Today we have a moderately speculative idea.: take stock of the manufacturer of computer devices Corsair Gaming (NASDAQ: CRSR), in order to capitalize on the growing popularity of its products.

Growth potential and validity: 18% for 12 months; 77% in 4 years; 150% for 10 years.

Why stocks can go up: they fell hard, and the company's business has not lost its prospects.

How do we act: we take shares now by 25,36 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

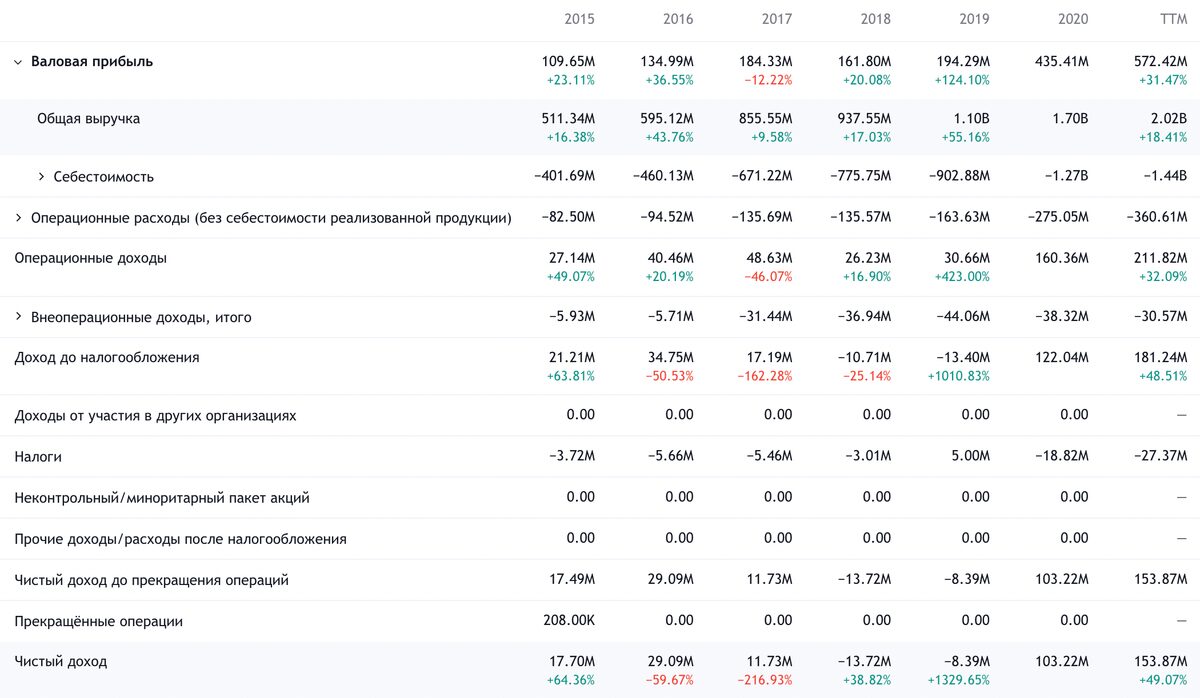

Corsair designs, manufactures and sells devices for playing on PC. According to the annual report, the company's revenue looks like this.

Peripherals for gamers and content creators — 31,7%. Mouse, headsets, keyboards, controllers, Microphones, ON, as well as services in this area. Segment gross margin — 35,2% from its proceeds.

Game components and systems — 68,3%. Memory modules, ready-made high-performance PCs, cooling solutions and more. Actually, 35,8% of all revenue of the company come from sales of solutions in the field of memory, gross margin of this category — 20,5% from its revenue. Other 32,5% — other game solutions, gross margin of this sales category — 27,2% from its revenue. Gross margin of a single segment — 23,7% from its proceeds.

A significant proportion of production - it is not known exactly how much - is carried out by third-party enterprises instead of the company.

Revenue by country and region:

- USA - 38%.

- Other countries in the Americas — 7,5%.

- Europe and the Middle East - 36,66%.

- Asian-Pacific area - 17,84%.

Arguments in favor of the company

Fell down. Since February, shares have fallen in price by almost 44% due to negative expectations of investors regarding the logistical problems of the company. To me, this fall seems excessive.. So you can take stocks with the expectation of a rebound.

