ETF (Exchange Traded Funds) – foreign exchange investment funds, securities which are traded on stock exchange, or, in other words, transparent “package”, where you can buy “whole market”, T. is. invest in all securities through a brokerage account, in the corresponding index.

ETF (Exchange traded funds )(Exchange Traded Funds) is a security, which is traded, like common stocks in the world's largest markets. The constituent parts of ETF can be securities of enterprises of any region or industry., like mutual funds. Working with ETF, trader can combine the security and smooth operation of the world's major exchanges with the ability to use a huge variety of financial conditions in different countries and regions of the world.

Exchange Traded Funds - Exchange Traded Funds (ETF)

Exchange Traded Funds - Exchange Traded Funds (ETF)

According to the legal classification, ETFs are classified as mutual funds and fall under the same rules of the US Securities Commission. (SEC), as traditional mutual funds. but, their peculiar structure ensured the difference between the SEC requirements in terms of, concerning buying and selling. ETFs differ from mutual funds in the same way, that orders for transactions with ordinary mutual funds are carried out on the market during the daytime, but the very execution of such operations, usually, produced before the close of the market. The price assigned to them is the total value of the daily closing prices of all assets., included in this mutual fund. This is not the case with ETFs.. These funds are traded all day long, and the investor has the opportunity to fix prices for the corresponding assets at any time.

Reliability of ETFs as a stock market instrument (considering separately from the reliability of any particular asset, which they can represent) should be treated in the same way, like any certificate for the securities themselves. ETF is a much more complex instrument in terms of its content., than mutual funds. In the same time, an interesting combination of participants in a specific market, presented by brokers, financial managers and market analysts makes it easy to work with them.

If you admit, that ETFs are index funds after all, then this encourages investors to delve deeper into the philosophy of investing in indices, downplaying stock picks in favor of the overall buying or selling of a given market. And unlike most traditional index funds, investors do not need to borrow a passive "bought – hold "position. ETFs are increasingly becoming an attractive hedging instrument for day traders as well.. Both types of investors can coexist in the market, effectively strengthening everyone's position by reducing overall operating costs.

The number of ETFs is large and amounts to many hundreds. But not all of them are liquid.

Here is a list of the most popular ETFs..

What is ETF : in simple words - about the complex

ETFs originated as passive funds. They reflect the behavior of a particular financial index - stocks, bonds, real estate, Goods. They can correspond to the behavior of an asset., say, gold or oil, a specific sector of the economy (finance, extraction of raw materials, biotechnology, etc.), geographic area (Europe, Of America, Asia, Of Russia), company values - large or small capitalization, short or long term bonds, as well as their credit rating. Let's say, one of the most famous ETFs - SPDR S&P 500 (тиккер SPY) repeats the movement of the S index&P 500.

Usually, the value of one ETF share rarely exceeds $100 - that is, ETFs are sufficiently accessible to a wide range of traders. They are successfully used in their work as institutional (pension funds, management companies) investors, as well as individuals. Even speculators use ETFs, buying or selling the whole market. This instrument has good liquidity and availability., which allows you to use it in different investment strategies, the simplest of which is asset allocation.

Most Popular ETFs ( Exchange traded funds )– Exchange Traded Funds

| Fund name | Ticker | Fund category | |

Bonds |

|||

| 20-summer government bonds | TLT | Bonds | |

| 20-summer government bonds X2 Fall | TBT | Bonds | |

| High-risk bonds (garbage) | JNK | Bonds | |

| High-risk bonds (garbage) | HYG | Bonds | |

| Short-term government bonds (1-3 of the year) | SHY | Bonds | |

| Super-short-term government bonds (T-Bills) | TIP | Bonds | |

| Corporate bonds (different sectors with invest. rating) | AGG | Bonds | |

Economy sectors |

|||

| Telecommunications sector | IYZ | Telecommunications sector | |

| Utilities sector | XLU | Utilities sector | |

| Insurance sector | KIE | Insurance sector | |

| Pharmaceutical companies sector | PPH | Pharmaceutical companies sector | |

| Health sector | XLV | Health sector | |

| Oil Industry Equipment Manufacturers Sector | IEZ | Oil Industry Equipment Manufacturers Sector | |

