Today we have a moderately speculative idea.: take stock of defense company Huntington Ingalls Industries (NYSE: HII), to capitalize on rising tensions between the US and China.

Growth potential and validity: 14,5% excluding dividends for 16 Months; 43% during 4 years excluding dividends; 9% per year for 14 years including dividends.

Why stocks can go up: the situation is always good for the company, and especially now.

How do we act: we take shares now by 193,63 $.

A detailed analysis of the company's business is already in T—J, so let's not repeat ourselves.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

Arguments in favor of the company

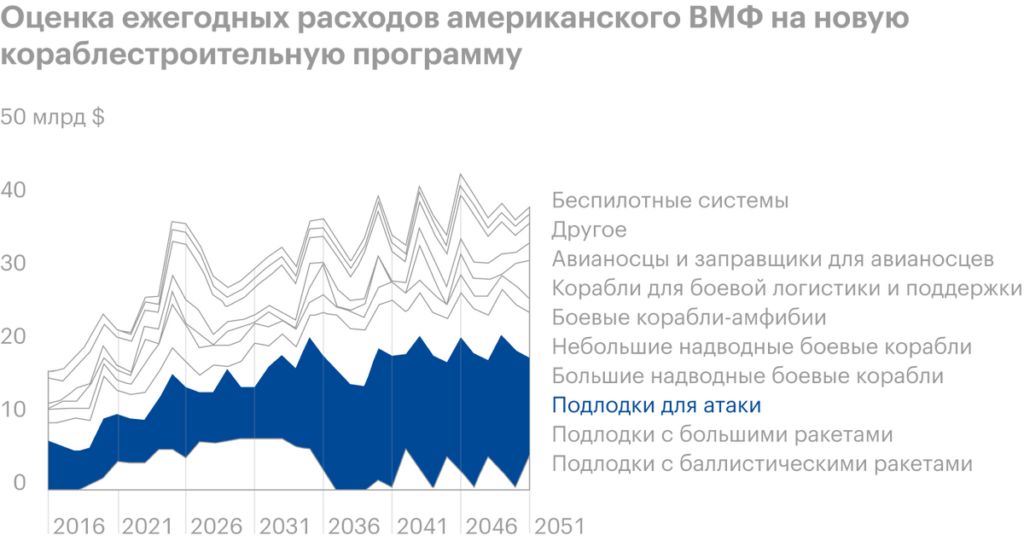

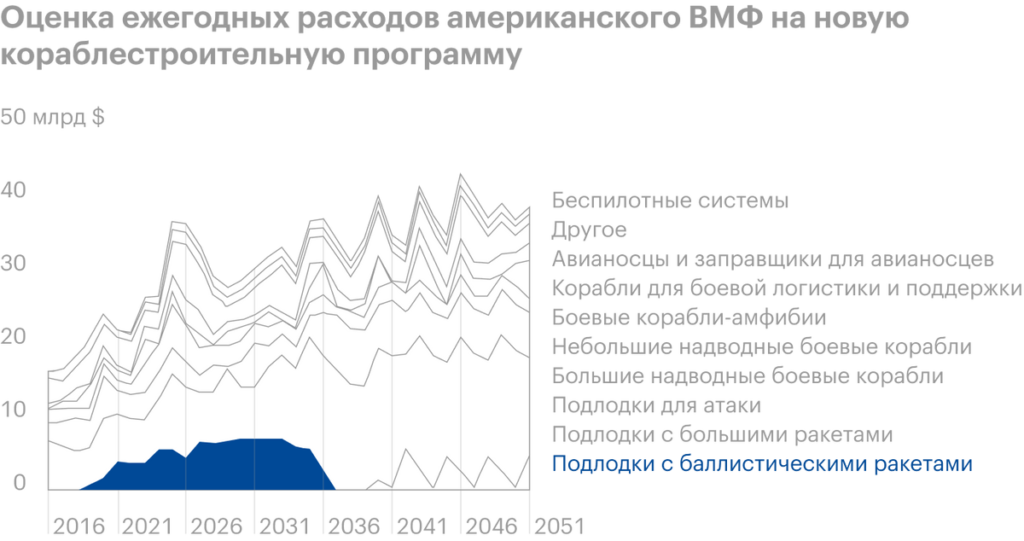

"Let's, tell her, because the night is short, how the devil unscrewed the horns of the sea. ". All the advantages of the old idea are relevant for the company, but there are new. There was a big naval agreement between the US and Australia, directed against the PRC. HII will be the beneficiary of this deal from the American side as a manufacturer of submarines and in general a service provider in this area.. But even if the company's Australian contracts do not collapse, even though it's unbelievable, the latest trends in American naval construction still play into her hands.

