Today we have a moderately speculative idea.: take shares of the fintech company Paymentus (NYSE: PAY), in order to capitalize on the growth of these shares after a recent fall and a favorable business environment for the company.

Growth potential and validity: 14% behind 15 Months; 38,5% for three years; 11% per year for 15 years.

Why stocks can go up: they fell recently, in general, the company is very promising.

How do we act: take now 28,88 $.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

We talked in great detail about the company's business in its analysis before the IPO in May, so we won't repeat ourselves here.. In short: Paymentus is a cloud platform in North America, which earns on the processing of electronic payments on invoices.

Arguments in favor of the company

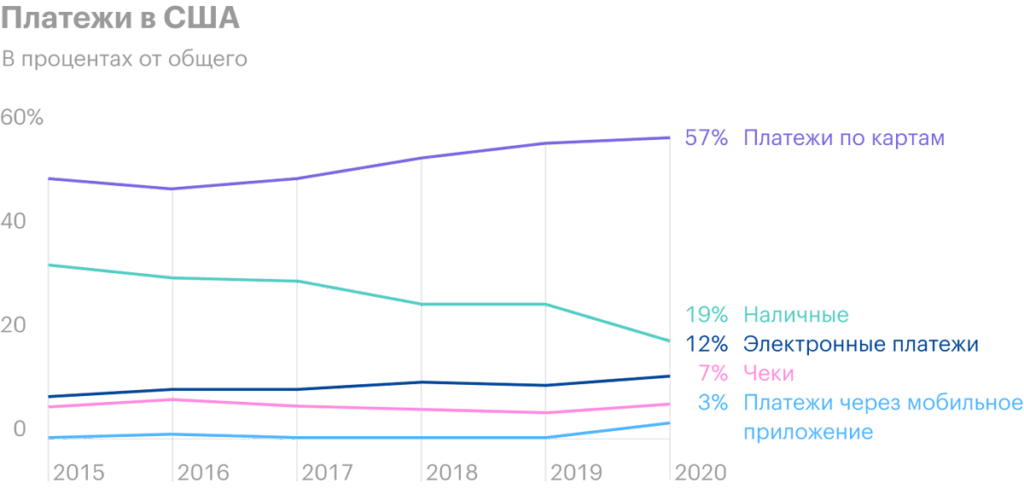

Conjuncture - current and long-term. In the analysis of the company, I talked a lot about, how much it favors the trend of transferring payments around the world to a non-cash basis, somewhere by force, and somewhere voluntarily.

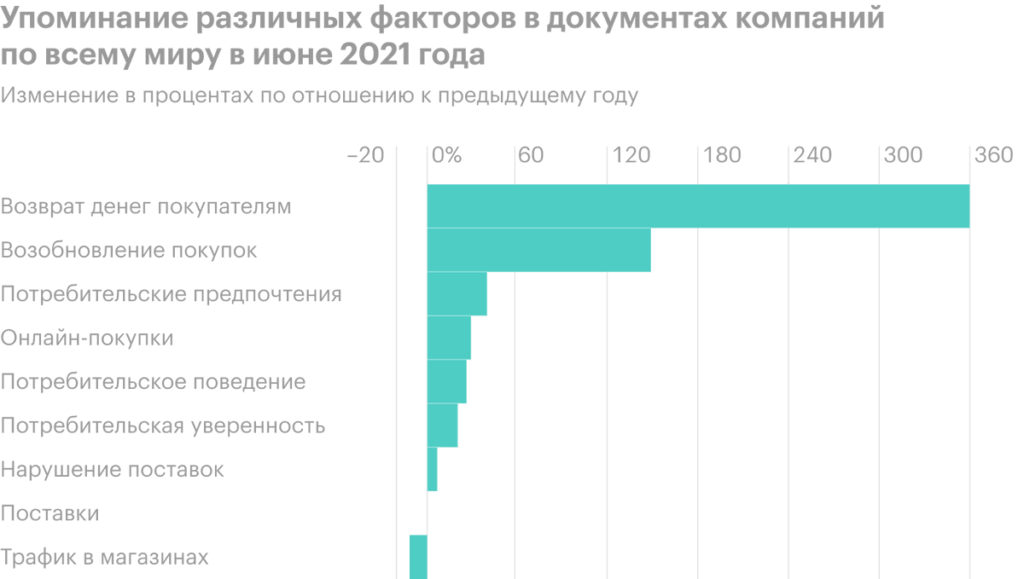

More companies are talking about rising demand. Clients of such companies in OECD countries are feeling more confident and are already hatching bold spending plans., especially in the USA. This is also indicated by the good results of Visa in the past quarter..

All in all, this means, that Paymentus can count on an increase in the flow of processed payments and for sure it will be able to capitalize on this.

