Hello, dear friends! Previously, I devoted quite a lot of material. ETF Funds and questions, related to their selection, portfolio formation and the principle of work in general. Today, the focus will be on that, how to buy shares for an individual and receive dividends. I wrote about the purchase of shares by individuals in one of the materials, I recommend that you familiarize yourself with it.

I would like to remind you in advance, what is important in the formation of an investment portfolio diversification. That is, it is necessary to include in its composition different tools: along with conventional ETFs and dividends, as well as special funds.

- What are ETFs and how do they use dividends

- How to understand, does the fund transfer dividends?

- We work with sites of management companies

- Working with etfdb.com

- Working with justetf.com

- Recommendations for choosing an Exchange Traded Fund

- Reinvestment

- Dividend payments

- Metrics, to consider when choosing

- An example of selecting securities for investment

- Examples of dividend assets

- The most reliable, high dividends

- High dividends

- The property (REIT)

- 10 stocks with high dividends and stable business

- Investor rules

- Resume

What are ETFs and how do they use dividends

First, let me remind you, what are ETFs. The abbreviation stands for Exchange Traded Fund, that is, the fund, stock-traded. The closest analogue is our mutual funds, although there are differences in the details in the principle of operation.

The fund invests in the securities of many companies and in other assets. This is followed by the issue of own shares. Each of their buyers automatically becomes the owner of a whole portfolio of securities. Due to this, saves a lot of time, and commission fees are significantly reduced. With regard to dividends, then any ETF can use them 2 Ways:

- Reinvest them, buying shares and thereby increasing the value of their securities;

- Periodically pay funds to holders of the fund's shares. The frequency of payments ranges from 1 once a year before the monthly distribution of dividends. They rarely pay income once a month, more often it happens with a frequency of 1 once a quarter up to a year.

The decision on the dividend policy depends on paylines specific ETF, and from Legislation State, in which he works. For a better understanding of the issue, I recommend reading my educational program about dividend stocks.

I also consider dividends as a kind of marker, Evaluating stability (this also applies to individual companies and ETF funds). If the management plans a stable increase in payments, it is a signal, talking about management confidence in the future. For an investor, such options are most attractive..

How to understand, does the fund transfer dividends?

All information on this issue can be obtained:

- On the site of the management company;

- On the site etfdb.com – there is everything you need for American Market;

- On justetf.com – for the market Europe.

Let's look at examples.

We work with sites of management companies

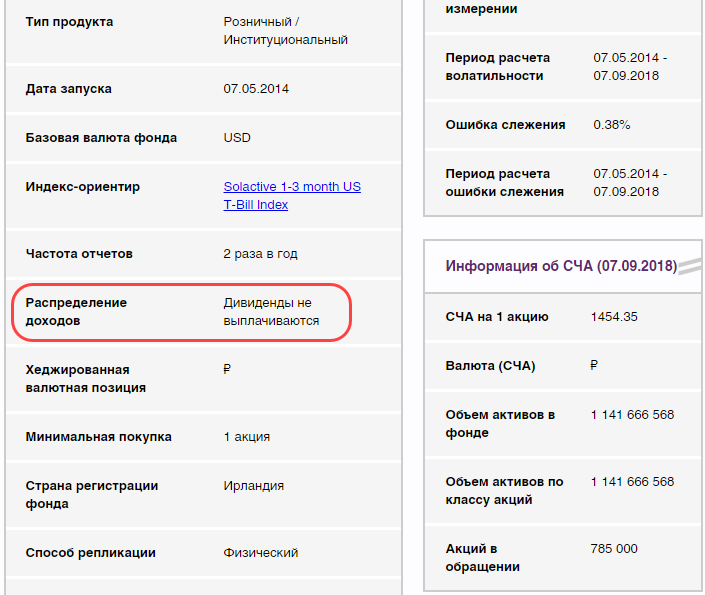

I recommend using this option for Russian companies: they are not on etfdb.com and justetf.com, so exploring the UK website – the only possible option.

To find out, how are things with dividends, it is enough to have the name of the foundation or ticker. Enter it in any search engine and find the site of the management company in the results. It will contain information on that, are payments made and how often.

