Now we have a uniformly speculative thought: take shares in IT products and services provider Insight Enterprises (Nasdaq: NSIT), to receive income on the growth of business investments in this area.

Growth potential and duration : thirteen percent for 13 Months; nine percent a year for ten years.

Why stocks can go up: IT spending on the rise, grow and will grow.

How do we act: we take at the moment 94,99 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

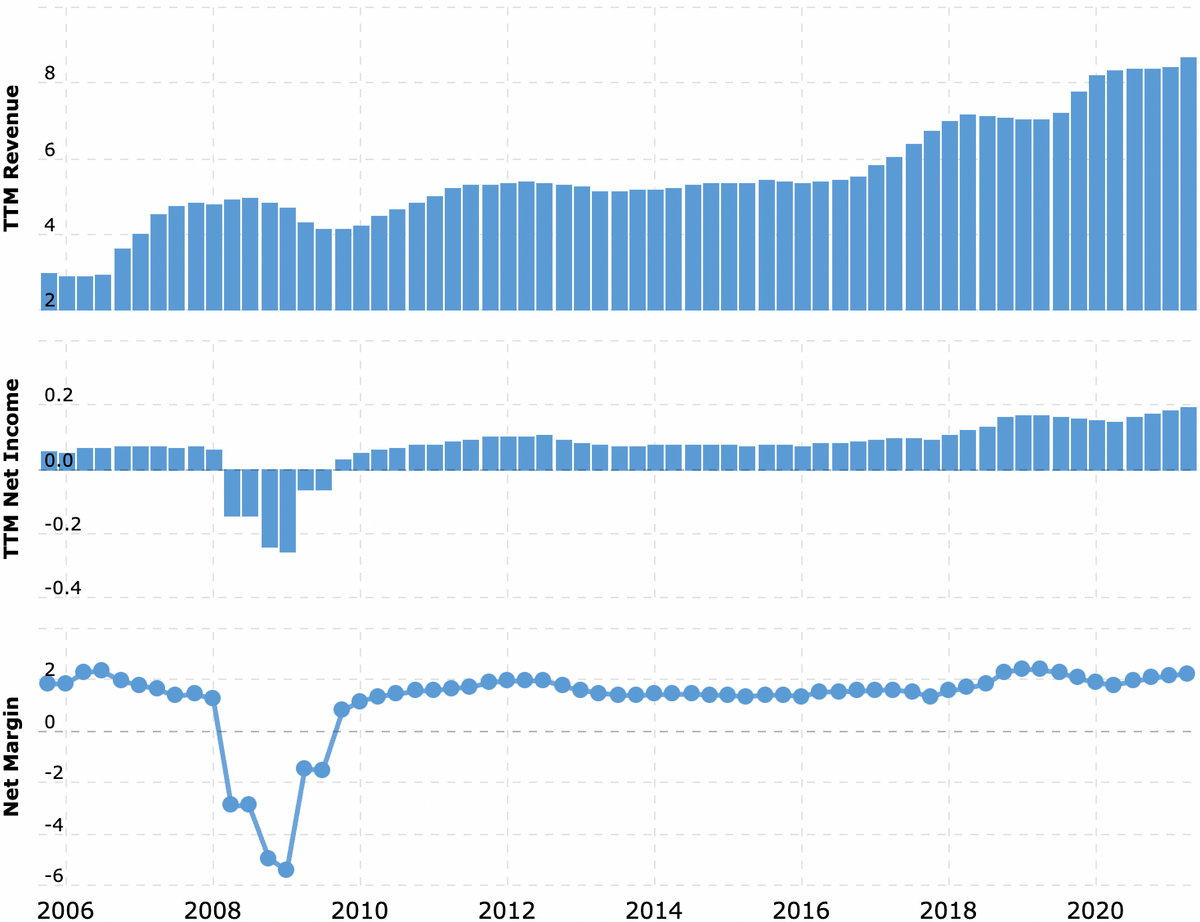

What the company makes money on

The company helps its customers get the IT products they need, also provides maintenance services for infrastructure facilities in the industry.

