Today we have a very speculative idea: take shares in software maker Dun & Bradstreet Holdings (NYSE: DNB), in order to earn on the growth of orders from the company.

Growth potential and validity: 21% behind 14 Months; 47% behind 4 of the year; 11% per annum during 15 years.

Why stocks can go up: there will be a demand for the company's services, And stocks are cheaper, than they could.

How do we act: take now 19 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

DNB makes software for analytics and business data processing. According to the company's annual report, its revenue is divided as follows:

- Finance and Risk - 60,05%. Financial Decision Software, in particular the issuance of loans, procurement and audits for compliance with the law.

- Sales and marketing - 39,95%. Customer Service Decision Making Software.

How the company's software looks in action, You can watch it on her YouTube channel.

As a matter of fact, the entire business of the company operates on a subscription model.

Revenue by country and region:

- North America - 83%. USA gives 81% company revenue.

- Other, unnamed regions — 17%.

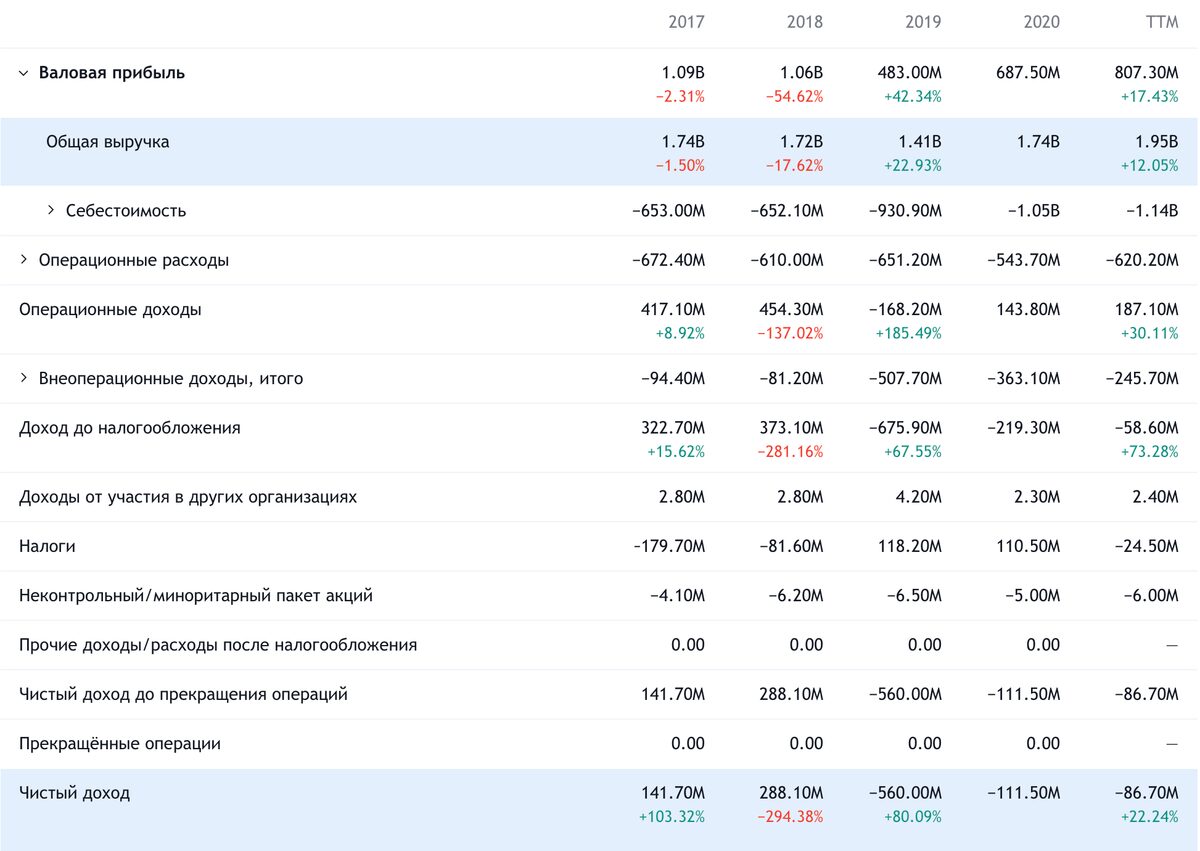

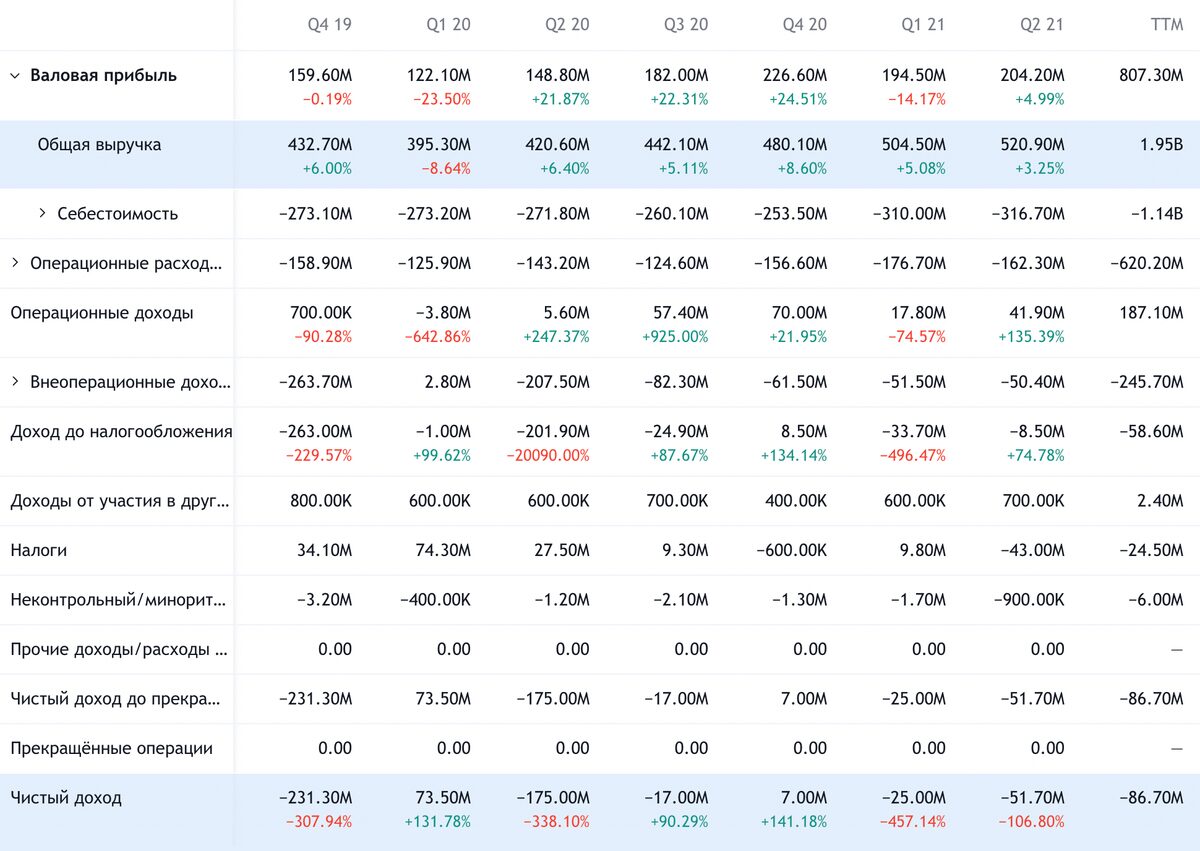

The company is unprofitable.

Arguments in favor of the company

Fell down. Compared to its historical maximum in 28 $ in October 2020, DNB shares fell by almost a third - to 19 $. Now the price has dropped even below that, for which the shares were sold during the IPO, — 22 $. And this allows us to hope for a rebound in shares - fortunately, there are prerequisites for this.

