Now we have a very speculative thought: take the shares of the medtech startup GoodRx (Nasdaq: GDRX), to profit from the speculative growth of his shares.

Growth potential and duration : twenty nine percent for 19 Months; eighty one percent in four years.

Why stocks can go up: the spread of new varieties of coronavirus infection is able to make telemedicine and company prices more attractive.

How do we act: take shares at the moment 30,83 $.

No guarantees

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

And what is there with the author's forecasts

What the company makes money on

This is a place to compare US prescription drug prices and find discount coupons for these drugs. The site works with more than 70 thousand pharmacy points throughout the state. The search company provides users free of charge. How then GoodRx makes funds?

According to the registration brochure,94 % company revenue - commission, which she receives for the implementation of codes from her website when purchasing pharmaceuticals on the Internet resources of partner pharmacies. The other six percent of the company's revenue is various solutions in the field of medicine.

Paid subscriptions. Different types of medical insurance, in which the client, for a certain fee, gets access to prescription medicines at a reduced cost. Generally, services are provided by other organizations, and GoodRx receives a commission as an intermediary.

Solutions for pharmaceutical manufacturers. Here the company acts as an intermediary for pharmaceutical manufacturers, Making?? discounts on your products.

Telemedicine. The company has its own service of online consultations with doctors Heydoctor, as well as a web site for choosing doctors for consultations from other sites. In the first case, the company receives funds directly for the provision of services., in the 2nd - a commission as an intermediary.

