Gazprom (MCX: GAZP) — the world's largest gas producing holding. Exports products to more than 100 countries near and far abroad, and also occupies a monopoly position in the pipeline gas market in Russia, controlling the world's longest gas transmission system.

30 August, the company published IFRS financial statements for the first half of 2021, which reflected an increase in net profit of almost 29 times compared to the same period last year amid rising prices and volumes of natural gas exports.

Before proceeding to the overview of financial indicators for the reporting period, I propose to evaluate the production results of Gazprom, as well as the situation on the European gas market, to better understand the context.

Disclaimer: if we write, that something went up or down by X%, then by default we mean a comparison with the report data for the same period last year, unless otherwise stated.

Market position and operating performance

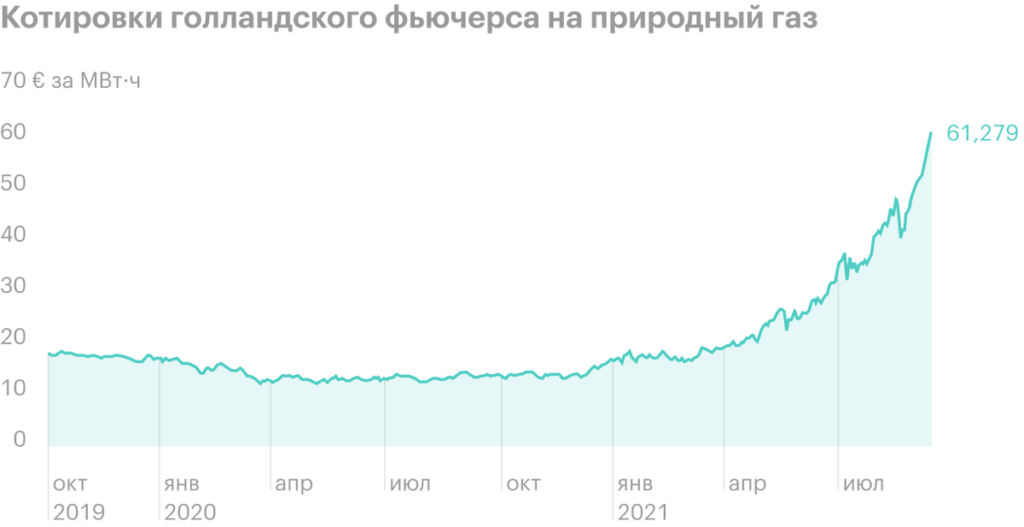

By the beginning of September, natural gas prices in Europe had increased by more than 20 once. On 14 September, the value of the October contract for the supply of natural gas to European consumers reached a record 810 $ for 1000 m2.

The main reason for the price increase was the cold winter of 2020-2021 and the hot summer of 2021, as well as partial filling of gas storage facilities in Europe in anticipation of cold weather and the start of a new heating season.

