Now we have a uniformly speculative thought: take stock of Swiss computer device manufacturer Logitech (Nasdaq: LOGI), to earn income by increasing the purchasing power of its products.

Growth potential and duration : thirteen percent for 12 Months; twenty four percent in two years; eleven percent a year for fifteen years. All excluding dividends.

Why stocks can go up: for the company's products, there is and will be a great demand.

How do we act: take shares at the moment 105,89 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

The company designs and manufactures computer peripheral devices: mice, keyboards, headphones, video communication devices and more.

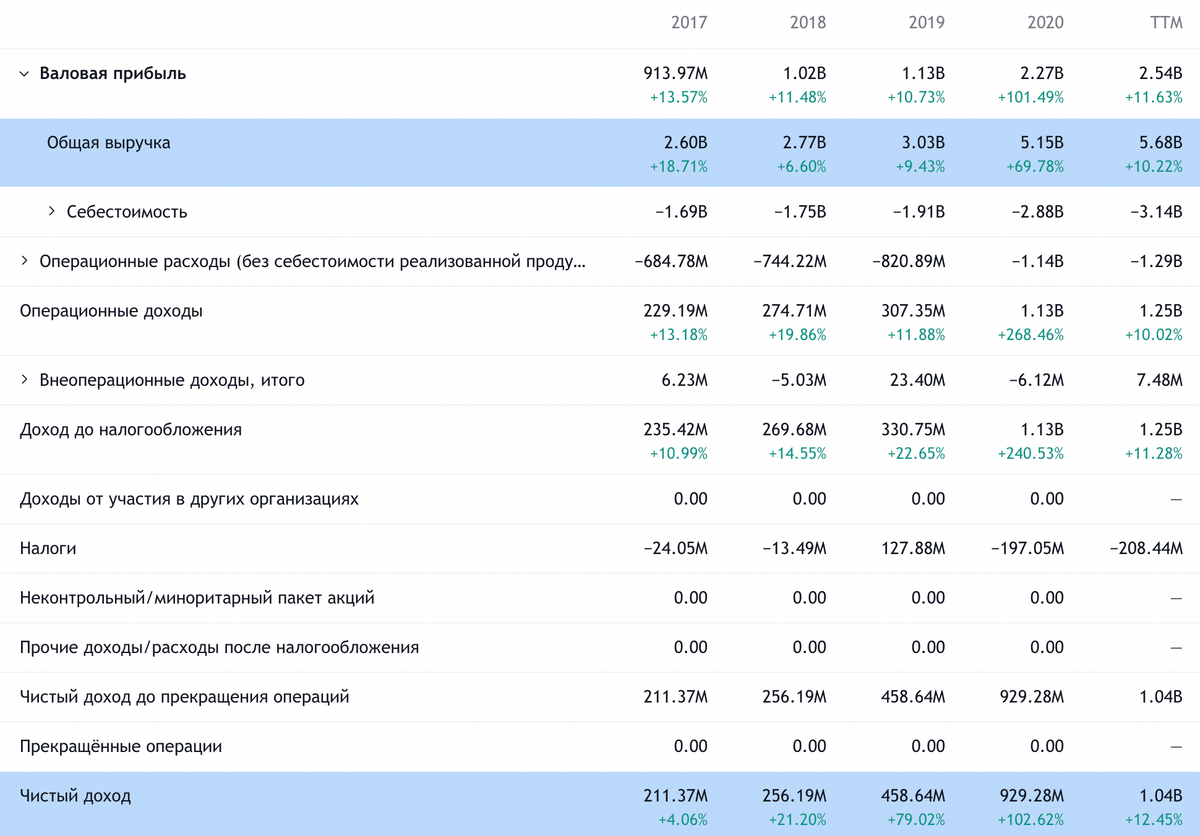

According to the report, the company's revenue is divided as follows:

- Pointing Devices - 12,96 %. These are mice, touchpads and presentation tools.

- Keyboards and related devices - 14,93 %.

- Internet cameras - 8,37 %.

- Tablet Devices - 7,31 %. Basically it's keyboards for tablets..

- Gaming sector - 23,58 %. These are mice, keyboards and other devices specifically for computer game players.

- Video Collaboration - 19,89 %. Video communication cameras.

- Portable speakers - 3,32 %.

- Audio- and wearables — 8,92 %. PC speakers, headphones, headsets, microphones for studio recording and more.

- Smart House - 0,65 %. These are security cameras and home controls from the Harmony line..

- Other - 0,07%. This sector contains all product lines, which the company plans to discontinue.

Company revenue by regions:

- America - 42%. USA gives 35% all proceeds.

- Europe, Middle East and Africa - 33%. Logitech's native Switzerland gives 3% all proceeds, and Germany - 16%.

- Asian-Pacific area - 25%. China gives 10% all proceeds.

