Today we have a very speculative idea: take promotions of the cloud service Five9 (NASDAQ: FIVN), in order to make money on the growth of these shares in view of that, that the company's management, seem to be, looks forward to a bright future.

Growth potential and validity: 24% behind 16 Months.

Why stocks can go up: not everything is so simple with the company and the deal with Zoom fell apart for a reason.

How do we act: we take shares now for 161 $.

How does the company earn Five9

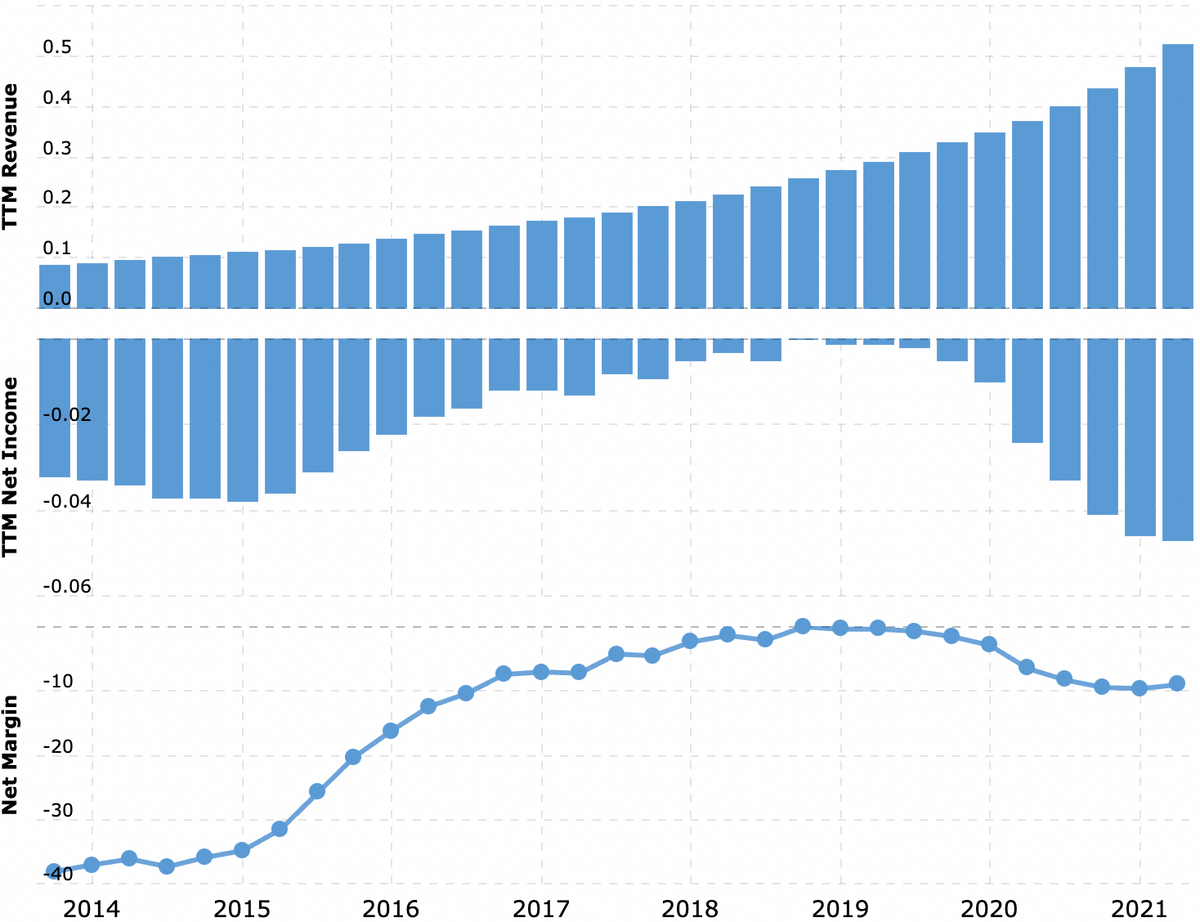

We have already published an idea for this company and analyzed its business there. Note only, that she is still unprofitable.