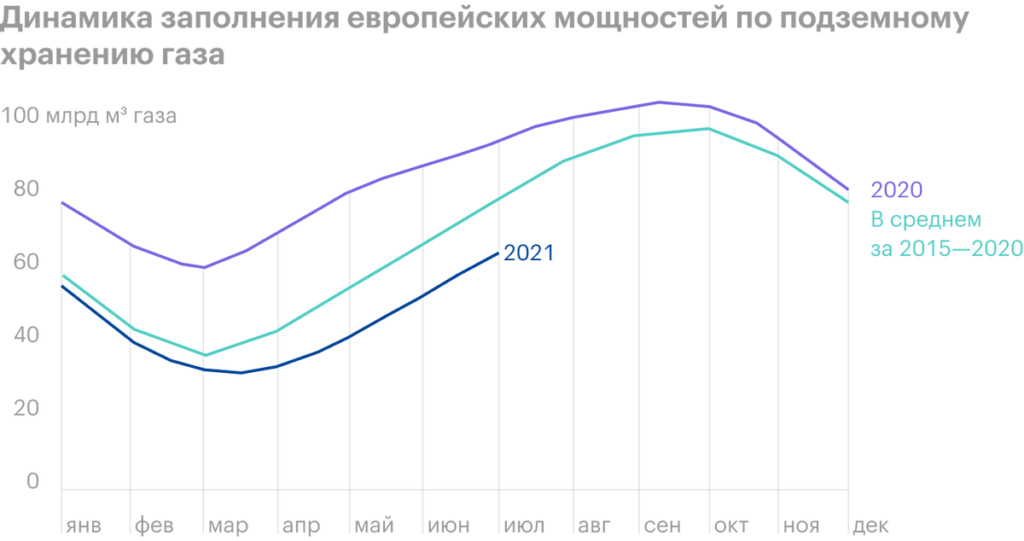

According to Gas Infrastructure Europe, gas reserves in European underground storage facilities 30 August minimum for the last 10 years. By the beginning of September, the storage facilities were filled only for 66,3% against 90% In the past year. Traditionally, the heating season in Europe starts in October., means, there is very little time to replenish stocks.

If the 2021-2022 winter season turns out to be cold, Europe may face a shortage of natural gas. These fears drive prices up., and this is in the hands of Gazprom. The holding's management in a press release predicts, that the underfilling of European natural gas storage facilities by the level of last year will reach 25%, and Ukrainian 30%.

I will note, that the need to pump additional volumes of natural gas to Europe is another argument in favor of launching Nord Stream 2, the laying of the second thread of which has already been completed.

Prices. Gazprom exports gas to Europe mainly under long-term contracts, therefore prices for consumers are not as volatile, like at large gas hubs, and depend not only on the current supply and demand in the market, but also on a number of other factors., including on production volumes and the cost of alternative energy sources.

At the same time, the cost of supplies for Russian consumers is formed according to a different principle and is regulated by the state.. Prices in the domestic market are different for the population and industrial consumers, and also depend on price belt due to transportation cost. So, in the first half of this year, the average prices for Russian consumers were in 3,6 times lower, than for European.

For Gazprom, following the results of the first half of the year, the average price of natural gas sales in Russia increased by 4%, to 4304,9 R for 1000 mW; to the countries of the former Soviet Union - to 13%, to 11 051,9 R; to Europe and other countries - to 63%, to 15 469,1 R.

Average price of natural gas for the first half of the year, rubles per 1000 m³

| Russia | Countries of the former USSR | Europe and others | |

|---|---|---|---|

| 2017 | 3760,7 | 9107,4 | 11 117,2 |

| 2018 | 3925,8 | 8935,2 | 13 858,9 |

| 2019 | 4100,8 | 10 637,1 | 15 331,0 |

| 2020 | 4156,8 | 9803,5 | 9475,4 |

| 2021 | 4304,9 | 11 051,9 | 15 469,1 |

Volumes. Let me remind you, that the volume of natural gas pumped in the first half of last year fell to a multi-year low amid the crisis in the hydrocarbon industry and the high occupancy of European gas storage facilities. This year the situation is reversed..

The volume of natural gas supplies in the domestic market increased by 13%, to a record 133.4 billion m³. Export deliveries increased by 23%, up to 138.9 bcm. Of these, the countries of the former Soviet Union accounted for 18.3 billion m³, and to Europe and other countries - 120.6 billion m³.

Volumes of natural gas supplies for the first half of the year, billion m³

| Russia | Countries of the former USSR | Europe and others | |

|---|---|---|---|

| 2017 | 124,1 | 18,4 | 119,1 |

| 2018 | 129,6 | 20,6 | 128,5 |

| 2019 | 126,4 | 19,1 | 117,9 |

| 2020 | 117,6 | 14,9 | 98,2 |

| 2021 | 133,4 | 18,3 | 120,6 |

Revenue and profit

Gazprom's sales revenue increased by 50% and reached a record 4,352 billion rubles. The main reason is the low base of last year, as well as growth in prices and sales volumes of oil and gas products.

