Today we have an extremely speculative idea.: take cloud service Box (NYSE: BOX), to capitalize on the growth in this sector.

Growth potential and validity: 27% behind 16 Months; 12% per year for 10 years.

Why stocks can go up: the company is now in the best shape in its history, but it hasn't affected the quotes yet..

How do we act: we take shares now by 22 $.

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

What the company makes money on

It is a cloud-based content management platform, which includes business process management software, application development and data protection. How it works, can be read in the company's report, but much better to see video Box.

The company has paid and free versions of its service - actually, 80% of all Box users are lovers of free service. According to the company's presentation, her revenue is structured as follows.

Subscriptions — 97% from proceeds. This is access to software and the provision of additional services for a fixed regular fee..

Services — 3% from proceeds. These are project management services and consulting.

U.S. brings 71%, and the rest 29% - unnamed other countries. The company's clients come from a variety of industries.

Arguments in favor of the company

The Illusion of Perspective. Like New Relic and Appian, the company operates in the field of cloud computing and for this reason alone can count on high growth rates of revenue and key business indicators. Data consumption and online transactions are vital to today's economy, and the share of relevant services in business processes will only grow, what we talked about in the article about the Lumentum manufacturing plant. Given the extremely small capitalization of Box - 3,52 billion dollars, - the company's shares can easily be pumped up by a crowd of investors, believing in, that "this is promising!».

Looks cute. Looking at the company's financial performance in retrospect, then you can see a loss-making startup, who strives for profit. The moment of profit seems very close - this should attract the attention of shareholders.

The valuation of the company does not look too arrogant: with target market capacity 55 billion dollars and small capitalization seems, that the company is still ahead. Box's share of this market is 1,41%, and it costs like 6,36% market. At first glance, this seems disproportionate., but against the background of some other companies, this is a very, very moderate assessment. The same Appian has a total market share 0,81%, and capitalization 30% market.

Non enim pullos suscitavit matris aquilae. The company's major competitors are Microsoft, Google и OpenText, and this creates the possibility of buying Box by one of them. Moreover,, according to the report, Box's revenue retention rate is 102% - from the existing client base it turns out to extract enough revenue, to compensate for user churn.

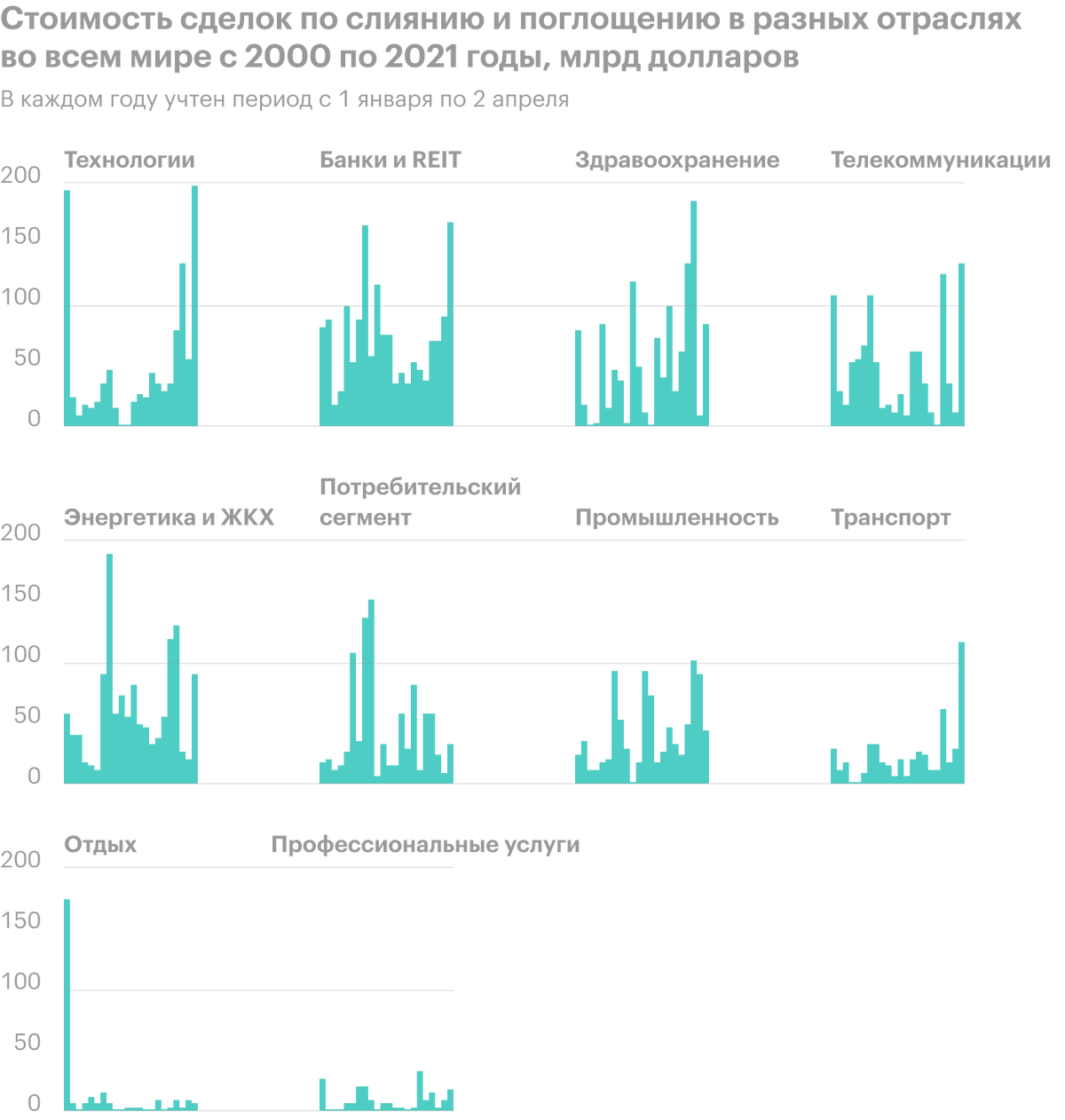

If you consider the subscription nature of the Box business, this fact allows you to seriously optimize the company after the purchase and make it profitable - by reducing the technical, who does not work directly on the product. Considering, that insane billions are spent buying tech companies every year, buying Box here will be just a drop in the ocean. The fact of competition with large companies is a plus, because big companies have money to buy Box.

What can get in the way

Unprofitableness. Since the company is unprofitable, it is guaranteed volatility of quotes. All this does not greatly contribute to increasing the attractiveness of the company in the eyes of a potential buyer..

Competitors. That, that large companies provide similar solutions, can play against Box: the same Microsoft can afford to make discounts and squeeze Box out of the market, to bring it almost to bankruptcy and buy it much cheaper than the current price.

What's the bottom line?

Shares can be taken now for 22 $, then there are two options:

- Considering, that the company, in terms of its business performance, is in the best shape in its history, investors will have to notice this sooner or later.. So that, I think, it will not be a big impudence to expect quotes to return to historical highs 28 $, already achieved in 2018 year. Think, we can expect this result in the next 16 Months;

- keep shares next 10 years in sorrow and joy in the hope of greater growth.

In any case, this idea is very speculative., so you need to be prepared for volatility. As Isocrates said in such cases, "do not reproach anyone with failure, for fate rules over all and the future is unknown.”.