Now we have a speculative thought: take shares of the gold mining company Newmont (NYSE: NO), to get income on the likely increase in gold prices.

Growth potential and duration : fifteen percent for 13 Months; ten percent a year for ten years. All excluding dividends.

Why stocks can go up: stocks fell off not so long ago, but gold can rise.

How do we act: take shares at the moment 58,88 $.

The idea was invented by our reader Yana Ivanova in the comments to the analysis of Vornado Realty. Suggest your thoughts in comments.

What the company makes money on

Newmont mines alloys, how generous, and not extremely. In accordance with the annual report of the company, the company's revenue is divided as follows:

- Gold - ninety percent. Gross margin from sector revenue — 57,42 %.

- Copper - 1,34 %. Gross margin of sector revenue — thirty-one percent.

- Silver - 4,43 %. Gross margin from sector revenue — 61,59 %.

- Lead - 1,16 %. Gross margin from sector revenue — 42,54 %.

- Zinc — 3,07%. Gross margin from sector revenue — 36,5 %.

According to the presentation of the company,35 % The company's gold reserves are located in the US and Mexico,33 % - in the states of South America,20 % - in Australia and twelve percent - in Africa. However, the company's annual report is extremely detailed, up to data for each field, - I advise you to look through it, to whom Newmont is extremely fascinating.

By region, the company's revenue is divided as follows:

- England — 73,83 %.

- Korea - 11,45 %.

- Germany - 2,4 %.

- Mexico - 2,4 %.

- Japan - 2,12%.

- Switzerland — 2,11%.

- Philippines - 2,1%.

- USA - 0,84%.

- Other regions — 2,75%.

However, the regional distribution of the company's sales is a convention, All proceeds are in dollars, and the largest buyer is the American investment bank J. P. Morgan, which brings 24% proceeds.

Arguments in favor of the company

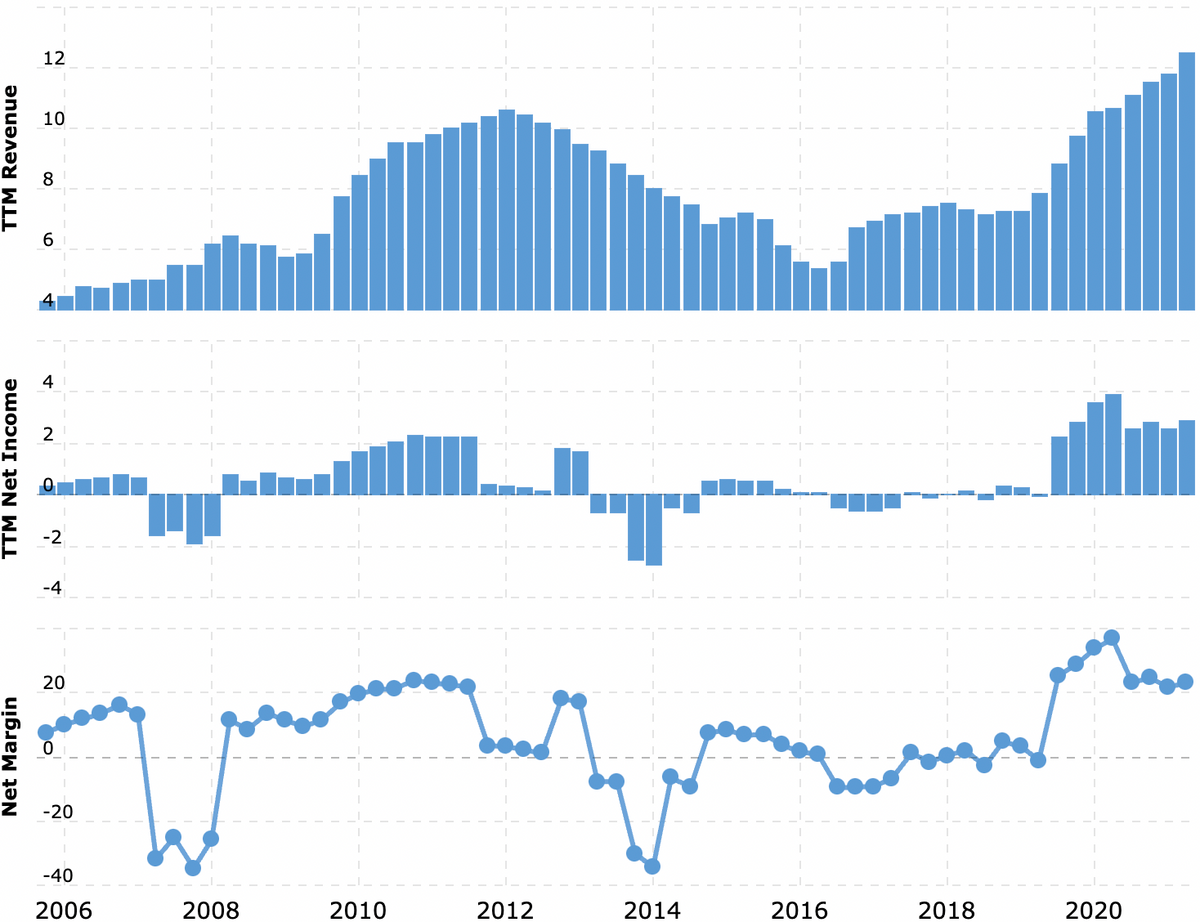

Stocks fell. Stocks have fallen since June 20% due to falling gold prices, which gives the company the main money. It seems to me, that the fall came out disproportionately strong: gold prices fell by 6% and they have potential for speculative growth, and Newmont itself is an efficient and successful business with a small P / E — 16,49. So there is potential for a rebound..

