We now have an extremely speculative thought on the verge of a foul: take a distance education platform Coursera (NYSE: COURT), to earn income on the hype in this area.

Growth potential and duration : twenty three percent for 16 Months; ten percent per annum for ten years.

Why stocks can go up: so that the topic is popular.

How do we act: we take at the moment 34,80 $.

The idea was suggested by our reader Alex Freeman in the comments to the news. Suggest your thoughts in comments.

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

Analysis, for example this and this, testify to, that the accuracy of the prophecies of motivated prices is not great. And it's acceptable: there are always a lot of surprises on the stock exchange and clear forecasts are rarely realized. If the state of affairs were reversed, then funds based on computer algorithms would perform better than humans, but no matter how annoying it may sound, they work worse.

What the company makes money on

Judging by the number of materials on the Internet resource, you have probably heard about this project. However, for those, who is not aware, tell separately. This is a platform for distance learning., which produces various courses. The company's revenue is divided into subsequent segments.

Users — 65,62 % proceeds. In this sector, personal users learn on their own through various courses and projects. User pays Coursera, and the site itself pays a partner - the creator of information for completing the course. The sector's gross margin is fifty-five percent of its revenue.

Companies — 26,17 % proceeds. This is access to courses for institutional clients based on a subscription model.. Here, Coursera's customers are the corporate sector., as well as educational institutions. They pay Coursera for employees to take courses, and Coursera itself pays the creator of information for each student. The sector's gross margin is sixty-nine percent of its revenue.

Diplomas — 8,21 % proceeds. These are training programs, undergraduate and graduate, which were created together with full-fledged universities, upon completion of which students receive a real diploma. The gross margin of the sector is one hundred percent of its revenue.

This highest margin here comes from, what, unlike the first 2 parts, Coursera has no information production cost here. All appropriate expenses are on the Institute's shoulders, who pays Coursera funds for the implementation of its platform: percentage of the tuition price, paying student.

The company is now unprofitable - its final margin is approximately -22% of revenue.

Revenue by region and country

| USA | 48,77 % |

| Europe, Middle East and Africa | 28,24 % |

| Asian-Pacific area | fifteen percent |

| Other states | 7,99 % |

Revenue and profit of the company by years, million dollars

| Revenue | Unsullied income | Margin | |

|---|---|---|---|

| 2019 | 184,41 | −46,72 | −25,33 % |

| 2020 | 293,51 | −66,81 | −22,76 % |

| Revenue | Net income | Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 73,73 | −13,92 | −18,87% |

| 3 neighborhood 2020 | 82,67 | −11,87 | −14,35% |

| 4 neighborhood 2020 | 83,26 | −26,72 | −32,09% |

| 1 neighborhood 2021 | 88,36 | −18,66 | −21,12% |

Arguments in favor of Coursera

Something about online education. The company is among the enterprises, who are dealing with a very promising topic of online education. In ideas by Chegg, 2In and Stride, nee K12, we discussed this subject in great detail., so we won't repeat ourselves here..

The market for higher education in the world is about 2 trillion dollars and remains relatively unaffected by digitalization, although the pandemic forced universities to start moving in this direction.

During the next 10 years in the world 1,3 billion people will reach working age. Even if a small part of them decide to take up their education, this will significantly expand the current user base of the company in 82 million people. Coursera has a fairly recognizable and strong brand., and I think, that the company will get enough attention from potential applicants.

It is worth adding also, that the company has a capitalization in the region 4,7 billion dollars. This greatly increases the likelihood, that stocks will be pumped up by investors in the wake of the popularity of online education.

Good report. The company went public 31 Martha, and her first quarterly report showed an excellent result: revenue growth in the consumer segment by 61%, among enterprises 63% and in the diploma segment 81%. The result was generally not noted by the market, because it was within expectations, but I believe, that the company can expect good growth rates in the future. This will lead to an increase in quotes sooner or later., especially now the company is not much more expensive 33 $ - IPO prices.

The likelihood of buying a company is very high. According to the company registration prospectus, 25% companies from Fortune 500 are her clients. Some of them may well buy Coursera, seeing the development potential of online education. It could very well be Microsoft - obviously, that the management of Bill Gates' company is eager to buy up unprofitable startups, so buying Coursera would be quite in line with their logic. But in general, anyone can be a buyer of Coursera, for example some cool large university.