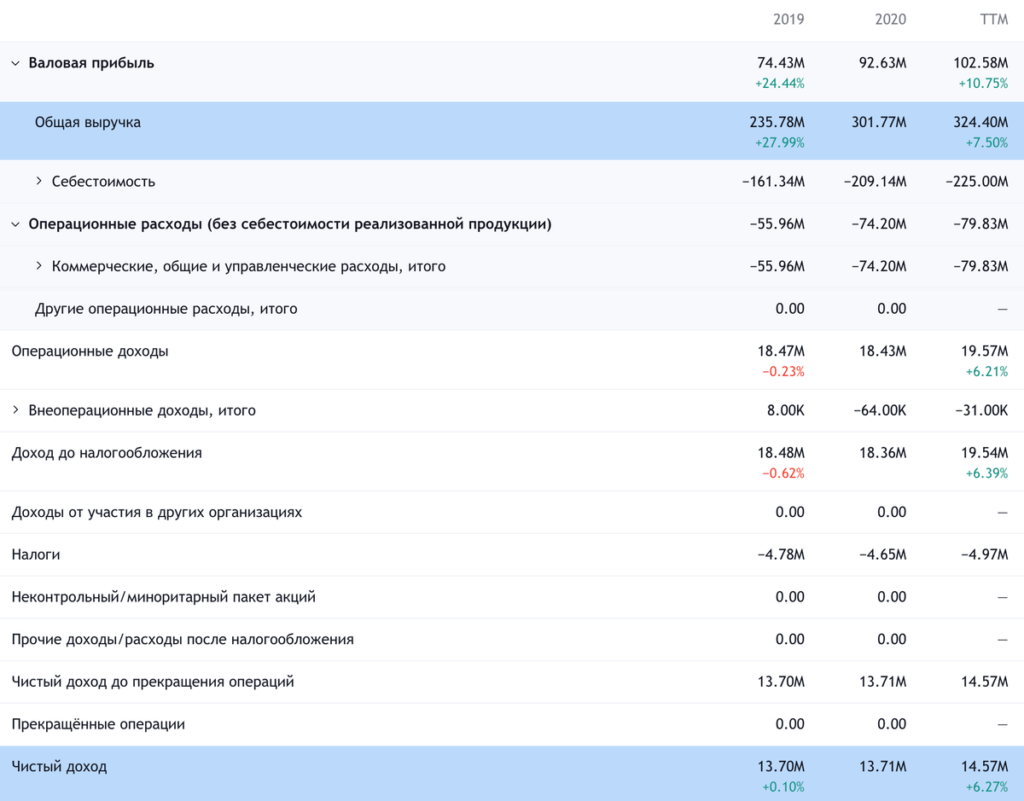

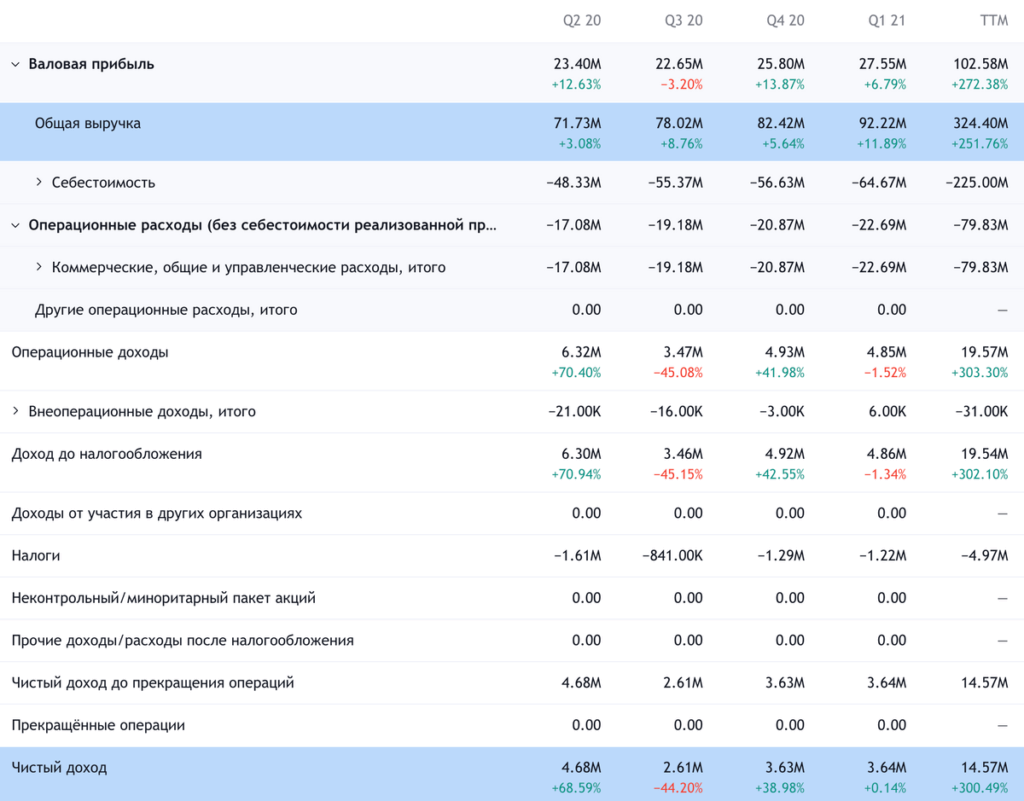

There is a profit - already the issuer. Paymentus is a pleasant exception to the series of IPOs of unprofitable companies: this is a profitable business. Truth, the company has a future P / E at the level 405, which is a lot, - but I'm guessing, that it doesn't matter much. Because the exchange is full of stories of losing companies, who grow shamelessly, not having P / E. For example, unprofitable Snap has grown to a capitalization of $ 120 billion - so against this background, Paymentus may well grow even more.

The very fact that Paymentus is profitable is already a huge bonus for today. Moreover, the company has a small capitalization - 3.39 billion dollars. And given the aura of perspective, its shares can be pumped up by retail investors.

Also worth remembering, that the company does not appear to be overvalued relative to its market. U.S. account payments alone represent $5 trillion in transactions per year, and Paymentus only handles 38 billion of that mass. The global volume of electronic payments is 35 trillion dollars a year. So there is still room for Paymentus to grow and rise in price even more..

Fell down. Although the stock is still above the price in 21 $, that was asked for them during the IPO, since the beginning of July they have fallen in price by 20%. I believe, what is a good entry point, taking into account the prospects of the business and its performance: you can take these shares in anticipation of a rebound.

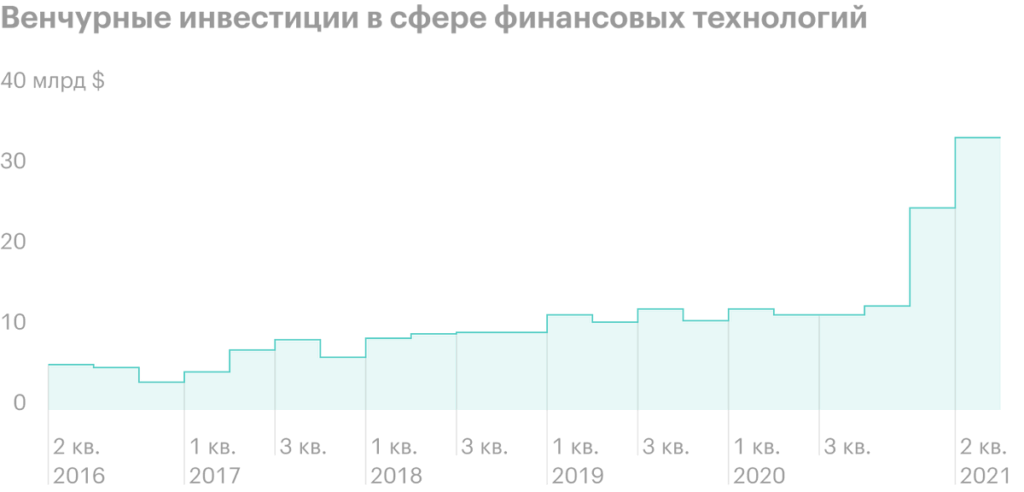