For example, at the investment fund ФинЭкс UCITS dividends are not paid, information about this can be found on the website finexetf.ru in the appropriate section. I highlighted the necessary nuance in the figure above – all income goes to reinvestment.

Here's the thing. RTS Equity UCITS pays dividends on an annual basis. The description states Distribution Frequency – Annually. In the same way, clarify this issue for the rest of the products you are interested in..

Working with etfdb.com

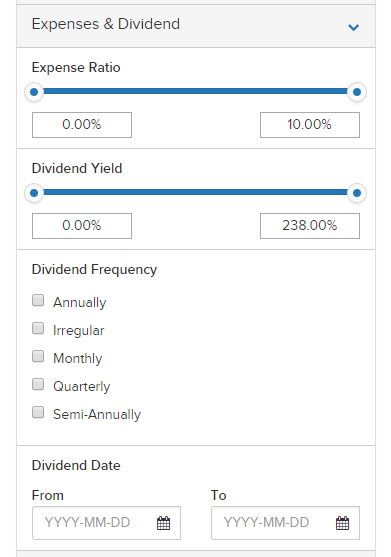

This site is very convenient screener for that, to find out, what dividends on shares a particular fund pays. We are interested in a section in the screener called Expenses & Dividend.

Here you can specify such search criteria how:

- Dividend Yield – the value of profitability;

- How often payments are made to the shareholders of the fund. This item in the screener is available registered Users. I have an opportunity 2 weeks after registration to work with the service Free, and then you can create a new account, so as not to pay the subscription fee;

- Dates of the beginning and end of the dividend payment period.

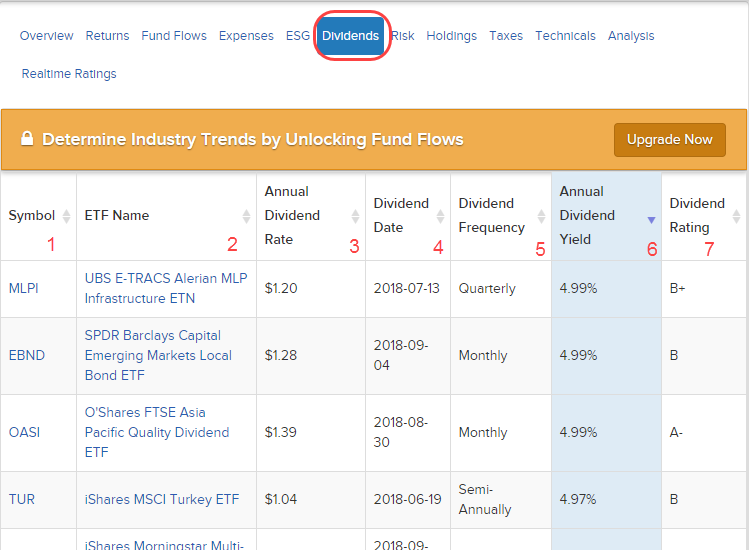

For example, let's set the value of dividends in the range 2-5%. Now in the search results let's switch to the tab Dividends and sort the found funds by the amount of payment.

Here we see:

- 1 – Symbol, fund ticker;

- 2 – ETF Name, fund name;

- 3 – Annual Dividend Rate, how much one share is paid per year;

- 4 – Dividend Date, when there is a distribution of funds among the shareholders;

- 5 – Dividend Frequency, payout frequency;

- 6 – Annual Dividend Yield, amount of dividends, paid per year;

- 7 – Dividend Rating, fund rating, rating assigned by etfdb.com.

By clicking on any link from the table, get detailed statistics on ETF. There is also data on dividend policy.. For example, for SPDR Barclays Capital Emerging Markets Local Bondjust go to the tab Dividend, to get the same information, as in the table before.

Etfdb.com service

Working with justetf.com

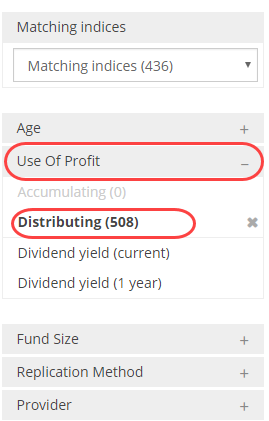

Here you can understand, which stocks bring dividends, but exclusively for the European market. The site structure is a bit like etfdb.com, the screener is also located on the left side of the screen, and the main area is occupied by search results. A little inconvenient then, that some of the information is available only to users, paid subscription, trial version, as on etfdb.com, here No.

