American aviation company Delta Air Lines (NYSE: FROM THE) presented a cash report for the 2nd quarter of 2021. In relation to the corresponding time period in 2019:

- revenue fell by forty-three percent, up to $7.1 billion;

- unsullied profits plummeted fifty-five percent, up to 0.7 billion;

- adjusted direct steel losses 0.7 billion;

- total debt tripled, with 10 up to 29.1 billion;

- adjusted net debt doubled from 9,3 up to 18.3 billion;

- total solvency, including funds, short-term investments and revolving credit bands, amounted to 17.8 billion;

- the corrected free currency flow fell from 2,2 up to 0.2 billion.

Let's consider these characteristics in more detail..

Monetary characteristics of the company

“We achieved significant results in this quarter, including impressive pre-tax profit in June and positive free foreign exchange flow for the quarter. Domestic tourist travel fully recovered compared to 2019, and there are encouraging signs in the corporate and interstate sectors.”, Delta Air Lines CEO Ed Bastian.

Revenue. Airline carrier emphasizes, that people began to book more often. Average daily cash ticket sales doubled quarter-on-quarter and 20 percent above expectations. In June, ticket sales amounted to seventy percent of the level of 2019. Corporate travel is also recovering, but slower: in June they amounted to forty percent of the level of 2019. Freight traffic increased by thirty-five percent in two years.

Profit. Delta received $1.5 billion in government bailouts in the second quarter. The company will use this money to pay salaries to employees laid off during the pandemic.. Excluding government subsidies, the company remains unprofitable, therefore, it is too early to talk about a full recovery of profits.

Forecast. In the next quarter, revenue may fall by 30-35% compared to the same period in 2019. Adjusted net debt of $ 19 billion.

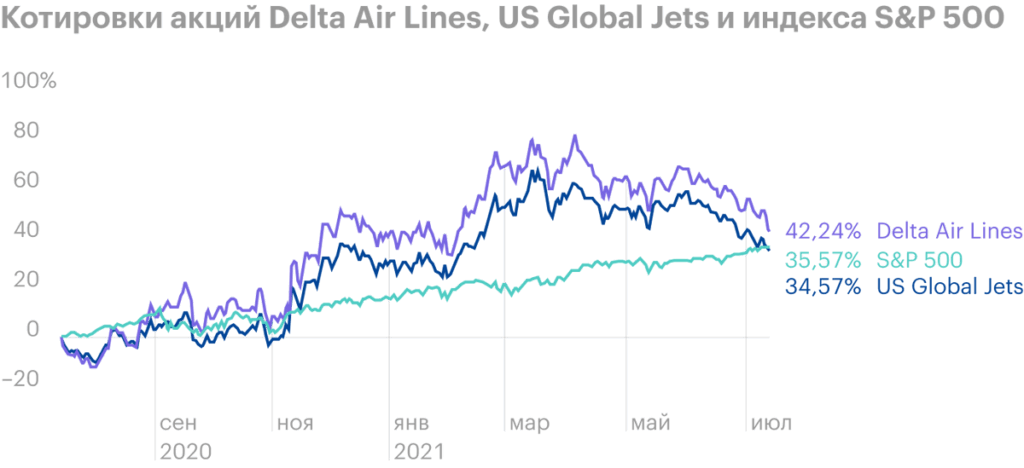

Promotions. Delta shares rose by 42%, and from the beginning of the year - on 5%, to 41 $. Company shares outperform US Global Jets fund and S index&P 500. According to analysts, Delta shares could rise by 40%, to 57 $.

Revenue in the second quarter, million dollars

| 2019 | 2021 | The change | |

|---|---|---|---|

| Passengers | 11 368 | 5339 | −53% |

| Cargo | 186 | 251 | 35% |

| Rest | 982 | 1536 | 56% |

| Total | 12 536 | 7126 | −43% |

Passengers

2019

11 368

2021

5339

The change

−53%

Cargo

2019

186

2021

251

The change

35%

Rest

2019

982

2021

1536

The change

56%

Total

2019

12 536

2021

7126

The change

−43%

Air carriers are recovering

The airline industry is one of the hardest hit during the pandemic. With the rise in the number of vaccinated people, consumer demand in the sector has begun to recover. In the summer, several large operators shared good news at once:

- American Airlines is bringing back fired pilots and flight attendants due to staffing shortages. The company said, what 4 July, passenger traffic tripled compared to 2020.

- American Airlines is waiting, that in the second quarter will be able to reduce losses and receive a small pre-tax profit.

- Delta Air Lines plans to hire a thousand pilots within a year.