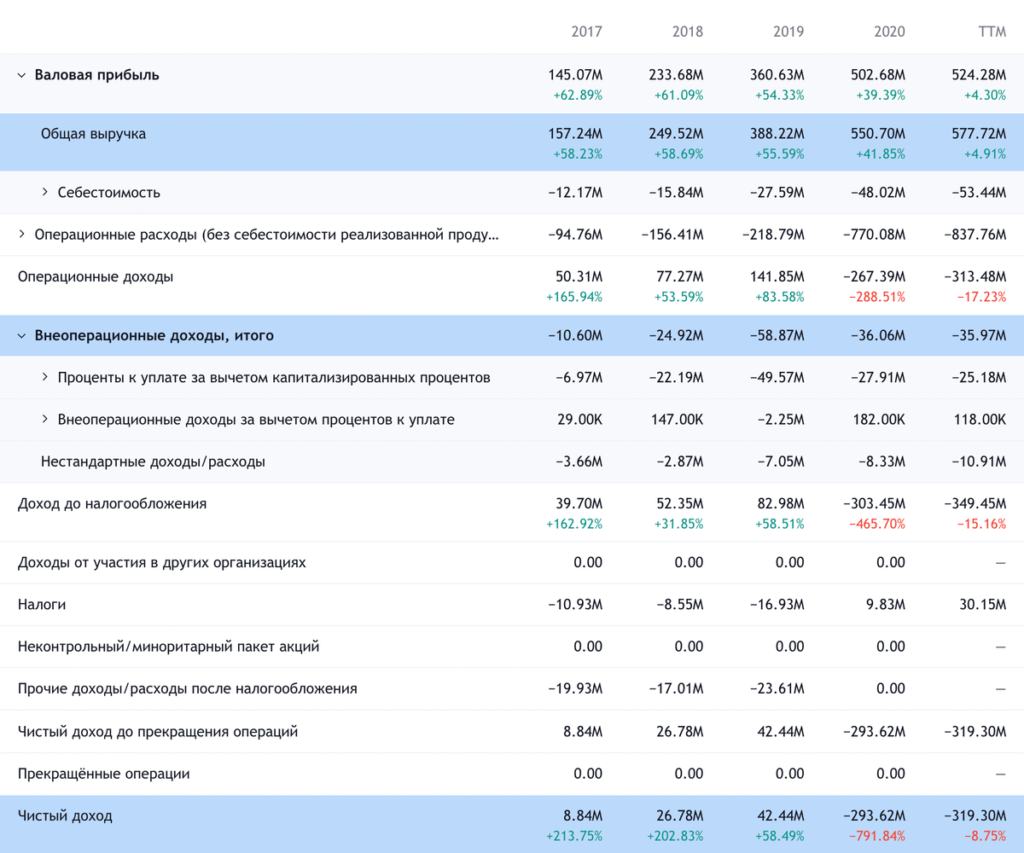

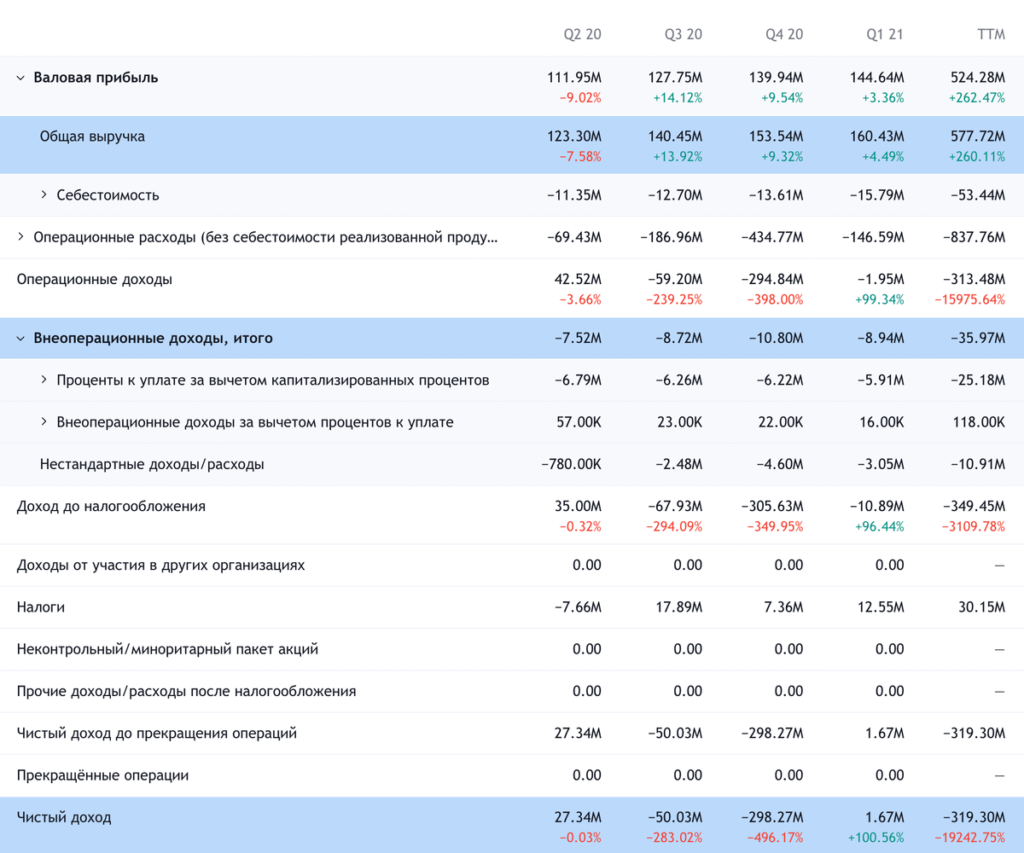

The company operates only in the USA. GoodRx unprofitable, but in principle, the situation with the profitability of the company is diverse.

Arguments in favor of the company

Aura of Perspective. Approximately $3.8 trillion a year is spent on public health care in the United States. GoodRx itself estimates the volume of its own market at 804 billion per year.: 524 billion - prescription pharmaceutical market, 250 billion - telemedicine and 30 billion - solutions for pharmaceutical companies. So from this point of view, its capitalization of $ 12.11 billion does not look superfluous.. Such numbers even predispose to the upcoming speculative growth on expectations, that the company will contribute to the digitalization of American healthcare. I've seen more crazy and baseless growth stories., and against this background, GoodRx looks quite impressive simply due to the presence of a large motivated market.

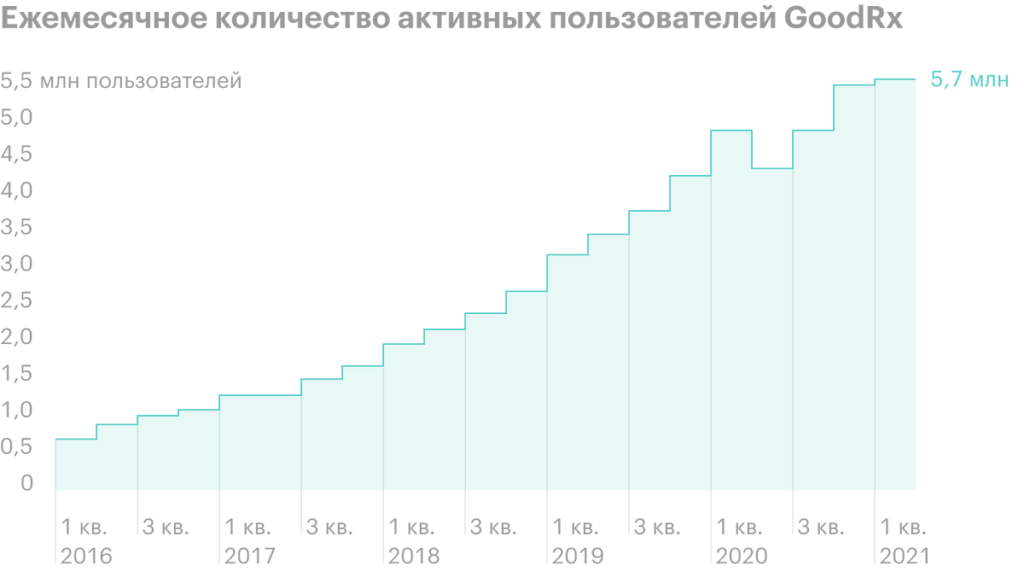

Necessity. In accordance with the prospectus,80 % operations with the introduction of company codes are given by its constant customers. The company's user base shows excellent promotion rates. And in general, there are completely serious prerequisites for this.