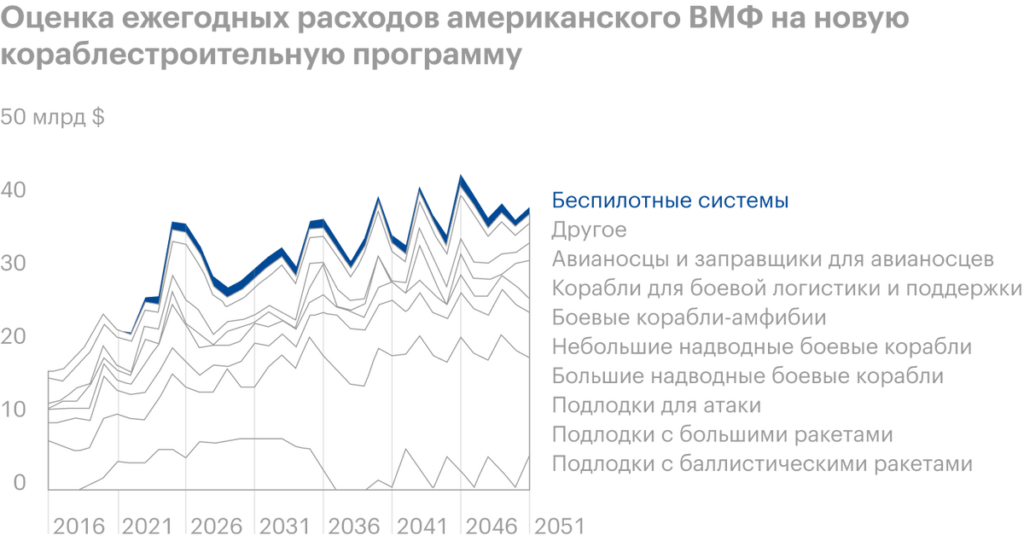

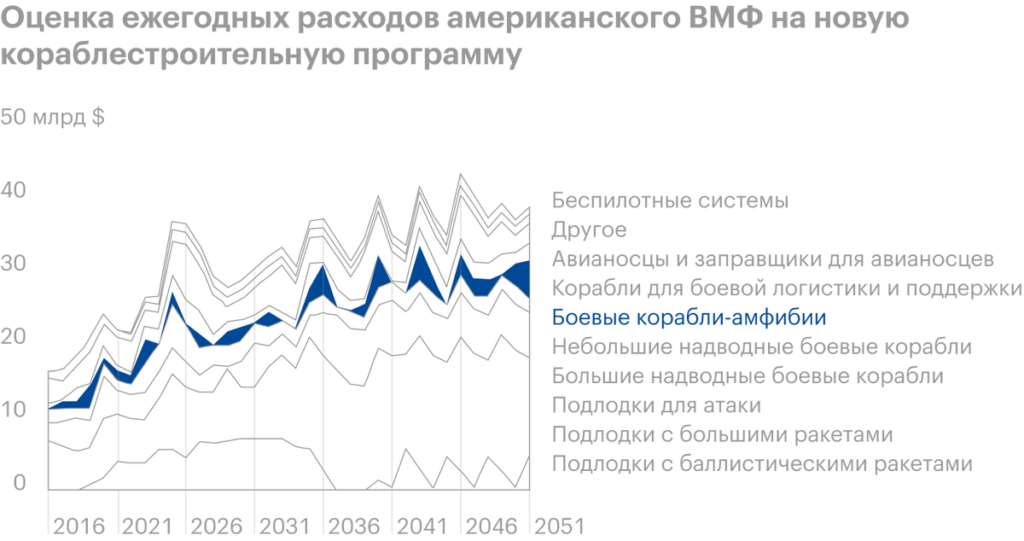

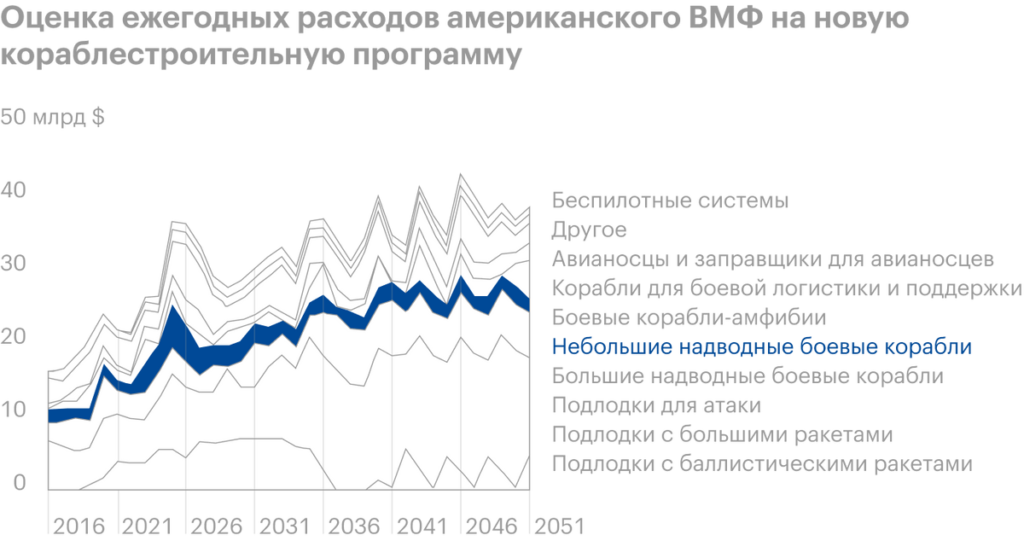

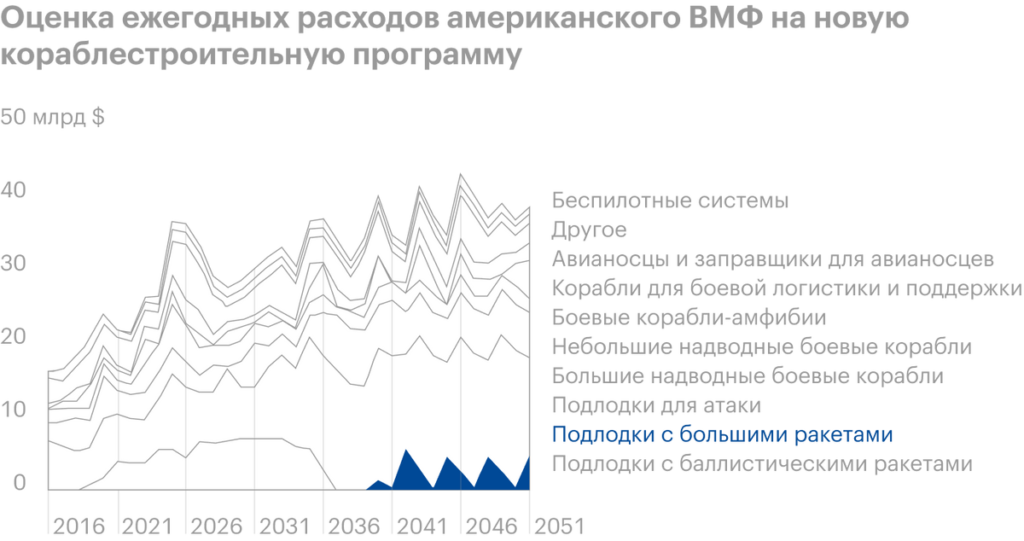

The leadership of the US Navy plans to increase spending on the construction of the fleet in the coming years: in the average annual volume, costs will be 6,25% above, than originally planned. And by 2026, annual expenses will grow by 72% compared to the current level of spending. Understandably, what else should the US Congress approve, but money to the fleet, probably, will give: confrontation with China is a strategic project for the United States and it can be effective only if, if the US maintains its naval supremacy. So the long-term outlook for HII is even better, what was.