- Southwest Airlines doubled overtime, to fill the lack of personnel.

- United Airlines has ordered 270 aircraft and announced plans to increase the staff.

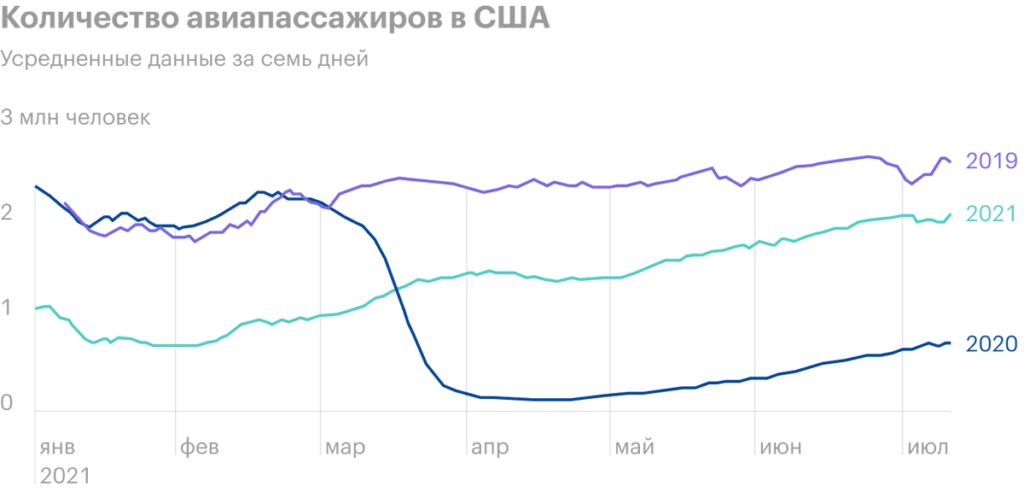

- The U.S. Transportation Security Administration said, what 1 July passenger traffic increased by 3% relative to the level of 2019.

Or not?

Despite the recovery in demand, weaknesses remain in the industry. Here are some of the risks analysts talked about.

Corporate and international passengers. Business travel is an important segment for airlines. Corporate passengers often buy tickets at the last moment and at a high price, which has a positive effect on the margins of the business. The head of United Airlines said, that in June business trips were reduced by 60% compared to the pre-pandemic period. CEO awaits, that business travel will not recover until 2023. Due to quarantine restrictions, international flights are also far from full recovery..

Work force. In the midst of the pandemic, many airlines laid off and sent their employees on vacation.. Now passenger traffic is growing, and companies are forced to urgently hire staff and increase overtime. American Airlines canceled hundreds of flights in June due to staff shortages.

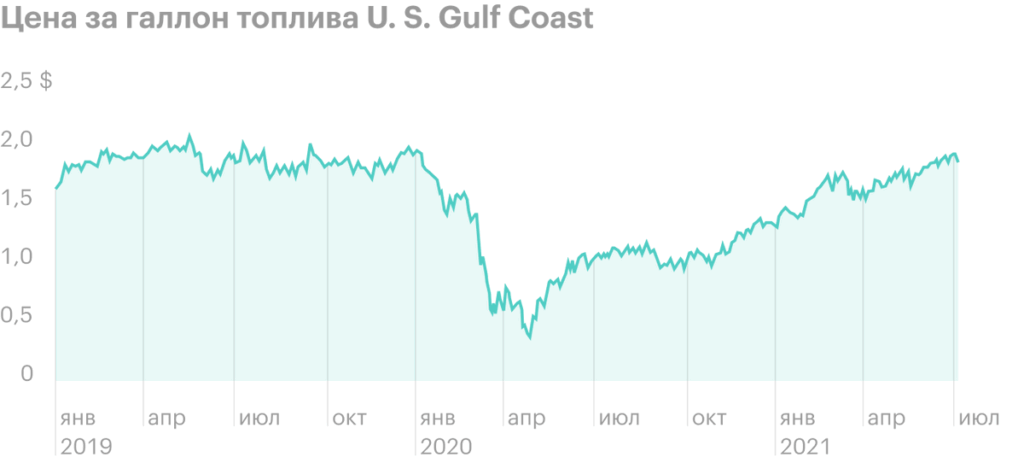

jet fuel prices. As oil prices rise, so does the cost of jet fuel.. Cowen analysts suggest, that fuel costs will rise more in the second quarter, than expected.

The end of the summer season. According to the heads of airlines, demand in the industry is growing largely due to vacationing Americans, who are willing to pay for more expensive air tickets. The future revenues and profits of airlines depend on, what will be the demand after the summer season.