Mexican restaurant chain Chipotle Mexican Grill (NYSE: CMG) reported for the 2nd quarter of 2021, which is over 30 June. Here are the main monetary indicators:

- revenue increased by 38,7 %, up to $1.9 billion;

- comparable sales increased by 31,2 %;

- digital sales increased by 10,5 %, to 48,5 % of total revenue;

- operating margin at the restaurant level increased from 12.2 to 24,5 %;

- total operating margin increased from −0.4 to thirteen percent;

- net profit increased from 8,2 up to 188 million;

- adjusted net income increased from 11.4 million to 212.8 million.

Why revenue has grown

A year earlier, due to quarantine restrictions, Chipotle sales decreased. In the 2nd quarter 2020 year, revenue fell to 4,8 %, and comparable sales in restaurants - on 9,8 %. Now the characteristics of the company have started to grow again.. As reported by Chipotle, digital sales contributed to increase revenue, quick recovery of customer traffic and new dishes on the menu.

In the 2nd quarter, digital sales increased by 10,5 %, up to 0.9 billion, and accounted for slightly less than half of the total revenue. The company refers to orders through the website as digital sales., application and third-party aggregators.

Per quarter Chipotle opened 56 new restaurants. Of them 45 - with Chiptolane support. Customers can order food in advance through the app, and later pick up without leaving the machine. This format helps the company to increase sales and business margins. Chipotle has 2853 restaurants in total. In 2021, the company promises to open 200 new outlets.

Revenue in the 2nd quarter, one thousand dollars

| 2020 | 2021 | The change | |

|---|---|---|---|

| Food & Beverage | 1 350 188 | 1 869 365 | 38,5% |

| Delivery | 14 550 | 23 173 | 59,3% |

| Total | 1 364 738 | 1 892 538 | 38,7% |

Food & Beverage

2020

1 350 188

2021

1 869 365

The change

38,5%

Delivery

2020

14 550

2021

23 173

The change

59,3%

Total

2020

1 364 738

2021

1 892 538

The change

0,387

restaurant statistics, million dollars

| 2 kV. 2020 | 3 kV. 2020 | 4 kV. 2020 | 1 kV. 2021 | 2 kV. 2021 | |

|---|---|---|---|---|---|

| Number of restaurants | 2669 | 2710 | 2768 | 2803 | 2853 |

| Average annual sales | 2161 | 2199 | 2223 | 2313 | 2466 |

| Comparable sales | −9,8% | 8,3% | 5,7% | 17,2% | 31,2% |

Number of restaurants

2 kV. 2020

2669

3 kV. 2020

2710

4 kV. 2020

2768

1 kV. 2021

2803

2 kV. 2021

2853

Average annual sales

2 kV. 2020

2161

3 kV. 2020

2199

4 kV. 2020

2223

1 kV. 2021

2313

2 kV. 2021

2466

Comparable sales

2 kV. 2020

−9,8%

3 kV. 2020

8,3%

4 kV. 2020

5,7%

1 kV. 2021

17,2%

2 kV. 2021

31,2%

Why did marginality increase?

Post-quarantine costs rise in food service industry, as food and freight prices have risen. More restaurants are facing shortages, because people are not in a hurry to go to work. Therefore, large networks, such as McDonald's, Chipotle, Papa John's and others, raised salaries and introduced bonuses for employees. All this reduces the margins of companies.

Chipotle promised to raise salaries to employees by the end of June, therefore, it will be possible to evaluate this item of expenditure only in the third quarter. Now the margin at the restaurant level has increased from 12.2 to 24,5% is the highest value since 2015. Product costs, wages and premises amounted to 75,6% from proceeds, and a year ago - 87,7%. Total operating margin, including depreciation and other expenses, increased to 13%.

According to Chipotle, business margin increased primarily due to higher food prices. To offset costs, in June, the company raised prices for 4%.

Share of direct operating expenses from revenue in the second quarter, one thousand dollars

| 2020 | share | 2021 | share | |

|---|---|---|---|---|

| Groceries | 454 756 | 33,3% | 574 748 | 30,4% |

| Salary | 385 266 | 28,2% | 464 506 | 24,5% |

| Premises | 95 576 | 7,0% | 103 430 | 5,5% |

| Rest | 262 378 | 19,2% | 287 242 | 15,2% |

Groceries

2020

454 756

share

33,3%

2021

574 748

share

30,4%

Salary

2020

385 266

share

28,2%

2021

464 506

share

24,5%

Premises

2020

95 576

share

7,0%

2021

103 430

share

5,5%

Rest

2020

262 378

share

19,2%

2021

287 242

share

15,2%

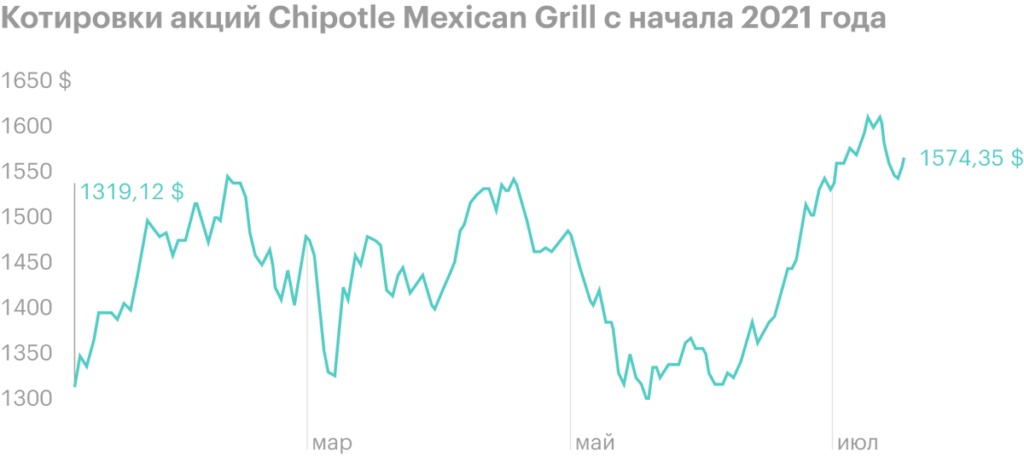

Stocks rose too

Investment banks raised expectations for Chipotle stock last week. Analysts at Goldman Sachs and Credit Suisse noted a steady increase in revenue and recommended buying the company's shares.

Since the beginning of the year, Chipotle shares have gained 19%. After the post-market report, the securities rose by another 4%, to 1643 $. Consensus forecast - 1770 $.