In the screener, we are interested in the item Use Of Profit, there is 2 Options:

- Accumulation – this includes funds, reinvesting profit received;

- Distribution - ETFs Distribute profit, we need this particular item.

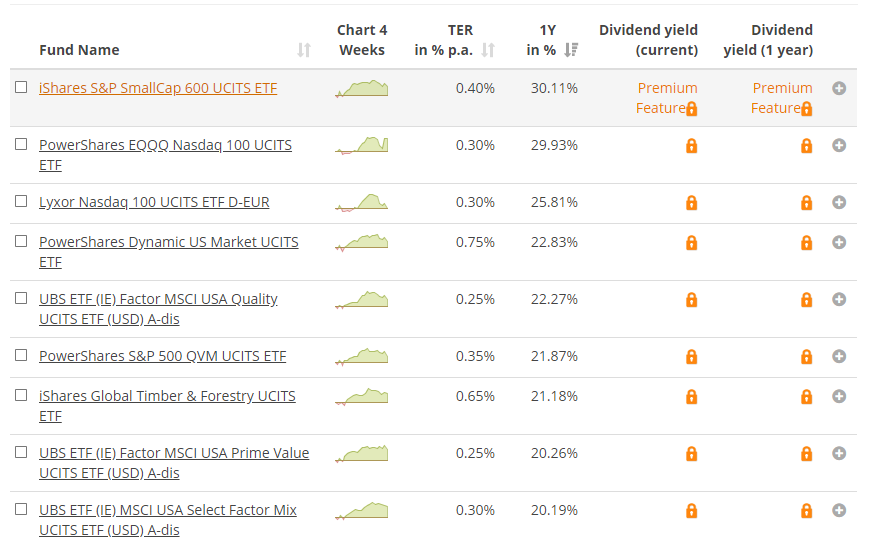

Results are displayed in tabular form. The picture below shows:

- Fund Name – name of the foundation;

- Chart 4 Week – schedule changes in the value of shares for the last 4 weeks;

- TER in % p.a. – TO HAVE stands for Total Expense Ratio, shows the overall level of fund management costs and other costs, related to his work. Calculated as the ratio of the total ETF value to its assets;

- 1Y in % – how the value of securities has changed over the year in percentage;

- Dividend Yield (Current) – information on the current dividend yield. Calculated as the ratio of cash-per-share payout to the value of the security, displayed as a percentage;

- Dividend Yield (Year) – profitability for the year.

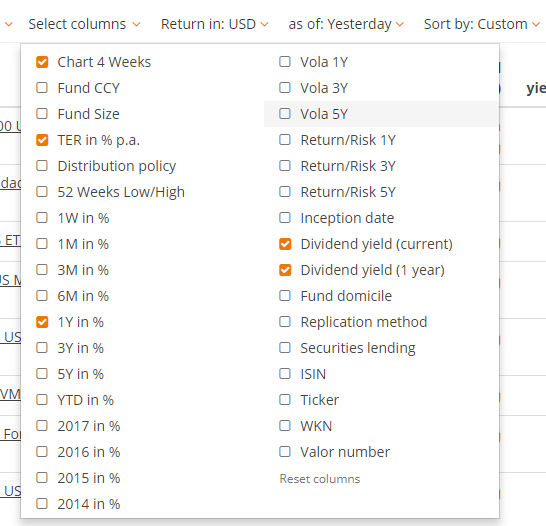

You can add other columns in the search results settings.:

Unfortunately, information on dividends is not displayed in the table. To get it, you need to register and pay for access, but you can work with information about the fund itself. To do this, follow the link in the table and study the statistics.. It also has a dividend yield, and frequency of payments:

- In the section Overview we are interested in the item Risk and fees. The frequency of payments is indicated here. In our example, for PowerShares EQQQ Nasdaq 100 UCITS profits among holders of securities are distributed Quarterly:

- For more information, go to the tab Dividends, for convenience I will switch the currency to USD. This shows the current income in dollars on 1 fund share and payment in past years. Despite, that payments are taking place 4 once a year, information is shown immediately after 12 Months;

- Dividend yield contribution - Not particularly useful information, this shows the contribution of each asset to the bottom line. Do not forget, that the ETF is built on a whole portfolio of stocks or other instruments (there could be more 100). Learn more about, what are ETF funds, read in a separate article;

- See also payments by month. It is seen, that quarterly earnings per share are from 20 to 30 U.S. Cents.