Arguments in favor of the company

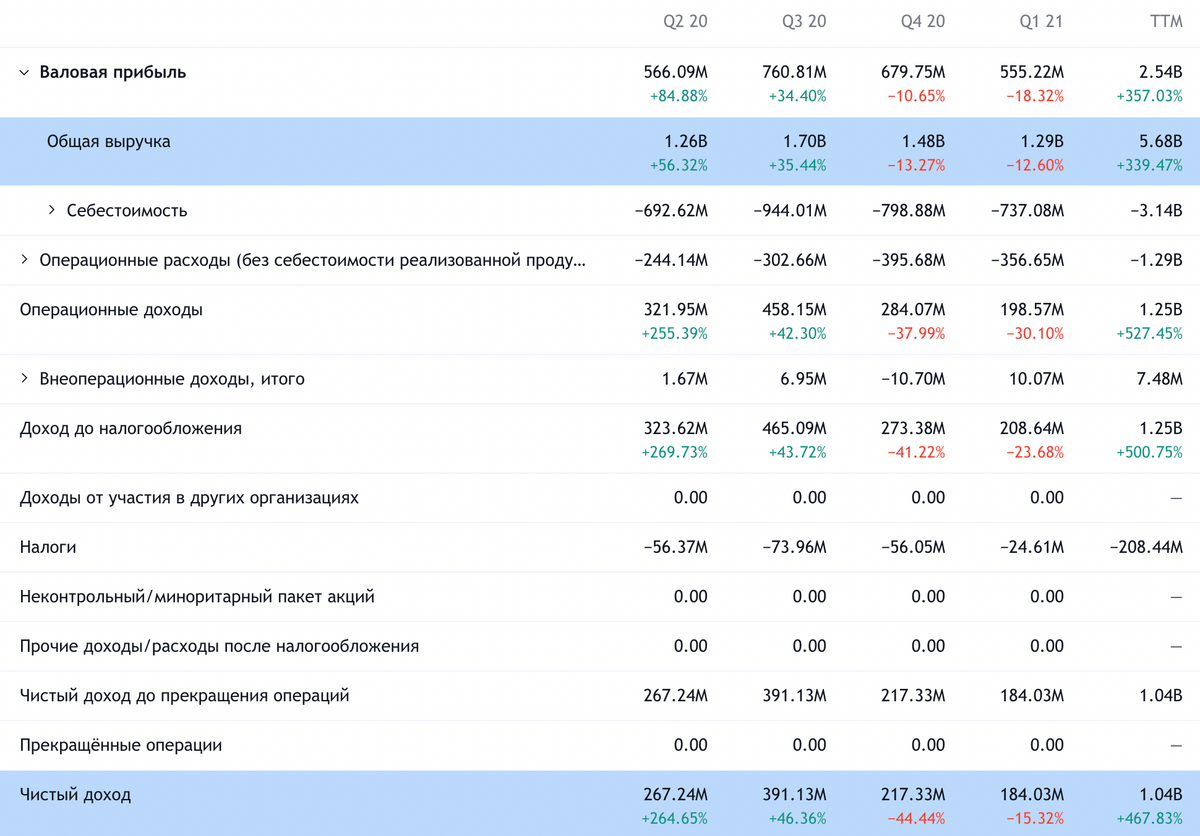

Dropped - select. Since June, Logitech shares have fallen by almost a quarter after, how the company gave a forecast for this year worse than analysts' expectations, which was at the level of previous forecasts of Logitech itself. In my opinion, there is nothing wrong with that, but we had the opportunity to take the shares of this company at a cheaper price, especially since the business itself and its prospects are very strong. With P / E 17,18 the company does not look very expensive. We may well expect stocks to rebound simply because, that investors will run into them with the wording “this is Logitech, something is cheap ".

A bit of everything. The company will be the beneficiary of the eternal quarantine economy. A quarantine, seems to be, now really will be forever: even if new strains don't appear indefinitely, substantial restrictions, introduced around the world, will in every possible way slow down the mobility of the population.

