Now we have a uniformly speculative thought: take ACI Worldwide (Nasdaq: ACIW), producing software for electronic payments, to get income on a positive situation.

Growth potential and duration : thirteen percent for 14 Months; ten percent a year for fifteen years.

Why stocks can go up: cashless payments are the future.

How do we act: we take at the moment 37,05

How does ACI Worldwide make money?

The company provides services in the field of electronic payments. According to company report, revenue is divided into subsequent segments:

- Access to the cloudy site of the company by subscription - sixty percent.

- Licenses — nineteen percent. Purchase of the right to implement the company's software for a long time.

- Technical support - sixteen percent. Different service tariff plans.

- Services - five percent. Services for installation and modification of own software at customer enterprises, also advising, education and testing.

In addition, the structure of the company's revenue can also be looked at in the context of the types of services provided., to see, what type of service is more profitable for her:

- Access to the company's software upon request - 59,42 %. Services, which the company provides to banks, merchants and those, who invoices on time, when they make payment transactions. This is practically a cloudy sector.. Sector Adjusted EBITDA — 19,45 %.

- Access to software at customer sites — 40,58 %. Revenue from those customers, who uses ACI software on their own servers or servers of third parties. The company provides customers with the ability to control ACI software without the help of others. Sector Adjusted EBITDA — 59,37 % from its proceeds.

You can also look at the company's revenue by type of customer, to realize, which of them is more profitable for her:

- They, who issues the invoice, — 45,31 %. Companies, who work in the field of consumer money, Insurance, health care, higher education, Housing and communal services, cabinet and mortgage lending. Sector Adjusted EBITDA — 23,04% from its proceeds.

- Merchants - 11,5 %. Personal sellers of products and services. Sector Adjusted EBITDA — 35,57 % from its proceeds.

- Banks — 43,19 %. Sector Adjusted EBITDA — 59,37 % from its proceeds.

Revenue by state and region:

- USA - 64,16 %.

- The rest of the states of the Americas 5,64 %.

- Europe, Middle East and Africa - 22,65 %.

- Asian-Pacific area - 7,55 %.

Arguments in favor of the company

This is fintech. The industry specificity of a company already means strategic, and tactical advantages for ACI.

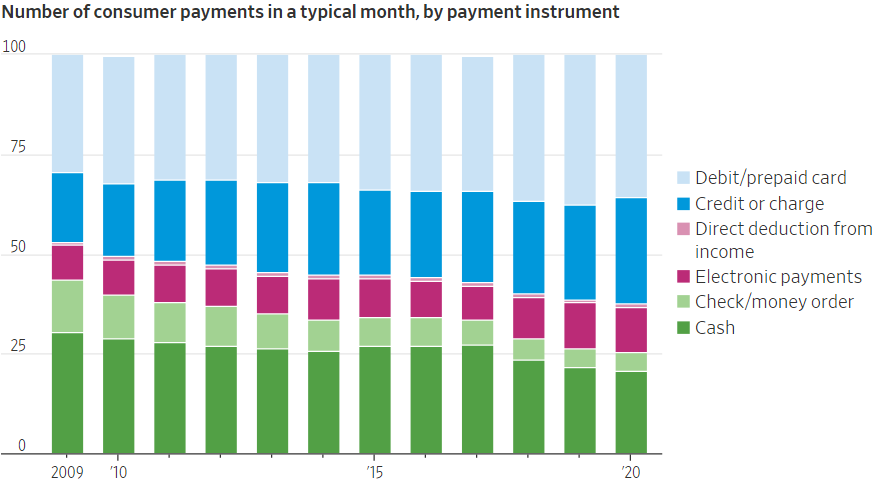

The first is the global economic environment.: cash payments are gradually being replaced by non-cash payments. The pandemic has accelerated this process, but all these trends were before the coronacrisis. So with ACI you are "on the winning side of history".