It's inconvenient, what with the indicator Dividend yield in % can be accessed only after paying for access to the service. You, certainly, you can independently calculate it as the ratio of the annual payment to the share value, but if the portfolio is just being formed, then for several dozen Exchange Traded Funds such a calculation is cumbersome.

The rest of the justetf.com service is good and, if you want to include European ETFs in your portfolio, I recommend it for use.

Justetf.com service

Recommendations for choosing an Exchange Traded Fund

Before analyzing ETFs in detail, you must decide, do you need an option with income reinvestment or you want to constantly receive money from the fund. Both options have advantages.

Reinvestment

- No need to think, how to use the funds received;

- Is automatically;

- No need to pay taxes. Think about it only at the moment of selling ETF shares..

Dividend payments

- You constantly receive investment result;

- You have to take care of paying taxes.

Basically, get the same effect, that even with the payment of dividends it is possible, if you periodically sell part of the investment fund's securities. But it's harder psychologically, yes and uncomfortable. Not every long-term investor wants to do this..

Metrics, to consider when choosing

Buying shares by individuals to receive dividends is no longer considered an exotic way of organizing passive income. In this section, with a specific example, I will show, exactly how an investor should reason when compiling a portfolio and selecting ETFs for investments. We will focus on safety And passivity investment. The selection criteria looks like this:

- Passive control strategy;

- Minimum costs. The larger the fund, the lower his management fee. UK can afford it, offsetting lower fees by a large number of investors;

- No liquidity problems. In this matter, we will be guided by in front: the lower it is, the higher this indicator. Here you can draw an analogy with the Forex market, Remember, on highly liquid pairs, the difference between prices We And Ask is total 1-2 item, while on unpopular instruments it comes to 10-20 and more. In the case of ETFs, the logic is the same.;

- Low portfolio turnover. Do not confuse the trading volume of securities and the fund's transaction activity. Us, as investors, disadvantageously, for the ETF to trade continuously, therefore, when searching, I recommend setting the turnover to 30%. With this scheme, the fund will work in your favor.;

- The most accurate match to the index, which the fund copies;

- Beware of a lurch towards one of the assets. Important diversification.

These are the main indicators. In addition to them, it is advisable to take into account:

- DPR - he's also payout ratio. Calculated as the ratio of dividends per share to earnings on it. There can be many options, for example, a young company allocates most of its income to development, as a result DPR is much less 1, but a stable business with a long history can increase DPR, when most of the profits go to divas;

- Total income – how much can be obtained per year due to the growth in the value of the fund's securities and dividends;

- Earnings per share (EPS) - calculated as net income, divided by the number of company securities;

- PE Ratio – calculated as the ratio of the paper price to profit, received for the year. It can be used to judge the underestimation of the company.. If the PE Ratio is small, then the paper is considered particularly promising. The indicator is in the screener on etfdb.com.

Listed above 4 parameter is available on dividend.com. Its structure resembles the same etfdb.com, on the left side there is a screener window, in the table - all the necessary information on the dividends of funds.

Site dividend.com

An example of selecting securities for investment

In the example, we will analyze, what stocks are worth buying, to receive dividends taking into account the requirements listed in the previous section. First, we use the screener on etfdb.com and select the necessary papers in accordance with the following criteria. In the screener:

- We select only ETFs with a passive management strategy;

- Exclude from search hedging, as well as inverse And leveraged funds. They are not suitable for passive investing.;

- Can be set provider restriction, leaving only funds from top issuers;

- In the structure, select only ETF;

- Expenses Ratio – we will be satisfied with the commission in the range 0,1-1%;

- Dividend Yield – when compiling a portfolio, I recommend not to consider securities with dividends higher 10%. I use a classification like this: risky - 8-10% in year, the property - 4-7%, reliable - up to 5%. In the screener, set the range 0,01-7%. We don't care about the frequency of payments, skip this point;

- Assets – funds with a volume of assets in excess of $1 billion.;

- Average trading volume must exceed 1 million. papers per day. Set the appropriate limit Average Daily Volume.