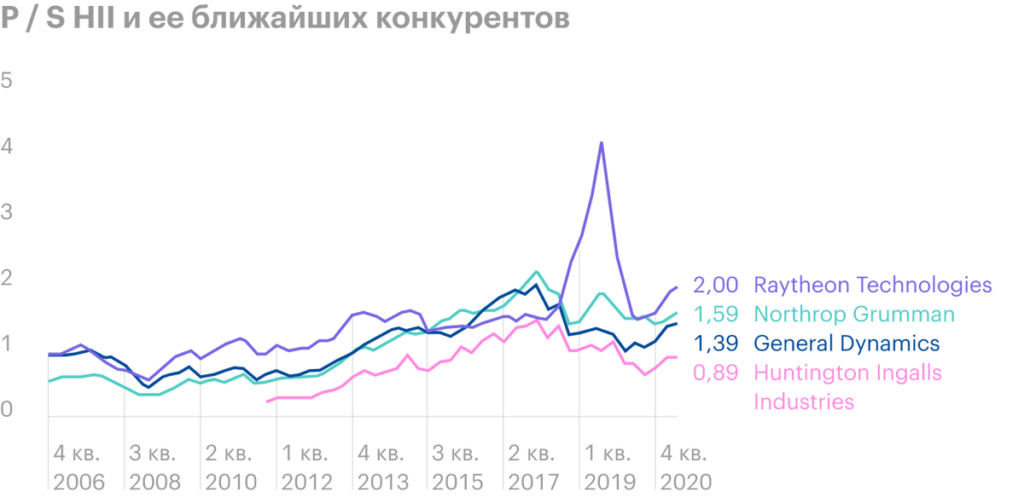

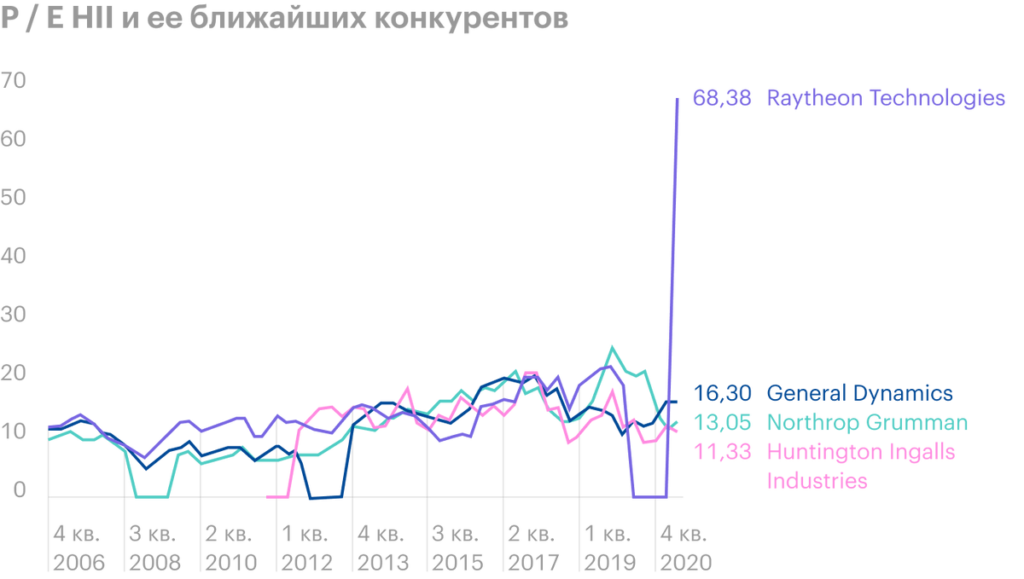

Somehow cheap. The company is inexpensive in absolute and relative numbers. When compared to competitors, then it looks much cheaper in terms of the ratio of share price and revenue. P / HII's E is also below the "hospital average" - about 11.

The capitalization of the company is not very large - 7.77 billion dollars. So I think, that HII shares will be easily pumped by a crowd of investors, who will enter them because, that "they are cheap".