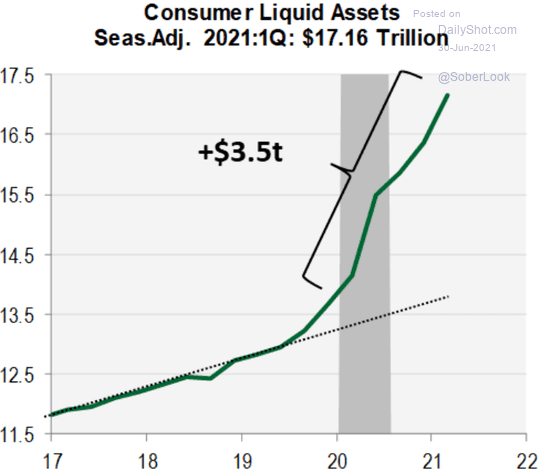

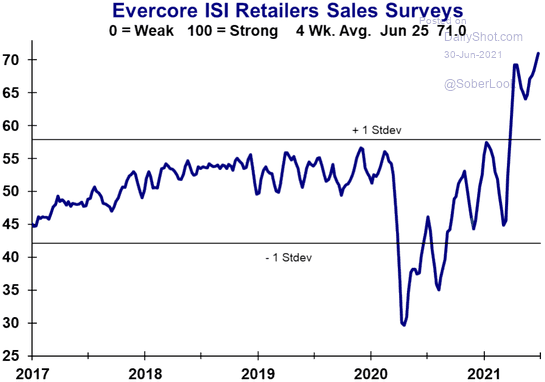

What about tactical advantages?, Now in the US, you can see a rare combination of rising consumer confidence and funds available to them, along with positive signals from retailers.. Therefore, it is possible to expect an increase in the volume of payments in America in the next six months.. Well, the more payments - the more work and revenue from ACI.

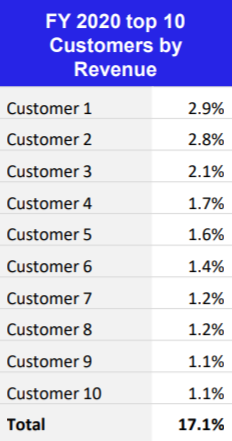

No scary concentration. According to company report, none of the clients give her more 10% proceeds. The ten largest clients of the company give it only 17,1% proceeds, the largest of these ten accounts for 2,9%, and for the smallest 1,1%. It's good: the loss of one of the major clients will not greatly spoil the overall picture.

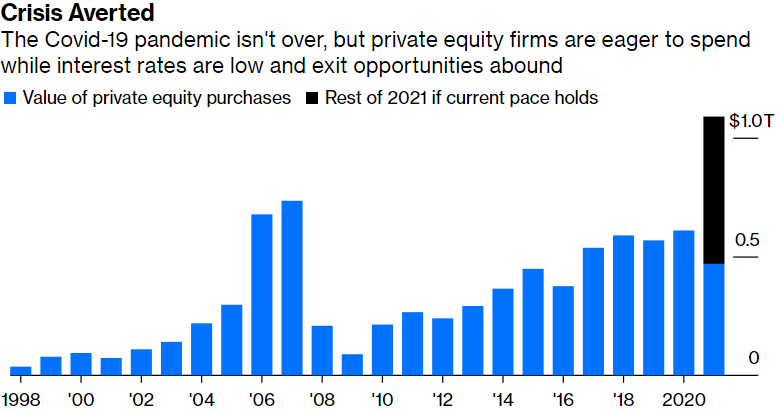

"You are a little fish, What ». Now private funds are buying up companies in large quantities.. ACI doesn't look like a bad buy for any fund for a number of reasons.. Fintech is a promising industry, and the company's business pleases with reliability. Renewable sources of income from subscriptions and renewable contracts provide 87% proceeds, what makes the company's business predictable.

The company does not have the smallest P / E — 46,28, but it doesn't compare to Paymentus price, in which P / E is in the hundreds. In absolute terms, ACI doesn't cost much either.: capitalization - 4,38 billion dollars. Buying a company by someone at the highest price possible will be a drop in the ocean of mergers and acquisitions this year, when the total volume of transactions is 470,1 billion dollars.

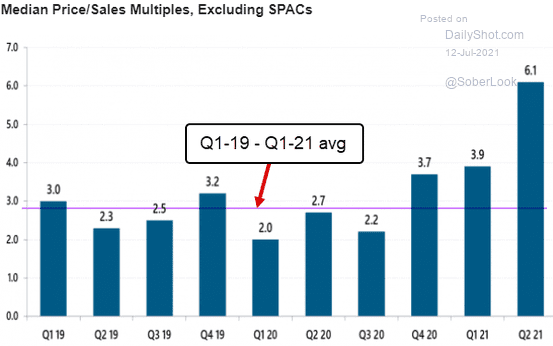

It is also worth considering, that the average P / S in the course of mergers and acquisitions in the United States is 6,1, it is much more, than ACI - 3,38. So the company on the general background looks relatively inexpensive..

