Today we have an extremely speculative idea.: take shares of KnowBe4 (NASDAQ: KNBE), working in the field of cybersecurity, in order to capitalize on the hype in this area.

Growth potential and validity: 19,5% behind 18 Months; 49% behind 5 years.

Why stocks can go up: news will stimulate the growth of quotations.

How do we act: take now 22,58 $.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

It is a cloud platform, where customers use its software.

The company entered the stock exchange quite recently - from the spring of 2021. According to the registration prospectus, the company receives all the money on a subscription model and on the basis of renewable contracts, segments are not included in the report.

This is what the company offers to its customers.

KMSAT — Kevin Mitnick Security Awareness Training — named after Mitnick himself, who now works for the company. Virtual Worker Cybersecurity Training Program. What does it look like, can be viewed on the company's website..

PhishER. A program to automate the work of cybersecurity experts in the field of threat analysis, emanating from the possibility of an attack on the virtual sphere of the enterprise through the use of its employees.

KCM - KnowBe4 Compliance Manager - a program for analyzing risks and automating the management of system audit functions and checking the compliance of the enterprise with the legislation.

Unfortunately, the company does not say, Which product brings in the most revenue?, but, judging by the emphasis in the report on the history of "social hacking", I think, what KMSAT gives the most.

Geographic revenue of the company, according to her presentation, distributed as follows:

- USA - 88,1%;

- other countries - 11,9%.

