Today we have a moderately speculative idea.: take stock of laser manufacturer IPG Photonics (NASDAQ: IPGP), in order to capitalize on the rebound of stocks after the fall.

IPG Photonics Growth Potential and Longevity: 13% behind 14 Months; 10% per year during 5 years.

Why stocks can go up: they fell hard, but the company's business retains good potential.

How do we act: take by 179,87 $.

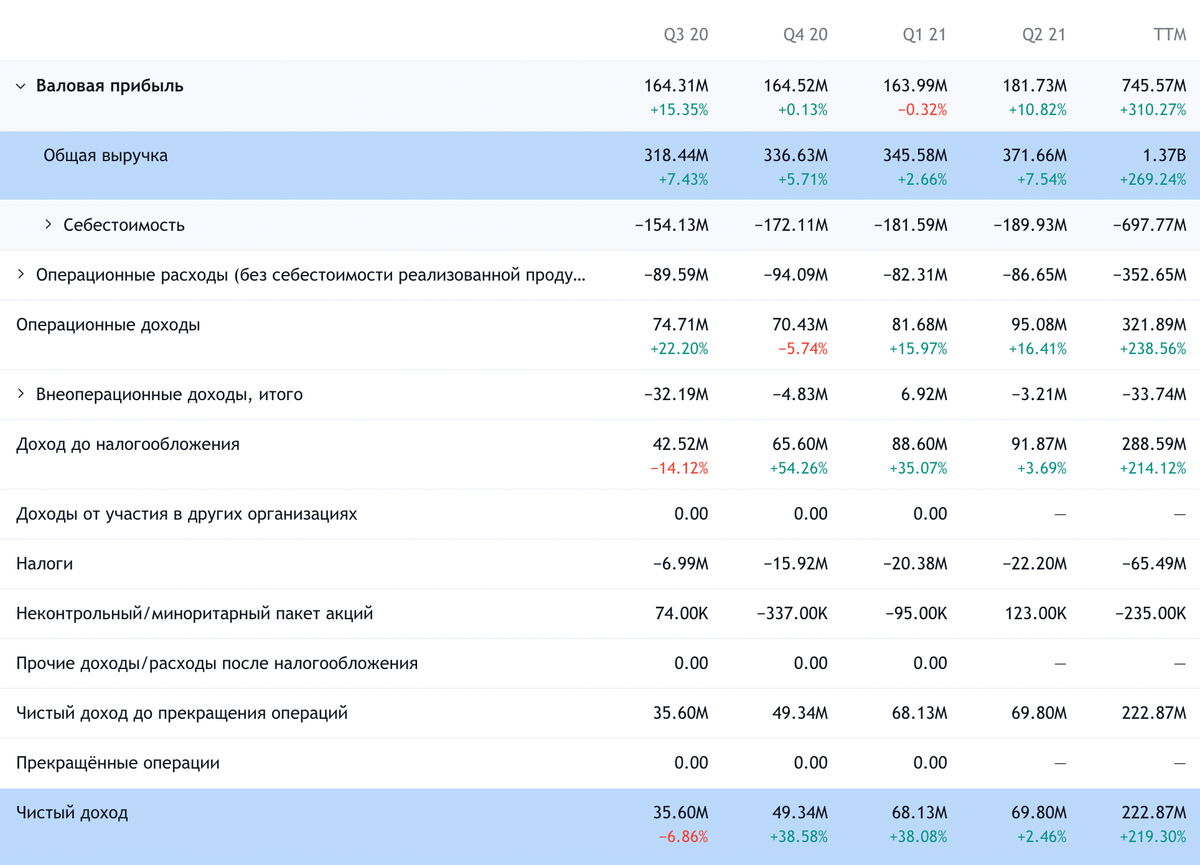

Often, when reporting companies, the numbers are rounded up, therefore, the totals in graphs and tables may not converge.

What the company makes money on

The company manufactures lasers and components for manufacturing plants in a wide variety of industries.: general production, automotive industry, consumer goods, medical devices, traditional energy and renewable energy, aerospace, railways, shipbuilding, microelectronics, defense, communications and R&D.

According to the company's annual report, its revenue by types of tasks solved is distributed as follows:

- work with materials 90,2%. Everything, What is related to the processing of products with a laser;

- applied Science - 5,3%. The company's products and services are used in scientific research by universities and government customers;

- communications — 1,9%. Components, which are used for applied purposes for organizing communications;

- medical procedures - 2,6%. Company products, which are used by doctors, especially in surgery.

Revenue is divided into two types by product: various lasers - 83,2% and amplifiers, services, spare parts and components — 16,8%.

Revenue by country and region:

- North America - 20,5%. The report said, that most of the sales are in the USA, but there are no exact numbers.;

- Europe. In the report, it is divided into Germany - 5,5% and the rest of Europe, including countries of Eastern Europe and the CIS, — 18,3%;

- Asia and Australia. This segment is divided into China − 41,8%, Japan - 4,4% and other countries - 8,6%;

- the rest of the world - 0,9%.