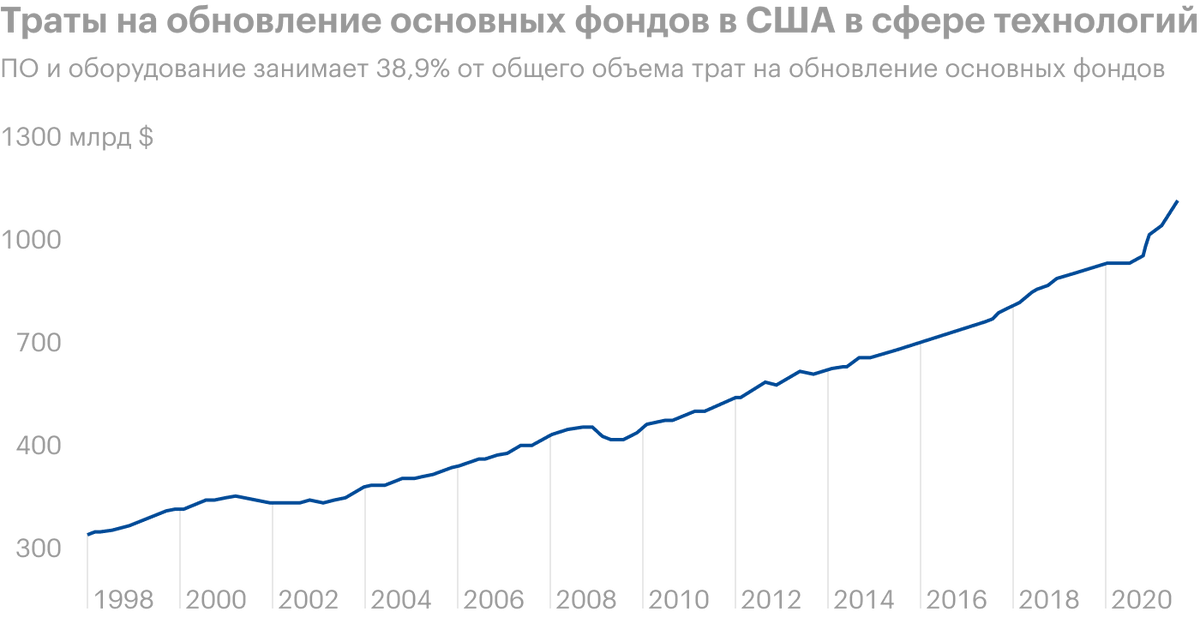

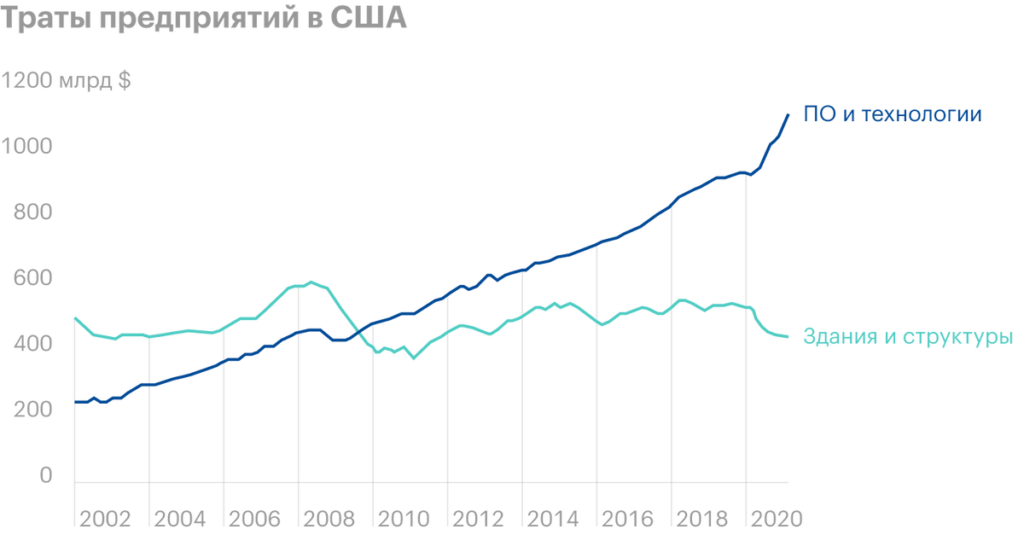

Mergers and acquisitions are booming in the US market, and spending on software and technology dominates the structure of US companies' spending on updating fixed assets of companies.

In favor of buying Coursera says that, that the company's revenue retention rate is 114%: from the existing customer base it turns out to extract so much revenue, that this covers losses from the departure of some customers. This means, that the new owners can safely reduce the cost of promotion and management of the company, leaving only those, who will work directly on the product. From this point of view, Coursera can be quite profitable..