In accordance with the annual report, the company's revenue is divided into subsequent segments:

- Components for computer equipment — 60,76 %. Products and services, which was produced by other companies: Cisco, Dell, HP, Lenovo, Hewlett Packard Enterprise, NetApp, Apple, Microsoft and IBM. Insight resells its products to its customers.

- PO — 25,22 %. Insight resells software from other companies: Microsoft, VMware, Adobe, IBM, Symantec и Citrix.

- Services - 14,02%. Solution of IT problems: from data scientists and application creation to technical support and budget management of IT departments of their own customers.

1-The first two sectors can be combined into one - the sale of products, gross margin is 9,42 % from its proceeds. Service Sector Gross Margin — 53,48 % from its proceeds.

Revenue by type of customer:

- Large enterprises - 67,99%.

- Small and medium businesses - 18,19%.

- State institutions - 13,82%.

Company revenue by regions:

- North America - 79,31%, US share unknown. Operating margin of the geographical segment — 3,31% from its proceeds.

- Europe, Middle East and Africa - 13,85%. Operating margin of the geographical segment — 2,59% from its proceeds.

- Asian-Pacific area - 7,02%. Operating margin of the geographical segment — 7,05% from its proceeds.

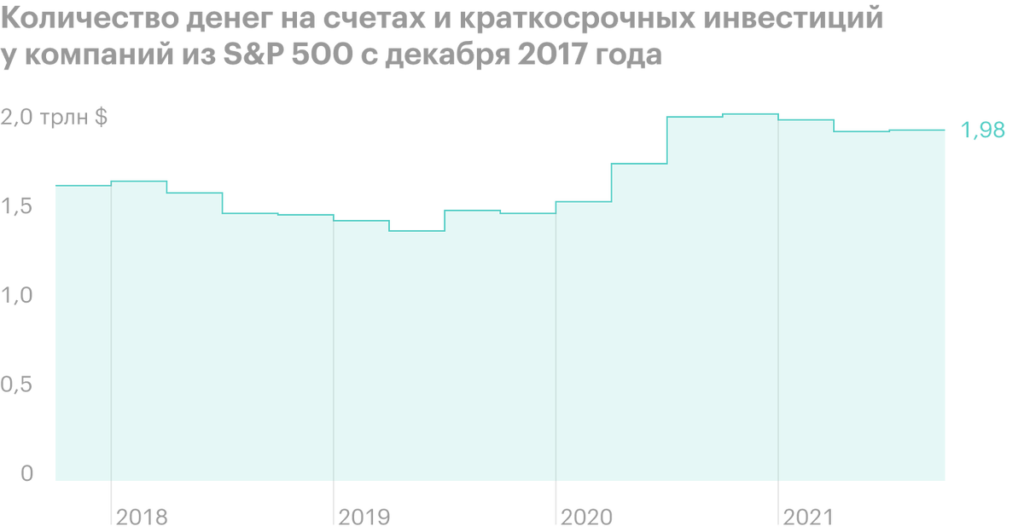

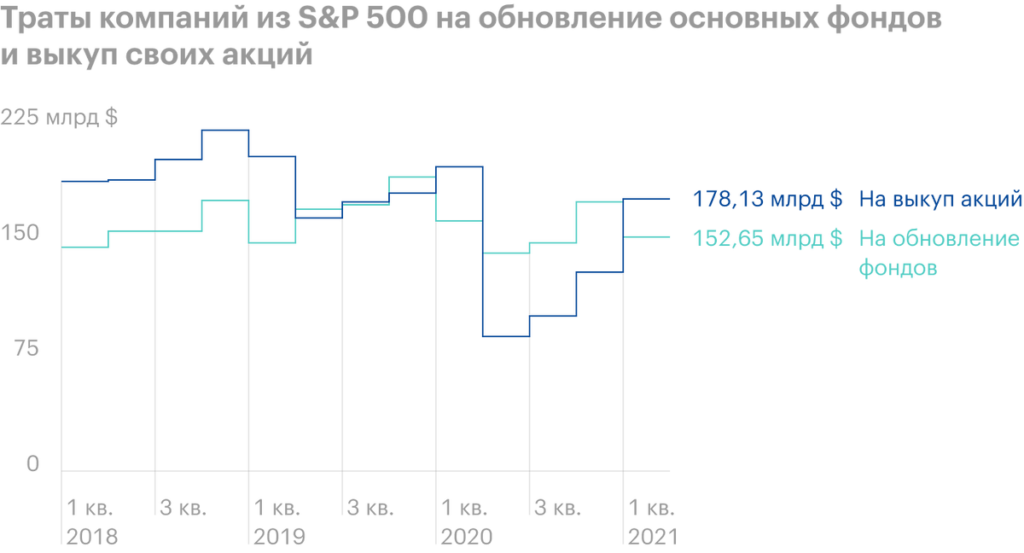

Arguments in favor of the company

