Today we have a speculative idea: take shares of the high-tech manufacturing enterprise Lumentum Holdings (NASDAQ: LITE), in order to capitalize on the growth of orders.

Growth potential and validity: 12% behind 14 Months; 10% per year for 10 years.

Why stocks can go up: there is a demand for the company's products.

How do we act: we take shares now by 92,52 $.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

The name Lumentum already gives the specifics of the company: from the Latin lumen - "light". Lumentum operates in the field of optical communications and photonics - this is, actually, Lasers. If you think, that you have heard it somewhere, it's for a reason. Competitors Lumentum - II-VI and MKS. The company's business is divided into two main segments, according to its annual report.

Optical communications — 90,3% proceeds. These are components and subsystems for equipment in the field of telecommunications, data transmission - bring 60,9% of the company's revenue - both in the consumer sector and industry - this sub-segment generates 29,4% company revenue. In the latter case, these are laser technologies for creating 3D sensors.. Segment gross margin — 46,5% from its proceeds.

Lasers — 9,7% proceeds. These are laser technologies for complex production. Segment gross margin — 46,6% from its proceeds.

Target customers of Lumentum are such companies, like Alphabet, Apple, Ciena, Cisco, Huawei Technologies, Infinera, Innolight, Nokia Networks, O-Net and ZTE.

The company makes most of its revenue outside the United States..

Revenue by country and region

| Hong Kong | 31,8% |

| South Korea | 15,5% |

| USA | 8,9% |

| Japan | 8,2% |

| Europe, Middle East and Africa | 7,4% |

| Mexico | 7,3% |

| Countries in the Asia-Pacific region, except for the above | 20,6% |

| Countries in the Americas, except for the above | 0,3% |

Hong Kong

31,8%

South Korea

15,5%

USA

8,9%

Japan

8,2%

Europe, Middle East and Africa

7,4%

Mexico

7,3%

Countries in the Asia-Pacific region, except for the above

20,6%

Countries in the Americas, except for the above

0,3%

Arguments in favor of the company

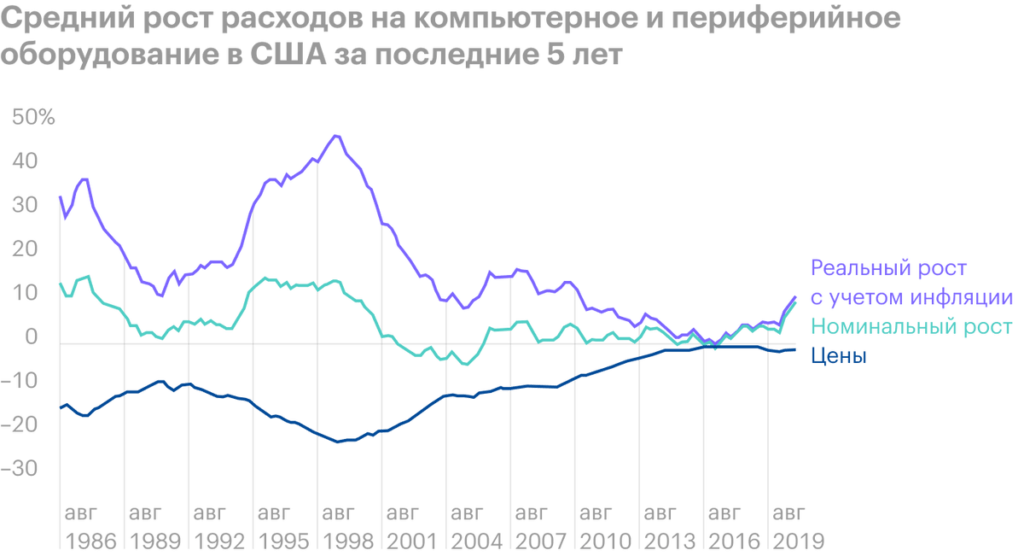

Because II-VI and MKS. The main arguments here are the same, as in the above ideas: the world's industrial rise, and at the top of this rise are high-tech industries. In this situation, Lumentum must fall over something. However, she should get something in the long run: spending on computers and peripherals in the US is growing strongly due to accelerated digitalization, which clearly indicates a favorable situation for Lumentum.