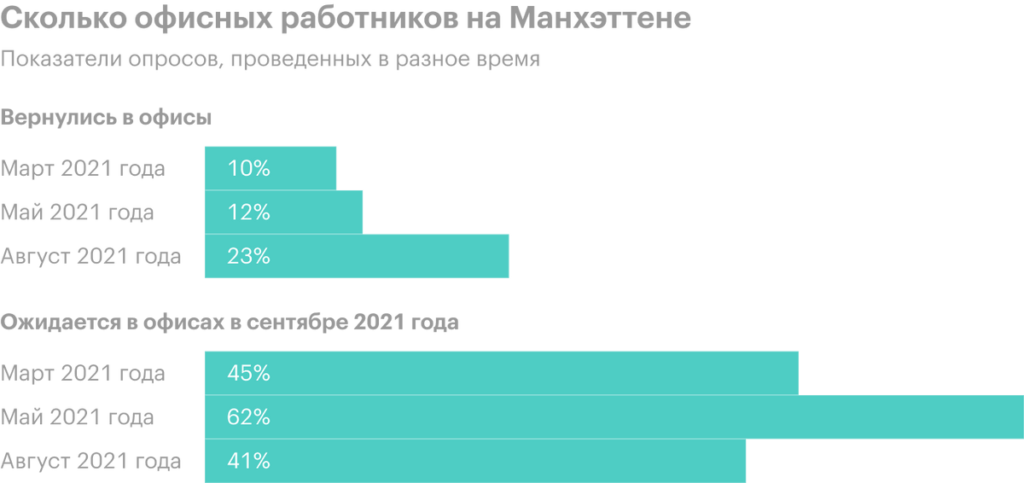

And there's no reason to believe, that this situation will change in the near future: the same The Economist Normalcy Index is still very far from the indicators of the "pre-war" time. Under these conditions, people will spend more time at home - and more time at computers and multimedia devices..

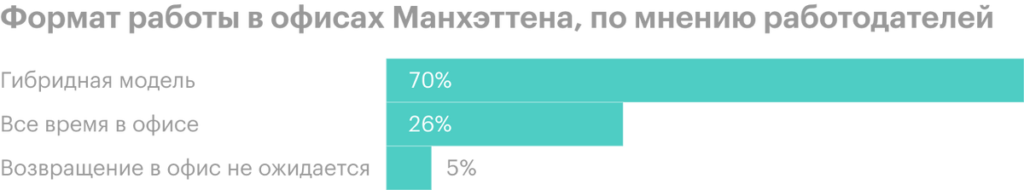

Translation of work at home, as indicated by studies among employers, will also stimulate demand for Logitech devices. Possible small relaxations in quarantine, which may affect the company's sales in a negative way, but all this "thaw" will be short-lived, and therefore consumers will soon be driven home again - to the mice, keyboards and headsets. So the business environment for the company is very positive..

What can get in the way

Concentration. According to the report, the company has two major clients: one has 14% proceeds, on the second - 13%. Changing relationships with one of them can negatively affect reporting..

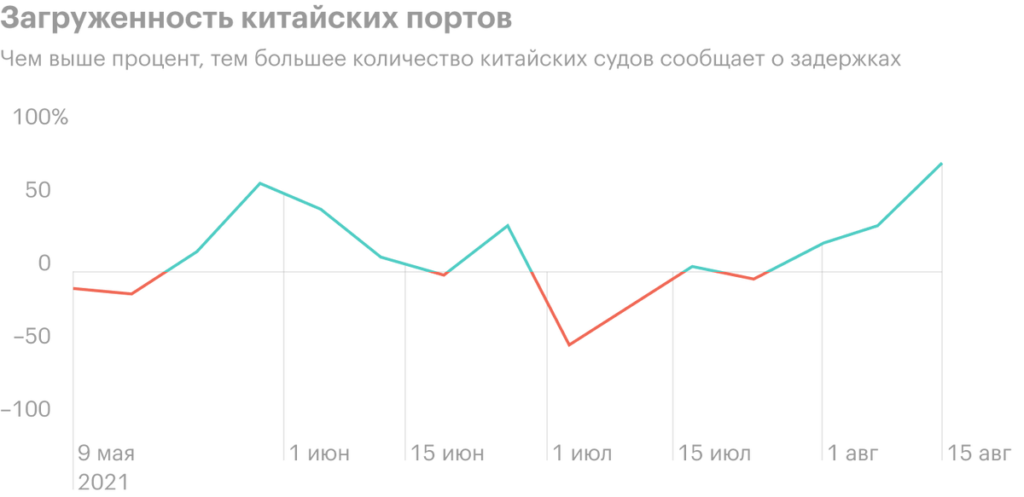

Asia-s! According to company report, over 74% its assets and production facilities are located in Asia and specifically 64,87% - in China. Given the logistical challenges, when the goods, ordered from Asia, go to America not 70 days after placing the order, like before, but almost 8 Months, this moment may adversely affect the company's reporting, ruining the margins of her business.

Not Enough Chips for Everyone. The company suffers from a shortage of semiconductors no less than other electronics manufacturers. This should be borne in mind.

The penny franc protects. The company pays a penny dividend: 87 cents per share, about 0,82% per annum. It takes her 155,8 million dollars per year - approximately 15% from her profits for the past 12 Months.

Basically, money for the company: with the ratio of debts and money in the accounts of Logitech, everything is fine. Yes, and this profitability is negligible, so it's unlikely that stocks will fall, if payments are cut. Besides, honestly, there is no apparent reason to cut payments. However, this point should be kept in mind..

What's the bottom line?

We take shares now by 105,89 $. And then there are three options.:

- wait 120 $. Think, that this level of the stock was reached in the following 12 Months;

- wait for them to return to their all-time high 132 $ - so much was asked for them back in June this year. Here you should prepare to wait two years: probably, during this time there will be a couple more waves of coronavirus and one or two hard quarantines, what will spur the company's business;

- hold shares 15 years in sorrow and joy.