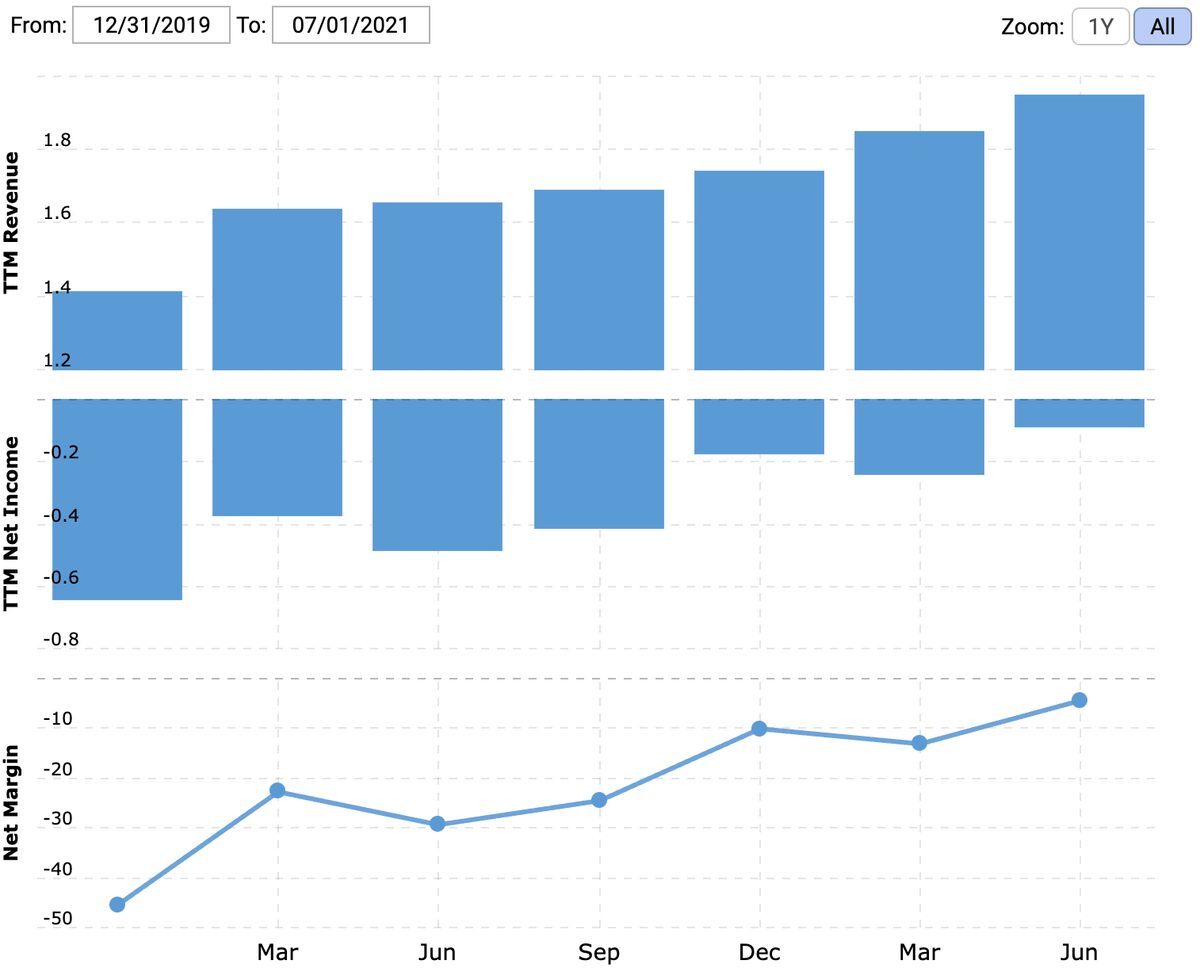

"On the path of correction and, maybe, cooperation with administration. If you expand the company's reporting in the form of a graph, its progress is clearly visible: there is not only revenue growth, but also to reduce losses.. Objectively, the company is now in much better shape., what it was a year ago, and at least for this reason, investors could mark its progress by pumping quotes.