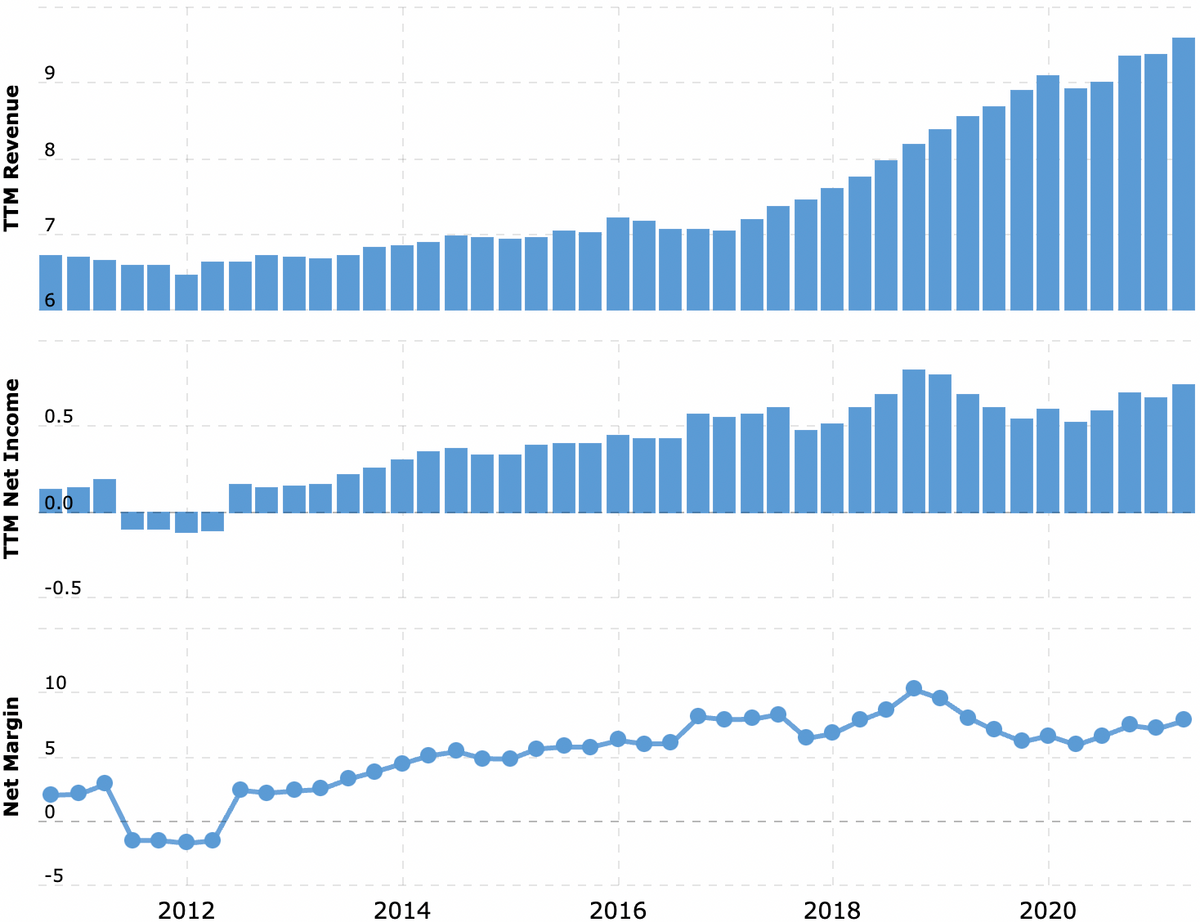

Stability. The company receives most of the money from the US government., so what can you expect, that the stock will be packed with those who want to find stability in these unstable times. This is a successful business with good prospects, cheap even by industry standards, the flow of orders is stable here. And there is also passive income for the doubters..

Wrecked. The company pays 4,56 $ dividend per share per year, which gives approximately 2,53% per annum. It's not that crazy a lot., but much more than the average for S&P 500 c 1,28% per annum, what will help to catch up with the supporters of the postulate “money should work” in stocks. Considering all the points described above, the effect of the raid of dividend investors can be very significant.

What can get in the way

The company can start to expand. Against the background of the Australian events, HII may begin to expand aggressively and, for example, will try to buy BWX Technologies. This will increase the debt burden of HII: debts from the company for 6.065 billion dollars, of which 2.123 billion must be repaid within a year.