| Water companies sector | PHO | Water companies sector | |

| Agricultural companies sector | MOO | Agricultural companies sector | |

| Semiconductor Sector | SMH | Semiconductor sector | |

| Semiconductor sector X2 – Growth | USD | Semiconductor sector | |

| Energy Sector 3X – The fall | ERY | Energy sector | |

| Raw materials sector | IYM | Raw materials sector | |

| Raw materials sector | XLB | Raw materials sector | |

| Raw materials sector 2X – The fall | SMN | Raw materials sector | |

| Raw materials sector 2X – Growth | UYM | Raw materials sector | |

| Companies index “clean” energy | PBW | Energy sector | |

| The solar energy sector of the world | TAN | Energy sector | |

| Energy sector | XLE | Energy sector | |

| Energy sector 3X – Growth | ERX | Energy sector | |

| US Energy Sector | IYE | Energy sector | |

| KBW American Banks Index | KBE | Financial sector | |

| American Regional Banks Index | RKH | Financial sector | |

| Index of American Regional Banks KBW | KRE | Financial sector | |

| Broker-Dealer Sector USA | IAI | Financial sector | |

| Sector prof. stock market participants | KCE | Financial sector | |

| Regional Banks Sector | boy | Financial sector | |

| Financial services sector | IYG | Financial sector | |

| Financial sector | XLF | Financial sector | |

| Financial sector | IYF | Financial sector | |

| Financial sector | VFH | Financial sector | |

| Financial Sector 2X - Drop | SKF | Financial sector | |

| Financial Sector 2X - Growth | APP | Financial sector | |

| Financial sector 3X – The fall | DOES | Financial sector | |

| Financial sector 3X – Growth | FAS | Financial sector | |

Natural resources |

|||

| Raw material 2X | DYY | Raw material 2X | |

| Commodity Markets Index | DBC | Commodity Markets Index | |

| Market basket index. Goods | DBA | Market basket index. Goods | |

| Commodities and Global Commodities | RJA | Commodities and Global Commodities | |

| Raw materials and commodities | GSG | Raw materials and commodities | |

| Industrial metals (Zinc, aluminum, copper) | DBB | Industrial metals | |

| Agricultural. Goods 2X | DAY | Agricultural. goods | |

| Gasoline (USA) | UGA | Gasoline (USA) | |

| Coal | COLL | Coal | |

| Steel | SLX | Steel | |

| Silver | SLV | Silver | |

| Gold X2 | GLD | Gold | |

| Gold X2 - Fall | DZZ | Gold | |

| Natural gas (USA) | ROTTEN | Gas, oil + gas | |

| Oil and gas sector 2X – Falls | DUG | Gas, oil + gas | |

| Oil and gas sector 2X – Growth | YOU | Gas, oil + gas | |

| Oil | OIL | Oil | |

| Oil | DBO | Oil | |

| Oil (USA) | USE | Oil | |

| Oil X2 – Growth | DXO | Oil | |

| Oil X2 – The fall | SCO | Oil | |

| Oil X2 - Growth | UCO | Oil | |

Country ETFs ( Exchange traded funds )– Exchange Traded Funds |

|||

| Austria Stock Index | EWO | Other country | |

| Belgium stock index | EWK | Other country | |

| Germany stock index | EWG | Other country | |

| Hong Kong Stock Index | EWH | Other country | |

| India Stock Index | INP | Other country | |

| Spain Stock Index | EWP | Other country | |

| Italy stock index | EWI | Other country | |

| Latin America S Stock Index&P Latin America 40 | ILF | Other country | |

| Malaysia Stock Index | EWM | Other country | |

| Mexico Stock Index | EWW | Other country | |

| Netherlands Stock Index | EWN | Other country | |

| Oceania Stock Index (without Japan) | EPP | Other country | |

| Russian stock index | RSX | Other country | |

| Singapore Stock Index | EWS | Other country | |

| United Kingdom Stock Index | EWU | Other country | |

| Taiwan Stock Index | EWT | Other country | |

| France stock index | EWQ | Other country | |

| Switzerland stock index | EWL | Other country | |

| Sweden Stock Index | EWD | Other country | |

| South Australia Stock Index | EWA | Other country | |

| South Korea Stock Index | EVE | Other country | |

| Brazilian Stock Index | EWZ | Other country | |

| Indian Equity Index “Tree of wisdom” | EPI | Other country | |

| China Stock Index (FTSE/Xinhua China 25) | FXI | Other country | |

| China Stock Index (FTSE/Xinhua China 25) X2 – The fall | FXP | Other country | |