Also noteworthy is the fact, that in the first half of 2021 the company reached operating profit, — what distinguishes it from other unprofitable IT companies, whose operating losses drag on for years. So that, it seems to me, quotes should bounce for at least this reason.

Diversification. None of the company's clients give more 5% proceeds. It's good, because it strengthens the negotiating position of the company and allows you to neutralize the negative effect of the departure of one of the clients.

Prospectively so and so. Today's enterprises need to process a huge amount of data when making decisions. The pandemic has boosted both the flow of data due to the forced digitalization of many businesses, and the need of the corporate sector to invest in software, which will help you get the most out of your available resources..

Considering, that many companies are now suffering from rising costs and shrinking margins, it seems to me, DNB software will be very, very in demand - which could lead to revenue growth. Also, the prospects of its direction can attract a lot of investors to the shares - although the company's capitalization in the region of $ 8.19 billion greatly darkens the prospects for pumping these shares.

Doesn't stand like an airplane wing. Company P / S in the area 4,2 - by the standards of the tech sector, this is rather modest.

Big guy for you. Investor Consortium, who took the company public in 2020, belongs to about 60,5% votes in the company. In theory, they can take action, which will not be in the interests of minority shareholders like us, - and this is a potential disadvantage.

But the consortium has little scope for oppression of minority shareholders within the limits of the current legislation.: its members, in fact, with us in the same boat and are extremely interested in, to increase the value of their investment.

Anyway good, that a controlling stake in the company is owned by non-founders, who sometimes do not worry about unprofitability, and investors, who want to earn, not "build an empire".

Can buy. Considering all the positives, the company may well be bought by some tech giant or just a large private fund. By the way, in 2018, the company was already bought with a premium to the then share price 18%, But today she looks much better.

According to the annual report, the company's revenue retention rate is 96% - the damage from unsubscribing is not very large. It is worse, how 100%, but for business, subscription, these are decent indicators. And considering, that the company is approaching payback, this will serve as an additional plus for a potential buyer: her business looks pretty stable.

What can get in the way

Consortium. Still, the collusion of large investors in theory could backfire on minority shareholders.. For example, consortium members may refuse to sell the company even with a premium 20% to its current price, if they decide, that you can try to bargain for better conditions, - it was, for example, with Five9.

This, certainly, purely hypothetical scenario. Some combinations with other investments of the consortium are much more likely - for example, DNB will provide services to a number of customers at cost or even at a loss. This is also a very hypothetical option., in this case, the consortium will actually steal from itself. But you should still keep in mind the possibility of negative news., associated with the consortium.

Startup troubles. Loss in the period, when everyone expects a rate hike FED and rise in the cost of loans, - this is bad. DNB has a huge amount of debt: 6,211 billion dollars, of which 972.9 million must be repaid during the year. Not a lot of money at the disposal of DNB: 177,6 mln on accounts and 322.5 mln counterparties' debts. So it is very likely, that DNB will have to borrow more money or even the company will be engaged in an additional issue of new shares, which can negatively affect quotes.

Losing stocks are, by definition, volatile, and bankruptcy is always near. A large debt of DNB will scare away some investors. Maybe, debt is already scaring them off - which will impede the growth of quotations.

What's the bottom line?

We take shares now by 19 $. And then there are three options.:

- wait for the stock to rise to 23 $. This is a rather modest goal., considering all of the above. So I think, what is this level we will reach for 14 Months;

- keep stocks up to all-time high 28 $. Think, here you have to wait 4 of the year;

- hold shares 15 years, to see, how the company will become Adobe from the world of business intelligence.

But still remember, that this idea is very volatile. So if you're not ready for that, that stocks will "storm", then forget about DNB.