Arguments in favor of the company

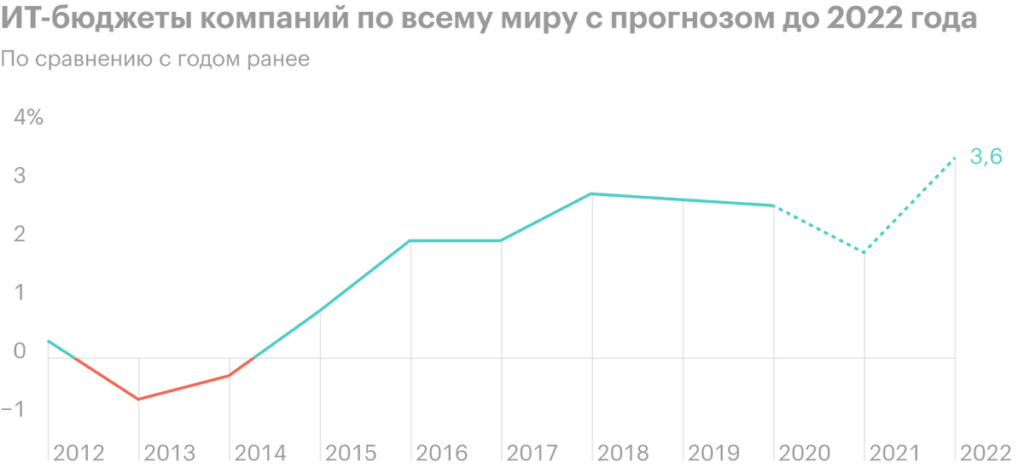

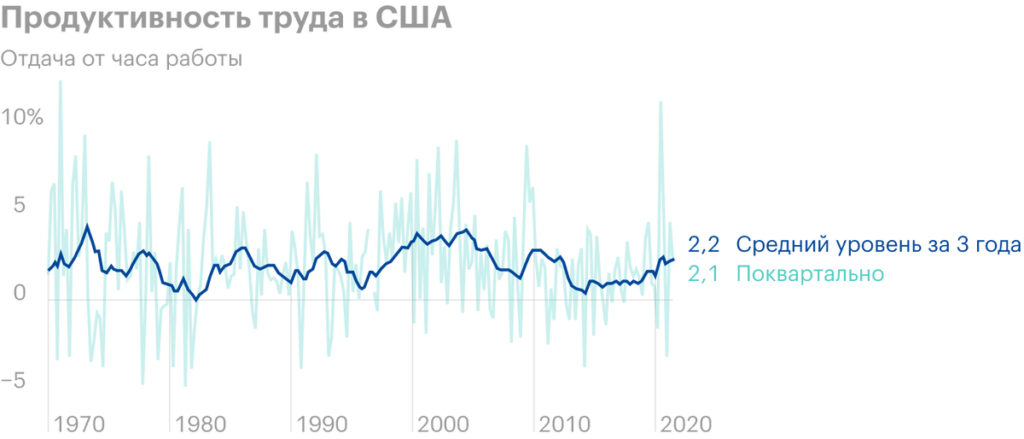

Season. The company has not yet exhausted its growth potential: corporate IT spending on the rise, while labor productivity stalls. Think, in such circumstances, Five9 can hope to increase orders due to the desire of customers to squeeze the maximum out of their available resources..

It's not even remote anymore., although this trend remains very strong, and in that, that companies are now maximally motivated to spend money on such software, to compensate for the damage from the lack of labor and its high cost. By the way,, Five9 adds speech recognition and voice bot services to its core cloud contact center business.

But the business environment here is nothing more than a support factor for Five9 shares.: the main driver of the idea is completely different.

Something outside the text. Five9 shareholders recently refused to sell it to Zoom at a premium 13% - this story is discussed in detail in the investment news. Zoom was preparing to fulfill the dream of all IT pros, which is, to shake off a loss-making IT enterprise to a large buyer, making money from it. There are two options for justified reasons for refusing a deal..

First option: Five9 management considers, that Five9's business is good enough to, to bring him and shareholders a good profit in the foreseeable future. This is a very likely option.. The official excuse for canceling the Zoom deal was, that the latter slows down growth. Well time "Zoom slows down", then Five9 guide, probably, considers, that Five9 will not “slow down”. And since this guide has access to non-public information, I dare to guess, that they can be trusted in this regard.

Second option: from the management of Five9, maybe, there is information about, that it will be able to sell the company to someone else at a price that satisfies the shareholders. This is a very likely scenario if, if Five9 was pressured by the American authorities because of the Chinese origin of Zoom. If Five9 refused to merge with Zoom "because of the Chinese", that is on 100% under pressure from the American establishment, there must be a verbal agreement, that Five9 will later buy "accredited", unquestionable investor from US authorities.

Finally, Hollywood for Chinese money is ready for any humiliation - did you ever think, why there are no chinese villains in the latest bond movies? - because the US government does not offer to compensate film studios for the lack of distribution in China. It is unlikely that the people at the head of Five9 are dumber than filmmakers. Probably Five9 refused to merge with Zoom, keeping in mind the possibility of someone else buying the company.

And most likely, both versions are equally correct - in this case, we can hope for the growth of Five9 shares. Because there is a high probability, that the Five9 management has some important information, which will contribute to the growth of quotes after the collapse of the deal with Zoom. For example, about that, that the growth rate of revenue will be even higher. Or that very soon the company will show profit. Or about, that Microsoft will buy it. This hypothesis, strictly speaking, the main argument in favor of these shares.

What can get in the way

Unprofitableness. The company is unprofitable, and this in itself guarantees the instability of its quotes. It is also worth noting the high volume of its debts - approximately 973 million dollars, out of which 139,4 million needs to be repaid within a year. There is enough money at the disposal of the company to close urgent debts: eat 175,199 million in accounts. But in general, its debt burden in an era of higher rates and more expensive loans will be a problem.. It can also scare off potential shareholders of the company.. And in general, with losses and large debts, there are always risks of bankruptcy..

And if everything is different. If my hypothesis about Five9's management cunning plan is wrong and there is no potential buyer or reporting miracles on the horizon, then it's trouble. Because without it, Five9 looks like an overvalued loss-making company..

The old investment idea worked, among other things, because, that the company had capitalization in 2 times less, than now, which made it easier for retail investors to pump it up. She's worth more now 10 billion dollars, so I wouldn't really hope for an influx of simpletons, which will help to quickly inflate quotes “because it is promising and remote”.

What's the bottom line?

We take shares now by 161 $ and we are waiting, when they cost 200 $, which roughly corresponds to the price, for which Zoom wanted to acquire them. Five9 management considers, that the company deserves more, - means, we can well count on the achievement of the shares of the specified level for the next 16 Months.

Think, during this time or Five9 will show itself from the best side, or she will draw a new buyer. It's too early to count on a higher price: unprofitable startups costing more 10 billion dollars seems very volatile to me.

But be aware, that this idea is very volatile and based on a hypothesis, the correctness of which has not yet been proven.