Arguments in favor of the company

“Stop!» Over the past few days, the company's shares have fallen by 17%, And, given the good environment for her business, we can pick them up now in anticipation of the rebound.

Let's figure it out, why did stocks fall when, in general,, not bad circumstances. Analysts expected better results, than those, which the company eventually reported: 376,9 million dollars of revenue according to the forecast and 372 million revenue in reality, expected earnings per share — 1,4 $, actually happened 1,29 $.

The company also gave a forecast for the third quarter.: 350—380 million in revenue, earnings per share in the region of 1.1-1.4 $. And it also turned out to be lower than analysts' forecasts., who promised 383,1 million revenue, and earnings per share 1,45 $.

I agree with James Dimon and Warren Buffett, that quarterly forecasts should be banned: they create unrealistic expectations among investors and harm quotes. But still I think, that IPG will be able to surprise us in the next six months, given the positive signals for her business. And even if the results are on par with expectations, I still think, that stocks will rise, as they fell too hard.

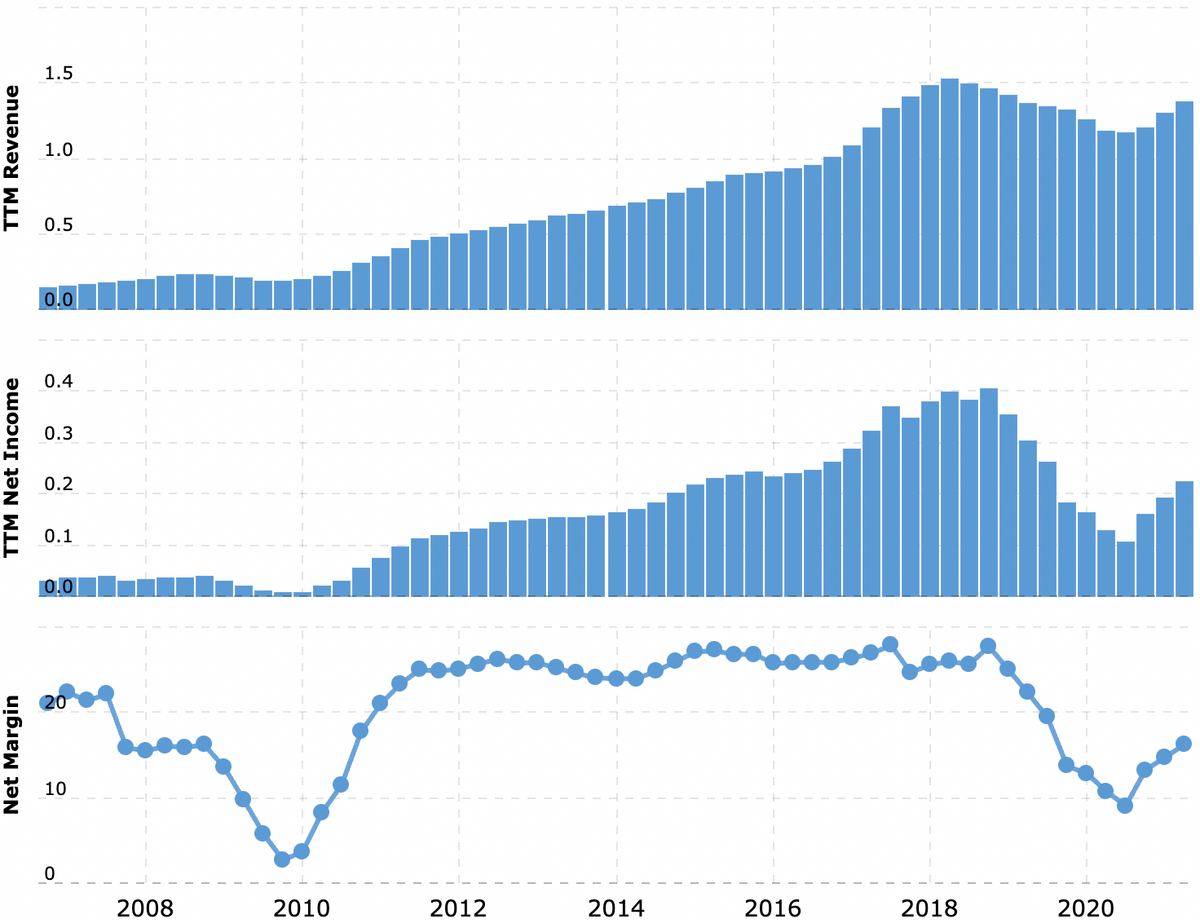

Company progress, shown in last report, in isolation from analysts' expectations, it seems very worthy: revenue increased by 25%, business margins have increased: gross margin increased from 46 to 48,6%, operating margin increased from 15,9 to 24,8%. Profit increased by 82% - partly helped by the absence of foreign exchange losses, who were last year, but even if you correct for this, the profit increased by 56,43%.

