Today we have an extremely speculative idea.: take shares of the provider of software solutions for online commerce PROS Holdings (NYSE: PRO), to capitalize on the speculative rebound of his shares after the fall.

Growth potential and validity: 17% behind 12 Months; 50% behind 3 of the year.

Why stocks can go up: promising sector.

How do we act: we take shares now by 34 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

PROS makes cloud-based e-commerce management software: to manage pricing, customer service on site, customizing the sales process, interface optimization and more. In a significant area, the company's software is based on machine learning technology.

The company's annual report shows the distribution of revenue by the following segments:

- Subscription - 67%. This is access to the company's software by subscription.. Segment gross margin — 69,69% from its proceeds.

- Technical support and maintenance - 18%. Segment gross margin — 77,9% from its proceeds.

- Services - 15%. This is the company's revenue from consulting and training clients., as well as optimization of PROS software for client needs. The segment was initially unprofitable: expenses here for 15% more revenue.

The company's clients come from a variety of industries: industry and automotive, B2B services, chemical industry and energy, food and supplies, healthcare, technology and tourism. But what matters to our history is, what unnamed, but a very noticeable percentage of the company's revenue comes from airlines.

Revenue by country and region:

- USA - 32%.

- Other countries in the Americas — 10%.

- Germany - 9%.

- Other European countries - 21%.

- Asian-Pacific area - 19%.

- Middle East — 9%.

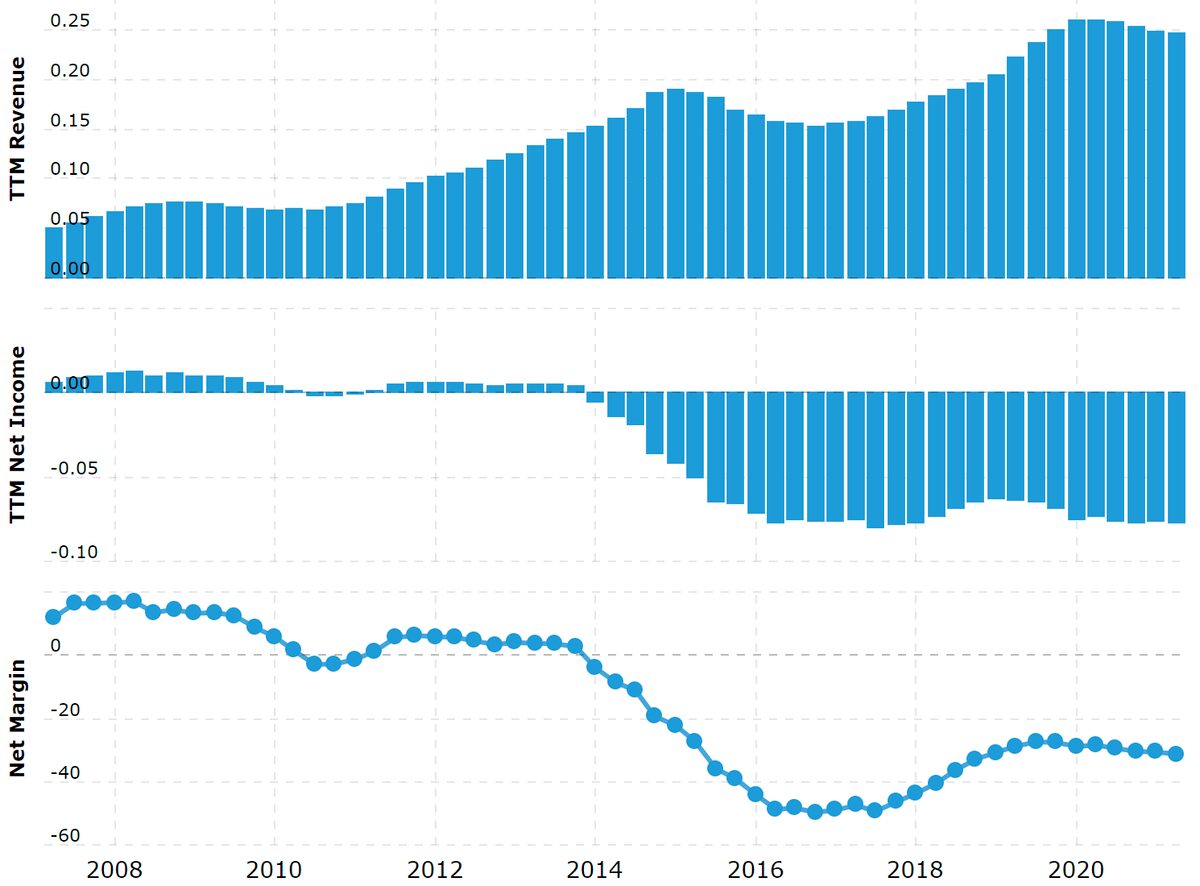

The company is unprofitable.

Arguments in favor of the company

We select. Since June, the company's shares have fallen in price by a third., and from the peaks in 75,13 $ in 2019 the company fell by 54% - to 34 $. So stocks can be taken with the expectation of their rebound.