| Index of Japanese stocks | EWJ | Other country | |

| DJA Index | MORNING | US Indices | |

| Nasdaq-100 Index | QQQQ | US Indices | |

| Index S&P500 | SPY | US Indices | |

| Index S&P500 X2 Fall | SSO | US Indices | |

Global ETFs ( Exchange traded funds )– Exchange Traded Funds |

|||

| New Frontier Global Dynamic Balanced Index | PCA | Global ETFs | |

| Index 1000 largest non-US companies (Bank of New York Europe index 100 ADR) | PEF | Global ETFs | |

| Nasdaq-100 Index Fall | QID | Global ETFs | |

| Russel Index (stock “growth”) | IWP | Global ETFs | |

| Russel Index 1000 (Promotions “growth”) | IWF | Global ETFs | |

| Russel Index 2000 (Promotions “growth”) | IWO | Global ETFs | |

| Index S&P 500 Shares “growth” | IVW | Global ETFs | |

| Asian ADR Index (Bank of New York Asia index 50 ADR) | ADRA | Global ETFs | |

| Asian Stock Index S&P Asia 50 | THAT | Global ETFs | |

| Stock index “growth” | VUG | Global ETFs | |

| Stock index “growth” mid-cap MidCap 400 | IJK | Global ETFs | |

| World Stock Index (without USA) | VOICE | Global ETFs | |

| Developed Countries Equity Index (without USA) (MSCI EAFE) | EFA | Global ETFs | |

| American Closed-End Funds Index (индекс Claymore CEF Index) | GCE | Global ETFs | |

| European ADR Index (Bank of New York Europe index 100 ADR) | ADRU | Global ETFs | |

| Index of European stocks S&P Europe 350 | IEV | Global ETFs | |

| European Emerging Markets Index S&P | GUR | Global ETFs | |

| Developed Countries Index (without USA) | SEE | Global ETFs | |

| Fund of leading European companies (Dow Jones Euro Stoxx index 50) | DID | Global ETFs | |

| Fund of leading European companies (Dow Jones STOXX Index 50) | FIRE | Global ETFs | |

| Fund of leading European companies (MSCI Europe Index) | VGK | Global ETFs | |

| Fund of leading European companies, members of the Economic and Monetary Union (MSCI EMU index) | EZU | Global ETFs | |

| Fund of leading European companies, traded on the US market | EKH | Global ETFs | |

| Oceania Leading Companies Fund (MSCI Pacific Index) | VPL | Global ETFs | |

| Money market fund | UEM | Global ETFs | |

| High risk fund (index S&P Target Risk Aggressive) | AOA | Global ETFs | |

| Reduced risk fund (index S&P Target Risk Moderate) | AOM | Global ETFs | |

| Moderate Risk Fund (index S&P Target Risk Growth) | AOR | Global ETFs | |

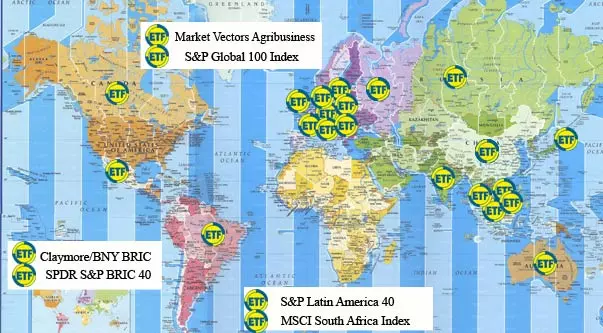

The whole world of ETF index funds on the map

| Fund name | Designation | Daily. turnover | Assets, $ | ||

Popular global ETFs |

|||||

| Market Vectors Agribusiness | AMEX: MOO | 1M | 944M | ||

| iShares S&P Global 100 Index | NYSE: IOO | 281K | 893M | ||

Popular ETFs in Emerging Markets |

|||||

| Vanguard Emerging Markets Stock | AMEX: pre-university education | 3.6M | 5.9B | ||