Natural gas sales account for slightly more than half of the holding's total revenue. Gazprom receives the rest of its income from the sale of oil and gas condensate, oil and gas processing products, electrical and thermal energy, as well as from providing its own gas transmission system.

Operating expenses of Gazprom increased by 24%, up to 3328.2 billion rubles. This was influenced by the increase in taxes on the extraction of minerals in 60%, increase in expenses for the purchase of oil and gas by 54% and receiving a foreign exchange loss due to the revaluation of receivables from foreign buyers and loans issued. Besides, the company recorded a loss from the impairment of financial assets in the amount of 41.5 billion rubles.

As a result, operating profit more than quintupled from last year's low base to a record RUB 986.6 billion.

Financial income decreased from 459.4 billion to 328 billion rubles against the backdrop of lower foreign exchange earnings and interest income. Finance costs have more than tripled, up to 217.7 billion rubles, due to a decrease in foreign exchange loss from 706.9 billion to 183.1 billion rubles.

The final net profit of the holding reached a record 968.5 billion rubles, what in 29 times higher than the results of the same period last year.

Sales revenue structure

| Gas | 51% |

| Oil and gas processing products | 27,4% |

| Crude oil and gas condensate | 9% |

| Electrical and thermal energy | 6,9% |

| Gas transportation services | 2,6% |

| Other | 3,1% |

51%

Company financial results for the first half of the year, billion rubles

| Revenue | Operating profit | Net profit | |

|---|---|---|---|

| 2017 | 3209,9 | 484,4 | 381,3 |

| 2018 | 3971,6 | 879,3 | 630,8 |

| 2019 | 4076,8 | 780,9 | 836,5 |

| 2020 | 2903,1 | 190 | 32,9 |

| 2021 | 4352 | 986,6 | 968,5 |

Debts and dividends

Debts. The company reduced its debt by 12%, up to 3396 billion rubles, due to the growth of cash and cash equivalents by 36% and a decrease in long-term and short-term loans and borrowings by 2%.

At the same time, EBITDA increased by 134%, which made it possible to reduce the level of debt burden according to the ratio “net debt / 12m EBITDA "with 2,64 to 1,49. This indicates a low debt load and good financial stability of the company..

Dividends. This year, for the first time, the company switched to payment 50% of the adjusted net profit under IFRS and paid at the end of 2020 12,55 P per share. According to management, the holding’s dividend base for the first half of 2021, taking into account all adjustments for one-time and non-cash items, is a record 845 billion rubles. In this way, payments for the first half of 2021 may amount to 18 P per share.

I will note, that in the next half of the financial results of Gazprom, probably, will not be worse, than in the current, taking into account the favorable situation in the gas market for business on the eve of the next heating season. That is, by the end of the current year, the company can pay shareholders at least 36 P per share, more than double the record payouts of 2018.

Debt dynamics, billion rubles

| net debt | "Net debt / 12B EBITDA » | |

|---|---|---|

| 2016 | 1933 | 1,46× |

| 2017 | 2398 | 1,63× |

| 2018 | 3014 | 1,16× |

| 2019 | 3168 | 1,7× |

| 2020 | 3873 | 2,64× |

| 1п2021 | 3396 | 1,49× |

What's the bottom line?

Against the backdrop of the recovery of the energy market after the crisis, Gazprom's revenue and net profit indicators have updated a new record and demonstrated strong dynamics from a low base in the same period last year.

Impressive natural gas sales on record prices and strong demand in Europe, which remains the key region of consumption in the foreign market. The low filling of European gas storage facilities ahead of the winter season allows us to expect, that in the second half of the year Gazprom will be able to make good money. AND, perhaps, it’s hard to think of a better time to launch Nord Stream 2, which will increase and diversify supplies to Europe, when the region will be in great need of stable supplies of blue fuel.

All things considered, shareholders can expect record dividends for 2021, which could more than double the previous record, given that, that management will continue to pay at least 50% from adjusted net profit.