Today we have a very speculative idea: take stock of digital advertising software manufacturer DoubleVerify Holdings (NYSE: DV), in order to make money on the positive market conditions.

Growth potential and validity: 16,5% behind 14 Months; 37% behind 4 of the year.

Why stocks can go up: there is a demand for the company's services - and there are some other circumstances, which indirectly favor it.

How do we act: we take shares now by 31,74 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

On the stock exchange the company recently, with 20 April. So the main source of information on it will be its registration prospectus.

DoubleVerify makes digital media scoring and analytics software. The meaning of the DV activity is, to help clients evaluate the ROI of online advertising campaigns. Actually, 91% DV revenue comes from advertisers themselves, to evaluate the effect of campaigns, and 9% — marketers, who, based on the company's software, draw up analytical reports for clients.

DV clients are a wide variety of companies, e.g. Colgate-Palmolive, Ford, Mondelez and Pfizer.

There is no breakdown of revenue by region in the prospectus – only, that the company has international operations, but its main customers are in North America.

Arguments in favor of the company

Fell down. Since June, DoubleVerify shares have fallen in price by 27%. Now they are standing. 31,74 $ — a little more expensive, than an IPO, — 27 $. This is partly due to the exorbitant price of the company., Partly themes, that the company has an aura of prospects.

Conjuncture. The digital advertising market is actively growing, largely due to, that it is nibbling an increasing percentage of budgets from traditional advertising: TV, radio and paper media. DV earns according to the number of campaigns analyzed by its software: the more campaigns run online, the greater the demand for its services. More and more campaigns. It's good, as for business DV, so for her quotes: a lot of retail investors will pump up everything, that looks promising.