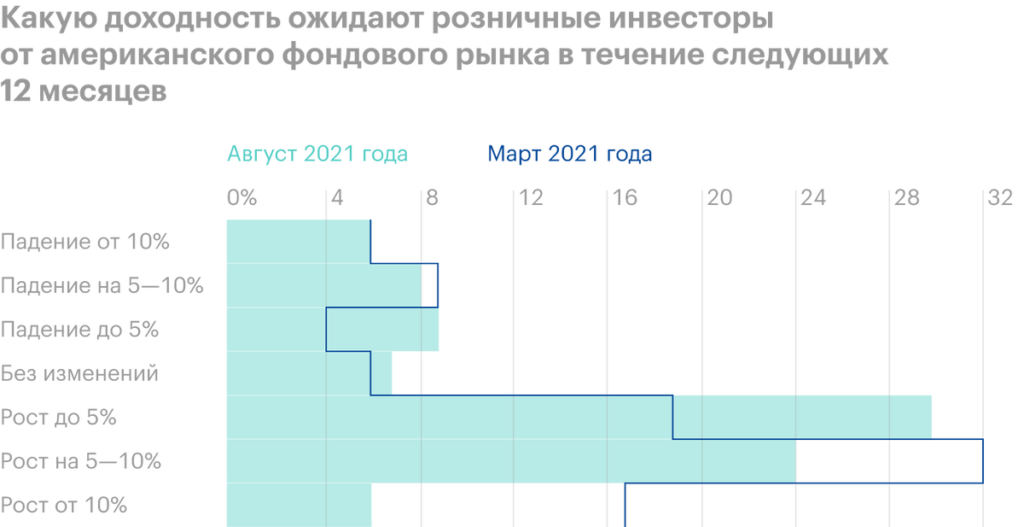

Possible speculative rise in gold prices. At all, Right away stock market looks more and more like a bubble in the eyes of many investors. It's not that scary in and of itself., but in combination with a real increase in the incidence of new strains of coronavirus, this can lead to a serious panic in the market and an increase in gold prices.

In fact, gold is considered a defensive asset in vain.: it used to be like this, that its prices fell along with the market. But anyway, as this misconception is very common, there is a possibility of speculative growth in gold prices - and such growth will positively affect the quotes of gold mining companies, because for most investors, “gold” and “gold mining enterprises” are synonymous. But an enterprise is an enterprise, it may go bankrupt or stop working, and the gold bar will not disappear anywhere, only if it doesn't melt. But, as this misconception is common too, it can also positively affect the growth of Newmont quotes.

Wrecked. The company pays 2,2 $ dividend per share per year, what gives 3,74% per annum. That's a pretty big deal these days., and I think, that it will attract many dividend investors into the company's shares.

What can get in the way

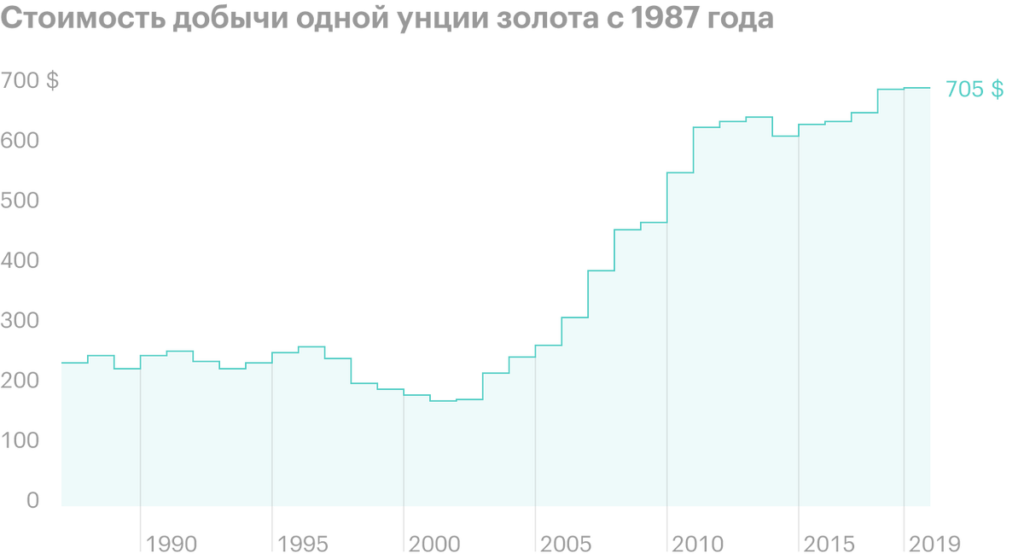

Expensive to dig. The cost of gold mining is steadily rising - which is bad for the company's margins.

The premises are still speculative. We published the first idea for Newmont in 2019. The difference between this idea and the old one is, that gold doesn't look undervalued this time - it even looks overpriced now. In today's idea, we are counting on a speculative influx of investors due to the belief in gold as a protective asset.. If our calculation fails, then gold prices will fall, and in this case, Newmont's quotes and earnings will be dragged along.

Wrecked. The company spends $1.766 billion a year on payouts, roughly 61,53% from her profits for the past 12 Months. At the same time, the company has debts of 16.583 billion, of which 2.787 billion must be repaid within a year. Basically, Newmont should have enough money for everything: she has $4.583 billion in her accounts alone. But still, the risks of cutting payments seem to me quite serious.. And if the payments are cut, then the stock will fall.

What's the bottom line?

You can take shares now by 58,88 $, then there are two options:

- wait for the stock to rise to 68 $, which is noticeably less 73,95 $, who asked for them back in June. In my opinion, this price will be fair, considering Newmont dividend yield. Think, that the indicated price we can wait for the next 13 Months;

- hold these shares for many years, to get rich.

But don't forget to check out the company's website., to the news section: suddenly they decide to cut dividends.