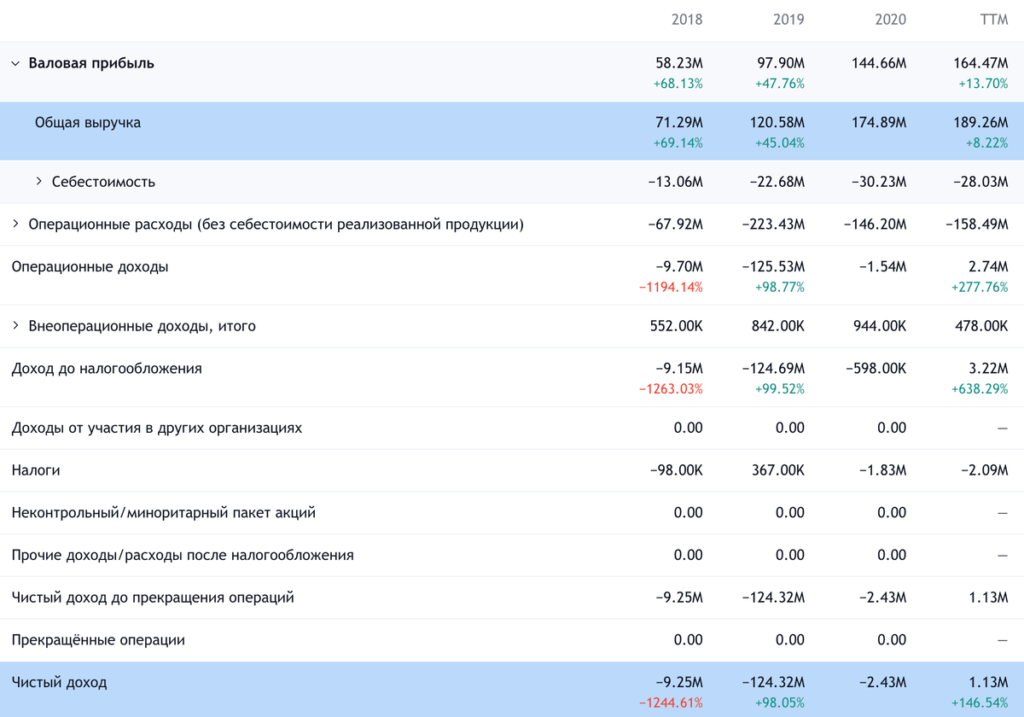

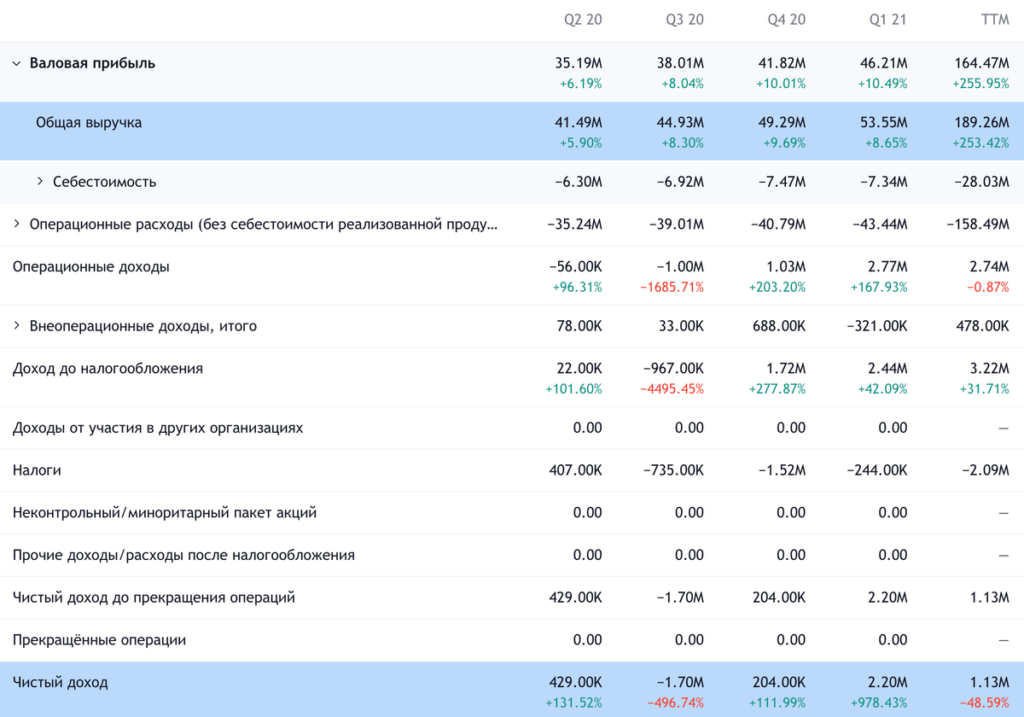

The company has been unprofitable until recently., but the last few quarters has been profitable.

Arguments in favor of the company

“We are talking about three-digit sums!» Maybe, nothing to write here, Besides, that “the cybersecurity sector is very promising, big money is spinning there ". Remember at least one of the many successful ideas - Tenable.

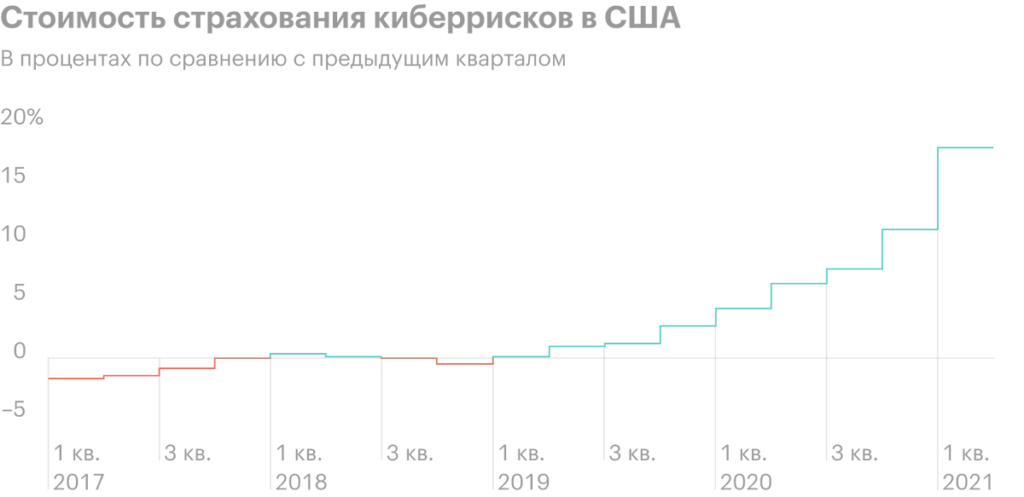

More and more hacker ransomware attacks - and educational targets often become targets of attacks., government and medical departments, which threatens with serious consequences for society. Imagine, what's going to happen, if hackers “take hostage” a large hospital. And the damage from such attacks is growing.: if in 2017 they caused damage of $ 5 billion, then this year it will be about 20 billion dollars.