| BLDRS Emerging Markets 50 ADR Index | Nasdaq: ADRE | 500K | 505M | ||

| iShares MSCI Emerging Markets Index | AMEX: EEM | 12K | 23M | ||

Popular BRIC ETFs |

|||||

| Claymore/BNY BRIC | NYSEArca: EEB | 430K | 610M | ||

| SPDR S&P BRIC 40 | AMEX: BIK | 230K | 189M | ||

Popular ETFs from other countries |

|||||

| Brazil iShares MSCI Brazil Index |

AMEX: EWZ | 19M | 5.66B | ||

| Mexico iShares MSCI Mexico Invstbl Mkt Index |

AMEX: EWW | 3.5M | 904M | ||

| Canada iShares MSCI Canada Index |

AMEX: EWC | 2.2M | 1.72B | ||

| South Africa iShares MSCI South Africa Index |

AMEX: EZ | 360K | 370M | ||

| Latin America iShares S&P Latin America 40 Index |

AMEX: ILF | 2.7M | 2.23B | ||

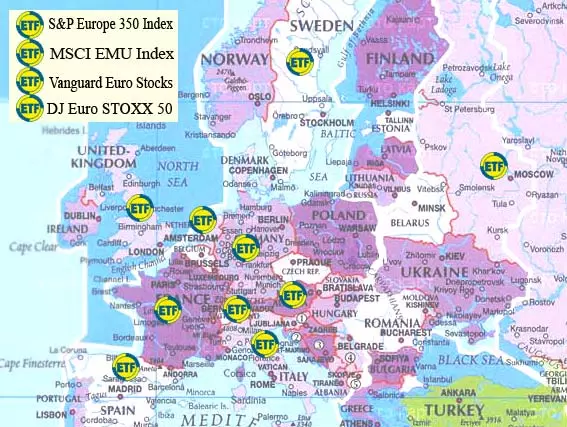

Europe ETF ( Exchange traded funds )– Exchange Traded Funds

| Fund name | Designation | Daily. turnover | Assets, $ | ||

Popular ETFs in Europe |

|||||

| iShares S&P Europe 350 Index | NYSEArca: IEV | 720k | 1.60B | ||

| iShares MSCI EMU Index | NYSEArca: EZU | 596k | 953.51M | ||

| Vanguard European Stocks | NYSEArca: VGK | 489k | 2.13B | ||

| SPDR DJ Euro STOXX 50 | NYSEArca: DID | 232k | 224.10M | ||

Popular European ETFs |

|||||

| Russia Market Vectors Russia ETF |

NYSEArca: RSX | 1,770k | 861.27M | ||

| Germany iShares MSCI Germany Index |

NYSEArca: EWG | 1,100k | 601.16M | ||

| United Kingdom iShares MSCI United Kingdom Index |

NYSEArca: EWU | 957k | 748.44M | ||

| Italy iShares MSCI Italy Index |

NYSEArca: EWI | 285k | 156.92M | ||

| Austria iShares MSCI Austria Index |

NYSEArca: EWO | 286k | 184.46M | ||

| Switzerland iShares MSCI Switzerland Index |

NYSEArca: EWL | 277k | 385.53M | ||

| France iShares MSCI France Index |

NYSEArca: EWQ | 251k | 294.61M | ||

| Sweden iShares MSCI Sweden Index |

NYSEArca: EWD | 213k | 188.38M | ||

| Spain iShares MSCI Spain Index |

NYSEArca: EWP | 203k | 342.39M | ||

| Holland iShares MSCI Netherlands Index |

NYSEArca: EWN | 109k | 191.01M | ||

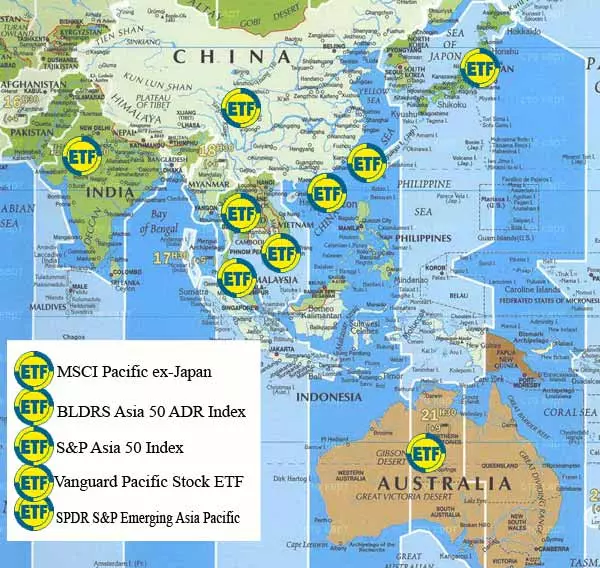

Asia ETF ( Exchange traded funds )– Exchange Traded Funds

| Fund name | Designation | Daily. turnover | Assets, $ | ||

Popular Asian ETFs |

|||||

| iShares MSCI Pacific ex-Japan | AMEX: EPP | 823K | 2.60B | ||

| Vanguard Pacific Stock ETF | AMEX: VPL | 584K | 1.45B | ||

| SPDR S&P Emerging Asia Pacific | AMEX: GMF | 40K | 163.7M | ||

| iShares S&P Asia 50 Index | NYSE: THAT | 40K | 36.00M | ||

Popular Asian ETFs |

|||||

| China iShares FTSE/Xinhua China 25 Index |

NYSE: FXI | 32M | 6.12B | ||

| Japan iShares MSCI Japan Index |

AMEX: EWJ | 29M | 6.66B | ||

| Taiwan iShares MSCI Taiwan Index |

AMEX: EWT | 15M | 2.27B | ||

| South Korea iShares MSCI South Korea Index |

AMEX: EVE | 12M | 1.85B | ||

| Hong Kong iShares MSCI Hong Kong Index |

AMEX: EWH | 6.7M | 1.46B | ||