An educated person differs from an uneducated person in the same way, like the living from the dead". American companies have saved up a lot of money, and they can and should be expected to increase investment in the renewal of fixed assets. In the idea for Cognizant, we have already said, that the main money companies invest in the development of their digital infrastructure. Moreover, these expenses, probably, the following will continue to grow 10 years. Insight will have to earn on this process.

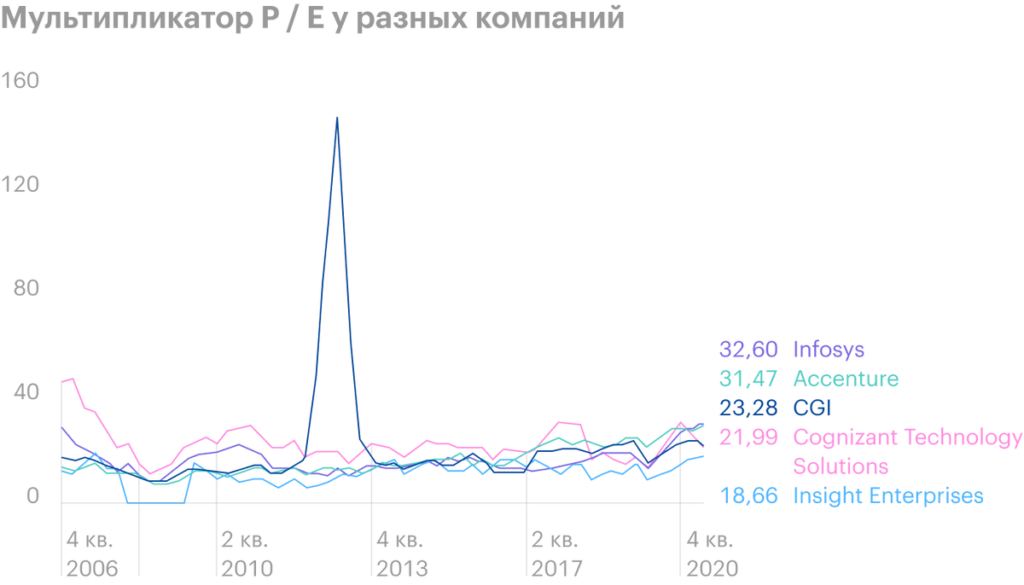

Inexpensive. Insight has a small cap of $3.31 billion and a small P / E — 17,73. From all companies, with which it can be compared, Insight is the cheapest. The likely scenario is, in which it will be bought by some Accenture or even the previously mentioned Cognizant. But even without a purchase, these shares are likely to grow from the influx of retail investors..

What can get in the way

Mediation and mediocrity. The financial result of Insight depends to a large extent on the circumstances, beyond its control. The main income comes from the resale of goods., which are produced by other companies. Logistic disruptions and semiconductor shortages could hurt its reporting this year.

The company's earnings will depend on its clients' investment plans this year.. These plans can be adjusted downwards, if the story with new strains of coronavirus leads to a new quarantine.

What's the bottom line?

We take shares now by 94,99 $. And then there are two options.:

- wait, when stocks exceed all-time highs and reach the level 108 $. Think, that here we will be able to achieve this goal in the following 13 Months;

- keep shares next 10 years.