What can get in the way of Coursera

Or maybe, and cannot. At one time we had an overview of the online education platform Pluralsight, where we also counted on the purchase of the company by someone larger. Finally bought it, but only after, how stocks fell, and the final sale price was not very high. As we have already told in Investnik, this story ended rather well for the shareholders of the company, but before that we were pretty nervous. Coursera can also be bought after a strong drawdown - and this will not be good for us, as we will be taking shares now.

Labor cost. In the IT field, the topic of organized collective action of workers is becoming more and more popular.. AND, it seems to me, Coursera may suffer here even more than any Microsoft: a content producer strike, modeled on the writers' strikes in Hollywood, could negatively impact its reporting. As you have seen above, the company has a fairly high gross margin, and its partners, curriculum development, may well ask for a larger piece of the pie, what they have now. This theoretical threat, but still worth keeping in mind.

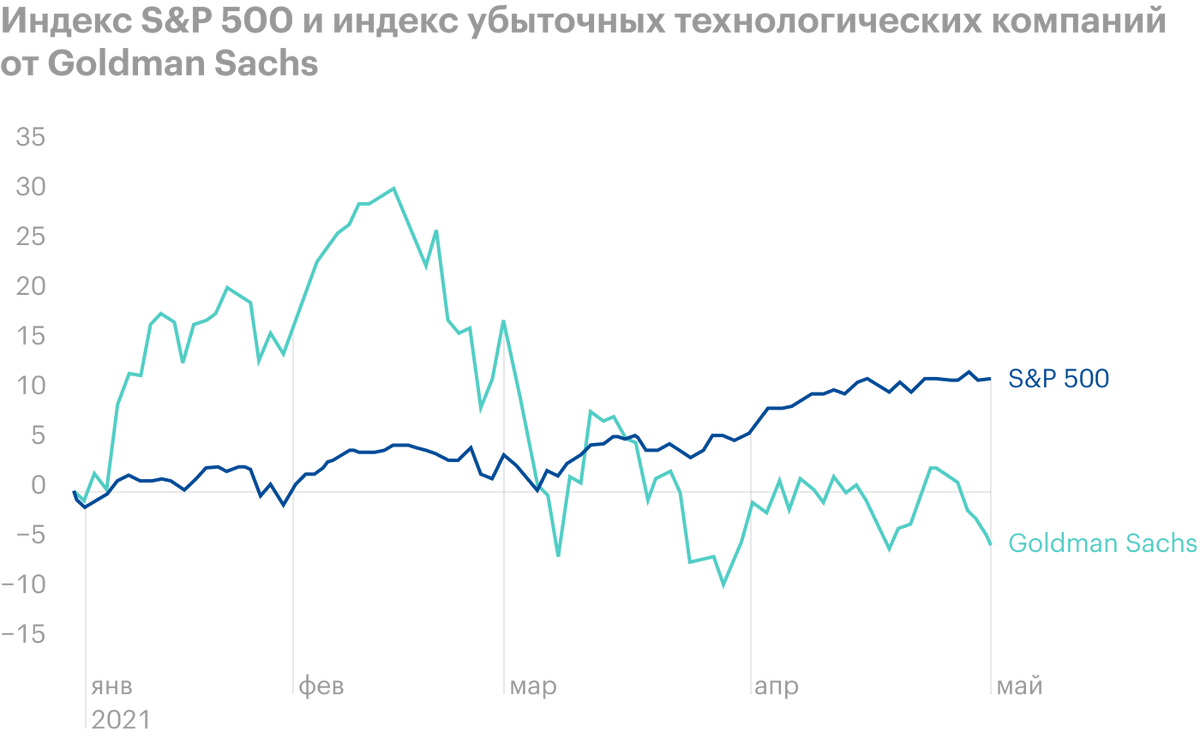

Human factor. I have always thought that most investors are greedy and not always farsighted.. However, lately, the stocks of unprofitable technology companies have performed much worse than the market.. Basically, there is nothing unusual about it: unprofitable companies are a priori volatile. But still, Coursera shares, as a non-profitable technology company, are at risk here..

What's the bottom line with Coursera

You can take shares now by 34,80 $. And then there are two options.:

- End, when will the shares be worth 43 $, which is much less than the historical maximum 58 $, achieved in April. Think, that in connection with all the positive factors mentioned above, we can wait for this in the next 16 Months.

- Hold 10 years, to see, How will the company become Google from the world of online education or go bankrupt and sink into oblivion.

But, considering the unprofitableness of the company, you should be prepared for the high volatility of these shares, and the possibility of a bad outcome for shareholders, as in the Pluralsight case mentioned above.