| Singapore iShares MSCI Singapore Index |

AMEX: EWS | 3.0M | 1.20B | ||

| Australia iShares MSCI Australia Index |

AMEX: EWA | 2.6M | 852.91M | ||

| Malaysia iShares MSCI Malaysia Index |

AMEX: EWM | 1.8M | 381.36M | ||

| India iPath MSCI India Index |

NYSE: INP | 780K | N/A | ||

America USA ETF ( Exchange traded funds )– Exchange Traded Funds

| Fund name | Designation | Daily. turnover | Assets, $ | ||

Popular US ETFs |

|||||

| SPDR S&P 500 | AMEX: SPY | 364M | 91.90B | ||

| PowerShares QQQ | NasdaqGM: QQQQ | 229M | 18.09B | ||

| iShares Russell 2000 Index | AMEX: ETC. | 124M | 16.21B | ||

| DIAMONDS Trust, Series 1 | AMEX: MORNING | 31M | 9.24B | ||

ETF, correlated with underlying assets |

|||||

| Gold SPDR Gold Shares |

NYSE: GLD | 19M | 21.47B | ||

| Silver iShares Silver Trust |

AMEX: SLV | 8.0M | 2.87B | ||

| Oil United States Oil |

AMEX: USE | 13M | 1.62B | ||

| Natural gas United States Natural Gas |

AMEX: ROTTEN | 7.8M | 1.12B | ||

Most liquid industry ETFs in the US |

|||||

| Financial Select Sector SPDR | AMEX: XLF | 237M | 11.7B | ||

| Energy Select Sector SPDR | AMEX: XLE | 46.5M | 8.00B | ||

| Materials Select Sector SPDR | AMEX: XLB | 14.1M | 1.39B | ||

| Semiconductor HOLDRS | AMEX: SMH | 13.5M | 1.05B | ||

| Industrial Select Sector SPDR | AMEX: XLI | 12.4M | 1.60B | ||

| Technology Select Sector SPDR | AMEX: XLK | 11.4M | 2.34B | ||

| Oil Service HOLDRS | AMEX: OIH | 11.3M | 2.77B | ||

| Retail HOLDRs | AMEX: RTH | 8.7M | 427M | ||

| Consumer Discretionary SPDR | AMEX: XLY | 8.2M | 1.05B | ||

| Utilities Select Sector SPDR | AMEX: XLU | 7.0M | 2.22B | ||

| Health Care Select Sector SPDR | AMEX: XLV | 6.0M | 2.39B | ||

| Consumer Staples Sector SPDR | AMEX: XLP | 5.3M | 2.91B | ||

| Regional Bank HOLDRs | AMEX: RKH | 3.0M | 453M | ||

| Pharmaceutical HOLDRS | AMEX: PPH | 1.0M | 1.65B | ||

| Biotech HOLDRs | AMEX: BBH | 208K | 1.47B | ||

| Internet HOLDRs | AMEX: HHH | 84K | 292M | ||

| Telecom HOLDRS | AMEX: TTH | 60K | 158M | ||

| Software HOLDRS | AMEX: SWH | 53K | 143M | ||

Information on ETFs provided by the Investment Company “DUNTONSE“

ETF types ( Exchange traded funds )– Exchange Traded Funds

For that, to effectively choose one or another ETF for trading, a novice investor or speculator needs to clearly structure an array of ETFs, represented on the stock market.

The following types of ETFs are presented on the stock market: Stock ETF, Commodity ETF, Bond ETF, Currency ETF, Index ETF, Reverse ETF, ETF with rate of change.

-

- Stock ETF - security paper, which displays the dynamics of a certain set of shares. Mostly, ETF data displays a set of stocks according to a particular industry or country. It could be, for example, energy sector, industrial sector. Or ETFs may include stocks, issuers located in China.