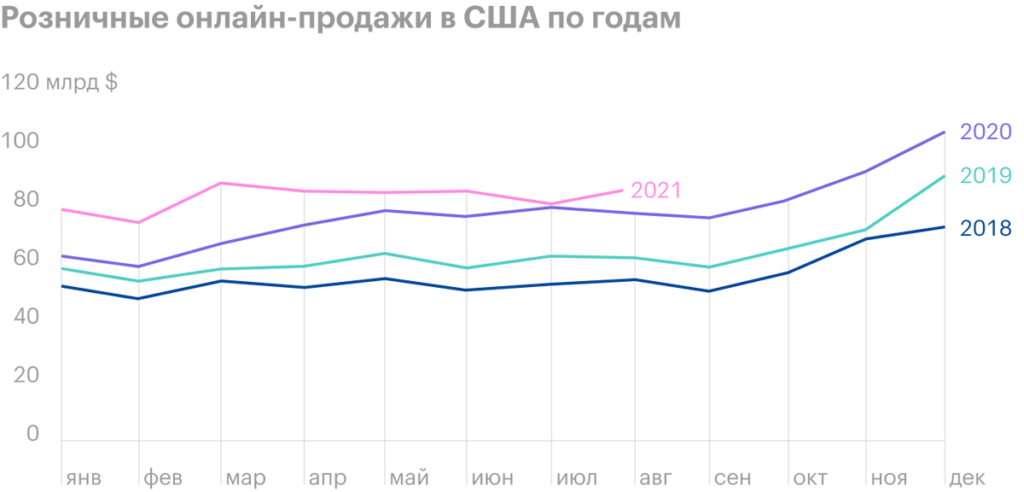

Many smart words. The company's report often uses words like "artificial intelligence", and she herself works in the ever-growing field of online commerce. I think, that this will surely drive a crowd of retail investors into the company's shares. Capitalization of PROS is only 1.51 billion dollars, so the pumping effect will be strong.

Can buy. Taking into account all the above points, the company may well be bought by some tech consulting giant like Accenture, who will be able to heavily advertise PROS solutions to clients from the crisis tourism industry.

The pandemic has given some business owners a false sense of, that digitalization is the solution to all their problems. In theory, Accenture can push the bright idea of spending more money on PROS solutions to customers in the travel sector in order to increase their competitiveness.. Even if tourism continues to choke, and these decisions will not make sense.

The target market for PROS is approximately $30 billion.. With skillful management from PROS, it can be useful, and given the unprofitability of PROS and the recent fall in the price of its shares, the company can be bought for a small premium. I wouldn't be too surprised, learning about it, that the company will be bought by some Airbnb or Booking, whom the crisis also battered and, probably, forced to look for new business opportunities. Maybe, the buyer of PROS will be Amazon.

It is unlikely that PROS will be able to independently realize its own potential: it is seen, that the coronavirus crisis in air travel slowed down the company's growth. So she'll be better off with a new owner.

What can get in the way

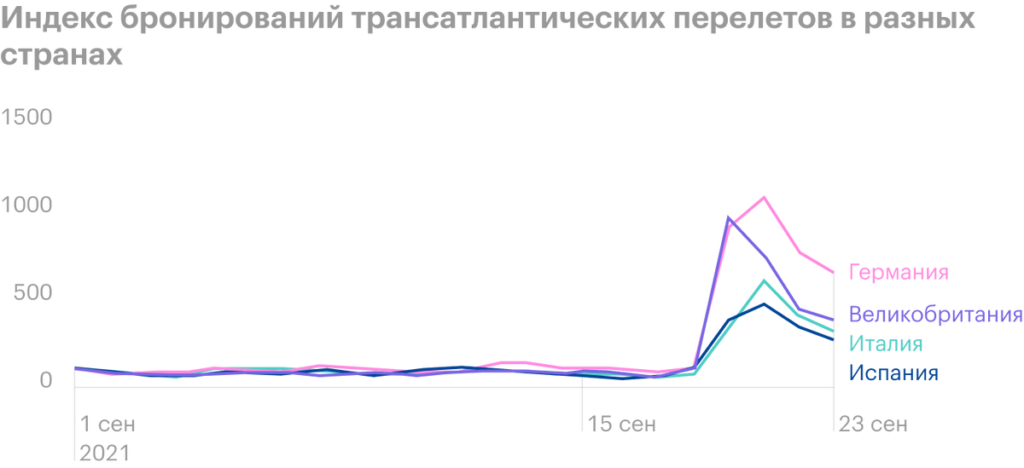

Air prison. It is unlikely that the tourism sector will be able to recover to the level of January in the near future 2020. Probably, the pandemic will drag on for a very long time - until 10 years. Maybe, even always, and every year there will be a new virus with 70 strains, and everyone will call 35 waves of epidemics. Maybe, I blow on the water and soon everything will be the same. But it's better to prepare for the worst case scenario.. Although I will note, that there are signs of improvement: increasing number of bookings for transatlantic and domestic flights.

Cool investment. Being a loss-making company on the eve of rate hikes and loan price hikes is not a good thing and guarantees volatility of quotes. And the threat of bankruptcy is always nearby.

Oxymoron. The company has almost all the attributes of a growing startup, except for the most important - revenue growth. The company's revenue slips and falls, what can be seen from the latest report. So the smartest of retail investors might pay attention to this - and then our hopes for the growth of shares from the influx of investor masses will not come true..

What's the bottom line?

Shares can be taken now by 34 $. And then we have two ways:

- keep up 40 $. Think, that this is a very modest goal and we will be able to achieve it in the next 12 Months;

- keep up 50 $, who asked for shares back in June.

But in any case, this idea is very volatile, so don't invest in these stocks., if you are not ready to tolerate volatility.