Now we have a uniformly speculative thought: take shares of the online auction for the sale of used cars IAA (NYSE: IAA), to earn income by increasing the purchasing power of cars in the USA.

Growth potential and duration : twelve percent for 14 Months,10 % per annum for ten years.

Why stocks can go up: since in the USA the wild demand for cars.

How do we act: take shares at the moment 54,98 $.

No guarantees

And what is there with the author's forecasts

What the company makes money on

The name of the company stands for Insurance Auto Auction - insurance auto auction. IAA conducts car auctions, with whom the insured event occurred: tragedy, theft, etc.. Basically, this is an online platform, but the company also holds live auctions. How the company works, you can check it out on her youtube channel. The IAA makes funds on commissions from participating auctions for the implementation of certain services.

In accordance with the annual report of the company, the company's revenue is divided in the following way:

- Car buyers - approximately ⅔ of revenue. Repair shops, scrap metal dealers and dismantlers. For this category of clients, the company provides similar services., like auctions and assistance in finding car loans.

- Car dealers - approximately ⅓ of revenue. Insurance industry organizations, charity organisations, car dealers, leasing companies and companies, who rent cars. Apart from auctions, IAA provides them with management services, transportation and security of vehicles for sale.

More or less complete list of paid offers of the organization with their description can be viewed in the report.

Company segments by types:

- Services - 89,03%. IAA fees from participating auctions for all services rendered to them. Sector Gross Margin — 41,48 % from its proceeds.

- Implementations of machines − 10,97 %. The company's income from the sale of purchased vehicles. Sector Gross Margin — 17,53 % from its proceeds.

Company sales geography:

- USA - 87,73 %. Total Sector Margin — 14,56 % from its proceeds.

- The rest of the states 12,27 %. Total Sector Margin — 10,48 % from its proceeds.

Arguments in favor of the company

Because the conjuncture. The most powerful demand for cars does not slow down even the insane rise in prices - consumers are still willing to pay any money for any car. New cars are still not enough due to a shortage of semiconductors, so consumers buy cars in the secondary market.

In the case of the specifics of the IAA business, there are subtleties, but in general the situation for the company is now favorable. So you can expect an influx of buyers to the company's platform: in conditions of scarcity, it would be logical to expect, that car dealers will resurrect damaged cars or, in the worst case, take them apart.

But even outside of seasonal fluctuations in demand, IAA is a good option for the long term.. The average age of cars in the US was growing and before the recent shortage, because even without the coronacrisis, the situation for consumers in the United States was changing for the worse. Therefore, a used car is an opportunity to save money.. So the IAA can count on an influx of consumers for years to come as well., like auto parts dealers.

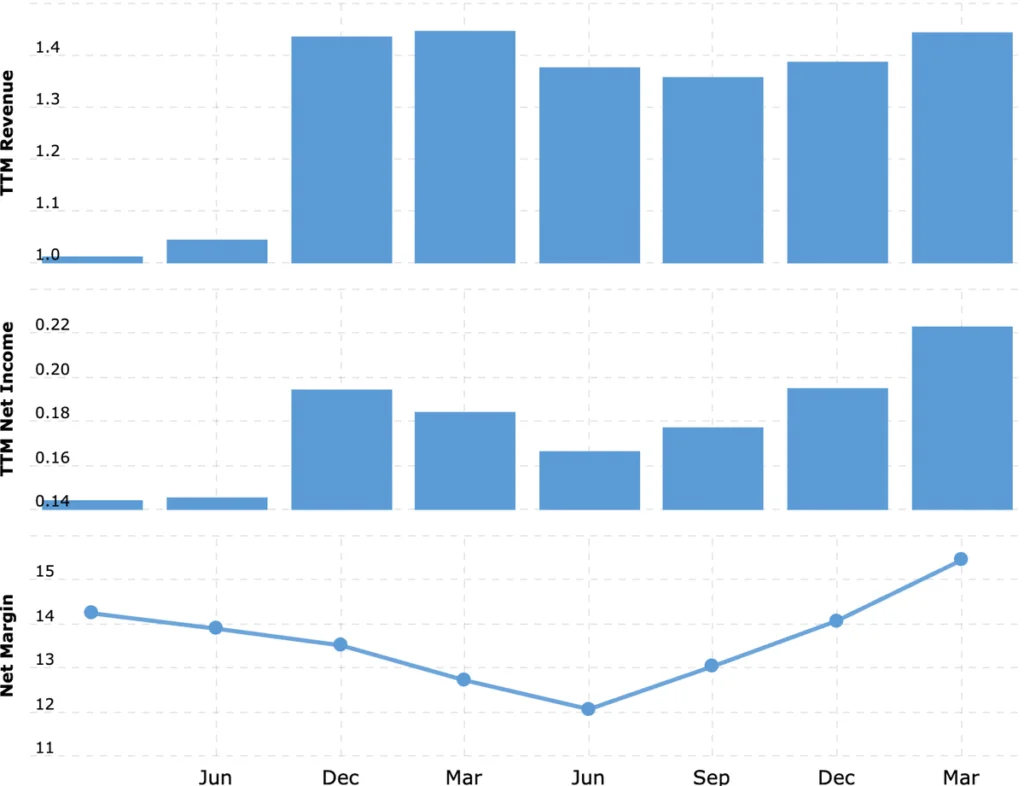

Also worth noticing here, that IAA is a rare example of successful digitalization of a predominantly offline industry: the company has greatly developed its digital platforms, which allowed her to squeeze out of her business unprecedented by the standards of a car dealership 15,45% final margin.