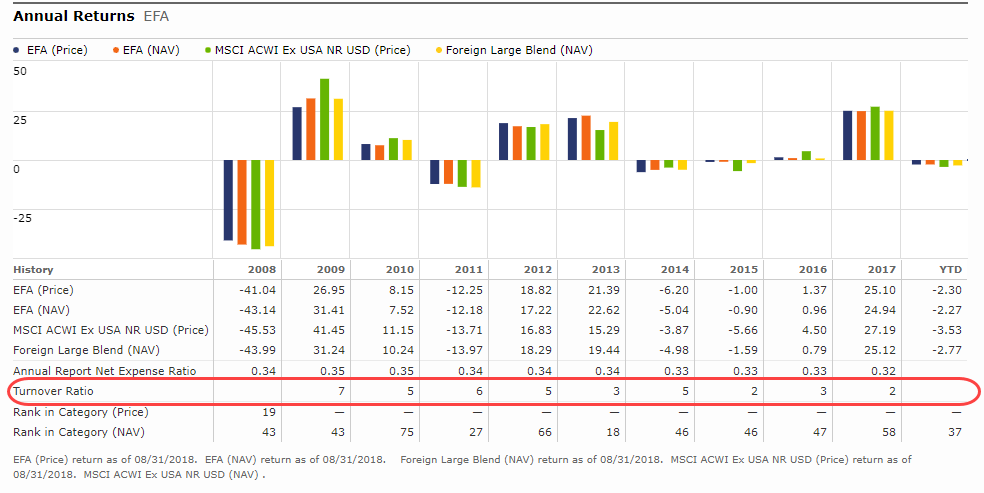

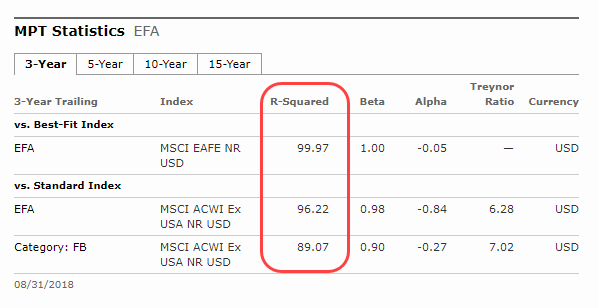

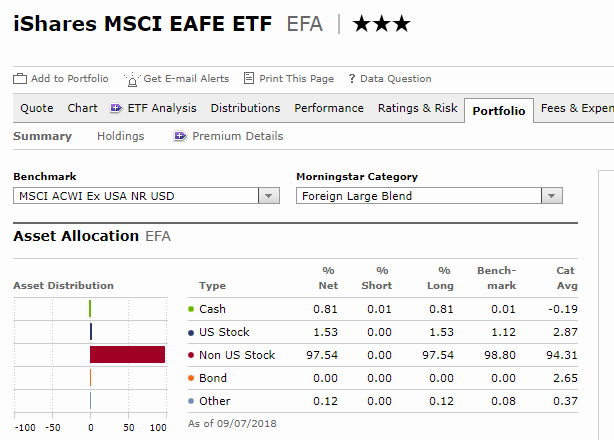

We will not touch other items in the screener. As a result, we get a little less 100 ETF, meeting our requirements. We have completed the initial selection of securities. Now we need to work with morningstar.com and find out the remaining details.. For example, let's take iShares MSCI EAFE ETF:

- Low turnover. Not in a single year has this figure exceeded even 10%, for our purposes the foundation fits;

- ETF benchmark meets, index R-squared exceeds 80%, according to this criterion, the fund also corresponds to Requirements;

- Now you need to explore composition of the fund. On the morningstar.com, go to the section Portfolio and we observe the following picture - the main emphasis is not on the American stock market.