The cost of drugs in the US is growing too brazenly and quickly, and the pandemic taught Americans to save so much, as soon as possible. Think, in the future, they will try to save as much as possible - which will contribute to the growth in demand for GoodRx services.

How scary to live. Tantrum around the new, a more dangerous strain of coronavirus already led to a stock market crash earlier this week. There is a possibility, that in the wake of expectations of a new tough quarantine, investors will begin to speculatively invest in everything, which is at least minimally related to telemedicine. In fact, GoodRx is more about pharmacies and a long-term perspective, but I think, that most investors will not understand and pump up the company's quotes simply because, what medtech!».

What can get in the way

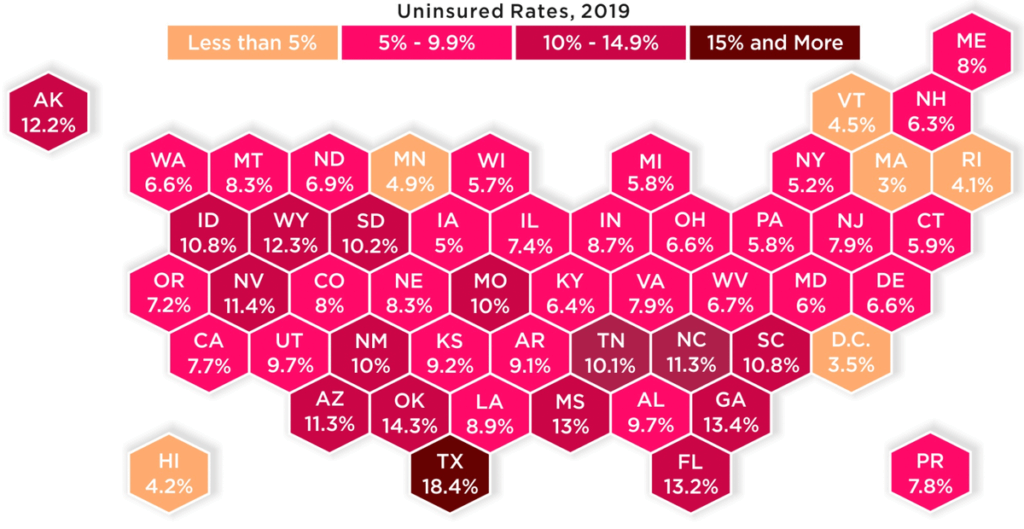

Not so promising. The main audience of the company is those, who do not have health insurance and who, respectively, the most pressing issue is the optimization of drug costs. And this is about 10% of the US population and only 5% from the prescription drug market. It's not so little, but not insanely much, which puts certain restrictions on the way of the company's revenue growth.

Over time, reporting will begin to disappoint investors, expecting startup growth rates, which will negatively affect prices. Outwardly, GoodRx seems like a cool breakthrough in the field of medical technology, but in fact - this is a fairly niche solution with a growth ceiling.

Concentration. For each of the three largest partners of the company: optum, Navitus и MedImpact, - according to the report, accounts for more than 10% GoodRx revenue. Changing relationships with one of them can negatively affect reporting..

When the smoke clears, there’ll be no more tears. Stock prices may jump seasonally on the topic of the popularity of telemedicine, but the coronavirus is more likely to harm the company's business, as a full quarantine reduces the activity of doctors, and patients and harms prescription. So the negative effect of potential quarantine should be considered., although the company is trying to balance it with the development of the telemedicine segment.

What's the bottom line?

We take shares now by 30,83 $. And then there are two options.:

- wait, when will the shares be worth 40 $, which is noticeably less than their historical maximum. Think, that this option will be achievable within the next 19 Months;

- wait, When will the company's shares be worth again? 56 $, like in february this year. Here, in my opinion, should be prepared to wait 4 years - during this time, GoodRx can turn into a giant of medical technology or someone will buy the company. But, given the unstable situation with her income, should be prepared for any outcome.

This idea is extremely speculative., what should be taken into account, if you decide to invest in these stocks. So don't invest in GoodRx, if you are not ready to tolerate volatility.