Can buy. With all the advantages of the company, it is logical to assume, that they can buy. This is especially true due to the huge volume of venture investments in fintech., against the background of which the Paymentus ransom does not look like an extremely expensive operation.

Especially 80% of votes in the company belongs to the private foundation Accel-KKR, not some startup coders. It is very good, because programmer founders often drive a company into losses in pursuit of expansion, because they have, you see, "Desire to change the world". The Foundation will be interested in, to squeeze the maximum profit out of Paymentus - and, basically, sell it for a higher price if possible.

What can get in the way

Extension. The company makes almost all of its money in the US., and the question arises of expanding operations outside this country. Probably, Paymentus will have to buy local solutions in other countries - and this is bad.

Fintech investment is on the rise. For the Paymentus extension, this will mean wild prices, which techies will dictate to companies. Paymentus extension will definitely not be cheap. Here, as Don Francisco Quevedo said in the novel "Captain Alatriste", "Will have to fight". From such news, Paymentus shares may fall, And it will also increase its debt burden..

And it's still expensive. P / E is well above the hospital average, so you have to be mentally prepared, that stocks will shake during stock market crashes.

What's the bottom line?

We take shares now by 28,88 $. And then we have the following options:

- wait, when will they cost 33 $, - this is just below the historical highs. Think, we will reach this level in the next 15 Months;

- wait 40 $. Here, in my opinion, will have to wait longer - up to three years;

- keep shares next 15 years in sorrow and joy.