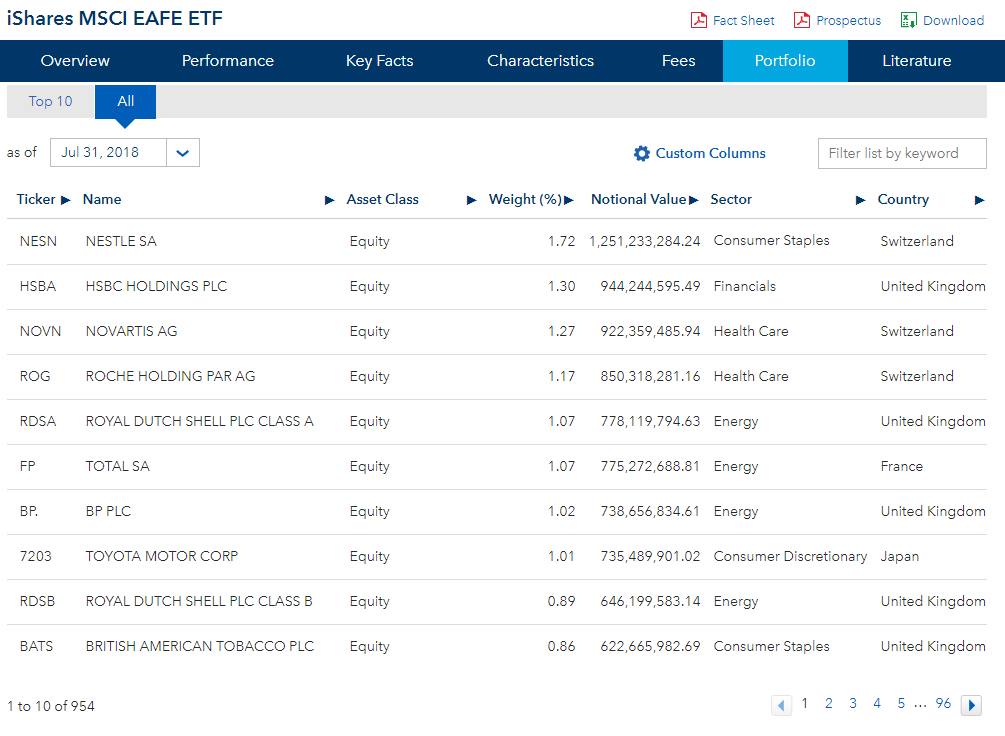

For a more detailed picture of how, what is included in the portfolio in this case, we will go to the issuer's website and study the section Portfolio.

See, what the fund includes 954 stock. Moreover, the maximum share of one company is equal to only 1,72%. Means, there is no skew, And the fund is suitable for investment.

I recommend you to work according to the same scheme.. Use etfdb.com to select a pool from several funds and then update the missing information on morningstar.com. My article will also be useful., how to form an investment portfolio.

Examples of dividend assets

Below I will briefly walk through the good, in my opinion, Funds.

The most reliable, high dividends

- Index ProShares S&P 500 Dividend Aristocrats (NOBL). Focused on companies, included in S&P 500 and have shown an increase in dividends over the past quarter century. Annual yield 2,06%, funds are paid quarterly, commission 0,35%;

- Vanguard Dividend Appreciation (VIG). It includes, companies, which increase dividends in dollar terms for at least 10 years. At the same time, in percentage terms, payments can be small. Total Commission 0,08%, dividends are 2,15%, paid quarterly;

- FlexShares Quality Dividend Defensive Index Fund (QDEF). Work is carried out with companies from the index Northern Trust 1250. Selection is performed by dividend level and Beta coefficient. Commission 0,37%, payments are equal 2,56%, funds are distributed quarterly;

- SPDR S&P Dividend ETF (SDY). Follows the index S&P 500, the focus is on companies, paying maximum dividends. Commission – 0,35%, Pay 2,36% in year, funds are distributed every quarter;

- Vanguard High Dividend Yield (VYM). Tied to companies from FTSE High Dividend Yield Index, preference is given to those, who pays big dividends. ETF composition is regularly reviewed. Commission 0,08%, Pay 2,84% per year on a quarterly basis;