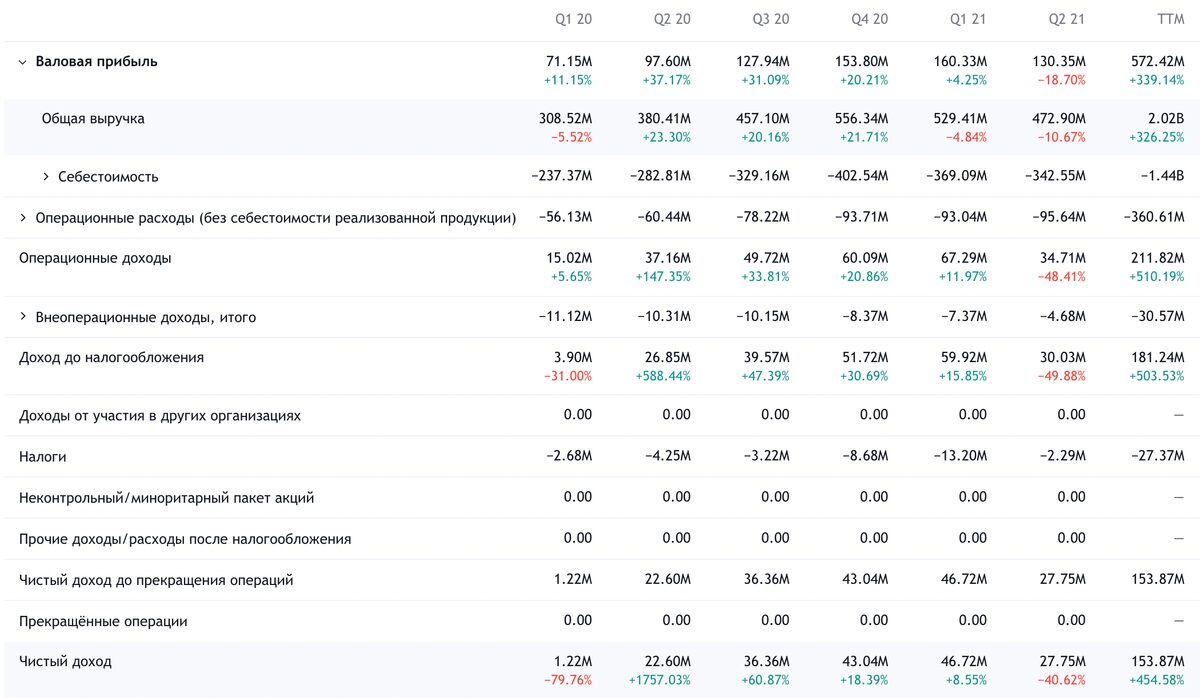

Smoking mirror. 2020 the year showed, what the future holds for people in developing countries: hopelessness and poverty with games and movies as anesthesia. So the company can count on a positive environment for its business - just like Skillz. Actually, Corsair's sales and profits continue to grow.

Cheapness. The market for PC gaming devices is now approximately $33 billion., looking ahead - it will reach about $45 billion in 2024. Corsair's market share in 6,12% just below its capitalization - this is only $ 2.37 billion, or 7,18% from its target market. In other words, the company does not look particularly overvalued. P / E she has only 16,7, and the nearest competitor Razer, for example, P / E in the area 30.

Indicator P / S the company has a little more than one, which is very small by American standards.. So Corsair shares can run as retail investors - "because I heard here, that games are promising”, — and institutional investors from among banks and funds, because games are really promising. Considering the low cost of the company, the effect of the inflow will be very significant.

Can buy. In terms of sales in the United States, the company consistently ranks from first to fourth in various product categories.: keyboards, headsets and more. Considering this and the above advantages, anyone, e.g. larger Logitech, may well buy Corsair.

What can get in the way

Declassification of PC boyars. PC is the least promising corner of the gaming market, whose revenue is marking time and will continue to mark time. It's a problem for Corsair., because it makes products, targeted specifically at PC players.

Think, company management understands this and will seriously spend money on expanding towards console and non-gaming peripherals. All this will negatively affect the already imperfect accounting and may lead to a drop in quotes..

Doesn't converge. The company is clearly focused on, who, like Henry Cavill, assembles its own PCs. According to company data, 46% the revenue of the entire market of gaming accessories for PC is given by gamers, building their own PCs, spending in the process about 953 $. This is quite tangible money even for the United States., and in the concept of "people will get poorer and play more games" I do not see a place for large spending on components.

Maybe, I blow on water and in the terrible new world of the future people will save on food, to buy a new PC and units for it. But still keep in mind, that Corsair could stumble over a drop in the purchasing power of its target audience.

Concentration. According to the annual report, 10 the largest buyers of the company give 52,7% its sales. The largest — Amazon, 24,6% Corsair sales. A change in relationship with one of them could negatively impact Corsair's reporting..

Eagle wooding. The largest shareholder of the company with 57% - EagleTree Capital Fund. Some analysts are afraid, that the foundation will do things, incompatible with the interests of minority shareholders, for example, to interfere with the sale of Corsair. But so far there are no prerequisites for this.

The main problem seems to me to be, that the fund may, for some reason, part with a large number of shares at a time, that in the conditions of small capitalization Corsair can lead to a strong fall in its shares. Basically, there's nothing particularly wrong with that, but noticeable drawdowns are possible.

Accounting. The company has a fairly large amount of debt - 848.7 million dollars, of which 494 million must be repaid within a year. At the same time, the money at her disposal is not to say very much.: 134,5 million on accounts and 258.7 million debts of counterparties. In the long term, this relatively high level of debt can damage the company's reputation in the eyes of potential shareholders..

Everything in the world. Logistical challenges, enhanced themes, that Corsair relies heavily on third-party manufacturers, and the shortage of semiconductors will surely hit the company's reporting. The only question is, how strong.

What's the bottom line?

Shares can be taken now by 25,36 $. And then there are several options:

- wait 30 $, who asked for these actions back in July. Think, we will reach this level within a year;

- wait for growth to their historical maximum, achieved in February, — 77 $. Think, here you should expect about 4 years of waiting;

- hold shares for the next 10 years.