- Commodity ETF - ETFs, which displays the price of physical goods. These goods can be agricultural products., natural resources and also valuable metals. A commodity ETF is primarily focused on a specific commodity. At the same time, such an ETF may be based on a physical commodity., which is in a specific storage location. Also, a commodity ETF can be based on a futures contract for the corresponding commodity.. Less common ETFs that display commodity indices in their value, which, in turn, can be calculated on the basis of a variety of goods in the form of a combination of physical goods and various derivatives.

- Bond ETF. Bonds are the underlying asset for ETFs of this type.. This, in turn, allows you to trade debt financial instruments through the stock market.

- Currency ETF - ETFs, which displays the value of the corresponding currency. This type of trading fund provides the ability to trade currency pairs, without entering the Forex market.

- Index ETF - ETFs, which displays the dynamics of a specific index, so close, as much as possible. Certainly, an index ETF can trade at a discount or premium to the index. But these time periods are very small, because very quickly the difference is leveled by arbitration on the part of institutional investors.

- Reverse ETF – ETF constructed with a variety of derivatives. The purpose of this design is to form a feedback between the ETF price and the corresponding index or set of shares.. What does, if a certain index has a downward trend, then the reverse ETF will grow. And vice versa, if a certain index has a growing dynamics, then the reverse ETF will fall. This type of ETF is very often used by institutional investors., which have restrictions on trading short positions. That's why, to hedge your risks in case of market or sector falls, institutional investors can buy this type of ETF.

- ETF with rate of change. These ETFs are based on a variety of assets. At the same time, the main feature of these funds is the presence of a certain coefficient of change of this ETF in relation to the underlying asset. This coefficient, usually, has the meaning 2 or 3. Therefore, this type of ETF can be called double or triple.. I.e, if we are considering a double ETF, then it grows twice as much, how its underlying asset is growing. And accordingly, the fall of this ETF will be twice as large as the fall of its underlying asset. These ETFs allow for more aggressive speculation, at the same time, the risks of trading with these instruments are also increased.

At the same time, a single ETF can combine the characteristics of several types, presented above. It could be, for example, index inverse ETF at odds 3. Direxion Daily S meets these characteristics&P 500 Bear 3X ETF (SPXS).