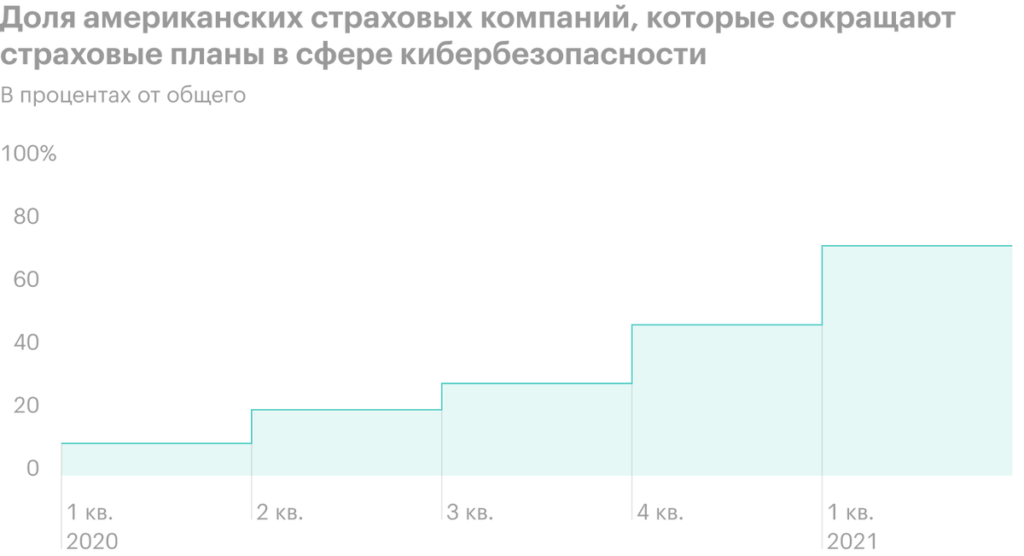

The cost of damage insurance against possible cyber attacks is growing strongly, and many insurance companies even limit the amount of insurance under this article of damage, mainly because, that the level of protection for customers is insufficient.

The human factor in the style of "followed the link in a suspicious letter", “logged in from unauthorized device to work email” plays a key role in most stories about large-scale hacks. Probably, companies in all industries will actively spend on training and retraining of personnel in the field of cybersecurity. Therefore, KnowBe4 can count on further revenue growth..

Well, that fact, that it has a small capitalization - $ 3.83 billion, - facilitate the growth of quotes. These shares could rise in price simply due to the influx of retail investors into them.. After all, news about large-scale hacks now appear more and more often., and from them KnowBe4 will grow simply on the speculative expectations of investors.

Fell down. The company's shares fell by a third from the highs, achieved in June, so you can take them now with the expectation of a rebound. The current price is not that far from the IPO price - 16 $, so, given the positive market conditions, there is a good potential for a rebound here.

Not so profitable. Over the past few quarters, the company has shown little, but still profit. This is a big plus in general: cybersecurity companies can be unprofitable for many, many years. That fact, that KnowBe4 is now profitable, can serve as an additional argument in favor of the purchase of its shares by many investors, including institutional. Given the small capitalization of the company, this can lead to a rapid increase in quotations..

Can buy. The combination of the factors described above can attract a buyer from among the largest enterprises in this industry to the company..

What can get in the way

Neskladushechka. According to company estimates, the size of its target market is 15 billion dollars a year. With a projected annual revenue in 2021 in the region of $ 231 million, the company will 1,54% target market. But with the current capitalization, the company stands as 25,53% target market. All in all, she looks overrated, and we can only hope, what investors, blinded by high revenue growth and keeping in mind the abstract “sector prospects”, can't think of this factor.. Otherwise, the company's shares may fall in price by another 3-4 times..

Clients. According to the company's prospectus, its revenue retention rate is 89%. For business, subscription, these are normal indicators, but it's not so good, how 100% and more, — companies in this sector often have higher revenue retention rates 100%. This means, that KnowBe4's customer churn is very noticeable and it has to spend a lot on attracting new customers and retaining old ones.

Competitors. There are many companies, which, in addition to security software, also provide personnel training services at customer enterprises: for example, Proofpoint, Cofense и Mimecast. Truth, someone might say, that KnowBe4 is in a better position, because, unlike its competitors, it focuses on general education without being tied to the programs it sells, and its competitors offer education solely based on their programs, which narrows the circle of potential buyers. But still, the presence of competitors will spoil KnowBe4 margins and make it difficult to attract customers..

Unprofitableness may return. Until the company lasted a whole year without a loss, and it cannot be considered fully profitable. At the same time, she has a rather large amount of debts.: 155,355 million dollars of urgent debts and 88 million non-urgent. She doesn't have much money.: 94,647 million on accounts and 37.261 million debts of counterparties. And the probability, that the company will become unprofitable again, in anticipation of higher interest rates and more expensive loans, certainly, alarming.

What's the bottom line?

We take shares now by 22,58 $. And then we have the following options.:

- wait, when stocks rise to 27 $. Think, that with all the positive aspects, this is quite possible in the following 18 Months;

- wait for the price 33,66 $ - historical maximum, achieved by the company last June. We can wait for this outcome within the next five years.

But still keep in mind, that this idea is very speculative, so if you are not ready to endure volatility, then do not touch these promotions.