Today we have a moderately speculative idea with a conservative touch: take shares of forklift manufacturer Hyster-Yale Materials Handling (NYSE: HY), to capitalize on the growth in demand for the company's products.

Growth potential and validity: 14% behind 14 Months; 50% for 5 years; 109% for 10 years. All excluding dividends.

Why stocks can go up: this business has prospects.

How do we act: we take shares now by 47,37 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark. As with the investment idea in general, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

HY designs and manufactures forklifts, also provides services in this area.. According to the annual report, The company's revenue is divided as follows:

- Forklifts — 76%.

- Spare parts - 14%.

- Services, rental of equipment — 5%.

- Bolzoni. Parts for forklifts — 5%.

What does the company's products look like?, can be viewed in her presentation.

The list of end users of the company's products is very wide: customers are in all industries. If you look at the company's forklift sales in North America, then the picture comes out as follows:

- Retail and LongEvity Products — 34%.

- Food & Drink — 18%.

- Industry - 28%.

- Logistics - 20%.

Revenue by country and region:

- USA - 58,34%.

- Europe, Middle East and Africa - 26,19%.

- Other countries and regions - 15,47%.

Arguments in favor of the company

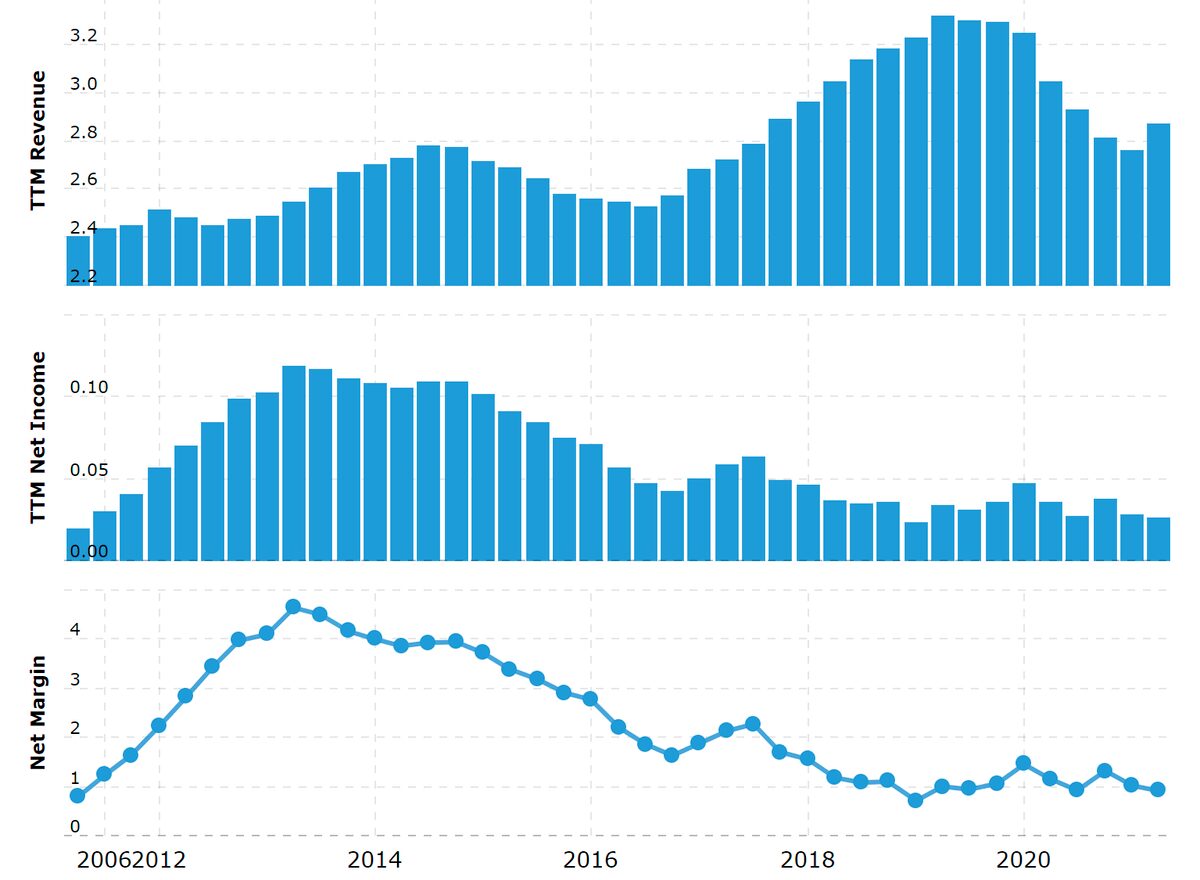

Cheap, must be taken! Price HY almost in 4 times lower than its annual revenue. And the shares fell in price in 2 since February amid investor concerns about the company's logistics costs.. The capitalization of HY is only 796.8 million dollars, so stocks can easily bounce simply because of investor speculation.