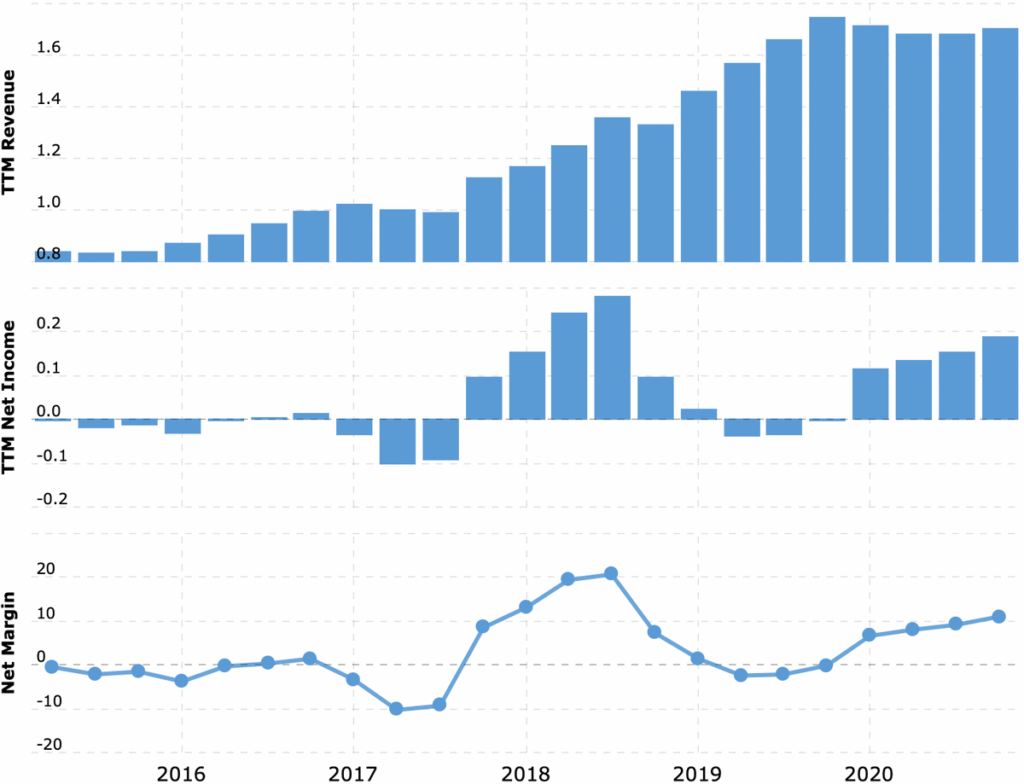

Because it works well. The company's business is successful and efficient - periodic losses are associated with expansion costs, the business itself works like clockwork. The company is associated with the high-tech sector, which is in front of everyone, - so a lot of investors will have to crowd into the stock, looking for "promising industries".

The company does not have a very large capitalization - $ 7 billion, and her P / E 38 let it be big, but not shamelessly overpriced - so the stock could well rise due to the speculative influx of retail investors.

'Cause II-VI can buy her. The probability of purchase threatens any high-tech enterprise. But in the case of Lumentum, this probability is especially high.. The company recently competed with II-VI, trying to buy Coherent. Lumentum failed: II-VI offered more money for Coherent. But it must be noted, that a duo of Lumentum and Coherent would look good. Lumentum Coherent would add a greater focus on microelectronics to work on market segments, aerospace and defense industry, as well as in the production of complex measuring goods and precision engineering. Approximately the same diversification is sought by II-VI. Therefore, the situation is very possible., at which II-VI will buy Lumentum in the foreseeable future: II-VI expands by acquiring competitors with the express purpose of diversifying revenue sources, to become a manufacturing high-tech conglomerate.

What can get in the way

Too many apples. According to company report, its sales structure has a very large share of several customers: 26% revenue is Apple, 13,2% — about Huawei. And that's the problem. Apple has set a course to expand the share of services in its revenue and plans to gradually move away from the sale of technology, what may affect the purchase of relevant goods from Lumentum.

Huawei is generally ostracized in the West - and quite possibly, that as part of the pressure on China, additional obstacles will appear for the export of high-tech products to China. All this will have a very bad effect on Lumentum's reporting..