Investors are worse than children: today they want one, tomorrow is another. Think, given the disproportionate drop in stock prices of this generally very attractive and promising business, IPG shares will start to rise again after a while. Maybe, then investors will finally come to their senses and decide, that these shares are worth it, to pick them up after an excessive fall.

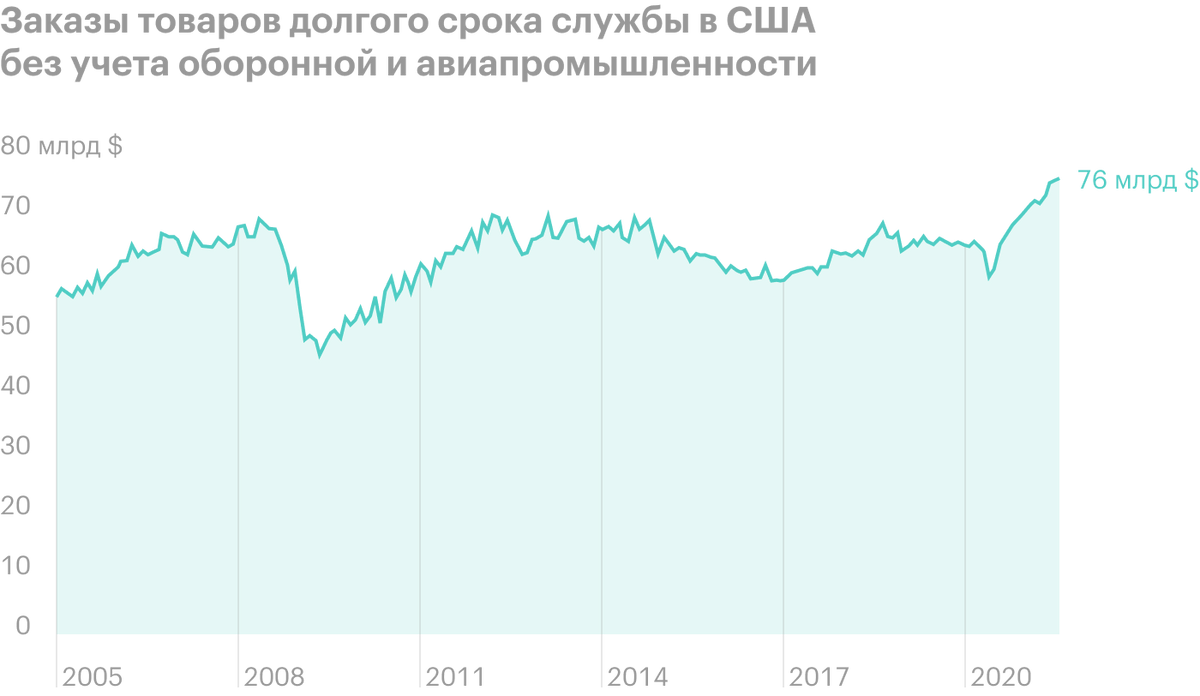

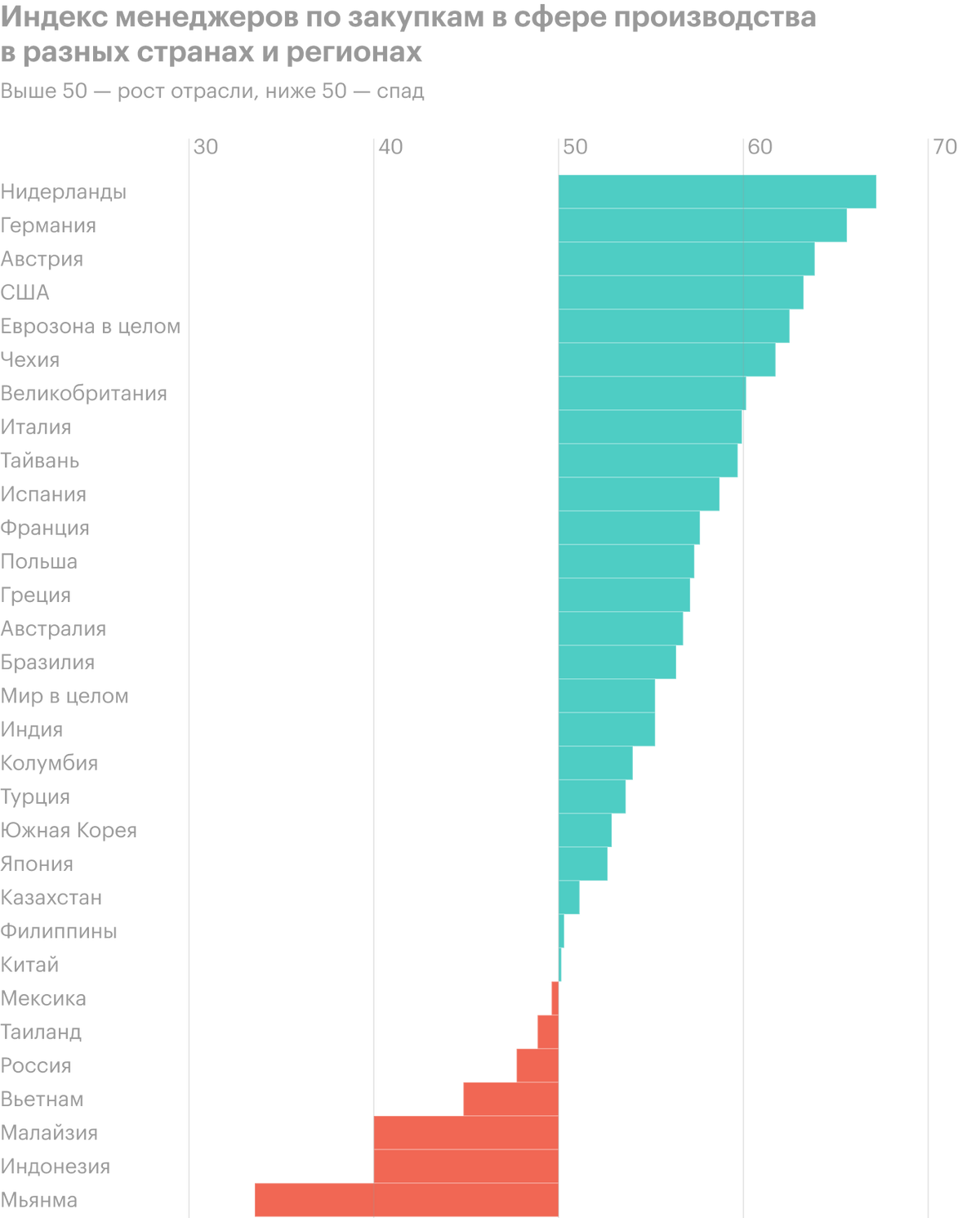

Positive now. Manufacturing figures in the US and other important countries for the company show good growth rates. Maybe, some concerns may be due to the small growth of the industry in China, which is important for the company, but I believe, that with the growth of production margins in China, we can soon expect an increase in orders for IPG and there.

Quite possibly, that the company will be able to make good money during this year.

Positive afterwards. Companies in the US and beyond have a lot of money and an urgent need to upgrade capital assets. This allows us to expect a boom in business investment for at least the next few years.. This is good news for IPG.

Accounting. According to the latest report, money in the company's accounts - and this 754,199 million dollars - much more, than all-all-all of her debts, of which in total 380,232 million. In anticipation of raising rates and rising prices for loans, this is very good.

What can get in the way

Concentration. According to the company's annual report, five unnamed biggest clients give her 24% proceeds. Moreover, the largest one accounts for 8% proceeds. A change in relationship with any of these large clients may affect the report.

