Asset fund managers say this: it is difficult to overtake the index in a boring market. Another thing, when the economy is changing rapidly, and the markets are volatile. Then, due to the point selection of stocks, managers are ready to destroy index funds. Since March 2020, they have had such a chance. Didn't work out.

Morningstar и S&P Global figured out, how many active funds showed better returns compared to indices. Both companies came to the same conclusion: over the past year about 60% Funds, investing in shares of the largest American companies, lagged behind S&P 500.

Manager results, who invest in stocks of small and mid-cap companies, Worse. According to S&P Global, 76-78% of such managers lost to S indices&P SmallCap 600 и S&P MidCap 400.

In the long run, active funds have nothing to brag about.. For 20 years 94% managers lagged behind S&P 500, as S says&P Global.

In the case of active funds, investors run the risk of not only falling behind the index, but also lose all your investment. So, according to Morningstar, the survival rate of such funds in the first year is 93%, across 20 years - 34%.

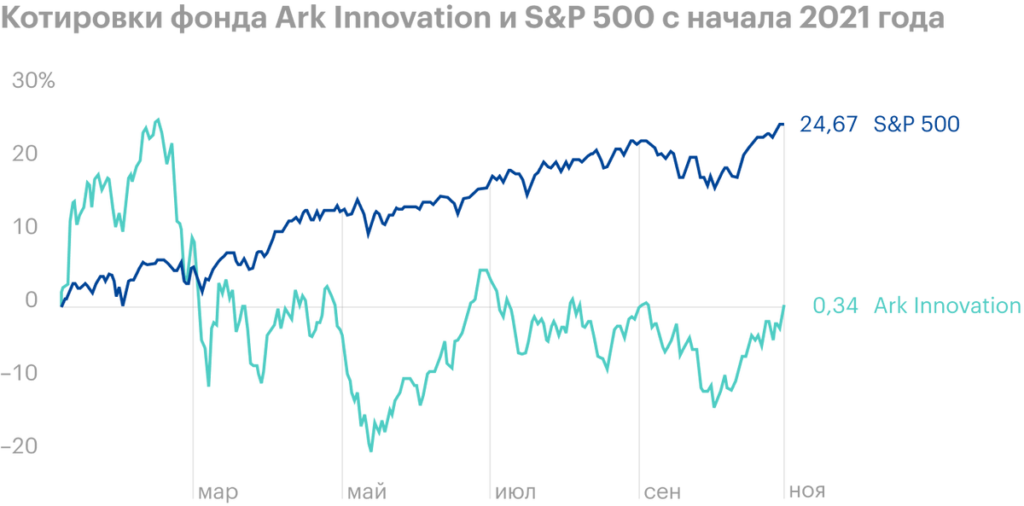

In the short term, some managers can deliver excellent results., what attracts investors. For example, in 2020 Cathy Wood Ark Innovation Foundation, which includes stocks of fast-growing companies like Tesla, Coinbase, Square и Zoom, added 150%. Index S&P 500 during the same period grew much less - by 17%. This year it's the other way around.: S&P 500 added 25%, but Ark Innovation has not grown at all.

Percentage of funds investing in the largest companies, who lagged behind S&P 500

| 1 year | 58% |

| 3 of the year | 68% |

| 5 years | 73% |

| 10 years | 83% |

| 20 years | 94% |

58%

Percentage of funds investing in the largest companies, who survived

| 1 year | 93% |

| 3 of the year | 85% |

| 5 years | 75% |

| 10 years | 59% |

| 20 years | 34% |

93%