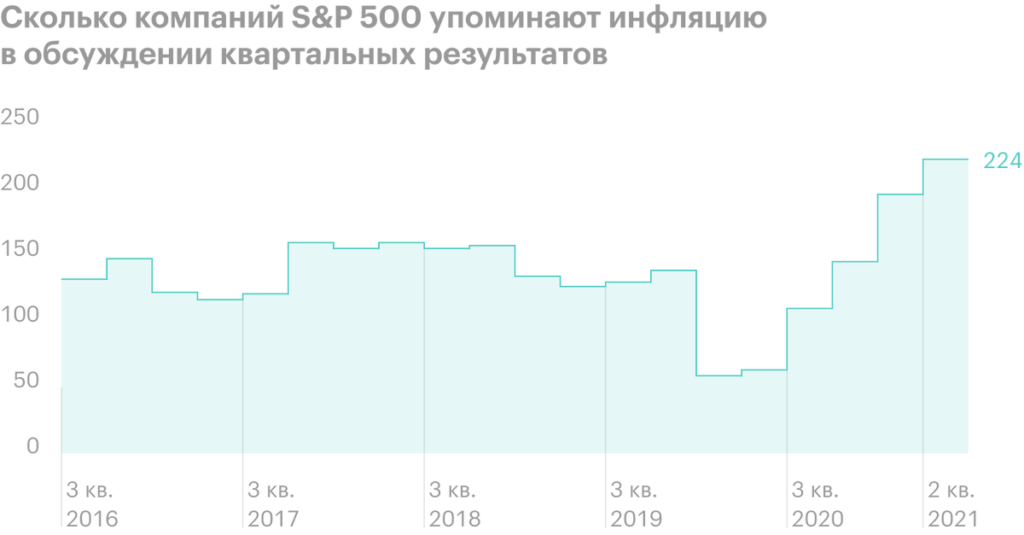

Expenditure items. As a manufacturing enterprise, HII, probably, hit by higher raw material costs, workers and logistics.

Payouts can cut. The company spends $ 184 million a year on dividends - approximately 24,53% from her profits for the past 12 Months. Certainly, the stability of the company's business greatly mitigates the risks of cutting payments, but, given the circumstances described above, payouts can cut - and stocks will fall heavily.

What's the bottom line?

Shares can be taken now by 193,63 $ for pike. And then there are three options.:

- keep shares up to price 222 $. They asked so much for them back in June, so I think, here we will reach the goal in the next 16 Months;

- keep stocks up to their all-time high 277 $. How much did the stock cost in January? 2020, And, considering all the positive points, we can reach this level in the following 4 of the year;

- keep shares next 14 years.

And if you have chosen the long-term path of investing in HII, described in the previous edition of this idea, now you can buy these shares.