- iShares Select Dividend (DVY). As a benchmark acts Dow Jones U.S. Select Dividend IndexSM. Like previous ETFs, this one focuses on companies with more than 5 years of dividend payout history.. Commission 0,39%, profitability 3,07% in year, funds are distributed every quarter;

- WisdomTree US Total Dividend (DTD). Follows WisdomTree U.S.. Dividend Index, it includes companies, whose shares are placed on NYSE, NASDAQ and who pay large dividends. Annual yield 2,46%, payments are made monthly, commission 0,28%;

- iShares High Dividend Equity Fund (HDV). Copies Morningstar Dividend Yield Focus Index. The portfolio includes 75 securities of American companies with consistently high payouts. Commission 0,08%, Dividends 3,45%, and they are distributed 1 once a quarter;

- SPDR Dow Jones Industrial Average (MORNING). Based on Dow Jones Industrial Average. It can be seen as the backbone of a portfolio, performed well even during the crisis 2008 G. and the technology bubble 2000 G. Commission 0,17%, Dividends 1,95% in year, funds are distributed monthly.

High dividends

- iShares US Preferred Stock (PFF). Copies S&P U.S. Preferred Stock IndexTM, the portfolio includes securities of companies, listed on NYSE And NASDAQ. The priority is those, who pays the most to shareholders. Commission 0,46%, Dividends 5,46% per annum, distributed monthly;

- Global X SuperDividend US (DIV). Repeats the composition INDXX SuperDividend US. Low Volatility, funds are equally distributed among 50 companies, included in this index. Commission 0,45%, Dividends 6,07%, pay them every month;

- Invesco KBW High Dividend Yield Financial (KBWD). Follows the index KBW Nasdaq Financial Sector Dividend Yield Index, it includes companies, employed in the US financial sector. Commission 2,40%, Pay 8,57% per year on a monthly basis;

- Global X SuperDividend (SDIV). Investments are made in 100 the most attractive assets in terms of dividends worldwide. Index is copied Solactive Global SuperDividend Index. Commission 0,58%, annual payments 7,52%, they are distributed monthly;

- Global X SuperDividend Alternatives (NASD:ALTY). Investments are distributed in several directions, including real estate, limited partnerships, infrastructure projects. The goal is to ensure stable profits. Commission 2,84%, dividend yield 7,57%, money is paid every month.

The property (REIT)

- Vanguard REIT (VNQ). Copies MSCI US Investable Market Real Estate 25/50 Index, money is invested in companies, buying houses, hotels and other real estate. Commission 0,12%, payments 4,29% in year, money is distributed every quarter;

- iShares US Real Estate (IYR). Investments made in the securities of companies, included in Dow Jones U.S. Real Estate Index. We work with real estate investment trusts. Commission 0,43%, payments are 3,59%, and money is distributed every 3 months;

- Vanguard Global ex-US Real Estate (VNQI). Follows the index S&P Global ex-U.S. Property Index, that is, investments were made in securities of companies from more than 30 countries of the world. Has a high potential for investment growth. Commission 0,14%, Dividends 5,11%, holders of securities receive money on a quarterly basis;

- iShares International Dev Rel Est (IFGL). There is a binding to FTSE EPRA/NAREIT Developed Real Estate ex-U.S. Index. Focus on the US real estate sector, Canada and Asia. Commission 0,48%, Pay 5,52% per annum, funds are distributed quarterly;

- iShares Europe Developed Real Estate (IFEU). Investments in company securities, working in the real estate sector on the European market. Copies FTSE EPRA/NAREIT Developed Europe Index. Fees are small – only 0,48%, annual dividend yield 4,26%, paid quarterly;

- Global X SuperDividend REIT (SRET). The money is invested in 30 real estate investment trusts around the world with maximum dividends. Index is copied Solactive Global SuperDividend REIT Index. Fees are 0,55%, per year paid 8,35% on a monthly basis;

- iShares Mortgage Real Estate (REM). Money is invested in companies, working in the US mortgage market, the fund follows FTSE NAREIT All Mortgage Capped Index. Commission 0,48%, per year dividend yield 9,79% with quarterly payout.