Oh, HY, Mark. It is quite possible to expect an increase in HY sales against the background of the restructuring of the US logistics sector. Companies in all industries will invest more in the development of their warehouses and the creation of storage systems for large volumes of goods. Part of the growth of e-commerce also plays a role here., but the main driver of HY's business growth will be a situation with constant logistical failures.. Now companies need to stock up on goods in large quantities, because they will not give you a ride on time and inexpensively.

Considering, that the U.S. will set records in retail trade this season of the November and December holidays, we can expect an increase in investment in warehouse equipment here and now. Probably, companies will not limit themselves to the 2021-2022 season only and will actively develop their storage capacities for at least several more years - with positive consequences for HY.

ESG. The company has a division of Nuvera Fuel Cells, which is engaged in the design and production of power supplies for hydrogen-powered vehicles. It is monstrously unprofitable.: final margin there −656% of revenue, — and gives direction only 0,13% company revenue. But hydrogen is considered the "ideologically correct" direction for investors., tuned to the progressive agenda. We assume, that it will add attractiveness to HY stocks. She also has 32% revenue accounts for electric forklifts. In sum, "environmental efforts" may well attract ethically concerned investors to HY shares., and this will be an additional plus in hy karma when accessing loans.

Wrecked. The company pays 1,29 $ dividend per share per year, what gives 2,72% per annum. It's almost in 2 times higher than the average for S&P 500 and in itself could attract a lot of fans of working money to the shares.. And this can greatly affect the value of HY shares..

Can buy. Taking into account all these advantages, the company may well be bought by someone larger. In its niche in terms of sales, HY ranks sixth in the world – it may well be bought., for example, Toyota. P / E HY is not very arrogant — 31, so I don't think so, that its cost will cause a potential buyer to have great doubts.

What can get in the way

Honey and chill. 44% the company's revenues are given by forklifts with internal combustion engines. In the long term, we can expect an increase in investor pressure on companies, producing or buying such equipment. Certainly, HY has a rag, to shake in front of the nose of the greens: hydrogen fuel and electric forklifts. But it's also possible., that the green-coiled corporate sector will begin to abandon conventional technology en masse, which will negatively affect HY reporting.

Beautiful far away. Now it is difficult to assess the prospects and progress of warehouse automation, but there is a very high probability, that over time forklifts, managed by humans, give way to automated forklifts. Maybe, and HY itself will begin to develop robot forklifts, but it will take a lot of time and money..

There are two classes... Company, just like unprofitable IT startups, there are two classes of shares – A and B: Class B gives 10 votes per share - against a vote per class A share. Most of the Class B shares belong to the family of descendants of the company's founder., which thus belongs to 72% company votes. These people may well make decisions., which will contradict the interests of minority shareholders. For example, descendants of the founder of HY may refuse to sell the company.

Double-edged sword. The company will suffer from logistical difficulties, rise in price of raw materials and labor costs. Its total margin is very small — 0,91% from proceeds. So it's very likely., that the company will have to fix a loss this quarter - or that the profit will be worse than investors' expectations.

Accounting. The company has a very large amount of debts: 1,361 billion dollars, of which 863.1 million will need to be repaid during the year. She doesn't have a lot of money at her disposal.: 87,5 million in accounts and 470.4 million counterparty debts, so, probably, debt burden will increase.

The company spends $ 21.4 million a year on dividends - approximately 71,3% of its profits over the past 12 months. Given the above-mentioned seasonal difficulties and simply the amount of debt, payouts can be cut, and this is, in its turn, will lead to a fall in shares. Also, a large debt will cause distrust of some investors in anticipation of raising rates.: taking into account the upcoming rise in price of loans, investors can bypass companies with large debts.

What's the bottom line?

We take shares now by 47,37 $. And then there are several options.:

- wait, when will the shares be worth 54 $. This is well below their historical highs., and thinking, that we will reach this level in the next 14 months;

- wait for growth to 71 $. Of this level we, probably, can achieve in the next 5 years;

- wait for the stock to rise to February highs in 99 $. Here it is better to count on 10 years.

But still look at the news section of the company's website: in order to have time to dump shares on the St. Petersburg Stock Exchange in case of cancellation or reduction of dividends before, how Russian investors will react to this news.