The table below shows examples of the described types of ETFs.

|

View ETF |

Name |

Ticker |

|

Stock ETF |

Industrial Select Sector SPDR ETF |

XLI |

|

WBI Tactical High Income Shares ETF |

WBIH |

|

|

iShares MSCI Australia |

EWA |

|

|

Commodity ETF |

United States Natural Gas |

ROTTEN |

|

iShares Gold Trust |

I TAKE |

|

|

United States Brent Oil |

BNO |

|

|

Bond ETF |

iShares 20+ Year Treasury Bond |

TLT |

|

iShares 7-10 Year Treasury Bond |

IEF |

|

|

iShares National Muni Bond |

MUB |

|

|

Currency ETF |

iShares Currency Hedged MSCI Japan |

HEWJ |

|

iShares Currency Hedged MSCI Canada |

HEWC |

|

|

Index ETF |

SPDR S&P 500 ETF |

SPY |

|

PowerShares QQQ ETF |

QQQ |

|

|

iShares Russell 2000 Value |

IWN |

|

|

Reverse ETF |

Direxion Daily Jr Gld Mnrs Bear 3X ETF |

JDST |

|

Direxion Daily S&P Biotech Bear 3X ETF |

LABD |

|

|

Direxion Daily Energy Bear 3X ETF |

ERY |

|

|

ETF with rate of change |

Direxion Daily FTSE China Bull 3X ETF |

YINN |

|

Direxion Daily Energy Bull 3X ETF |

ERX |

|

|

Direxion Daily S&P 500 Bear 3X ETF |

SPXS |

TOP 9 ETF of funds by popularity (capitalization)

- Infographics: TOP-9 ETF of funds by popularity (capitalization)

- SPDR S&P 500 ETF.

- iShares Core S&P 500 ETF.

- Vanguard Total Stock Market ETF.

- CRSP US Total Market Index.

- Invesco QQQ.

- Vanguard FTSE Developed Markets ETF.

- iShares Core U.S. Aggregate Bond ETF.

What is better than stocks or ETFs?

How ETF Funds Work?

Investment fund purchases a large diversified portfolio of assets, and then sells it piece by piece. For this, the fund issues its own shares.. I.e, by buying one ETF share, an investor invests money in several attractive instruments at once.

A simple analogy: allowable, you want to try some exotic dish. The ingredients are expensive for him., and some can only be bought in bulk. Besides, you are not sure, how exactly this dish should be prepared. In this situation, it is easier to order it in a cafe.. There in the kitchen there are all the necessary products, a professional chef has already prepared a large saucepan and will be happy to serve you a couple of plates. And this is not a luxury, and savings: one serving of the dish will cost you less than even the most profitable wholesale purchase.

The same happens with ETFs.:

- first, the fund professionally prepares a "big pot" - analyzes risks and collects an investment portfolio,

- then he sells to each shareholder his "plate" - a share,

- in which all the "ingredients" are present - the share of all the assets of the fund.

In this way, ETF is a convenient way to reduce risk and use many instruments at the same time.

There is a tool similar to ETF - mutual fund. It allows you to pool capital with other investors and get a share in the total assets of the fund.. When choosing between mutual funds and ETFs, keep in mind the differences, for example, in costs.

The first ETFs appeared on the Moscow Exchange in April 2013 of the year. Now there is represented 15 ETF from two asset management companies. The list of available funds can be found on the Mosbirzh website (1), and full information on them - on the website of the providers (FinEx (2), ITI Funds (3)).

Let us briefly outline the possible directions of investments and the names of the funds., which correspond to them.

USA (FXUS), United Kingdom (FXUK), China (FXCN), Germany (FXDE), Japan (FXJP), Australia (FXAU), Kazakhstan (FXKZ).

The Russian RTS Index is based on 2 ETF fund: FXRL and RUSE.

Russian corporate Eurobonds (FXRB, FXRU, RUSB): Gazprom, Sberbank, Rusnano, Lukoil, etc..

Short-term US Treasury bonds (FXMM)

The general recommendation for an investor when choosing an ETF is to choose that market and industry, which are interesting to him, are well understood and according to which he owns the forecasts of experts.

But it may be so, that the economic situation is unstable, there are prerequisites for, that even a familiar market will "storm". In this case, it is most reasonable to choose an ETF on a stable asset - gold.. Another plus of buying ETFs for gold is VAT exemption., which would have to be paid in the usual procedure for buying precious metals.