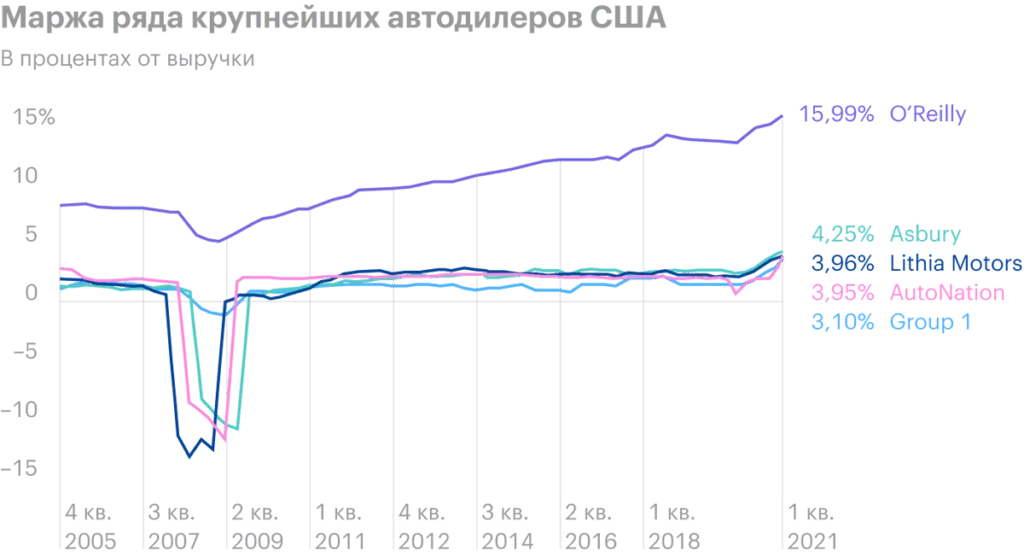

Because the car dealership business sucks.. If you have been with us for a long time, then, maybe, remember our analyzes of American car dealers: Asbury, AutoNation, Lithia Motors, O’Reilly Automotive и Group 1. There we pointed out the main features of their business.:

- "Syndrome Amazon». Low margin of the main business, which strongly drags down the result of the whole company. Here, perhaps O’Reilly stands apart with a high final margin of the entire company..

- High marginality of segments, which bring the least revenue.

In this regard, the scenario is very likely, in which IAA will be bought by one of the mentioned large companies, most likely O'Reilly. IAA business is strong and profitable, and the company itself is not worth very much in relative and absolute numbers: P / E 33.37 and capitalization of $ 7.41 billion.

What can get in the way

Concentration. According to company report, 40% of cars sold at the company's site are accounted for by three unnamed large insurance suppliers. Change of relationship with one of them can spoil the IAA reporting.

Heritage. Until the summer 2019 the company was a division of a similar company KAR Auction Services, and the allocation of IAA had several features.

IAA banned for 5 years, following the separation, compete with KAR in some segments of the car market. There are exceptions, but in these cases, IAA will have to share the proceeds with KAR. There are also restrictions on business expansion.. There was also a ban on the sale of the company, but this ban is about to expire or has already expired. This will slow down the growth of IAA's financial performance.

IAA during the separation made a tax maneuver, and the government may reconsider its decision on it. The American state is intensively developing extractive institutions: for example, the introduction of retroactive large taxes is being seriously discussed. There is a risk here, that a tax audit would “delight” the IAA with news of a large tax payment. In this case, the company will suffer losses, but, On the other hand, it will be a one-time loss. All this must be kept in mind.

Accounting. According to the latest report, IAA has a fairly large amount of debt: 294,1 USD million term and $2.189 billion non-term. The company has enough money now, to pay off urgent debts: 341,9 million on accounts and 366.9 million debts of counterparties. Such a large amount of debt will become a heavy burden for the company in the future., when it starts to expand, gaining the right to compete with KAR. But by then, the stakes will probably be much higher., than now, so servicing old and creating new loans for the company will become significantly more expensive. This problem is relevant for those, who will choose the path of a long-term investor.

It is not that simple. The company sells not just used cars, and cars, having been in an accident. That is, the activity on its site depends on the level of activity on the roads.: more activity - more accidents. IN 2020 traffic activity was lower due to coronavirus restrictions, which affected the company's sales not in the best way. From this, the "parent" KAR also suffered losses.

Traffic congestion in America and elsewhere is gradually returning to pre-pandemic levels, but new quarantines could ruin IAA sales. All in all, the lower America and the world are in The Economist's "Normalcy Index", the worse the IAA will be.

What's the bottom line?

We take shares now by 54,98 $. Next we have several options.:

- wait for the stock to rise to 62 $ - how much they asked for back in April this year;

- hold shares 10 years, to see, how the company will turn into Amazon from the world of broken clunkers. Well, over long distances, the possibility of buying a company by someone increases greatly.