What can get in the way

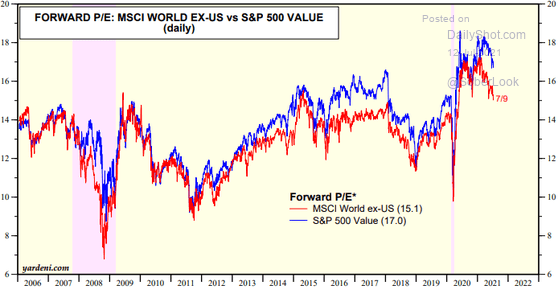

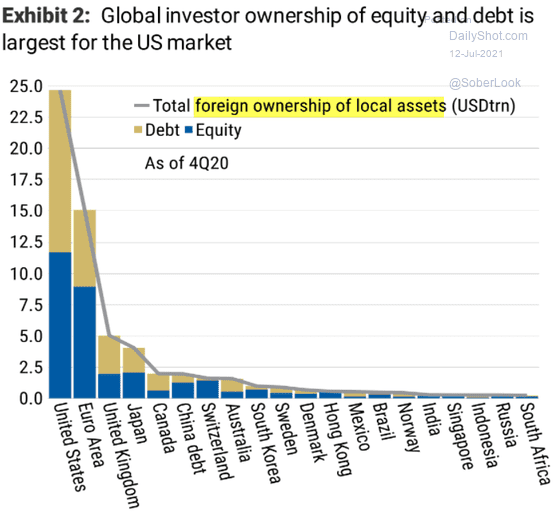

Correction. American stock market rode hard ahead at the price, when compared with other countries. This may lead to correction. The relative high cost is noticeable to everyone, and the share of foreign investors in the US securities market is very large. Investors can get very sensitive about this relative high cost and have a sell-off. In the event of a correction, the ACI may fall dramatically, since the company is still not cheap and is trading near historical highs.

Debts. The company has a fairly large amount of long-term debt: 1,097 billion dollars and 250 million in arrears, to be repaid within a year. She doesn't have much money.: 184,364 million in accounts and 280,386 mln of counterparties' debts. The situation is not dire, but in the current position the company depends on the availability and cheapness of loans. Given the upcoming rate hike, this is not very good.. This should also be taken into account due to the high probability of spending by ACI itself on the acquisition of small fintech startups.: they are very expensive and the cost of acquiring them will be an additional burden for the accounting department.

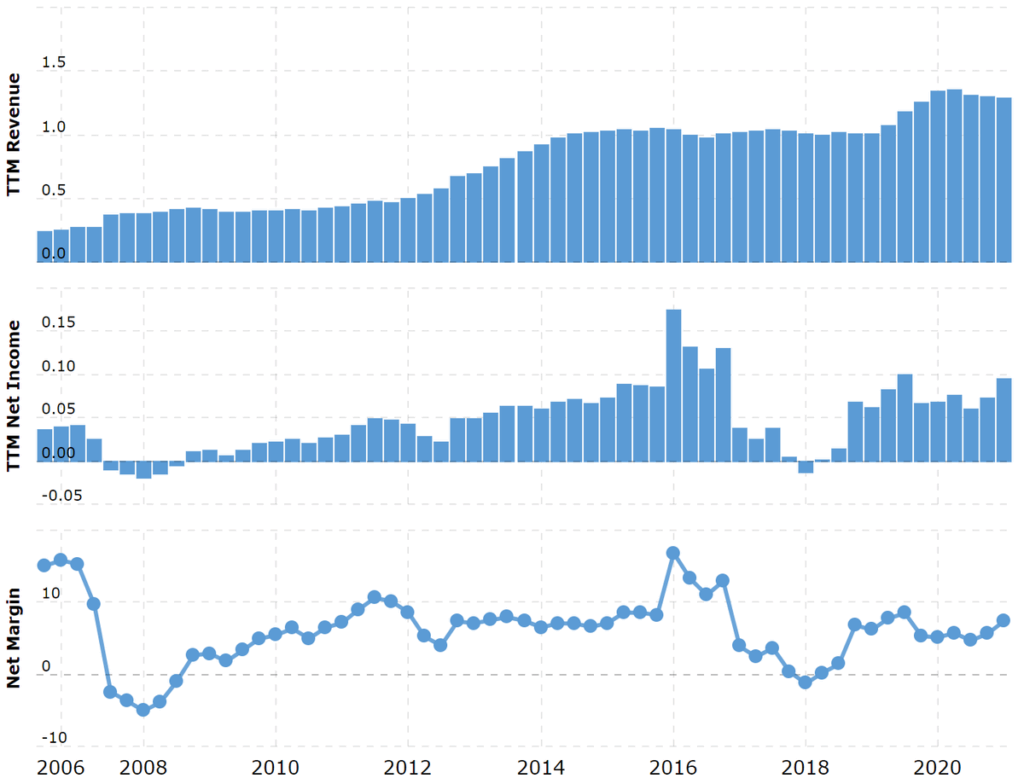

Coronavirus is a problem. The spread of new strains of coronavirus and the likelihood of a new quarantine with a drop in payment activity will have a bad effect on the company's reporting. Actually, it could be observed in 2020 year: see the dynamics of revenue and profit.

What's the bottom line?

We take shares now by 37,05 $. And then there are two options:

- wait, when will the shares start to cost 42 $ - just below historical highs. Taking into account all the positive aspects of this level, we will be able to achieve in the following 14 Months;

- keep shares in sorrow and joy next 15 years, to see, as fintech bypasses everything.