Most ETFs — index, that is, it is a tool for long-term investment. Trade ETFs in Brief- and in the medium term it makes no sense. Other tools are suitable for this purpose., for example, index futures. Or the so-called shoulder ETFs, which, although tied to the index, but traded with borrowed funds, increasing both potential profit, and potential losses.

Before using any tool, including ETF, the investor needs to figure out the basic things, concepts, technical analysis - you can study on your own or resort to the advice of a professional consultant.

How much does an ETF share cost?

so, buying ETF allows you to invest in international stock market and buy shares of leading companies, as well as bonds and gold. Exist 2 ETF stock price type: settlement and market.

The formula for determining the estimated price is simple: the net asset value of the fund is divided by the number of shares issued by the fund.

Example

The hypothetical fund has 1 stock company X and 1 share of company Y - by 300 rubles each.

The fund's net asset value will be 300 + 300 = 600 rubles.

If released 300 Shares, then the estimated price will be 2 ruble per share.

The net asset value of real ETF funds and the estimated prices of their shares can be found on the websites of their providers..

In addition to the estimated price, the market price of the share is also important - that is, that, which is actually offered for it on the stock exchange. It is regulated by market makers. These are liquidity providers, which support a certain trading volume and spread. Their function is regulatory.

You can even buy one share of an ETF fund on the Moscow Exchange. Their price is from 180 to 4150 rubles apiece. The average market price changes many times per day, up-to-date information can be found on the Mosbirzh website .

As you can see, the entry threshold is really low - buying an ETF is cheaper than collecting a similar diversified portfolio on your own. For example, gold on the Moscow Exchange costs about 2780 rubles per gram, you can buy a minimum 10 grams. For comparison: 1 gold ETF share is worth about 600 rubles.

Anyone can buy ETF. Some civil servants are an exception., who are prohibited from using foreign financial instruments (and ETFs are considered just like that) - heads of state departments, FSB employees, etc..

You can buy several ETFs at once and make a well-diversified investment portfolio from them. This requires a brokerage account or individual investment account. (IIS). You can open an account with any broker. You will give him instructions for buying and selling on the exchange..

Advice

- Costs. When trading ETFs, they are negligible.: exchange and brokerage commissions are measured, respectively, tenths and hundredths of a percent of the invested funds.

- taxes. Received investment income from ETF (as well as from other financial instruments) taxed at the rate 13%. This amount broker withholds and transfers to the budget independently (if the investor is not exempted from personal income tax for using IIS).

What determines the profitability of ETF shares

Making a decision, which assets will be included in their portfolio, ETFs most often rely on a specific stock index.

Index Is not a number, and the list. Namely - a list of companies, whose securities the exchange or the fund itself considers important. It is also called the index basket..

Key indicator - index value. This is already some hypothetical number., which for different indices is calculated in different ways. Absolute index values are not important. Only his fluctuations in time matter.: they reflect the general condition of assets, companies included in the index. If securities get cheaper, the index falls - and vice versa.

ExampleThe MSCI USA Index includes stocks 622 the largest and most profitable US companies. Its value reflects the general state of the American stock market.. What is higher, the better and more expensive the shares are sold. With 2016 on 2018 year the value of the MSCIUSA index increased (6)c 2 535 points to 3 0780 points (21%).

By choosing an index, ETFs buy securities from their member companies (there can be hundreds of them - a complete list of assets for each fund can be found on the provider's website (7)). In this way, fund shareholders in each of them receive their share, and the share price is tied to the index value.

As you can see, investing in ETFs, easy to track the profitability of your investments. If the index rose by 10% - ETF shares rise in price by the same amount. The exact dependence and profitability of shares can also be found from the fund's documentation on the provider's website..

Results:

- ETFs are an easy and relatively inexpensive way to diversify your portfolio.

- To trade ETFs, you need a brokerage account or IIS.

- On the Moscow Exchange traded 15 ETF. You can invest in stocks, bonds and gold.

- It's easy to buy ETFs - you can do it through a broker.

- ETF is a long-term investment tool.

- Sanctions have no negative impact on ETFs available to a Russian investor.