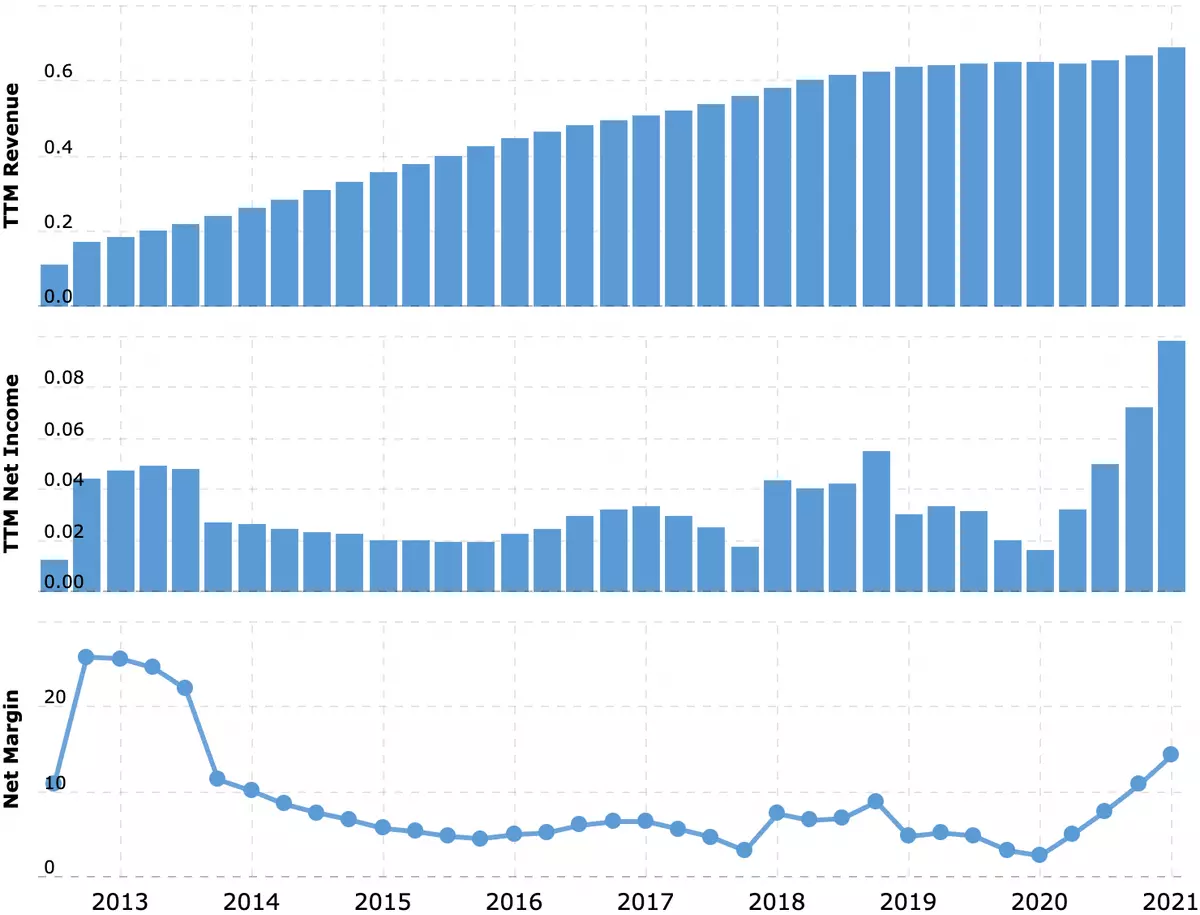

Just good fellows. This is a very strong and marginal business., which compares favorably with the mass of unprofitable startups by having a working business model. Given the modest capitalization in 3,33 billion dollars, acceptable price - P / E 34,55 — i, finally, a fairly favorable environment for digital content creators as with a pandemic, so without it, I think, that this business and its quotes still have good room for growth.

Diversification of clients. According to the annual report, 25 the largest customers of the company give less 7% her proceeds. It is very good: means, no major client can seriously spoil the company's reporting in the event of a sudden review of relations.

Why not buy. Shutterstock's many strengths, combined with its low price tag, might well entice someone bigger to buy the company.. Certainly, the buyer can be anyone, but it seems very likely to me, that J2 Global would like to acquire the company, in whose interests it would be to increase the output of its digital media segment.

But I repeat, Anyone can be a buyer Google, even Microsoft.

Earnings per share of the company in dollars

| Current | Forecast | |

|---|---|---|

| 2 neighborhood 2020 | 0,62 | 0,26 |

| 3 neighborhood 2020 | 0,80 | 0,29 |

| 4 neighborhood 2020 | 0,93 | 0,58 |

| 1 neighborhood 2021 | 0,98 | 0,69 |

| 2 neighborhood 2021 | — | 0,68 |

What can get in the way

Not a startup. The main indicators of the company are growing, but rather slowly. Here you definitely should not count on stunning revenue growth rates..

Do not protect against inflation. The company pays 0,84 $ dividend per share per year, which gives 0,92% per annum. The company spends 30,4 million dollars a year - a little less than a third of its profits over the past 12 Months. Basically, profitability is not so great, to cause stocks to drop if payouts are canceled or cut. Reasons to consider, that payments will soon be cut, No: the company's business is quite stable, and bookkeeping is good. However, the possibility should be kept in mind..

What's the bottom line?

Shares are available now 91,06 $. Given all the positives - mainly the low share price - I think, that we may well wait for the price 103 $ per share for the following 14 Months.

You can also hold shares of the following 15 years: as i said above, Shutterstock's business is very stable and we can expect good growth for a long time.. In addition, in the long run, the probability of buying a company increases..