Too hot potatoes. The company has factories in Belarus and the Russian Federation - in total, this 17,5% from the value of its long-term assets. And in the Russian Federation, the company works 29% employees. This should be borne in mind due to the deteriorating geopolitical situation for these two countries and the trend towards increasing their international isolation.. And the recent deterioration in industrial indicators in the Russian Federation may signal, that the company's sales in Europe may be worse, what investors would like.

Coronacrisis. Quarantine affected the IPG result very badly, reduced the need for companies to invest in new equipment. So the repetition of this story - and this is very likely, given the emergence of new strains of coronavirus, - can greatly spoil the company's reporting.

Neskladushechka. According to rough estimates of the company, the capacity of its target market is about 17,5 billion dollars. With their 1,37 billion dollars in revenue for the past 12 months the company takes 7,82% their market, but with capitalization 9,64 billion it is worth as 55% market. In this way, investors may have complaints about the fairness of the company's current valuation. Moreover, the company P / E 43,6 - that's not to say much, but still, stocks can shake during the next stock market crash.

What's the bottom line?

We take shares now by 179,87 $. And then there is 2 course of action:

- hold until the price is reached 205 $ - it is noticeably lower, how 218 $, which shares were worth at the beginning of this week. Think, that we can wait to reach this level within the next 14 Months;

- hold shares for the following periods 5 years, so that the company can capitalize on the coming boom in investments in the renewal of fixed assets. Theoretically, in this scenario, the purchase of IPG Photonics by someone larger is possible, but, considering its high price, I would focus more on the growth of quotations due to an increase in the company's income.