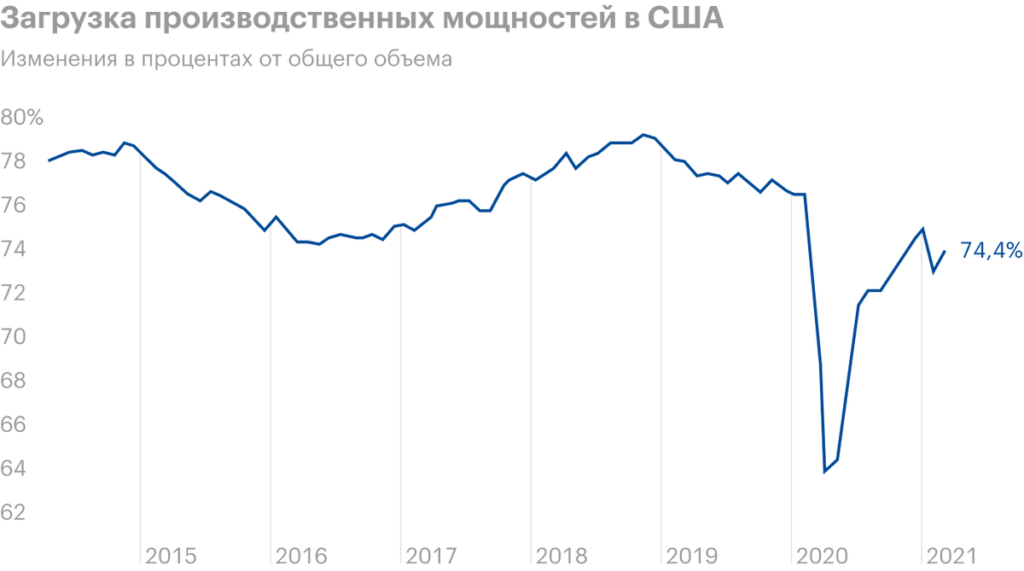

Failure in production. Despite U.S. production load figures, in late winter - early spring there was a slight decrease in industrial growth, which could negatively affect Lumentum's reporting.

The company is worth a lot and has consistently outperformed earnings growth forecasts over the past year — even if it stumbles a little, stocks may fall markedly.

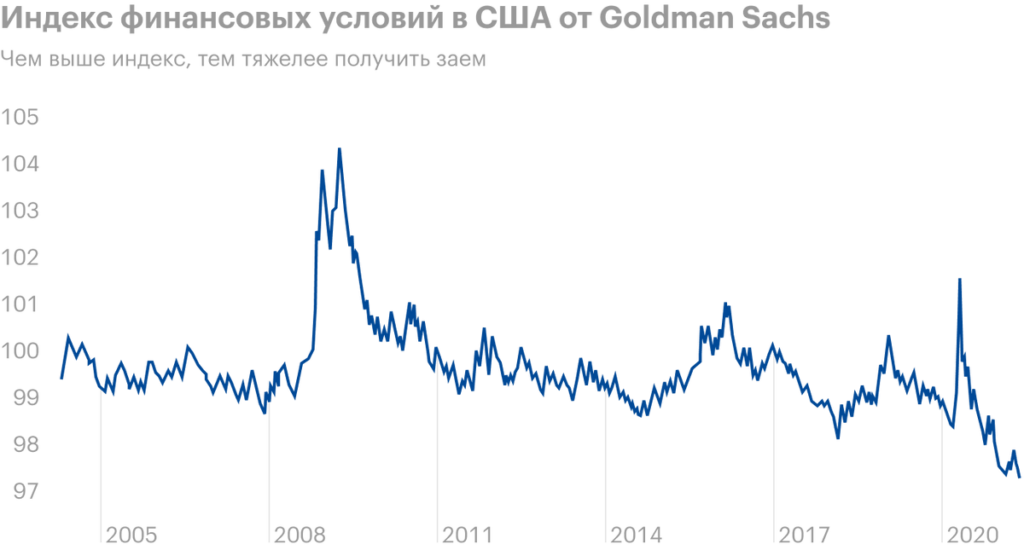

Accounting. According to the latest report, the amount of debts of the company is approximately 1.546 billion dollars, of which 647.3 million must be repaid during the year. But she doesn't have much money at her disposal.: 321,3 million on accounts and 276.7 million debts of counterparties. Probably, to cover urgent debts, the company can easily borrow money at a favorable interest rate: conditions for loans in the USA are now the most favorable for almost 20 years. But still, the debt is large and could become even more., if the company spent money to buy Coherent, Let's keep this fact in mind, since the presence of large debts can cool the ardor of a possible buyer.

Earnings per share

| Current | Expectations | |

|---|---|---|

| 3 neighborhood 2020 | 1,26 $ | 1,05 $ |

| 4 neighborhood 2020 | 1,18 $ | 0,83 $ |

| 1 neighborhood 2021 | 1,78 $ | 1,47 $ |

| 2 neighborhood 2021 | 1,99 $ | 1,91 $ |

| 3 neighborhood 2021 | — | 1,40 $ |

Current

3 neighborhood 2020

1,26 $

4 neighborhood 2020

1,18 $

1 neighborhood 2021

1,78 $

2 neighborhood 2021

1,99 $

3 neighborhood 2021

—

Expectations

3 neighborhood 2020

1,05 $

4 neighborhood 2020

0,83 $

1 neighborhood 2021

1,47 $

2 neighborhood 2021

1,91 $

3 neighborhood 2021

1,40 $

What's the bottom line?

Take the shares now for 92,52 $. And then there are two options.:

- wait, when will the shares be worth 104 $, and sell them. This is noticeably less than the historical maximum in 108 $, achieved in January of this year. With all the positives, I think, that we can reach this level in the next 14 Months;

- hold shares 10 years in sorrow and joy. At this interval, the possibility of buying a company by someone increases greatly., in particular II-VI. Also, given Lumentum's strong business performance, maybe, that during this time the company will begin to pay dividends and the shares will grow at the expense of fans of payments.

It is worth considering the high amount of debts and the likelihood of falling sales in the Chinese direction.