10 stocks with high dividends and stable business

In this section I will list stocks with dividends that are good in my opinion. 2018 of the year.

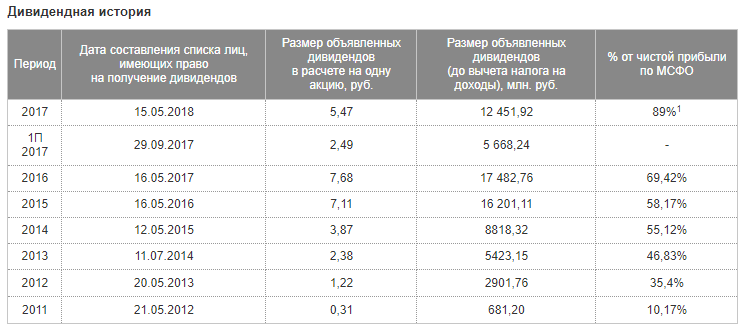

- MICEX – securities of the Moscow Exchange look good. This is an established and reliable business. Despite the difficult situation in recent years, there has been a steady increase in clients. Dividends are growing, in 2017 G. went to them 89% from net profit;

- Norilsk Nickel – another company with a stable business. Rare earth metals are always in high demand. Analysts predict a serious increase in payments next year;

- Gazprom – included in the list thanks to Reliability. The need for energy does not disappear anywhere, so that the company will not have problems with payments. But a record growth in dividends is not expected either.;

- Mobile TV systems. Dividend policy has been revised, and guaranteed payment of at least 20 rubles on the action. Business reliability is also beyond doubt;

- Oracle Corporation – in the software sector, the player is well-known. Small dividends (1,55% in year), but the company has few competitors in terms of reliability;

- Philip Morris International - Another American company, the largest manufacturer of tobacco products in the world. Product demand is consistently high, dividend yield is 5,89% in year;

- Synchrony Financial – representative of the US financial market, included in the index S&P 500. In a year, payments reach 2,59%;

- Royal Dutch Shell - A guest from Europe on my list. This is an oil and gas company. Capitalization is $269 billion, annual profitability at the same time 5,88%;

- Anheuser-Busch InBev – Belgian brewing corporation with capitalization in $149,58 billion. Here the dividend yield for the year is up to 5,44%;

- GlaxoSmithKline – pharmaceutical company from the UK. In a year, the yield is 5,13%, and due to capitalization in $96,11 billion. considered one of the largest in the world.

This is just a rough list of good companies to invest in.. If you wondered, what stocks bring dividends and how you can improve your financial situation on this, I recommend to work with the screeners on your own. Use screeners on tradingview.com, investing.com, finviz.with. It is convenient to work with representatives of the Russian segment through dohod.ru.

Investor rules

I recommend:

- Look for an opportunity to buy at the lowest price;

- Build up shares in purchased assets;

- Avoid bias in favor of one asset, even if he looks attractive. Diversification is the key to success;

- Don't risk it, our choice is only reliable companies with stable, an established business;

- Sometimes stocks are sold with Discount, at such moments buy them. Similar services offered by BCS broker;

- Priority should be companies with growing dividends. This indirectly confirms the confidence of management in the future of the business.;

- Diversification should not only be between individual companies, but also on Different Industry, Countries.

Resume

Examples of investing in ETF assets I gave earlier, the link can refresh your memory on this topic. Today, the emphasis is on the method of analyzing proposals., Tom, how to choose options suitable for investment. I know from my own experience - when you try to build a portfolio for the first time, then the eyes run up due to the abundance of options. Every time it seems, that you need to slightly change the composition.

Think, my tips will help you avoid the agony of choice and immediately start acting clearly and consciously, without unnecessary throwing. Actually there is nothing difficult in the analysis, just stick to the rules, select only those options, which meet the criteria. Certainly, investments will not grow in a year 100 once, but our goal is different – through this approach you will achieve Stability, and this is the main thing.

IN Comments be sure to share your comments, ask questions, if something remains unclear. And don't forget subscribe to updates my blog, subscription guarantees, that you will not miss the release of new material.

I say goodbye to you on this. Hope, that investing will make your life better, and you can achieve financial independence.

Original article :