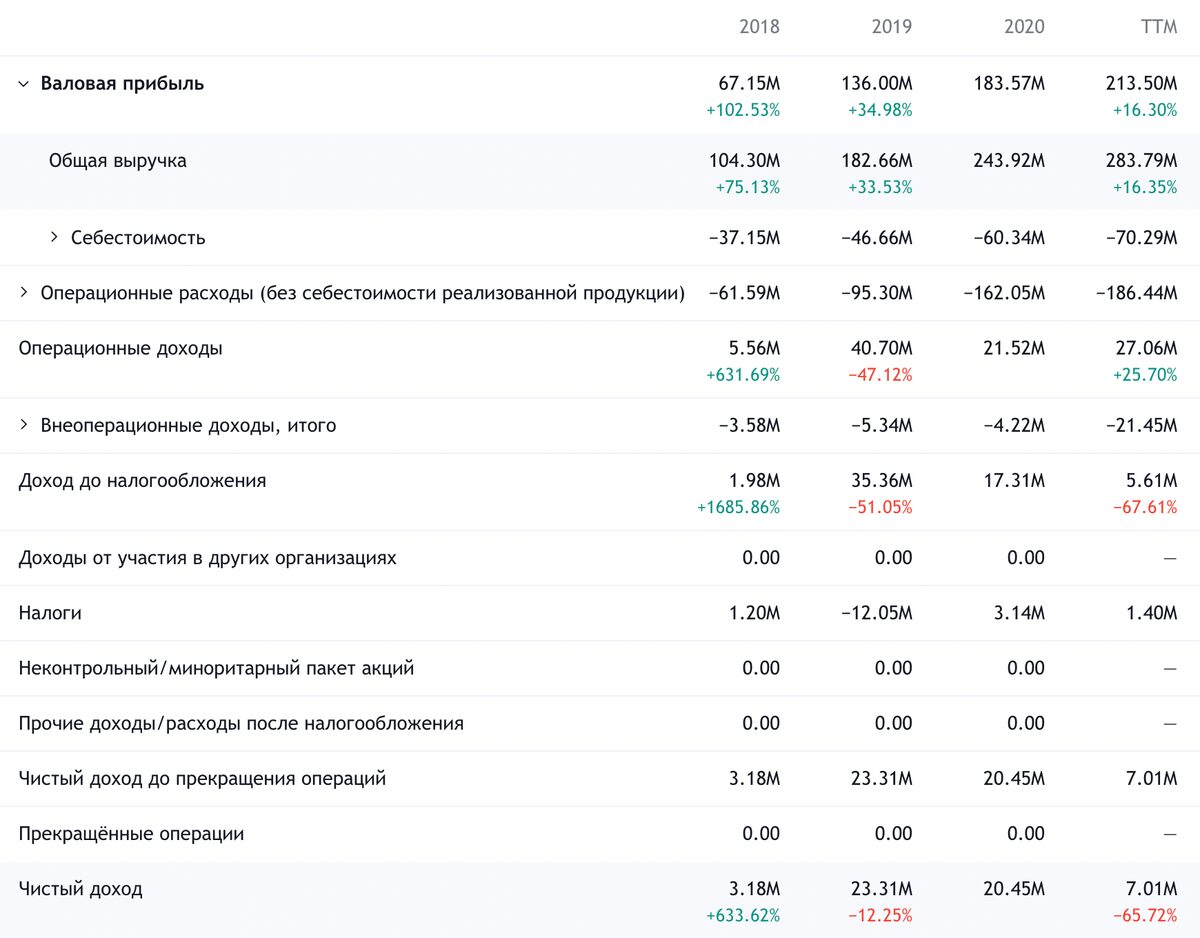

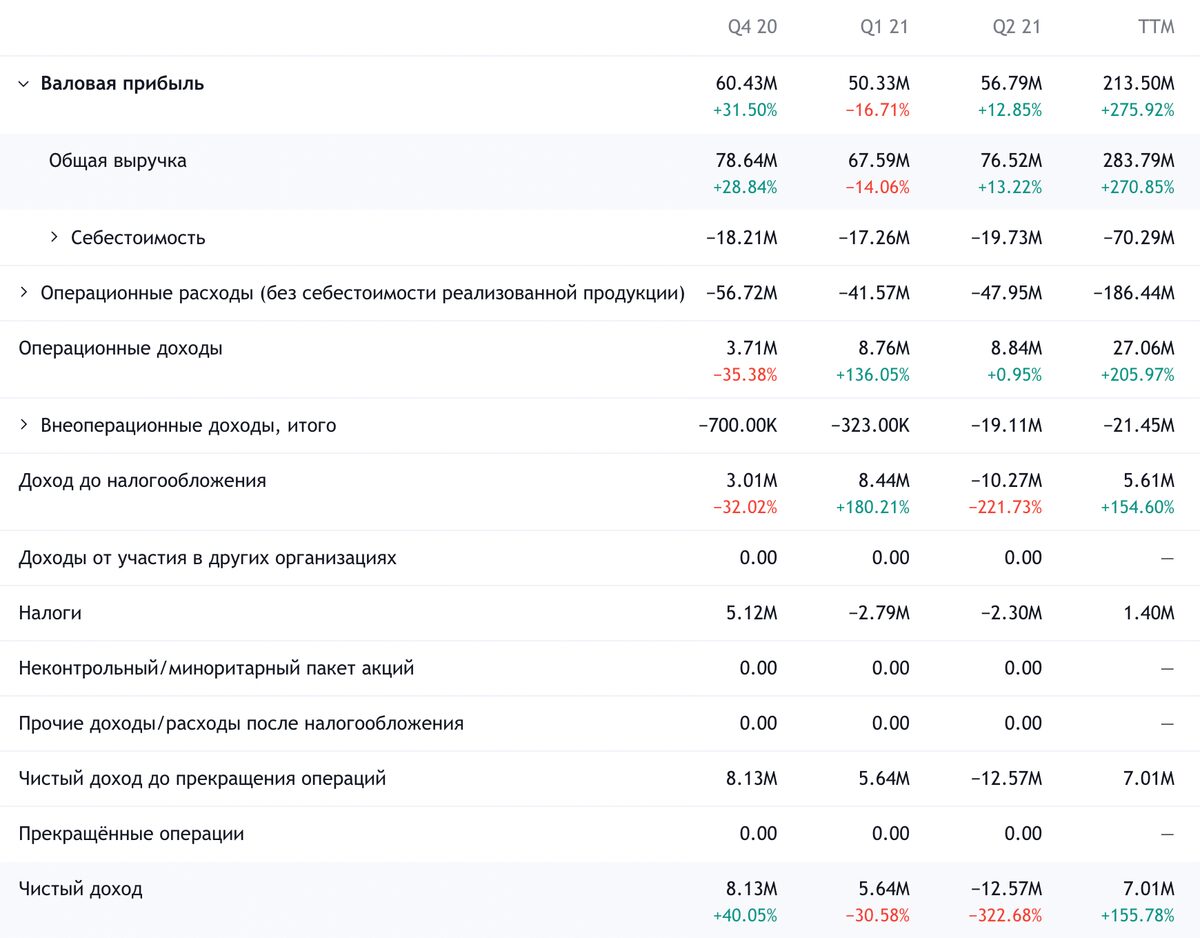

There's even a P here. / E. DoubleVerify decided to break the unspoken rule of IT companies and became profitable. P / E she has a high — 661, but in general the main thing is that she has it. This alone could attract enough investors into the stock.. The company made a loss last quarter., but it was caused by one-time expenses, related to IPO, and has nothing to do with the core business, which is profitable.

Punish the Cartel. That, what Google changed the targeting rules, has become a problem for many companies, working in this area. DV, basically, ready for these changes, although this may increase its costs. But there is a small chance, that a lawsuit by U.S. antitrust regulators against these Google plans will be crowned with success. This regulatory victory could benefit DV.: so it will avoid expenses, associated with higher costs when switching to a new advertising system.

Chances of it, that the lawsuit of regulators will be crowned with success, I think they are weighty enough: in the US, the popularity of the idea of “breaking technological giants on the knee is growing, so that they know their place", so the court may well take the side of the plaintiffs.

What can get in the way

Still expensive. According to company estimates, spending in the digital advertising market in the world is 170 billion dollars, by 2023 this market will grow to 225 billion. DV is a marketing software for measuring the effectiveness of campaigns with a market size of 13 billion in revenue. The company occupies approximately 2,18%, but with its capitalization it costs as 38,4% market. DV is now worth 17.6% of its annual revenue, which is unrealistically much even by the standards of the American stock market. So you should be mentally prepared for the strongest volatility of these stocks..

I forbid you to sell. The company's articles of association set out the rules, which seriously limit the rights of minority shareholders. The main problem point: DV management can block a deal to sell the company to someone without asking. This limits the prospects for DV to find its simple IT happiness - to attract a buyer from among large corporations to its overpriced, expensive business.

What's the bottom line?

Shares can be taken now by 31,74 $. And then there are two options.:

- wait 37 $, who asked for shares back in September. Think, then you'll have to wait 14 Months;

- wait for the historical maximum of these shares — 43,5 $. Here you should count on 4 years of waiting.

Usually in the case of high-tech businesses, I recommend horizons from 10 years and more, but in case of DV I will refrain: we don't know yet, how the global digital advertising landscape will change if Google changes its policy and whether such a change will take place. There are still too many unknowns left here..